Definition Home Insurance

Understanding the intricacies of home insurance is crucial for every homeowner. It provides financial protection against various unforeseen events that could potentially damage your property and disrupt your life. This comprehensive guide will delve into the definition, importance, and various aspects of home insurance, offering valuable insights for anyone seeking to protect their most significant investment.

The Essence of Home Insurance

Home insurance, also known as property insurance or homeowners insurance, is a contract between a policyholder and an insurance company. It offers financial protection against losses and damages that may occur to a residence, its contents, and the residents themselves. This form of insurance is designed to provide peace of mind and financial security, ensuring that policyholders can rebuild and recover from unexpected events that could otherwise be financially devastating.

The coverage provided by home insurance policies can vary widely, depending on the specific needs and circumstances of the policyholder. It typically includes coverage for:

- Damage to the dwelling structure, including walls, roofs, floors, and fixtures.

- Personal belongings and valuables inside the home, such as furniture, electronics, and clothing.

- Liability for injuries or damages caused to others on the insured property.

- Additional living expenses incurred if the home becomes uninhabitable due to a covered event.

- Certain natural disasters, like hurricanes, tornadoes, or wildfires.

Why Home Insurance Matters

Homeownership is a significant milestone, often representing one of the largest investments an individual or family will make. Home insurance is an essential tool to protect this investment and manage the risks associated with homeownership. Here’s why it matters:

Financial Protection

Unexpected events like fires, storms, or burglaries can cause extensive damage to a home and its contents. Without insurance, the financial burden of repairing or replacing these items can be overwhelming. Home insurance provides a safety net, covering the costs of repairs or replacements, ensuring that homeowners can recover from such incidents.

Peace of Mind

Knowing that your home and its contents are protected can bring immense peace of mind. It allows homeowners to focus on their daily lives without constant worry about potential disasters. With home insurance, you can rest assured that you have the support you need to rebuild and recover.

Legal Requirements

In some regions, having home insurance is a legal requirement for homeowners. This is often the case for mortgage lenders, who may require borrowers to maintain insurance coverage as a condition of the loan. By having home insurance, you not only protect your investment but also comply with legal obligations.

Key Components of Home Insurance

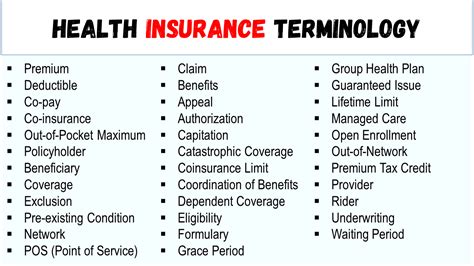

A home insurance policy is a comprehensive document that outlines the specific coverages, limits, and exclusions of the policy. It’s important to understand these components to ensure that your policy meets your needs and expectations.

Coverage Types

Home insurance policies typically offer a range of coverage types, including:

- Dwelling Coverage: Protects the physical structure of the home, including attached structures like garages and porches.

- Personal Property Coverage: Covers personal belongings and furnishings inside the home.

- Liability Coverage: Provides protection if someone is injured on your property or if you, as a resident, cause damage to someone else's property.

- Additional Living Expenses: Covers the cost of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered event.

- Medical Payments Coverage: Pays for medical expenses if someone is injured on your property, regardless of liability.

Policy Limits and Deductibles

Every home insurance policy has limits, which are the maximum amounts the insurance company will pay for a covered loss. It’s crucial to ensure that your policy limits align with the replacement cost of your home and its contents. Additionally, policies typically have deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in.

Exclusions

While home insurance covers a wide range of risks, there are certain events and circumstances that are typically excluded from coverage. Common exclusions include:

- Flood damage (often requires separate flood insurance)

- Earthquakes (separate earthquake insurance is usually needed)

- Normal wear and tear

- Intentional acts or negligence

- Certain types of water damage, such as those caused by maintenance issues or plumbing problems

Factors Influencing Home Insurance Rates

The cost of home insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions when choosing a policy and potentially save money.

Location

The geographical location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters like hurricanes, tornadoes, or wildfires tend to have higher insurance premiums. Similarly, neighborhoods with high crime rates or a history of frequent claims may also see higher insurance costs.

