Different Types Of Auto Insurance

Auto insurance, also known as vehicle insurance or motor insurance, is a vital aspect of responsible vehicle ownership. It provides financial protection against potential risks and liabilities associated with owning and operating a motor vehicle. With a variety of coverage options available, understanding the different types of auto insurance is essential for making informed decisions and ensuring adequate protection.

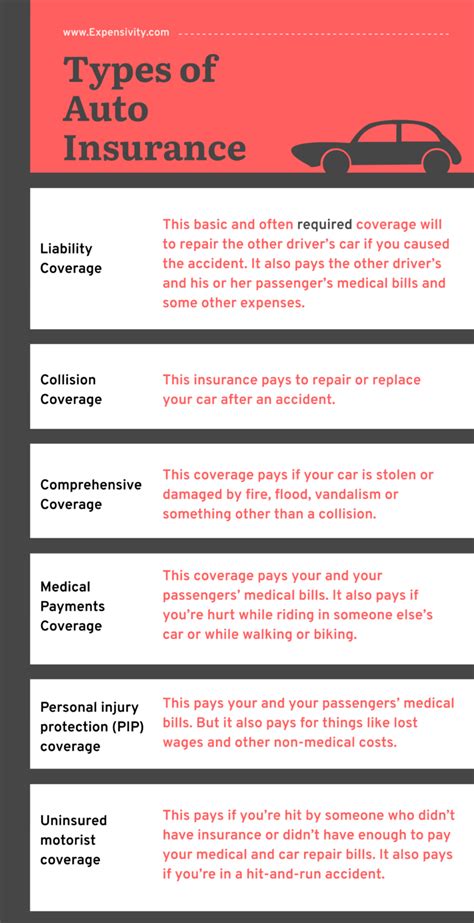

Liability Coverage

Liability coverage is the most fundamental type of auto insurance and is often mandatory by law in many regions. This coverage protects you against claims arising from bodily injury or property damage that you or your vehicle may cause to others in an accident. It consists of two main components:

- Bodily Injury Liability: This coverage pays for the medical expenses, rehabilitation costs, and potential lost wages of individuals injured in an accident caused by you or your insured vehicle.

- Property Damage Liability: It covers the repair or replacement costs of any property, including vehicles, damaged as a result of an accident for which you are deemed responsible.

Liability coverage is crucial as it protects your financial well-being in the event of an at-fault accident. While the specific limits and requirements vary by jurisdiction, it is recommended to carry adequate liability coverage to safeguard against potential lawsuits and significant financial losses.

Collision Coverage

Collision coverage is an optional type of auto insurance that provides protection for your vehicle in the event of a collision with another vehicle or object. This coverage pays for the repair or replacement of your insured vehicle, regardless of who is at fault in the accident. It is particularly beneficial if you own a newer or more valuable vehicle, as it ensures you are not solely responsible for the costs associated with repairing or replacing your vehicle after an accident.

Collision coverage typically has a deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can result in lower premiums, but it’s important to select a deductible amount that you are comfortable paying in the event of a claim.

Comprehensive Coverage

Comprehensive coverage, often referred to as “other than collision” coverage, provides protection for your vehicle against damages caused by events other than collisions. This type of coverage is essential for protecting your vehicle from unforeseen circumstances such as theft, vandalism, natural disasters, and damage caused by animals.

Comprehensive coverage typically includes the following perils:

- Theft: Protection against loss or damage due to the theft of your vehicle or its parts.

- Vandalism: Coverage for intentional acts of vandalism or malicious damage to your vehicle.

- Natural Disasters: Protection against damage caused by events like hurricanes, hailstorms, floods, earthquakes, and fires.

- Animal Strikes: Coverage for damage resulting from collisions with animals, such as deer or other wildlife.

- Falling Objects: Protection against damage caused by objects falling on your vehicle, such as tree branches or debris.

Similar to collision coverage, comprehensive coverage usually has a deductible. Choosing a higher deductible can lead to lower premiums, but it’s important to strike a balance between cost-effectiveness and adequate coverage.

Personal Injury Protection (PIP) or Medical Payments Coverage

Personal Injury Protection (PIP) or Medical Payments coverage is designed to cover the medical expenses and related costs incurred by you or your passengers after an accident, regardless of fault. This coverage provides a safety net to ensure that you and your passengers receive the necessary medical treatment without worrying about the immediate financial burden.

PIP coverage typically includes the following benefits:

- Medical Expenses: Covers reasonable and necessary medical, surgical, hospital, and nursing services, as well as medication and rehabilitation costs.

