Delta Dental Insurance Coverage

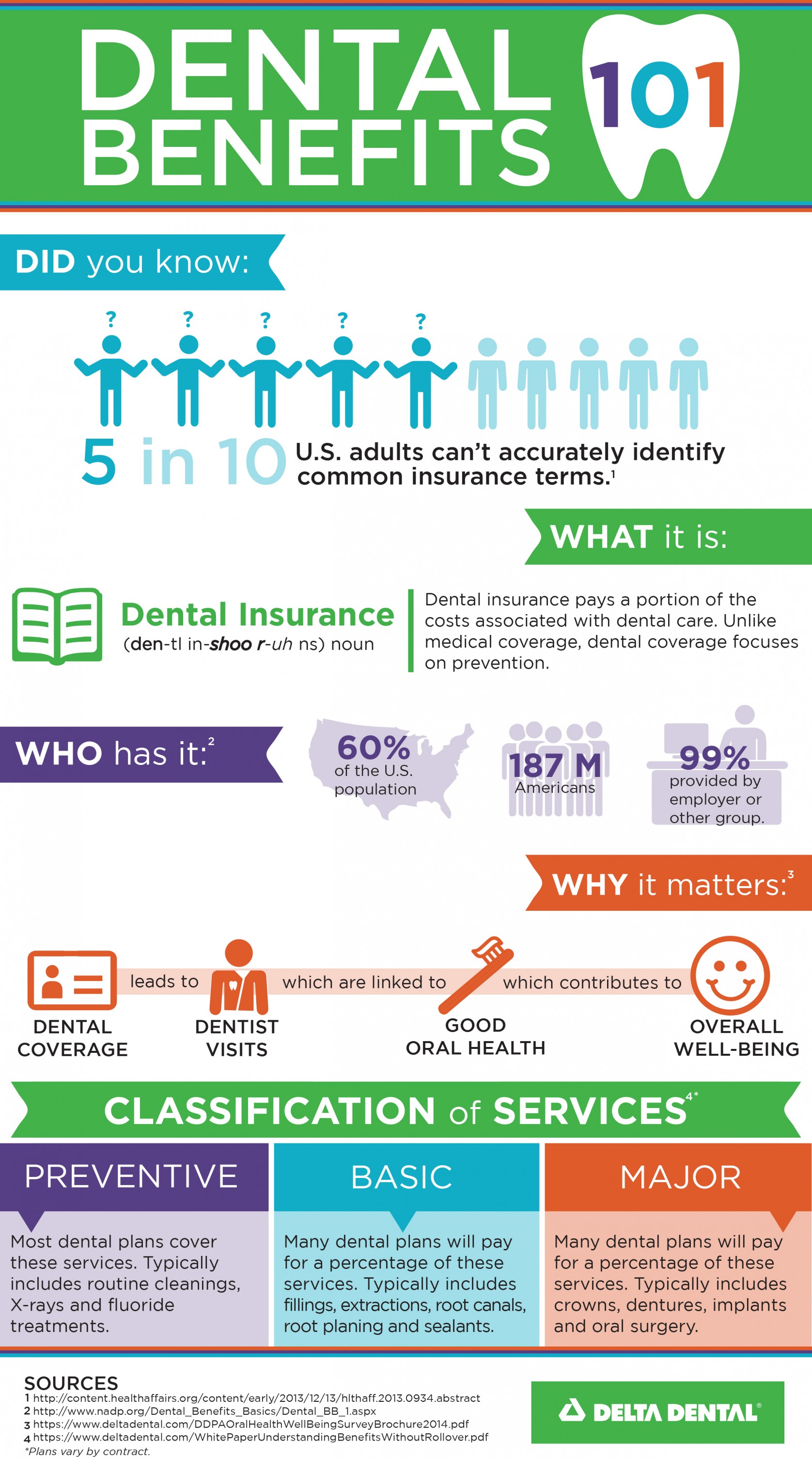

Dental health is a crucial aspect of overall well-being, and having reliable dental insurance can make a significant difference in maintaining optimal oral health. Delta Dental, one of the leading dental insurance providers in the United States, offers a comprehensive range of plans designed to cater to various individual and family needs. This article aims to provide an in-depth exploration of Delta Dental's insurance coverage, shedding light on its benefits, plan options, and the impact it can have on individuals and families seeking quality dental care.

