Federal Marketplace Insurance

The Affordable Care Act (ACA), commonly known as Obamacare, brought about significant changes to the health insurance landscape in the United States. One of the key provisions of the ACA was the establishment of Health Insurance Marketplaces, also referred to as Exchanges, to provide individuals and small businesses with a platform to compare and purchase health insurance plans.

This article will delve into the world of the Federal Marketplace Insurance, exploring its history, structure, and the impact it has had on millions of Americans' access to healthcare. By understanding the intricacies of this system, we can better appreciate its role in shaping the healthcare industry and ensuring affordable coverage for many.

Understanding the Federal Marketplace

The Federal Marketplace, officially named the Health Insurance Marketplace, is a centralized online platform that serves as a one-stop shop for individuals and families seeking health insurance coverage. It was created as a result of the Affordable Care Act to address the challenges faced by uninsured Americans and to provide a transparent and efficient way to shop for health plans.

The Marketplace offers a range of qualified health plans (QHPs) from various insurance carriers, ensuring that individuals have a variety of options to choose from based on their specific needs and budgets. These plans are categorized into Metal Categories (Bronze, Silver, Gold, and Platinum) to help consumers understand the level of coverage and cost-sharing associated with each plan.

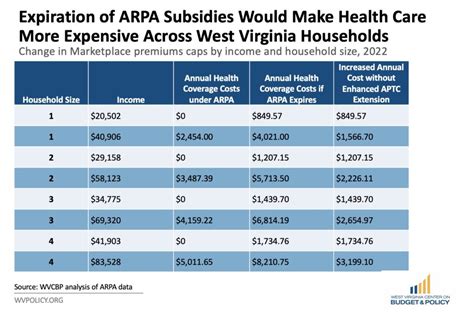

One of the key features of the Federal Marketplace is the availability of premium tax credits and cost-sharing reductions for eligible individuals and families. These subsidies aim to make health insurance more affordable, especially for those with lower incomes. The amount of subsidy one can receive is determined by their income level and the cost of insurance in their area.

Key Elements of Federal Marketplace Insurance

- Open Enrollment Period: The Federal Marketplace operates on a defined Open Enrollment Period, typically lasting several months each year. During this time, individuals can enroll in a health plan or make changes to their existing coverage. Outside of the Open Enrollment Period, individuals may only qualify for a Special Enrollment Period if they experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage.

- Essential Health Benefits: All qualified health plans offered through the Marketplace must include a set of Essential Health Benefits. These benefits cover a range of services, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care. Ensuring these essential benefits provides a comprehensive healthcare foundation for individuals and families.

- State-Based Marketplaces: While the Federal Marketplace is a national platform, some states have opted to establish their own state-based Marketplaces. These state-run platforms function similarly to the Federal Marketplace but may offer additional features or programs specific to that state. State-based Marketplaces allow for more localized control and can provide tailored options for residents.

| Marketplace Type | Features |

|---|---|

| Federal Marketplace | National platform, offering a wide range of plans with tax credits and cost-sharing reductions. Operates on a defined Open Enrollment Period. |

| State-Based Marketplaces | State-specific platforms with potential additional features. May offer a more localized approach to health insurance options. |

Navigating the Federal Marketplace

For individuals and families looking to navigate the Federal Marketplace, understanding the process and key steps can make the experience smoother and more efficient. Here’s a breakdown of the steps involved in selecting and enrolling in a health plan through the Marketplace.

Eligibility and Enrollment

The first step in the process is to determine eligibility for the Federal Marketplace. Most individuals and families are eligible, but those with access to affordable employer-sponsored coverage or certain government programs may not qualify for subsidies through the Marketplace. Once eligibility is established, individuals can proceed with the enrollment process.

During enrollment, individuals will need to provide personal and household information, including income details, to determine their eligibility for premium tax credits and cost-sharing reductions. This information is crucial in ensuring that individuals receive the appropriate level of financial assistance based on their income.

Choosing a Plan

The Federal Marketplace offers a variety of health plans from different insurance carriers. When selecting a plan, individuals should consider their healthcare needs, preferred doctors and hospitals, and their budget. The Marketplace provides tools and resources to help consumers compare plans based on these factors, ensuring an informed decision.

The Metal Categories (Bronze, Silver, Gold, and Platinum) are a useful guide when choosing a plan. Each category represents a different level of coverage and cost-sharing. For instance, Bronze plans typically have lower premiums but higher deductibles, while Platinum plans offer more comprehensive coverage with higher premiums.

Understanding Coverage and Benefits

All qualified health plans offered through the Marketplace must include the Essential Health Benefits, as mentioned earlier. These benefits provide a solid foundation for healthcare coverage. However, it’s important to understand that specific services and treatments may vary between plans.

Additionally, individuals should review the plan's Summary of Benefits and Coverage document, which provides detailed information on what is covered, any limitations or exclusions, and the cost-sharing requirements. This document ensures that individuals are aware of the specifics of their chosen plan and can make informed decisions about their healthcare.

Special Enrollment Periods

While the Open Enrollment Period is the designated time for individuals to enroll in a health plan, there are instances where a Special Enrollment Period may be granted. These periods are typically triggered by qualifying life events, such as marriage, birth or adoption of a child, loss of other coverage, or changes in income.

Special Enrollment Periods allow individuals to enroll outside of the standard Open Enrollment timeframe, ensuring that life changes do not disrupt access to healthcare coverage. It's important to note that the length of these periods varies, and individuals should act promptly to take advantage of this opportunity.

