Cost Car Insurance

Navigating the world of car insurance can be a complex and often confusing task. With numerous factors influencing the cost of coverage, understanding the variables that impact your insurance premium is essential. This comprehensive guide will delve into the intricacies of car insurance costs, providing you with a clear and detailed analysis of the key elements that affect your policy's price.

The Multifaceted Nature of Car Insurance Costs

Car insurance costs are determined by a myriad of factors, each contributing to the overall premium. From the type of vehicle you drive to your personal driving history, numerous variables play a role in calculating insurance rates. Let’s explore these factors in detail to gain a comprehensive understanding of the cost structure.

Vehicle-Specific Factors

The type of car you drive is a significant determinant of your insurance costs. Different makes and models of vehicles carry varying levels of risk, which insurance companies factor into their premium calculations. For instance, sports cars and luxury vehicles often attract higher insurance rates due to their higher repair costs and increased likelihood of theft.

| Vehicle Type | Average Annual Insurance Cost |

|---|---|

| Economy Cars | $800 - $1200 |

| Family Sedans | $1000 - $1500 |

| SUVs | $1200 - $1800 |

| Luxury Vehicles | $1500 - $2500 |

Additionally, the age and condition of your vehicle are considered. Older cars, especially those without modern safety features, may result in higher insurance costs due to increased repair expenses. Similarly, cars with a history of accidents or extensive modifications can also drive up insurance premiums.

Driver-Related Factors

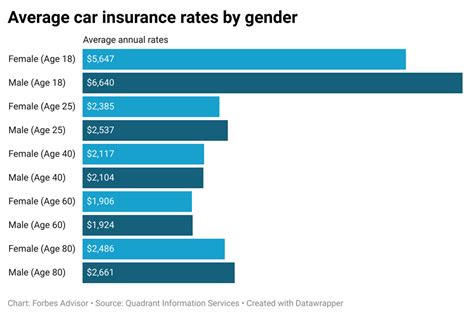

Your personal driving history and demographics play a crucial role in determining insurance costs. Insurance companies assess your risk profile based on factors such as age, gender, marital status, and driving experience. Younger drivers, particularly those under 25, often face higher insurance premiums due to their relative lack of experience on the road.

Your driving record is another critical factor. A clean driving record with no accidents or traffic violations can lead to significant discounts on your insurance policy. Conversely, a history of accidents, especially those deemed your fault, can substantially increase your insurance costs. Insurance companies view such incidents as indicators of increased risk and adjust premiums accordingly.

Location and Usage Factors

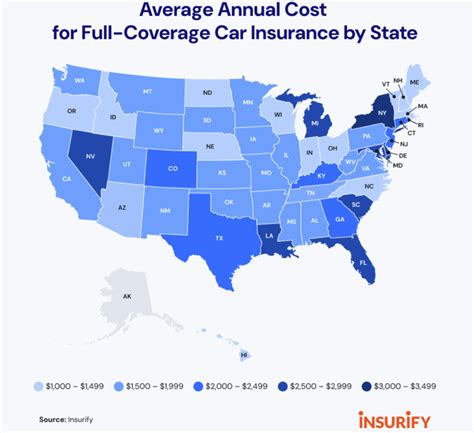

The area where you live and the purpose for which you use your vehicle can also impact your insurance costs. Insurance rates vary significantly across different regions due to factors like crime rates, traffic density, and weather conditions. For instance, urban areas with higher traffic volumes and theft rates often have higher insurance premiums compared to rural areas.

The purpose for which you use your vehicle also matters. If you primarily use your car for commuting to work, your insurance costs may be higher due to the increased exposure to potential accidents. Conversely, if you use your vehicle infrequently or primarily for leisure, your insurance costs may be lower.

Coverage and Deductible Choices

The level of coverage you choose for your insurance policy can significantly impact your overall costs. Comprehensive and collision coverage, which provide protection against damage to your vehicle, can increase your insurance premiums. However, these coverages are essential for protecting your investment and providing peace of mind.

Your deductible choice also plays a role in determining your insurance costs. A higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower insurance premiums. However, it's important to choose a deductible that you can comfortably afford in the event of a claim.