Understanding Delta Dental’s Insurance Coverage

Delta Dental, with its extensive network of dental providers and a strong commitment to oral health, has established itself as a trusted name in the industry. Their insurance coverage options are tailored to provide accessible and affordable dental care, ensuring that individuals and families can receive the necessary treatments without compromising their financial stability.

One of the key strengths of Delta Dental's insurance plans is their focus on preventive care. Recognizing the importance of early intervention and regular check-ups, Delta Dental emphasizes the value of preventive measures in maintaining good oral health. This approach not only benefits the insured individuals but also contributes to the overall reduction of more complex and costly dental issues down the line.

Plan Options and Coverage Details

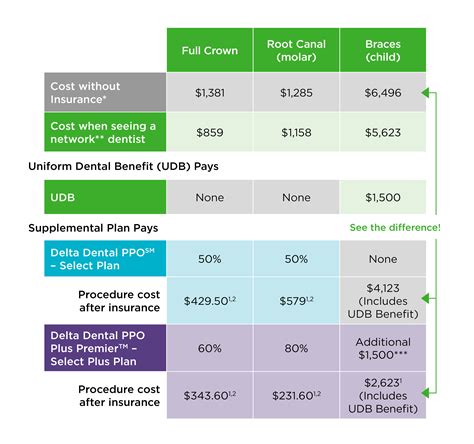

Delta Dental offers a diverse range of insurance plans to accommodate different budgets and dental needs. Here’s an overview of some of the plan options:

- Individual Plans: Tailored for single individuals seeking comprehensive dental coverage, these plans offer a variety of benefits, including preventive care, restorative treatments, and even orthodontics in some cases. The level of coverage can be customized to fit the specific needs and budget of the insured.

- Family Plans: Designed to cater to the unique requirements of families, these plans provide coverage for multiple family members. With a focus on accessibility and affordability, Delta Dental's family plans ensure that the entire family can receive the necessary dental care without placing a significant financial burden on the household.

- Senior Plans: Recognizing the unique dental needs of seniors, Delta Dental offers specialized plans for this demographic. These plans often include additional benefits, such as coverage for dentures, dental implants, and other advanced procedures that may be required as individuals age.

- Employer-Sponsored Plans: Many employers opt to provide Delta Dental's insurance coverage as a benefit to their employees. These plans are typically tailored to the specific needs of the workforce, offering a balance between cost-effectiveness and comprehensive dental care.

Each plan option comes with its own set of coverage details, including the frequency and extent of covered procedures, waiting periods, and any applicable deductibles or copayments. Delta Dental ensures transparency by providing detailed plan summaries and explanations, allowing individuals and employers to make informed decisions about their dental insurance choices.

| Plan Type | Coverage Highlights |

|---|---|

| Individual Plans | Customizable coverage, preventive care focus, optional orthodontics |

| Family Plans | Affordable family coverage, tailored to diverse needs |

| Senior Plans | Specialized coverage for seniors, including advanced procedures |

| Employer-Sponsored Plans | Cost-effective, comprehensive care for employees |

Benefits of Delta Dental Insurance

Choosing Delta Dental insurance offers a range of advantages that contribute to improved oral health and overall well-being. Here are some key benefits:

- Comprehensive Coverage: Delta Dental's plans provide extensive coverage for a wide range of dental procedures, ensuring that individuals can access the necessary treatments without significant financial barriers.

- Preventive Care Focus: By prioritizing preventive care, Delta Dental helps individuals maintain good oral health, reducing the risk of more complex and costly dental issues in the future.

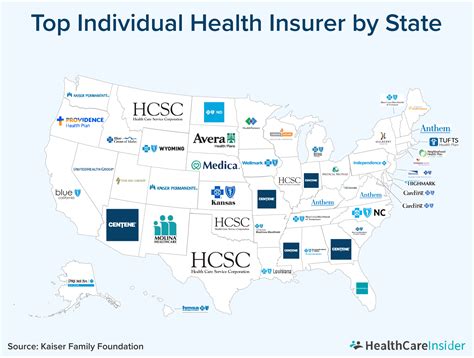

- Nationwide Network: With an extensive network of dental providers, Delta Dental ensures that insured individuals have access to quality care regardless of their location. This is particularly beneficial for those who travel frequently or relocate.

