Find The Best Car Insurance

When it comes to finding the best car insurance, there are numerous factors to consider, and the options can seem overwhelming. From different types of coverage to varying price points, it's essential to make an informed decision that aligns with your specific needs. In this comprehensive guide, we will delve into the world of car insurance, offering expert insights and practical advice to help you navigate the process effectively.

Understanding Your Car Insurance Needs

Before embarking on your search for the ideal car insurance policy, it’s crucial to assess your individual requirements. Consider the following aspects to gain a clearer understanding of what you’re looking for:

- Coverage Options: Determine the extent of coverage you desire. Do you require comprehensive coverage, collision insurance, or liability-only protection? Understanding your coverage needs is the first step toward finding the right policy.

- Budget Considerations: Set a realistic budget for your car insurance. While it's tempting to opt for the cheapest option, remember that price should not be the sole determining factor. Assess your financial situation and strike a balance between affordability and the level of coverage you require.

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can impact your insurance rates. Consider factors such as the make and model of your car, its age, and whether it's primarily used for commuting, leisure, or business purposes. Different insurance providers may offer specialized policies tailored to your vehicle's unique characteristics.

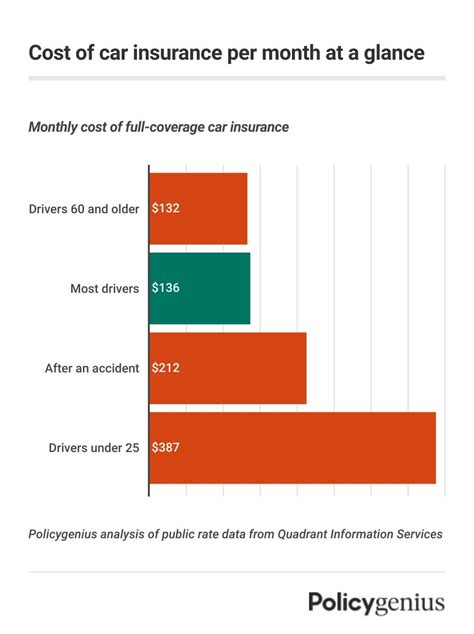

- Personal Circumstances: Your personal circumstances, such as your age, driving record, and location, play a significant role in determining your insurance rates. Younger drivers, for instance, may face higher premiums due to their perceived risk. Likewise, those with a history of accidents or traffic violations may need to explore options that cater to their specific needs.

Researching and Comparing Insurance Providers

With a clear understanding of your insurance needs, it’s time to delve into the research phase. Exploring the market and comparing different insurance providers is crucial to finding the best fit for your situation.

Online Research and Comparison Tools

The internet provides a wealth of resources to aid in your search. Utilize online comparison websites and insurance aggregator platforms to quickly gather quotes from multiple providers. These tools allow you to input your specific details and preferences, generating a list of tailored options for you to review.

| Comparison Website | Key Features |

|---|---|

| Insurify | Offers a user-friendly interface, allowing you to compare quotes from top insurers. Provides a comprehensive overview of coverage options and additional features. |

| The Zebra | Specializes in car insurance comparisons, offering detailed quotes and insights into coverage options. Highlights discounts and savings opportunities. |

| Policygenius | Caters to a range of insurance needs, including car insurance. Provides personalized recommendations and helps you understand the nuances of different policies. |

Additionally, delve into online reviews and forums to gain insights from real customers. Their experiences can offer valuable perspectives on the reliability, customer service, and overall satisfaction levels of various insurance providers.

Understanding Insurance Provider Reputation

When comparing insurance providers, it’s essential to assess their reputation and financial stability. Consider the following factors:

- Financial Strength Ratings: Check the financial ratings of insurance companies. Reputable rating agencies such as AM Best, Moody's, and Standard & Poor's provide insights into an insurer's financial health and ability to pay claims.

- Customer Satisfaction: Look for providers with a strong track record of customer satisfaction. Consider factors such as prompt claim processing, effective communication, and a dedicated customer support team.

- Industry Reputation: Research the insurer's standing within the industry. Has the company been recognized for its innovation, customer service, or overall performance? Positive industry recognition can be a testament to their reliability and commitment to excellence.

Evaluating Coverage Options and Add-Ons

Once you’ve narrowed down your list of potential insurance providers, it’s time to delve into the specifics of their coverage options and available add-ons. Remember, the best car insurance policy for you should provide the right balance of coverage and value.

Understanding Coverage Levels

Car insurance policies typically offer various coverage levels, each with its own set of benefits and limitations. Here’s a breakdown of common coverage options:

- Liability Coverage: This is the most basic form of car insurance, covering damages you cause to others' property or injuries you cause to others. It does not provide coverage for your own vehicle or injuries.

- Collision Coverage: Collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object. It provides protection for your own vehicle, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive insurance covers a wide range of non-collision incidents, such as theft, vandalism, weather-related damage, and collisions with animals. It provides broad protection for your vehicle beyond collision-related incidents.

- Personal Injury Protection (PIP): PIP coverage, available in certain states, provides medical coverage for you and your passengers, regardless of who is at fault in an accident. It ensures prompt access to medical treatment and can help cover related expenses.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who lacks adequate insurance. It provides financial protection for your medical bills and property damage, ensuring you're not left financially burdened.

