Dental Insurance Cheapest

Dental insurance is an essential aspect of maintaining good oral health, but finding the cheapest option that suits your needs can be a daunting task. With a myriad of plans and providers available, it's crucial to understand the key factors that influence the cost of dental insurance and how to navigate the market to secure the best deal. In this comprehensive guide, we will delve into the world of dental insurance, exploring the various factors that impact its affordability, providing practical tips for finding the cheapest plans, and offering insights into the value of investing in quality dental care.

Understanding the Cost of Dental Insurance

The cost of dental insurance can vary significantly depending on several key factors. These factors include the type of plan, the coverage offered, the provider, and your geographic location. By understanding how these elements interplay, you can make more informed decisions when choosing a dental insurance plan.

Plan Types and Coverage

Dental insurance plans come in various types, each with its own set of benefits and limitations. The most common types include:

- Indemnity Plans: These traditional plans allow you to choose any dentist, but you may need to pay out-of-pocket and then submit claims for reimbursement.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility, allowing you to choose from a network of dentists while still providing coverage for out-of-network care, albeit at a higher cost.

- Health Maintenance Organization (HMO) Plans: HMO plans typically require you to select a primary dentist from a network and may have limited coverage for out-of-network services.

- Discount Dental Plans: Unlike traditional insurance, these plans offer discounted rates on dental services but do not provide actual insurance coverage.

The level of coverage offered by these plans also varies. Some plans may only cover basic preventive care, while others may provide comprehensive coverage for a wide range of procedures, including orthodontics and cosmetic dentistry. The more comprehensive the coverage, the higher the premium is likely to be.

Provider Influence

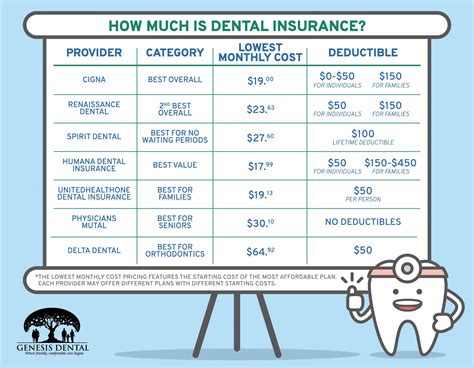

The dental insurance provider you choose can significantly impact the cost of your plan. Established providers with a wide network of dentists may offer more competitive rates due to their negotiating power. On the other hand, smaller providers or those with a limited network may charge higher premiums to cover their costs.

Geographic Location

The cost of dental insurance can also vary based on your geographic location. Dental care costs can differ from one region to another, and insurance providers may adjust their premiums accordingly. Additionally, the availability of dentists and the competition among providers in your area can influence the cost of insurance.

Tips for Finding the Cheapest Dental Insurance

Now that we understand the factors that influence the cost of dental insurance, let’s explore some practical strategies to help you find the cheapest plans that meet your needs.

Compare Multiple Plans

The first step in finding the cheapest dental insurance is to compare multiple plans from different providers. Utilize online comparison tools or work with an insurance broker who can provide quotes from various companies. By comparing premiums, coverage, and network dentists, you can identify the plans that offer the best value for your money.

Consider High-Deductible Plans

High-deductible plans typically have lower monthly premiums but require you to pay a larger portion of your dental costs out-of-pocket before the insurance coverage kicks in. If you’re generally healthy and only require occasional dental care, a high-deductible plan can be a cost-effective option.

Evaluate Network Dentists

When comparing plans, pay close attention to the network dentists associated with each provider. Choose a plan with a network that includes dentists in your area who offer the services you need. This ensures that you have convenient access to quality care without incurring additional out-of-network costs.

Opt for Preventive Care

Investing in preventive dental care can save you money in the long run. Many dental insurance plans cover preventive services like cleanings, check-ups, and X-rays at little to no cost. By prioritizing preventive care, you can catch potential issues early on, reducing the need for more expensive treatments down the line.

Negotiate with Your Provider

Don’t be afraid to negotiate with your insurance provider. If you’ve been a loyal customer for several years or have a solid history of paying your premiums on time, you may be able to negotiate a lower rate or additional benefits. Contact your provider and inquire about any available discounts or promotions that could reduce your costs.

Combine with Other Insurance

If you have other types of insurance, such as health or life insurance, consider combining them with your dental insurance. Many insurance companies offer bundled packages that can provide significant discounts on your overall premiums.

Use Online Tools and Resources

Take advantage of online tools and resources specifically designed to help you find the cheapest dental insurance plans. Websites and apps dedicated to insurance comparison can provide detailed information about various plans, allowing you to make an informed decision based on your unique circumstances.

The Value of Quality Dental Care

While finding the cheapest dental insurance is important, it’s equally crucial to recognize the value of quality dental care. Dental health is closely linked to overall well-being, and neglecting your oral health can lead to serious health complications.

Long-Term Savings

Investing in quality dental insurance can lead to long-term savings. Regular check-ups and preventive care can help identify and address dental issues early on, preventing them from becoming more complex and costly to treat. By catching problems like gum disease or cavities in their early stages, you can avoid expensive procedures like root canals or tooth extractions.

Improved Overall Health

Oral health is an integral part of overall health. Poor dental hygiene has been linked to various systemic health conditions, including heart disease, diabetes, and respiratory infections. By maintaining good oral health through regular dental care, you can reduce your risk of developing these and other health issues.

Peace of Mind

Having dental insurance provides peace of mind, knowing that you are covered for unexpected dental emergencies or major procedures. Dental emergencies can be costly, and without insurance, you may be faced with difficult financial decisions. With insurance, you can receive the necessary treatment without worrying about the financial burden.

Access to Specialized Care

Quality dental insurance plans often provide access to specialized dental care, such as orthodontics or periodontics. These specialized services can address specific oral health concerns and improve your overall quality of life. With insurance coverage, you can afford the care you need to achieve and maintain a healthy smile.

Conclusion

Finding the cheapest dental insurance that suits your needs is a balance between cost and coverage. By understanding the factors that influence the cost of dental insurance and employing practical strategies, you can navigate the market to find the best deals. However, it’s essential to remember that investing in quality dental care offers long-term benefits for your oral and overall health.

As you explore your options, keep in mind that dental insurance is a valuable investment in your well-being. With the right plan, you can access the care you need to maintain a healthy smile and enjoy a higher quality of life. Take the time to research, compare, and choose a plan that aligns with your unique circumstances and budget.

How often should I compare dental insurance plans?

+It’s recommended to review and compare dental insurance plans annually or whenever your circumstances change significantly. This ensures you stay up-to-date with the latest offerings and can make adjustments to your coverage as needed.

Are there any government programs that offer discounted dental insurance?

+Yes, some government programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), provide discounted or free dental insurance for eligible individuals and families. Check your state’s eligibility requirements to see if you qualify.

Can I switch dental insurance providers if I’m unhappy with my current plan?

+Absolutely! You have the freedom to switch dental insurance providers at any time. However, be mindful of any waiting periods or coverage limitations that may apply when transitioning to a new plan.

What should I do if I have a dental emergency and don’t have insurance?

+In the event of a dental emergency, seek immediate medical attention. Many dental offices offer payment plans or financing options to help cover the cost of emergency treatment. Additionally, you can explore short-term dental insurance plans or discount dental programs that provide coverage for a limited period.