Cost Of Small Business Liability Insurance

As a small business owner, understanding the importance of liability insurance is crucial for safeguarding your enterprise and its future. Liability insurance serves as a vital protection against potential financial risks arising from unforeseen circumstances. This article aims to provide an in-depth analysis of the cost of small business liability insurance, exploring the factors that influence premiums and offering valuable insights to help you make informed decisions about coverage.

Overview of Small Business Liability Insurance

Small business liability insurance, often referred to as general liability insurance, is a type of coverage that protects your business from financial losses resulting from third-party claims and lawsuits. These claims can arise from a variety of incidents, including bodily injury, property damage, advertising-related disputes, and personal and advertising injury. General liability insurance is a fundamental aspect of risk management for small businesses, providing a safety net against the unpredictable.

The purpose of this article is to delve into the intricacies of small business liability insurance, focusing on the costs associated with this essential coverage. By understanding the factors that influence premiums and the various options available, you can make well-informed decisions to ensure your business is adequately protected.

Factors Influencing the Cost of Liability Insurance

The cost of small business liability insurance is determined by a multitude of factors, each playing a role in the overall premium calculation. These factors include:

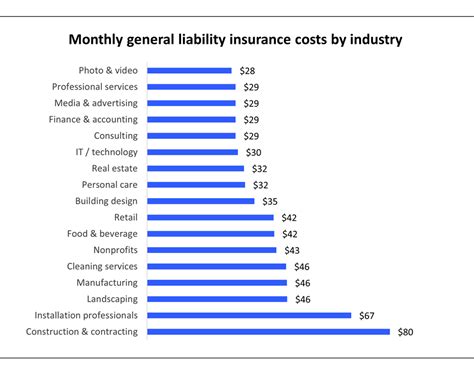

- Industry and Business Type: Different industries and business types carry varying levels of risk. For instance, a construction business faces higher risks compared to a consulting firm. Insurance providers consider these distinctions when determining premiums.

- Business Size and Revenue: The size and revenue of your business are key factors. Larger businesses with higher revenue often face increased exposure and may require more extensive coverage, impacting the cost.

- Location: The geographical location of your business can affect premiums. Certain areas may have higher claims rates or specific environmental risks, leading to variations in insurance costs.

- Claims History: A history of claims or lawsuits against your business can influence insurance premiums. Insurers carefully consider past claims when assessing the risk associated with insuring your business.

- Coverage Limits: The level of coverage you choose significantly impacts the cost. Higher coverage limits provide more protection but also result in higher premiums.

- Deductibles: Similar to other insurance policies, the deductible you select can affect the premium. Opting for a higher deductible may reduce the cost, but it means you'll bear more of the financial burden in the event of a claim.

- Additional Coverage Options: Beyond general liability insurance, you may opt for additional coverage such as product liability, professional liability, or cyber liability insurance. These extra protections can increase the overall cost of your insurance package.

Average Costs and Premium Ranges

The cost of small business liability insurance can vary significantly based on the factors mentioned above. On average, small businesses can expect to pay between $300 to $1,000 per year for general liability insurance. However, it's important to note that these figures are just estimates, and the actual cost can be higher or lower depending on your specific circumstances.

To provide a more detailed understanding, here's a breakdown of average premium ranges based on different business types:

| Business Type | Average Annual Premium |

|---|---|

| Retail Stores | $500 - $1,500 |

| Service Businesses (e.g., Consulting, Hair Salons) | $300 - $800 |

| Construction and Trade Businesses | $800 - $2,000 |

| Manufacturing and Distribution Businesses | $1,000 - $3,000 |

These ranges offer a general idea, but it's crucial to obtain personalized quotes to understand the precise cost for your specific business.

Determining Adequate Coverage

When assessing the cost of small business liability insurance, it's essential to consider the coverage limits that best suit your needs. Adequate coverage ensures you're protected against potential claims without overspending on insurance.

Here are some key considerations to help you determine the right coverage limits:

- Assess Your Risks: Evaluate the specific risks associated with your business. Consider factors like the likelihood of customer injuries, property damage, or legal disputes. Understanding these risks will guide your coverage decisions.

- Industry Standards: Research the industry standards for liability insurance coverage. Many industries have established benchmarks for coverage limits, which can serve as a starting point for your assessment.

- Consult an Expert: Seek advice from insurance professionals who specialize in small business coverage. They can provide valuable insights and help you navigate the complex world of liability insurance, ensuring you select the right coverage for your business.

The Importance of Comparing Quotes

Obtaining multiple quotes is a critical step in securing the best small business liability insurance coverage at the most competitive price. Comparing quotes allows you to understand the market rates and make informed decisions about your insurance provider and coverage.

Here's a step-by-step guide to help you compare quotes effectively:

- Identify Reputable Insurers: Start by researching and creating a list of reputable insurance companies that offer small business liability insurance. Look for companies with a strong track record and positive reviews.

- Gather Information: Prepare the necessary information about your business, including details on your industry, revenue, location, and claims history. This information will be crucial for obtaining accurate quotes.

- Request Quotes: Contact the insurers on your list and request quotes. Provide the required information and be as detailed as possible to ensure accurate estimates.

