Cost Of Insurance Per Month

Understanding the cost of insurance per month is essential for individuals and businesses alike, as it directly impacts financial planning and budget allocation. The expense can vary significantly based on numerous factors, making it crucial to delve into the specifics to gain a comprehensive understanding. In this article, we will explore the various aspects that influence insurance costs and provide an in-depth analysis of the monthly expenses associated with different insurance types.

The Complex Nature of Insurance Costs

Insurance costs are not one-size-fits-all, and the monthly premiums can differ greatly depending on several key factors. These factors include the type of insurance, coverage limits, deductibles, and personal or business circumstances. Let’s delve into these aspects to gain a clearer picture.

Insurance Type and Coverage

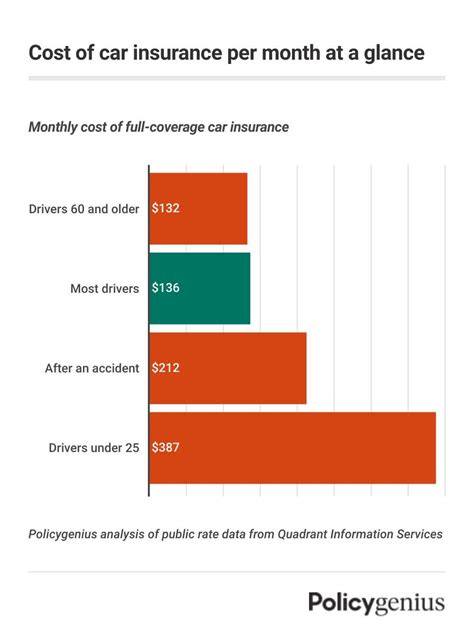

The first significant determinant of insurance costs is the type of insurance and the coverage limits chosen. Different types of insurance, such as health, auto, home, life, and business insurance, each have their own unique cost structures. For instance, health insurance premiums can vary based on the plan’s benefits, such as whether it covers prescription drugs, specialist visits, or alternative therapies. Similarly, auto insurance costs are influenced by factors like the make and model of the vehicle, the driver’s age and driving record, and the level of coverage desired.

| Insurance Type | Average Monthly Premium |

|---|---|

| Health Insurance | $400 - $1,200 |

| Auto Insurance | $50 - $250 |

| Home Insurance | $50 - $200 |

| Life Insurance | $25 - $300 |

| Business Insurance | Varies based on industry and coverage needs |

Within each insurance type, the coverage limits also play a pivotal role in determining costs. For example, a health insurance plan with a higher coverage limit for hospital stays will typically cost more than a plan with a lower limit. Similarly, a home insurance policy that provides coverage for natural disasters like hurricanes or earthquakes will likely have a higher premium compared to a basic policy.

Deductibles and Premium Costs

The choice of deductibles is another critical factor in insurance costs. Deductibles are the amount of money an insured individual or business must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower monthly premiums, as the insured party is taking on more financial responsibility. Conversely, lower deductibles lead to higher monthly premiums, as the insurance provider assumes more of the financial burden.

For instance, consider auto insurance. If an individual chooses a policy with a $1,000 deductible, their monthly premium might be lower compared to a policy with a $500 deductible. However, in the event of an accident, they would need to pay the first $1,000 of repairs out of their own pocket before the insurance coverage takes effect.

Personal and Business Circumstances

Personal and business circumstances also heavily influence insurance costs. For individuals, factors such as age, gender, health status, and lifestyle choices can impact insurance premiums. Younger individuals, for example, often pay higher premiums for auto insurance due to their perceived higher risk of accidents. Similarly, smokers may pay more for life insurance due to the increased health risks associated with smoking.

For businesses, the industry, size, and risk profile play a crucial role in determining insurance costs. High-risk industries like construction or manufacturing typically have higher insurance premiums compared to low-risk industries like consulting or software development. Additionally, the size of the business can impact premiums, with larger businesses often benefiting from economies of scale and lower per-employee insurance costs.

Case Studies: Real-World Insurance Costs

To further illustrate the variation in insurance costs, let’s examine a few real-world examples. These case studies will provide concrete insights into the monthly expenses associated with different insurance types.