Exploring Add-Ons and Optional Coverage

In addition to the standard coverage options, many insurance providers offer a range of add-ons and optional coverage to enhance your policy. Consider the following:

- Rental Car Coverage: If you frequently rent cars, this add-on can provide peace of mind by covering the cost of a rental vehicle while your own car is being repaired or replaced.

- Roadside Assistance: Roadside assistance coverage offers 24/7 support for various emergencies, such as flat tires, dead batteries, or towing services. It can be a valuable addition, especially for those who travel frequently or in remote areas.

- Gap Insurance: Gap insurance covers the difference between your car's actual cash value and the amount you still owe on your loan or lease. It's particularly beneficial for those who have financed or leased their vehicles, ensuring they're not left with a financial burden in the event of a total loss.

- Custom Parts and Equipment Coverage: If you've invested in custom modifications or high-end equipment for your vehicle, this add-on can provide specialized coverage to protect your unique investments.

Analyzing Pricing and Discounts

When it comes to car insurance, pricing is a crucial factor to consider. While it’s important to find a policy that fits your budget, it’s equally essential to ensure you’re not sacrificing coverage for cost savings. Here’s how to strike the right balance:

Comparing Premiums and Deductibles

Premiums refer to the amount you pay for your car insurance policy, typically on a monthly or annual basis. Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage kicks in. When comparing insurance quotes, pay attention to both premiums and deductibles to assess the overall cost of the policy.

Consider your financial situation and determine whether you can afford a higher deductible to lower your premiums. Remember, a higher deductible means you'll have to pay more upfront in the event of a claim, but it can result in significant savings over time if you remain claim-free.

Exploring Discounts and Savings Opportunities

Many insurance providers offer a range of discounts to help reduce your premiums. These discounts can vary depending on the provider, but here are some common opportunities to explore:

- Multi-Policy Discounts: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you may be eligible for significant discounts.

- Safe Driver Discounts

- Loyalty Discounts: Some insurance companies offer loyalty discounts to customers who have been with them for an extended period. Staying with the same provider can result in long-term savings.

- Good Student Discounts: If you're a student or have a young driver in your household, inquire about good student discounts. Many insurers offer reduced rates for students with good academic standing.

- Vehicle Safety Discounts: If your vehicle is equipped with advanced safety features such as anti-lock brakes, air bags, or collision avoidance systems, you may be eligible for safety discounts.

If you have a clean driving record, free of accidents and violations, you may qualify for safe driver discounts. Insurance providers often reward responsible driving behavior with reduced premiums.

Making an Informed Decision

With a comprehensive understanding of your insurance needs, coverage options, pricing, and available discounts, you’re now equipped to make an informed decision. Here’s a step-by-step guide to finalizing your choice:

- Review and Compare Quotes: Carefully examine the quotes you've gathered, paying attention to the coverage levels, premiums, and deductibles. Consider the reputation and financial stability of the insurance providers as well.

- Assess Your Priorities: Reflect on your specific needs and priorities. Do you prioritize comprehensive coverage, or are you more concerned with finding the most affordable option? Weigh the trade-offs between coverage and cost to make the best decision for your situation.

- Contact Insurance Providers: Reach out to the top insurance providers on your shortlist. Discuss your specific requirements and any concerns you may have. This allows you to gain a deeper understanding of their policies and ensure you're making an informed choice.

- Read the Fine Print: Before finalizing your decision, carefully review the policy documents provided by the insurance provider. Pay attention to the exclusions, limitations, and any additional terms and conditions. Ensure you fully understand what is and isn't covered.

- Seek Professional Advice: If you're still unsure or have complex insurance needs, consider consulting an independent insurance agent or broker. They can provide expert guidance and help you navigate the intricacies of car insurance to find the best policy for your circumstances.

Conclusion

Finding the best car insurance is a crucial decision that impacts your financial well-being and peace of mind. By understanding your needs, researching and comparing providers, evaluating coverage options, and considering pricing and discounts, you can make an informed choice that provides the right balance of protection and value. Remember, car insurance is not a one-size-fits-all solution, so tailor your policy to your unique circumstances to ensure you’re adequately protected on the road.

What is the average cost of car insurance?

+The average cost of car insurance varies depending on several factors, including your location, driving record, and the make and model of your vehicle. According to the Insurance Information Institute, the national average annual premium for car insurance was approximately $1,674 in 2022. However, it’s important to note that your specific rate may differ based on your individual circumstances.

Are there any ways to reduce my car insurance premiums?

+Yes, there are several strategies you can employ to potentially reduce your car insurance premiums. Some common methods include shopping around for quotes from different providers, bundling your car insurance with other types of insurance, maintaining a clean driving record, and exploring discounts such as multi-policy discounts, safe driver discounts, or good student discounts.

What happens if I don’t have car insurance and get into an accident?

+Driving without car insurance is illegal in most states and can result in significant financial and legal consequences. If you’re involved in an accident without insurance, you may be held personally liable for all damages and injuries, which can lead to substantial financial burdens. It’s essential to have car insurance to protect yourself and others on the road.