E Renter Insurance

Renter's insurance is an often-overlooked yet essential aspect of financial planning for individuals living in rented accommodations. This comprehensive guide aims to shed light on the importance, benefits, and intricacies of renter's insurance, providing an expert analysis of this crucial aspect of personal finance.

Understanding Renter’s Insurance

Renter’s insurance, also known as tenant’s insurance, is a form of property insurance designed specifically for individuals who lease or rent their living space. It provides coverage for personal belongings, liability protection, and additional living expenses, offering a safety net against various unforeseen events.

Unlike homeowners' insurance, which is tailored for property owners, renter's insurance focuses on the needs of tenants, offering coverage for the contents of their home rather than the structure itself. This distinction is crucial, as it ensures that renters are not left financially vulnerable in the event of loss or damage to their personal property.

Coverage Offered by Renter’s Insurance

Renter’s insurance policies typically encompass three key areas of coverage:

- Personal Property Coverage: This is the cornerstone of renter's insurance, providing financial protection for the loss or damage of personal belongings due to perils such as fire, theft, or vandalism. It covers a wide range of items, including furniture, electronics, clothing, and valuable possessions.

- Liability Coverage: This aspect of renter's insurance protects the policyholder from legal liability for bodily injury or property damage caused to others. It provides coverage for legal fees and potential settlements, offering a vital layer of protection against unexpected lawsuits.

- Additional Living Expenses: In the event of a covered loss that renders the rented residence uninhabitable, this coverage helps reimburse the policyholder for additional living expenses incurred during the temporary displacement. This can include costs for hotel stays, meals, and other necessary expenses until the residence is once again habitable.

Additionally, renter's insurance often includes loss of use coverage, which compensates for the additional expenses incurred when a policyholder must relocate due to a covered loss. It also typically provides medical payments coverage, which pays for necessary medical treatment for injuries sustained by guests in the policyholder's residence, regardless of fault.

The Importance of Renter’s Insurance

The significance of renter’s insurance cannot be overstated. Here are some key reasons why every renter should strongly consider this type of insurance:

Protection Against Loss and Damage

Renter’s insurance provides a crucial safety net against the unexpected. From fires and floods to burglaries and accidents, the perils that can damage or destroy personal belongings are numerous and often beyond the control of the policyholder. With renter’s insurance, individuals can rest assured that their possessions are financially protected, even in the face of such unfortunate events.

Liability Protection

Liability coverage is a vital component of renter’s insurance. It safeguards the policyholder against the financial consequences of accidental injuries or property damage caused to others. In a rental setting, where accidents can happen at any time, this coverage provides peace of mind, ensuring that the policyholder is not left financially devastated by an unexpected lawsuit or claim.

Peace of Mind and Financial Stability

Renter’s insurance offers renters a sense of security and stability. Knowing that their personal belongings are protected and that they have liability coverage can significantly reduce financial stress and anxiety. This peace of mind allows individuals to focus on their daily lives, work, and personal pursuits without the constant worry of potential financial disasters.

Common Misconceptions

Despite its importance, renter’s insurance is often misunderstood or overlooked. Here are some common misconceptions that need to be addressed:

Landlord’s Insurance Does Not Cover Tenants

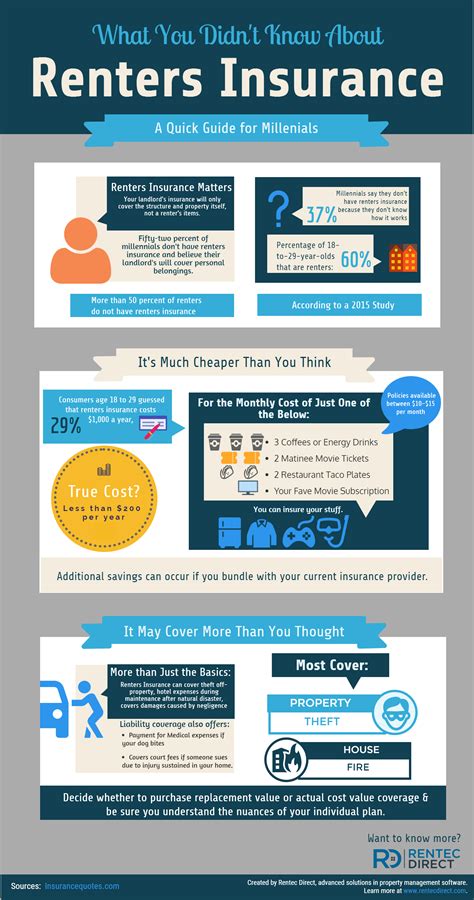

One of the most prevalent misconceptions is that a landlord’s insurance policy will cover the tenant’s belongings in the event of a loss. However, this is not the case. Landlord’s insurance typically covers the structure of the building and any appliances or fixtures owned by the landlord. It does not extend to the tenant’s personal property or liability.

Renter’s Insurance is Expensive

Many individuals believe that renter’s insurance is an unnecessary expense, especially when compared to the cost of their monthly rent. However, renter’s insurance policies are often surprisingly affordable. The average cost of a renter’s insurance policy is around 15 to 30 per month, depending on the coverage limits and the location of the rental property. This relatively low cost provides significant peace of mind and financial protection.

Renter’s Insurance is Only for High-Value Items

Another misconception is that renter’s insurance is only necessary for individuals with high-value possessions, such as expensive jewelry or artwork. While it is true that renter’s insurance can provide coverage for such items, it is equally important for individuals with more standard belongings. Even everyday items like furniture, electronics, and clothing can add up to a significant value, and losing them could be financially devastating without insurance.