Health Insurance for a Family

Consider a family of four living in a suburban area. The family chooses a health insurance plan with a 2,000 deductible and a 6,000 out-of-pocket maximum. This plan provides comprehensive coverage, including prescription drug benefits and specialist visits. The monthly premium for this plan is approximately $1,000, which includes individual premiums for each family member.

Auto Insurance for a Teen Driver

A teenager, aged 16, recently obtained their driver’s license and needs auto insurance. Due to their age and lack of driving experience, the insurance company classifies them as a high-risk driver. The chosen policy has a 500 deductible and provides comprehensive coverage, including collision and liability insurance. The monthly premium for this policy is around 300.

Home Insurance for a Coastal Property

Imagine a homeowner living in a coastal region prone to hurricanes. The homeowner’s insurance policy provides coverage for both the home and its contents, including protection against hurricane damage. With a 1,500 deductible, the monthly premium for this policy is approximately 250. The higher premium reflects the increased risk associated with the property’s location.

Life Insurance for a Young Professional

A 30-year-old non-smoker seeks life insurance coverage. They opt for a 500,000 term life insurance policy with a 20-year term. The policy has a low monthly premium of around 25 due to the insured’s age, health status, and the nature of the term policy.

The Impact of Regional Differences

Insurance costs can also vary significantly based on geographical location. Regional factors such as crime rates, natural disaster frequency, and local laws can influence insurance premiums. For instance, areas with higher crime rates may have higher auto insurance premiums due to the increased risk of theft or vandalism. Similarly, regions prone to natural disasters like hurricanes or earthquakes will often have higher home insurance costs.

| Region | Average Monthly Premium (Auto Insurance) | Average Monthly Premium (Home Insurance) |

|---|---|---|

| Urban Center | $200 | $250 |

| Suburban Area | $150 | $180 |

| Rural Community | $120 | $150 |

It's important to note that these averages are just a snapshot and can vary significantly based on specific circumstances. Additionally, some regions may have unique insurance requirements, such as flood insurance in flood-prone areas, which can further impact monthly premiums.

Future Implications and Strategies

Understanding the cost of insurance per month is not only about the present but also about planning for the future. As circumstances change, insurance needs may evolve, and staying informed about potential cost fluctuations is crucial.

For individuals, regularly reviewing insurance policies and shopping around for competitive rates can help manage costs. This is especially true for auto and home insurance, where rates can vary significantly between providers. Additionally, maintaining a good credit score and a clean driving record can positively impact insurance costs over time.

Businesses, on the other hand, may benefit from risk management strategies to mitigate insurance costs. This could include implementing safety protocols to reduce workplace accidents or investing in disaster preparedness measures to minimize potential losses. Regularly reviewing insurance policies and negotiating with providers can also lead to more favorable terms and lower premiums.

FAQ

How do I choose the right insurance coverage for my needs?

+Choosing the right insurance coverage involves assessing your specific needs and priorities. Consider factors like your financial situation, risk tolerance, and the potential consequences of various events. For instance, if you have a high-value home, you may want to prioritize home insurance with adequate coverage limits. Similarly, if you have a family to support, life insurance becomes a critical consideration. It’s often beneficial to consult with an insurance professional who can guide you through the process and help tailor a plan that suits your unique circumstances.

Are there ways to reduce insurance costs without sacrificing coverage?

+Absolutely! One effective strategy is to increase your deductibles. By taking on a larger portion of the financial responsibility in the event of a claim, you can often reduce your monthly premiums. Additionally, some insurance providers offer discounts for bundling multiple policies, such as auto and home insurance. Maintaining a good credit score can also positively impact insurance costs, as it is often considered in premium calculations. Finally, regularly reviewing your coverage and shopping around for competitive rates can help you identify cost-saving opportunities without compromising on essential coverage.

What factors influence insurance costs for businesses?

+Business insurance costs are influenced by a variety of factors, including the industry the business operates in, the size of the business, and its risk profile. High-risk industries like construction or manufacturing often have higher insurance premiums due to the increased likelihood of accidents or claims. The size of the business can also impact costs, as larger businesses may benefit from economies of scale and lower per-employee insurance costs. Additionally, the business’s risk management strategies and loss history can play a role in determining insurance premiums. Regularly reviewing insurance needs and implementing effective risk management practices can help businesses control their insurance costs.