Coverage Dental Insurance

Dental insurance is an essential component of overall healthcare coverage, ensuring that individuals have access to necessary dental care without incurring substantial financial burdens. This comprehensive guide aims to delve into the intricacies of dental insurance, providing an expert analysis of its coverage, benefits, and implications for individuals and families. By understanding the nuances of dental insurance, individuals can make informed decisions about their healthcare and ensure optimal oral health.

Understanding Dental Insurance Coverage

Dental insurance plans vary widely in their coverage and benefits, offering a range of options to suit different needs and budgets. At its core, dental insurance is designed to provide financial protection against the costs of dental procedures, which can be substantial, especially for complex treatments. By enrolling in a dental insurance plan, individuals gain access to a network of dental providers who have agreed to offer discounted rates to plan members.

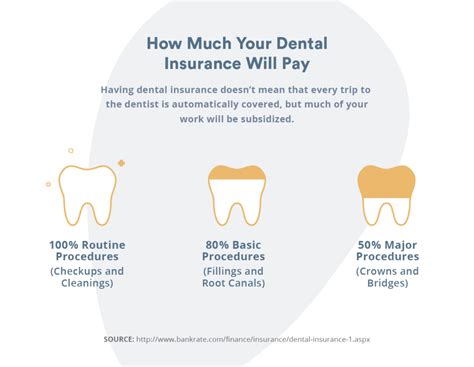

The scope of coverage in dental insurance plans can be categorized into three main types: preventive, basic, and major services. Preventive services, such as routine check-ups, cleanings, and X-rays, are typically covered at a higher percentage or even 100% by most plans, as they are essential for maintaining good oral health and can help prevent more costly issues from developing.

Basic services, including fillings, extractions, and root canals, are often covered at a lower percentage, typically around 70-80%. While these procedures are more costly than preventive services, they are still relatively common and necessary for maintaining oral health. Major services, such as crowns, bridges, and dentures, are generally covered at the lowest percentage, around 50%, due to their higher cost and less frequent need.

In-Network vs. Out-of-Network Coverage

A key aspect of dental insurance coverage is the concept of in-network and out-of-network providers. Dental insurance plans typically have a network of preferred providers who have agreed to offer discounted rates to plan members. In-network providers are those who have contracted with the insurance company and have agreed to accept the plan's negotiated rates as full payment for their services. This means that when you visit an in-network dentist, you will typically only be responsible for a copay or coinsurance amount, which is a predetermined percentage of the cost of the procedure.

On the other hand, out-of-network providers are those who have not contracted with the insurance company. If you choose to see an out-of-network dentist, you may still be able to receive coverage, but the process and costs can be different. Out-of-network providers are not bound by the insurance company's negotiated rates, so they may charge more for their services. In this case, you may need to pay the full cost of the procedure upfront and then submit a claim to your insurance company for reimbursement. The reimbursement amount will depend on your plan's out-of-network benefits and may be subject to a lower percentage of coverage compared to in-network providers.

| Coverage Type | Percentage Covered |

|---|---|

| Preventive Services | 70-100% |

| Basic Services | 50-80% |

| Major Services | 40-50% |

Benefits and Advantages of Dental Insurance

Dental insurance offers a multitude of benefits that extend beyond financial protection. One of the primary advantages is the encouragement of regular dental visits, which are crucial for maintaining optimal oral health. By covering the costs of preventive care, dental insurance plans incentivize individuals to seek regular check-ups and cleanings, allowing for early detection and treatment of potential issues.

Additionally, dental insurance provides a safety net for individuals facing unexpected dental emergencies or complex treatments. The coverage offered by insurance plans can significantly reduce the financial burden of such situations, ensuring that individuals can access the necessary care without facing excessive out-of-pocket expenses. This is particularly beneficial for individuals with pre-existing dental conditions or those who require ongoing maintenance for oral health issues.

Promoting Oral Health and Preventive Care

Dental insurance plans play a vital role in promoting oral health and preventive care. By covering the costs of routine check-ups, cleanings, and diagnostic procedures, insurance providers encourage individuals to prioritize their oral hygiene and overall well-being. Regular dental visits allow dentists to identify and address potential issues early on, preventing minor problems from escalating into more complex and costly treatments.