- Flexibility and Customization: Delta Dental's plans are designed with flexibility in mind, allowing individuals and families to choose coverage options that align with their specific needs and budgets. This customization ensures that everyone can find a plan that suits their unique circumstances.

- Educational Resources: Beyond insurance coverage, Delta Dental provides valuable educational resources and tools to help individuals understand oral health better. This includes informative articles, videos, and tips on maintaining good dental hygiene practices.

Real-World Impact: Success Stories

To illustrate the tangible benefits of Delta Dental insurance, let’s explore a few real-world success stories:

Case Study 1: Preventing Costly Dental Issues

Meet Sarah, a busy professional who prioritized her oral health by enrolling in a Delta Dental insurance plan. With regular check-ups and preventive care, Sarah’s dentist identified early signs of gum disease. Thanks to Delta Dental’s coverage, Sarah was able to receive timely treatment, preventing the progression of gum disease and avoiding more extensive and costly procedures down the line.

Case Study 2: Family Dental Care

The Johnson family, consisting of two parents and three children, opted for a Delta Dental family plan. With young children and aging parents, their dental needs varied widely. Delta Dental’s plan provided comprehensive coverage for everyone, ensuring that regular check-ups, orthodontics for the children, and specialized care for the parents were all accessible and affordable. The family’s oral health improved significantly, and they appreciated the peace of mind that came with knowing their dental needs were well-managed.

Case Study 3: Senior Dental Health

Mr. Wilson, a retiree, chose Delta Dental’s senior plan to address his unique dental requirements. With age-related dental concerns, such as tooth decay and gum recession, Mr. Wilson benefited from the plan’s coverage for dentures and advanced procedures. Delta Dental’s insurance allowed him to maintain his oral health and overall well-being without worrying about the financial burden of specialized dental care.

Performance Analysis and Future Implications

Delta Dental’s insurance coverage has consistently demonstrated its effectiveness in improving oral health outcomes. By prioritizing preventive care and offering accessible, comprehensive plans, Delta Dental has contributed to a reduction in costly dental emergencies and the overall improvement of dental health among its insured population.

Looking ahead, Delta Dental's focus on innovation and technological advancements is expected to further enhance its insurance offerings. The company's commitment to staying at the forefront of dental care trends ensures that its plans will continue to provide cutting-edge coverage, keeping up with the evolving needs of individuals and families.

As dental technology advances, Delta Dental is well-positioned to incorporate new treatments and procedures into its insurance plans, ensuring that its insured population has access to the latest and most effective dental care options. This forward-thinking approach not only benefits individuals but also contributes to the overall advancement of oral health practices.

What is the average cost of Delta Dental insurance plans?

+The cost of Delta Dental insurance plans varies based on factors such as the type of plan, coverage level, and region. On average, individual plans range from $30 to $50 per month, while family plans can cost between $100 and $150 per month. Employer-sponsored plans may have different rates, and senior plans often have specialized pricing structures.

Does Delta Dental cover cosmetic dentistry procedures?

+Delta Dental's coverage for cosmetic dentistry procedures varies depending on the plan and the specific procedure. While some plans may offer limited coverage for cosmetic procedures, others may exclude them altogether. It's essential to review the plan details carefully to understand the extent of coverage for cosmetic treatments.

Are there any waiting periods for Delta Dental insurance plans?

+Yes, some Delta Dental insurance plans have waiting periods for certain procedures. These waiting periods can range from a few months to a year, depending on the plan and the type of treatment. It's important to review the plan's details to understand any waiting periods that may apply.

In conclusion, Delta Dental’s insurance coverage stands as a testament to its commitment to oral health and accessible dental care. With a range of plan options, a focus on preventive care, and a nationwide network of providers, Delta Dental empowers individuals and families to take control of their dental health. As the company continues to innovate and adapt to the evolving landscape of dental care, its insurance offerings are poised to remain a reliable and trusted choice for those seeking quality dental coverage.