- Lost Income: Provides compensation for income lost due to an accident-related injury, helping to alleviate financial strain during recovery.

- Funeral Expenses: Covers the costs associated with funeral and burial services if an accident results in a fatality.

- Child Care: Offers coverage for the cost of alternative child care services if the insured individual requires hospitalization due to an accident.

PIP coverage varies by state, and some states require it as part of their no-fault insurance laws. In states without no-fault laws, Medical Payments coverage serves a similar purpose, providing coverage for medical expenses regardless of fault.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage provides protection in the event of an accident with a driver who either lacks insurance or has inadequate insurance coverage. This coverage is essential as it helps protect you from financial losses in situations where the at-fault driver is unable to compensate you for your damages.

Uninsured Motorist coverage includes two main components:

- Uninsured Motorist Bodily Injury (UMBI): This coverage pays for your medical expenses and related costs if you are injured in an accident caused by an uninsured driver.

- Uninsured Motorist Property Damage (UMPD): It covers the repair or replacement of your vehicle if it is damaged in an accident caused by an uninsured driver.

Underinsured Motorist coverage is similar but applies when the at-fault driver’s liability coverage is insufficient to cover the full extent of your damages. It bridges the gap between the at-fault driver’s coverage and your own coverage limits.

Gap Insurance

Gap Insurance, also known as Guaranteed Asset Protection (GAP) coverage, is an optional type of auto insurance that provides protection in the event of a total loss or theft of your vehicle. It covers the difference between the actual cash value of your vehicle and the outstanding balance on your auto loan or lease.

Gap Insurance is particularly beneficial if you have financed or leased your vehicle, as it ensures that you are not left with a financial shortfall if your vehicle is deemed a total loss or stolen. This coverage is especially relevant during the initial years of ownership when the vehicle’s value may depreciate more rapidly than the loan balance decreases.

Rental Car Reimbursement Coverage

Rental Car Reimbursement Coverage provides compensation for the cost of renting a vehicle while your insured vehicle is undergoing repairs due to a covered loss. This coverage is valuable as it ensures that you have a temporary replacement vehicle during the repair process, minimizing disruptions to your daily routine.

The coverage typically includes a daily rental limit and a maximum number of days for which the insurance company will reimburse you. It’s important to note that this coverage may not apply to all situations, and some insurers may offer it as an optional add-on to your auto insurance policy.

Custom Parts and Equipment Coverage

If you have customized your vehicle with aftermarket parts or equipment, Custom Parts and Equipment Coverage is essential to ensure that these modifications are adequately insured. Standard auto insurance policies may not cover the full value of these additions, leaving you vulnerable to financial losses in the event of a covered loss.

This coverage provides protection for modifications such as custom wheels, stereo systems, suspension upgrades, and other performance enhancements. It ensures that you receive the appropriate compensation for the unique features and upgrades you have invested in your vehicle.

Roadside Assistance Coverage

Roadside Assistance Coverage offers peace of mind by providing emergency services in the event of a breakdown or other roadside emergencies. This coverage typically includes services such as towing, battery jump-starts, flat tire changes, fuel delivery, and locksmith services if you lock your keys in your vehicle.

Roadside Assistance Coverage can be added as an optional endorsement to your auto insurance policy or obtained through membership in an auto club or other service provider. It is particularly valuable for individuals who frequently travel long distances or drive in remote areas.

Conclusion

Understanding the different types of auto insurance coverage is crucial for making informed decisions and ensuring comprehensive protection for your vehicle and yourself. By selecting the appropriate coverage options, you can tailor your auto insurance policy to your specific needs and circumstances, providing the necessary financial security and peace of mind while navigating the roads.

How do I determine the right auto insurance coverage for my needs?

+Determining the right auto insurance coverage involves considering factors such as your vehicle’s value, driving habits, and financial situation. Assess your risk tolerance, the likelihood of accidents, and potential financial losses. Consult with insurance agents or brokers to discuss your options and customize a policy that aligns with your needs.

What factors influence auto insurance rates?

+Auto insurance rates are influenced by various factors, including your driving record, age, gender, location, vehicle type, and coverage options. Insurers also consider your credit score and claims history. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Can I customize my auto insurance policy to include specific coverage options?

+Yes, auto insurance policies can be customized to include specific coverage options based on your individual needs. Work with your insurance provider to tailor your policy, adding or removing coverage as necessary. This ensures that your policy provides the right balance of protection and affordability.