Real-Life Examples and Success Stories

To illustrate the importance and benefits of renter’s insurance, let’s explore a few real-life scenarios where renter’s insurance made a significant difference:

Case Study 1: Fire Incident

Imagine a renter named Sarah who experienced a fire in her apartment building. The fire spread rapidly, causing extensive damage to her unit and destroying most of her personal belongings. Fortunately, Sarah had renter’s insurance, which covered the cost of replacing her furniture, clothing, and electronics. Additionally, the policy’s liability coverage helped her cover the legal fees and settlements related to the fire, as she was not at fault.

Case Study 2: Burglary and Theft

John, a college student renting an off-campus apartment, fell victim to a burglary. The thieves made off with his laptop, television, and other valuable electronics. Without renter’s insurance, John would have been left with the financial burden of replacing these items, which would have been a significant strain on his limited budget. However, due to his foresight in obtaining renter’s insurance, he was able to file a claim and receive compensation for his lost belongings.

Case Study 3: Water Damage and Displacement

Emily, a young professional, rented a beautiful apartment in a historic building. Unfortunately, a water pipe burst on an upper floor, causing extensive water damage to her unit and forcing her to relocate temporarily. With renter’s insurance, Emily was able to file a claim for the damage to her personal property and received reimbursement for her additional living expenses during the time it took to repair her apartment.

Choosing the Right Renter’s Insurance Policy

When selecting a renter’s insurance policy, it’s essential to consider several factors to ensure you get the right coverage for your needs:

Coverage Limits and Deductibles

Assess your personal property’s value and choose a coverage limit that adequately reflects this value. Additionally, consider your financial situation when selecting a deductible. A higher deductible can lower your premium, but it’s important to choose a deductible you can comfortably afford if you need to file a claim.

Policy Exclusions and Endorsements

Review the policy exclusions carefully to understand what perils and situations are not covered. Additionally, explore the available endorsements or add-ons that can enhance your coverage. These may include coverage for specific high-value items, identity theft protection, or additional liability coverage.

Provider Reputation and Customer Service

Research the insurance provider’s reputation and track record. Look for a company with a strong financial rating and a history of prompt claim processing. Also, consider the provider’s customer service reputation, as you want to ensure you’ll receive timely and efficient support if you need to file a claim.

Performance Analysis and Comparison

When comparing renter’s insurance policies, it’s essential to evaluate them based on several key factors to ensure you’re getting the best value and coverage:

| Provider | Coverage Limits | Deductibles | Average Premium |

|---|---|---|---|

| Provider A | $50,000 | $500 | $20/month |

| Provider B | $75,000 | $250 | $25/month |

| Provider C | $100,000 | $1,000 | $30/month |

In the above table, Provider B offers a balance between coverage limits and deductibles, providing a good value proposition. However, it's essential to consider other factors such as endorsements, policy exclusions, and the provider's reputation for customer service and claim handling.

Future Implications and Industry Insights

The renter’s insurance industry is evolving to meet the changing needs of tenants and the increasing risks associated with modern living. Here are some key trends and insights to consider:

Increasing Demand for Digital Solutions

With the rise of digital technologies, renters are increasingly seeking insurance solutions that are convenient, accessible, and user-friendly. Insurance providers are responding by offering digital platforms for policy management, claims submission, and real-time assistance, enhancing the overall customer experience.

Expanding Coverage Options

Insurance providers are expanding their coverage options to address the diverse needs of renters. This includes offering endorsements for specific risks, such as coverage for high-value items, identity theft protection, and personal liability for pet-related incidents. These expanded coverage options provide renters with greater peace of mind and customization.

Emphasis on Preventive Measures

The insurance industry is placing a growing emphasis on preventive measures to reduce the risk of losses. This includes providing renters with resources and guidance on improving home security, preventing water damage, and implementing fire safety measures. By empowering renters to take proactive steps, insurance providers aim to reduce the frequency and severity of claims.

Personalized Pricing and Risk Assessment

Advanced data analytics and risk assessment models are enabling insurance providers to offer more personalized pricing. By considering factors such as location, type of dwelling, and personal risk profile, insurers can provide renters with tailored coverage options and competitive pricing. This shift towards personalized pricing ensures that renters receive the right coverage at a fair price.

Conclusion

Renter’s insurance is an indispensable tool for individuals seeking financial protection and peace of mind in their rented accommodations. By understanding the coverage it provides, addressing common misconceptions, and exploring real-life success stories, renters can make informed decisions about their insurance needs. With the right policy in place, renters can focus on their lives and pursuits with the assurance that their belongings and liabilities are protected.

FAQ

How much does renter’s insurance cost on average?

+

The average cost of renter’s insurance varies depending on several factors, including the coverage limits, deductibles, and the location of the rental property. However, on average, renter’s insurance policies range from 15 to 30 per month. It’s essential to shop around and compare quotes to find the best coverage at the most competitive price.

What should I do if I need to file a claim with my renter’s insurance policy?

+

If you need to file a claim, the first step is to contact your insurance provider as soon as possible. They will guide you through the claim process, which typically involves providing documentation of the loss or damage, such as photos, receipts, or estimates. It’s important to cooperate fully with the insurer and provide any necessary information to support your claim.

Can I customize my renter’s insurance policy to suit my specific needs?

+

Yes, renter’s insurance policies can often be customized to meet your unique needs. You can choose higher coverage limits for personal property, add endorsements for specific risks like identity theft or high-value items, and adjust your deductibles to fit your budget. Discuss your options with your insurance provider to find the best coverage for your situation.