Furthermore, many dental insurance plans offer additional benefits aimed at promoting oral health. These may include discounts on orthodontic treatments, coverage for dental sealants to protect against cavities, or even incentives for maintaining good oral hygiene practices. By investing in preventive care, dental insurance plans not only save individuals money in the long run but also contribute to improved overall health and well-being.

| Benefit | Description |

|---|---|

| Preventive Care Coverage | Routine check-ups, cleanings, and X-rays are typically covered at a higher percentage, encouraging regular dental visits. |

| Financial Protection | Dental insurance provides coverage for a range of services, reducing the financial burden of dental treatments. |

| Early Detection and Treatment | Regular dental visits facilitated by insurance coverage allow for the early identification and treatment of oral health issues. |

Choosing the Right Dental Insurance Plan

Selecting the appropriate dental insurance plan is a crucial decision that requires careful consideration of individual needs and circumstances. When evaluating different plans, it's essential to assess factors such as the scope of coverage, network of providers, and any additional benefits or limitations. Understanding the potential out-of-pocket costs associated with different procedures is also key to making an informed choice.

For individuals with specific dental needs or a history of oral health issues, it may be beneficial to opt for a plan with a broader network of providers and more comprehensive coverage. This ensures access to a wider range of specialists and reduces the likelihood of facing unexpected costs. On the other hand, those with generally good oral health may find that a plan with a narrower network and more limited coverage is sufficient to meet their needs.

Evaluating Plan Options

When comparing dental insurance plans, it's important to thoroughly examine the details of each option. Consider the following factors to make an informed decision:

- Network of Providers: Check if your preferred dental providers are in-network with the plan. In-network providers offer discounted rates, making your dental care more affordable.

- Coverage Limits: Review the plan's coverage limits for various procedures. Some plans have annual maximums or restrictions on certain treatments, which could impact your out-of-pocket expenses.

- Waiting Periods: Be aware of any waiting periods before certain procedures are covered. Some plans may have waiting periods for major services, such as crowns or implants.

- Additional Benefits: Look for plans that offer extra perks, such as coverage for orthodontic treatments, dental accidents, or discounts on dental products.

- Premiums and Deductibles: Consider the cost of the plan's premiums and deductibles. While a plan with lower premiums may seem appealing, it might have higher out-of-pocket costs for services.

It's also beneficial to read reviews and ratings of different dental insurance providers to get an idea of their customer service and claim processing efficiency. Remember, the right dental insurance plan should align with your specific needs and budget, ensuring you receive the necessary coverage without unnecessary financial strain.

Conclusion: The Impact of Dental Insurance

Dental insurance plays a pivotal role in ensuring access to quality dental care for individuals and families. By understanding the intricacies of coverage, benefits, and plan options, individuals can make informed decisions that align with their oral health needs and financial capabilities. The impact of dental insurance extends beyond financial protection, fostering a culture of preventive care and early intervention that ultimately contributes to improved oral health and overall well-being.

As the dental insurance landscape continues to evolve, it is essential for individuals to stay informed and engaged with their healthcare choices. By staying up-to-date with plan changes, understanding their coverage, and actively seeking preventive care, individuals can take control of their oral health and make the most of their dental insurance benefits.

Frequently Asked Questions

What is the average cost of dental insurance per month for an individual?

+

The average cost of dental insurance for an individual can vary widely based on factors such as location, age, and the specific plan chosen. Generally, premiums range from 30 to 50 per month, but this can increase or decrease depending on the coverage and benefits included in the plan.

Are there any discounts or incentives for families with multiple members enrolled in a dental insurance plan?

+

Yes, many dental insurance providers offer family plans with discounted rates for additional family members. These plans can provide significant savings for families, making it more affordable to ensure everyone’s oral health is covered.

Can I use my dental insurance for emergency dental procedures?

+

Yes, dental insurance typically covers emergency dental procedures, although the specific coverage and reimbursement rates may vary depending on the plan and the nature of the emergency. It’s important to review your plan’s coverage details and contact your insurance provider in case of an emergency to understand your benefits and any necessary steps to receive coverage.

How often should I visit the dentist if I have dental insurance?

+

The recommended frequency for dental visits is typically twice a year, or every six months. This allows your dentist to monitor your oral health, provide necessary cleanings, and address any potential issues early on. However, the specific frequency of visits may vary depending on your individual oral health needs and the recommendations of your dentist.

Are there any alternative dental care options for individuals who don’t have dental insurance?

+

Yes, there are alternative options available for individuals without dental insurance. These include discount dental plans, which offer reduced rates for dental services, and dental schools or clinics that provide low-cost or free dental care as part of their training programs. It’s important to research and explore these options to find the best fit for your needs and budget.