- Compare Premiums and Coverage: Carefully analyze the quotes you receive, comparing not just the premiums but also the coverage limits and deductibles. Look for the best combination of affordable premiums and adequate coverage.

- Consider Additional Benefits: Beyond the basic coverage, some insurers offer additional benefits or perks. These could include policy discounts, flexible payment options, or valuable add-on coverages. Evaluate these benefits as part of your comparison.

- Seek Expert Advice: If needed, consult an insurance broker or agent who can provide impartial advice and help you understand the nuances of each quote. Their expertise can guide you towards the best coverage and value.

Bundling Insurance Policies for Cost Savings

Bundling your small business liability insurance with other types of coverage can often result in significant cost savings. Many insurance providers offer package policies or business owner's policies (BOPs) that combine general liability insurance with other essential coverages, such as property insurance, business interruption insurance, and more.

By bundling your policies, you not only simplify your insurance management but also enjoy potential discounts. Insurance companies often provide multi-policy discounts as an incentive for customers to purchase multiple coverages from them. These discounts can reduce your overall insurance costs and provide a more comprehensive protection package for your business.

When considering bundling, it's important to carefully review the specific coverages included in the package. Ensure that the bundled policy aligns with your business's unique needs and provides the necessary protection. Consulting with an insurance professional can help you navigate the options and select the best bundle for your business.

The Role of Deductibles in Premium Costs

The deductible you choose for your small business liability insurance policy can have a significant impact on your premium costs. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

When selecting a deductible, it's crucial to find a balance between cost savings and financial preparedness. Opting for a higher deductible can save you money on premiums, but it means you'll need to have sufficient funds available to cover potential claims. On the other hand, a lower deductible provides more financial protection but comes at a higher premium cost.

Consider your business's financial stability and risk tolerance when deciding on a deductible. If your business has a strong financial foundation and can handle the potential financial burden of a higher deductible, you may opt for a higher deductible to save on premiums. However, if your business operates on a tighter budget or has limited financial resources, a lower deductible may be more suitable to ensure you can cover unexpected expenses without straining your finances.

It's important to note that deductibles apply to each claim, so selecting a higher deductible means you'll be responsible for a larger portion of each claim. Be sure to assess your business's risk profile and the likelihood of claims to make an informed decision. Consulting with an insurance professional can provide valuable insights and help you choose a deductible that aligns with your business's needs and budget.

Future Implications and Trends in Liability Insurance

The landscape of small business liability insurance is continually evolving, driven by changing business environments, emerging risks, and advancements in technology. Staying informed about these trends is essential for business owners to ensure they have the right coverage in place.

Here are some key future implications and trends to consider:

- Increasing Awareness and Education: As small business owners become more aware of the importance of liability insurance, there is a growing demand for comprehensive coverage. Insurance providers are responding by offering more educational resources and tailored solutions to meet the unique needs of small businesses.

- Emerging Risks and New Coverages: The business world is constantly evolving, and new risks emerge regularly. From data breaches to environmental liabilities, insurance providers are developing innovative coverages to address these emerging risks. Small business owners should stay updated on these developments to ensure they have the necessary protection.

- Technology and Digital Transformation: The digital transformation of the insurance industry is revolutionizing the way small businesses access and manage their insurance policies. Online platforms and digital tools are making it easier and more convenient for business owners to obtain quotes, compare policies, and manage their coverage.

- Collaborative Partnerships: Insurance providers are increasingly partnering with small business associations, chambers of commerce, and other organizations to offer exclusive group rates and tailored coverage options. These partnerships provide small businesses with access to more affordable and specialized insurance solutions.

- Risk Mitigation and Loss Prevention: Insurance companies are focusing on risk management and loss prevention strategies to reduce the likelihood and impact of claims. By providing resources and guidance on risk mitigation, insurers are helping small businesses reduce their exposure to potential liabilities.

Staying informed about these future implications and trends will empower small business owners to make proactive decisions about their liability insurance coverage. By understanding the evolving landscape, business owners can ensure they have the right protection in place to navigate the challenges and opportunities that lie ahead.

Conclusion

In conclusion, understanding the cost of small business liability insurance is crucial for safeguarding your enterprise and making informed decisions about coverage. By considering the factors that influence premiums, assessing your coverage needs, and comparing quotes, you can secure the right protection at a competitive price.

Remember, liability insurance is an essential component of your business's risk management strategy. Stay informed, consult experts when needed, and regularly review your coverage to ensure it aligns with your business's evolving needs. With the right protection in place, you can focus on growing your business with confidence and peace of mind.

What is the average cost of small business liability insurance?

+

The average cost of small business liability insurance can range from 300 to 1,000 per year. However, the exact cost depends on various factors such as industry, business size, location, and coverage limits.

How can I determine the right coverage limits for my small business?

+

To determine the right coverage limits, assess your business’s specific risks, research industry standards, and consult with insurance professionals. They can help you understand the appropriate coverage limits based on your business’s unique needs.

What are the benefits of bundling small business insurance policies?

+

Bundling small business insurance policies can result in cost savings through multi-policy discounts. It also simplifies insurance management and provides a more comprehensive protection package for your business.