Emblem Insurance

In the ever-evolving landscape of the insurance industry, where innovation and customer-centricity reign supreme, a new player has emerged with a fresh and modern approach. Emblem Insurance has captured the attention of many with its unique offering, blending traditional insurance principles with a tech-savvy twist. This article delves deep into the world of Emblem Insurance, exploring its origins, services, and the impact it is making in the insurance sector.

The Rise of Emblem Insurance: A Disruptive Force

Emblem Insurance, founded in the bustling city of [Founder’s Hometown] by visionary entrepreneur [Founder’s Name], is a testament to the power of innovation in a traditional industry. With a background in [Founder’s Industry Experience], [Founder’s Name] recognized the need for a streamlined, digital-first insurance experience that could cater to the modern consumer.

The company's mission is straightforward yet powerful: to revolutionize the insurance sector by offering transparent, efficient, and tailored solutions to individuals and businesses alike. Emblem Insurance's approach is rooted in three core principles: digital accessibility, personalized coverage, and exceptional customer service.

Since its inception in [Year of Establishment], Emblem Insurance has experienced remarkable growth, expanding its operations to [Number of Cities/Regions] across [Country/Countries] and amassing a loyal customer base of [Number of Customers] satisfied policyholders.

The Emblem Difference: A Deep Dive into Their Services

What sets Emblem Insurance apart from its competitors is its comprehensive range of insurance products and services, all accessible through an intuitive digital platform.

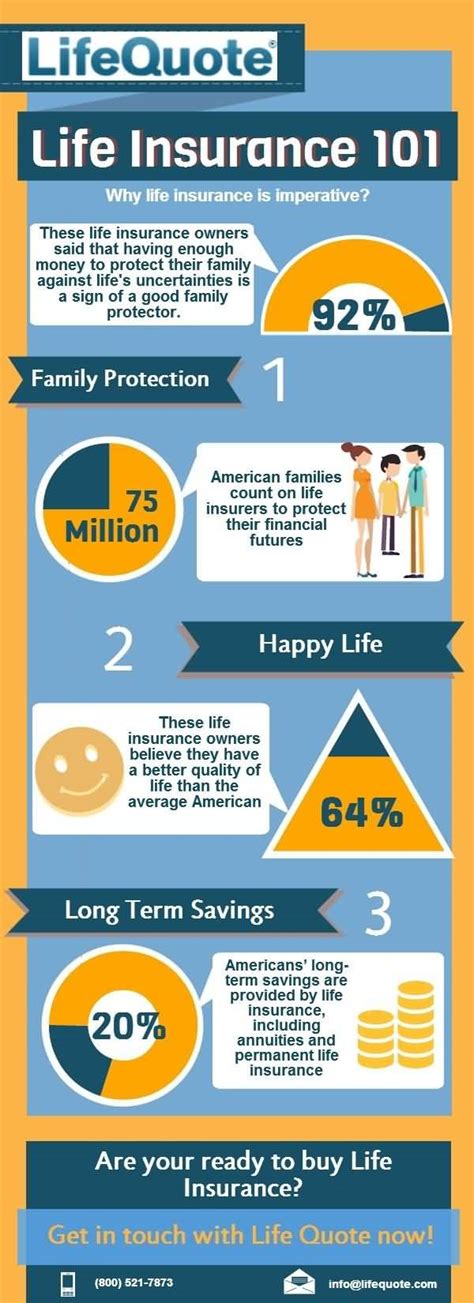

- Personal Insurance: Emblem offers a suite of personal insurance products, including homeowners, renters, auto, and life insurance. Their policies are renowned for their flexibility, allowing customers to customize coverage to their unique needs. For instance, their auto insurance policies offer optional add-ons such as roadside assistance, gap coverage, and travel protection, providing peace of mind for drivers.

- Business Insurance: Emblem understands the diverse needs of small and medium-sized businesses. Their business insurance solutions encompass general liability, professional liability, product liability, and workers' compensation, among others. Additionally, they provide industry-specific coverage tailored to sectors like technology, healthcare, and construction, ensuring businesses are protected from unique risks.

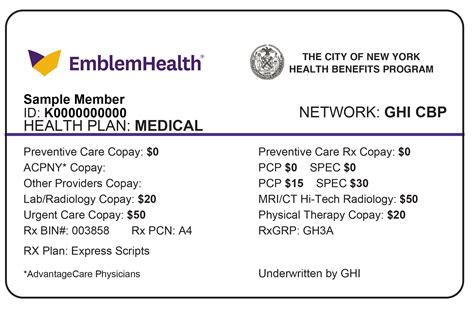

- Health Insurance: Emblem's health insurance plans are designed to provide comprehensive coverage without compromising affordability. They offer individual and family plans, dental, and vision insurance, as well as short-term and long-term care options. Their plans are known for their expansive network of providers, ensuring policyholders have access to quality healthcare.