Home Value and Construction

The value of your home and the materials used in its construction can impact insurance rates. Homes with higher replacement costs will generally have higher premiums. Additionally, homes built with fire-resistant materials or equipped with security systems may qualify for lower rates.

Coverage Limits and Deductibles

The level of coverage you choose and the associated deductibles can affect your insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums, as the insurance company assumes more financial risk.

Claim History

Insurance companies consider the claim history of both the property and the policyholder. Homes with a history of frequent claims may face higher premiums, as they pose a greater risk to the insurer. Similarly, policyholders with a history of multiple claims may see their rates increase or may have difficulty finding insurance.

Tips for Choosing the Right Home Insurance

Selecting the right home insurance policy involves careful consideration of your needs and circumstances. Here are some tips to guide you through the process:

Assess Your Needs

Begin by evaluating your specific needs and the potential risks your home faces. Consider factors like your location, the value of your home and its contents, and any unique circumstances, such as living in a flood-prone area.

Compare Policies

Research and compare multiple home insurance policies from different providers. Look beyond the price and consider the coverage limits, deductibles, and exclusions. Ensure that the policy you choose offers adequate coverage for your needs.

Understand Exclusions

Carefully review the exclusions listed in the policy. Ensure that you understand what events or circumstances are not covered, and consider whether you need additional insurance for those risks.

Consider Endorsements and Riders

Endorsements and riders are add-ons to your policy that can provide additional coverage for specific items or risks. These can be particularly useful for valuable possessions or unique circumstances.

Choose a Reputable Insurer

Select an insurance company with a strong financial standing and a good reputation for customer service. This ensures that they will be able to pay out claims and provide support when you need it most.

The Future of Home Insurance

The home insurance industry is evolving, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of home insurance:

Digital Transformation

The rise of digital technologies has led to more efficient and convenient ways of obtaining and managing home insurance. Online platforms and mobile apps now offer quick quotes, easy policy management, and streamlined claims processes.

Data-Driven Underwriting

Advanced analytics and data science are being used to assess risk more accurately. This allows insurers to offer more tailored policies, potentially leading to better coverage and more competitive pricing for policyholders.

Smart Home Integration

The integration of smart home technology with insurance policies is gaining traction. Insurers are exploring ways to offer discounts or incentives for homes equipped with smart devices that can help prevent or mitigate losses, such as smart smoke detectors or water leak sensors.

Sustainable and Green Initiatives

With growing environmental awareness, insurers are beginning to offer incentives for homeowners who adopt sustainable practices or install green technologies. This could include discounts for homes with solar panels or energy-efficient appliances.

Personalized Coverage

The future of home insurance is moving towards more personalized coverage. Insurers are exploring ways to offer policies that adapt to the changing needs and circumstances of policyholders, providing flexibility and tailored protection.

Conclusion

Home insurance is a vital tool for protecting one of life’s most significant investments - your home. By understanding the definition, importance, and various aspects of home insurance, you can make informed decisions to ensure your home and its contents are adequately protected. Remember, the right home insurance policy provides not just financial protection but also peace of mind, allowing you to enjoy your home without the worry of unforeseen disasters.

What is the average cost of home insurance?

+The average cost of home insurance can vary significantly based on factors such as location, home value, and coverage limits. According to recent data, the national average premium for home insurance is approximately $1,300 per year. However, it’s important to note that this is just an average, and your specific premium can be higher or lower depending on your individual circumstances.

Does home insurance cover flood damage?

+Standard home insurance policies typically do not cover flood damage. Flood insurance is often a separate policy that must be purchased specifically to cover damage caused by flooding. It’s important to check with your insurance provider or agent to understand the specific coverage options available to you.

Can I customize my home insurance policy?

+Yes, home insurance policies can often be customized to meet your specific needs. You can choose different levels of coverage for your dwelling, personal property, and liability. Additionally, you can opt for additional coverage for valuable items or unique circumstances, such as jewelry, art, or identity theft protection. Working with an insurance agent can help you tailor your policy to your specific requirements.