Impact and Success Stories

The implementation of the Federal Marketplace Insurance has had a profound impact on the lives of millions of Americans. By providing a streamlined platform for health insurance enrollment and offering financial assistance, the Marketplace has helped reduce the number of uninsured individuals and families across the country.

Increased Access to Healthcare

One of the primary goals of the Affordable Care Act and the Federal Marketplace was to increase access to healthcare for all Americans. Through the Marketplace, individuals and families who previously lacked insurance coverage or faced unaffordable premiums have gained access to quality healthcare plans. This has resulted in improved health outcomes and a reduction in financial strain for many households.

For instance, a study by the Kaiser Family Foundation found that the Marketplace helped reduce the uninsured rate among non-elderly adults from 20.4% in 2013 to 13.3% in 2018. This significant decrease highlights the success of the Marketplace in reaching and enrolling individuals who were previously uninsured.

Financial Assistance and Premium Tax Credits

The availability of premium tax credits and cost-sharing reductions through the Federal Marketplace has been a game-changer for many Americans. These subsidies have made health insurance more affordable, especially for those with lower incomes. By reducing the cost of premiums and out-of-pocket expenses, individuals can better afford the healthcare services they need.

A report by the Congressional Budget Office estimated that, as of 2018, approximately 11 million individuals were receiving premium tax credits through the Marketplace. These credits have provided a crucial financial support system for many, allowing them to maintain their health coverage despite economic challenges.

Improved Health Outcomes

With increased access to healthcare and more affordable coverage, the Federal Marketplace Insurance has contributed to improved health outcomes for Americans. Regular access to preventative care, timely treatment for acute conditions, and ongoing management of chronic illnesses have become more feasible for individuals and families.

Research has shown that having health insurance coverage leads to better health outcomes, including reduced mortality rates, improved management of chronic diseases, and increased utilization of preventative services. The Marketplace has played a vital role in connecting individuals with the healthcare resources they need to maintain their health and well-being.

Future Implications and Potential Changes

As with any large-scale healthcare initiative, the Federal Marketplace Insurance continues to evolve and adapt to changing needs and policy landscapes. While the Marketplace has already made significant strides in improving access to healthcare, there are ongoing discussions and potential changes on the horizon.

Policy and Regulatory Changes

The future of the Federal Marketplace Insurance is heavily influenced by policy and regulatory decisions at the federal and state levels. Changes in leadership and political priorities can impact the structure and funding of the Marketplace, as well as the availability of subsidies and other support mechanisms.

For instance, ongoing debates surrounding the Affordable Care Act and potential legislative actions can shape the future of the Marketplace. While some advocate for maintaining and strengthening the Marketplace, others propose alternative approaches to healthcare reform. These discussions can have far-reaching implications for individuals and families relying on the Marketplace for their healthcare coverage.

Expanding Coverage and Improving Affordability

Despite the successes of the Federal Marketplace, there is still work to be done to expand coverage and improve affordability for all Americans. Ongoing efforts focus on finding ways to further reduce premiums and out-of-pocket costs, especially for those with lower incomes or specific healthcare needs.

One potential approach is the expansion of Medicaid coverage in states that have not yet adopted the expansion. By extending Medicaid eligibility to more individuals, the Marketplace could reach and assist a larger population, ensuring that healthcare is accessible to those who need it most.

Technology and Innovation

Advancements in technology and digital innovation have the potential to greatly enhance the Federal Marketplace Insurance experience. By leveraging technology, the Marketplace can improve its efficiency, streamline enrollment processes, and provide more personalized recommendations to consumers.

For example, the use of artificial intelligence and machine learning algorithms can help the Marketplace better understand consumer needs and preferences, allowing for more tailored plan recommendations. Additionally, improved data analytics can provide valuable insights to policymakers and stakeholders, guiding future decisions and improvements to the Marketplace.

How can I determine if I'm eligible for premium tax credits through the Federal Marketplace?

+Eligibility for premium tax credits is based on your household income. If your income falls within a certain range, typically between 100% and 400% of the Federal Poverty Level, you may qualify for tax credits to help lower your monthly premiums. You can estimate your eligibility by using the Premium Tax Credit Calculator provided by the Health Insurance Marketplace.

Can I enroll in a health plan outside of the Open Enrollment Period?

+Yes, you may be eligible for a Special Enrollment Period if you experience a qualifying life event, such as marriage, birth or adoption of a child, loss of other coverage, or changes in income. These events trigger a Special Enrollment Period, allowing you to enroll outside of the standard Open Enrollment timeframe. It's important to act promptly when a qualifying event occurs to ensure uninterrupted coverage.

What happens if I miss the Open Enrollment Period and don't qualify for a Special Enrollment Period?

+If you miss the Open Enrollment Period and don't qualify for a Special Enrollment Period, you may need to wait until the next Open Enrollment Period to enroll in a health plan through the Marketplace. However, you may still have other options for obtaining health insurance coverage, such as through your employer or a private insurance provider. It's important to explore all available options to ensure you have the coverage you need.

The Federal Marketplace Insurance has played a pivotal role in shaping the healthcare landscape in the United States. By providing a centralized platform for health insurance enrollment and offering financial assistance, it has helped millions of Americans gain access to quality healthcare coverage. As the Marketplace continues to evolve, it will be crucial to monitor policy changes, explore opportunities for expansion, and leverage technological advancements to further improve the experience for consumers.