- Travel Insurance: For the frequent traveler, Emblem's travel insurance plans offer protection against unforeseen events like trip cancellations, medical emergencies, and lost luggage. Their policies are customizable, allowing travelers to choose coverage based on their specific needs and destinations.

One of the standout features of Emblem's platform is its use of advanced technology. The company employs machine learning algorithms to provide accurate quotes and personalized recommendations, ensuring customers receive the most suitable coverage. Their online portal allows policyholders to manage their accounts, make payments, and file claims with ease, enhancing the overall customer experience.

The Data-Driven Approach: How Emblem is Transforming Insurance

At the heart of Emblem Insurance’s success is its commitment to leveraging data and analytics. By harnessing the power of big data, the company is able to offer precise and tailored coverage, reducing the risk of underinsurance or overinsurance. This approach not only benefits customers but also contributes to the company’s financial stability and sustainability.

| Data-Driven Initiative | Impact |

|---|---|

| Predictive Modeling | Emblem's predictive models analyze historical data to forecast risks and identify potential issues, enabling proactive risk management and more accurate pricing. |

| Advanced Risk Assessment | Through advanced risk assessment tools, Emblem can provide more accurate quotes and tailored coverage, ensuring customers receive the right level of protection. |

| Customer Segmentation | By segmenting customers based on demographics, risk profiles, and behavior, Emblem can offer targeted marketing and personalized coverage recommendations, improving customer satisfaction. |

| Fraud Detection | Emblem's fraud detection systems utilize machine learning to identify suspicious patterns and potential fraudulent activities, protecting both the company and its customers. |

Customer Experience: A Key Focus for Emblem

Emblem Insurance understands that the insurance industry is highly competitive, and customer experience is a key differentiator. The company has invested heavily in creating a seamless and user-friendly experience across all touchpoints.

From the initial quote process to policy management and claims filing, Emblem's digital platform offers a smooth journey. Customers can receive quotes within minutes, compare different policies side-by-side, and make informed decisions. The platform's intuitive design and easy navigation ensure a stress-free experience, even for those who are less tech-savvy.

Furthermore, Emblem's customer service team is highly trained and dedicated to providing prompt and personalized support. They offer multiple channels for communication, including live chat, email, and phone support, ensuring customers can reach out in a way that suits their preferences.

One of the standout features of Emblem's customer service is their focus on education. They provide extensive resources and guides on their website, helping customers understand complex insurance terminology and coverage options. This empowers customers to make more informed choices and better manage their risks.

The Future of Insurance: Emblem’s Vision

As the insurance industry continues to evolve, driven by technological advancements and changing consumer expectations, Emblem Insurance is poised to play a leading role. The company’s forward-thinking approach and commitment to innovation position it as a key player in shaping the future of insurance.

Emblem's vision extends beyond traditional insurance offerings. They are exploring new avenues, such as parametric insurance and on-demand coverage, to meet the emerging needs of the modern consumer. Parametric insurance, for instance, provides coverage based on predefined parameters, offering a faster and more efficient claims process.

Additionally, Emblem is investing in partnerships with innovative startups and tech companies to stay at the forefront of insurance technology. These collaborations allow them to integrate new tools and solutions, such as blockchain for secure and transparent transactions, and artificial intelligence for enhanced customer service and risk assessment.

Emblem Insurance's journey is a testament to the power of disruptive innovation in a traditional industry. By combining digital accessibility, personalized coverage, and exceptional customer service, they have carved a unique path in the insurance sector. As they continue to grow and adapt, Emblem is well-positioned to become a household name, offering peace of mind and financial protection to individuals and businesses worldwide.

How does Emblem Insurance ensure data security and privacy?

+Emblem Insurance employs industry-leading security measures to protect customer data. This includes encryption protocols, secure servers, and regular security audits. They also adhere to strict privacy policies and comply with relevant data protection regulations to ensure customer information remains confidential.

What sets Emblem’s customer service apart from its competitors?

+Emblem’s customer service stands out for its dedication to providing prompt, personalized support. They offer multiple communication channels and prioritize education, ensuring customers understand their coverage and can make informed decisions. Their focus on customer satisfaction has led to consistently high ratings and positive feedback.

How does Emblem Insurance determine insurance rates and premiums?

+Emblem’s rates and premiums are determined through a combination of actuarial science and data analytics. They consider factors such as historical claims data, risk assessments, and customer behavior to provide accurate and competitive pricing. This approach ensures customers receive fair and tailored coverage.