Strategies for Reducing Car Insurance Costs

While numerous factors influence car insurance costs, there are strategies you can employ to potentially reduce your insurance premiums. Here are some practical tips to consider:

Shop Around and Compare Quotes

Insurance rates can vary significantly between different providers. It’s essential to shop around and compare quotes from multiple insurance companies to find the most competitive rates for your specific circumstances. Online comparison tools can be particularly useful for quickly obtaining quotes from various insurers.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts for customers who choose to bundle their policies, providing a cost-effective way to manage your insurance needs.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a critical factor in determining your insurance costs. Maintaining a clean driving record, free from accidents and traffic violations, can lead to significant discounts on your insurance policy. Additionally, completing defensive driving courses or other safety programs can sometimes result in reduced insurance premiums.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that offers potential savings for drivers. With this type of insurance, your premiums are based on your actual driving behavior, such as the number of miles driven and your driving habits. If you’re a safe and cautious driver, usage-based insurance can potentially reduce your insurance costs.

Explore Discounts and Savings Opportunities

Insurance companies often offer various discounts and savings opportunities to their customers. Common discounts include those for safe driving, multi-policy bundling, good student status, and vehicle safety features. It’s worth exploring these options with your insurer to see if you qualify for any discounts that can reduce your insurance costs.

The Future of Car Insurance Costs

As technology continues to advance and the automotive industry evolves, the landscape of car insurance is likely to undergo significant changes. Here’s a glimpse into some of the potential future developments that could impact car insurance costs:

Autonomous Vehicles and Advanced Safety Features

The rise of autonomous vehicles and the integration of advanced safety features in modern cars are expected to revolutionize the insurance industry. With self-driving cars and improved safety systems, the risk of accidents is anticipated to decrease significantly. This could lead to lower insurance premiums as the likelihood of claims diminishes.

Telematics and Data-Driven Insurance

Telematics, the technology that enables the collection and transmission of vehicle data, is already being utilized by some insurance companies to offer usage-based insurance. In the future, telematics-based insurance is likely to become more prevalent, providing insurers with detailed data on driving behavior and enabling more accurate risk assessment. This could result in personalized insurance rates based on individual driving habits.

Insurtech Innovations

The emergence of insurtech, or insurance technology, is bringing about significant changes in the insurance industry. Insurtech startups are developing innovative solutions to streamline insurance processes, improve risk assessment, and enhance customer experiences. These advancements could lead to more efficient insurance operations and potentially lower costs for consumers.

Environmental and Sustainability Considerations

With growing concerns about environmental sustainability, the insurance industry is likely to increasingly consider factors like fuel efficiency and vehicle emissions when determining insurance rates. Electric and hybrid vehicles, which produce lower emissions, could potentially enjoy reduced insurance premiums in the future.

Conclusion

Understanding the factors that influence car insurance costs is essential for making informed decisions about your insurance coverage. By considering the various elements discussed in this guide, you can better navigate the complex world of car insurance and potentially reduce your insurance premiums. Remember, it’s always beneficial to shop around, compare quotes, and explore the range of options available to find the best car insurance deal for your specific circumstances.

Frequently Asked Questions

How do I know if I’m getting a good deal on my car insurance?

+To ensure you’re getting a good deal on your car insurance, it’s important to compare quotes from multiple insurers. Consider factors such as coverage limits, deductibles, and any additional benefits or discounts offered. Additionally, check online reviews and ratings to assess the insurer’s reputation and customer satisfaction.

Can I lower my insurance costs by choosing a lower level of coverage?

+While choosing a lower level of coverage may result in lower insurance premiums, it’s essential to ensure that you have adequate coverage to protect yourself and your assets. It’s a balance between cost and protection, so carefully consider your specific needs and circumstances before making any adjustments to your coverage.

Are there any insurance companies that offer specialized policies for certain professions or demographics?

+Yes, some insurance companies offer specialized policies tailored to specific professions or demographics. For example, certain insurers may provide discounted rates for teachers, nurses, or military personnel. It’s worth exploring these options to see if you qualify for any specialized policies that could potentially reduce your insurance costs.