Florida Insurance Auto

When it comes to navigating the world of auto insurance in the Sunshine State, understanding the unique landscape of Florida insurance is crucial. With its diverse demographics, varying weather conditions, and specific legal requirements, Florida presents a distinct set of considerations for drivers seeking adequate coverage. This comprehensive guide aims to demystify the process, offering an in-depth analysis of the key factors, options, and strategies to ensure you make informed decisions about your auto insurance coverage.

Understanding Florida’s Auto Insurance Landscape

Florida’s auto insurance market is characterized by a unique set of factors that influence the coverage options available to drivers. From no-fault insurance requirements to the impact of severe weather events, understanding these nuances is essential for making informed choices.

No-Fault Insurance: A Florida Necessity

One of the most distinctive features of Florida’s auto insurance landscape is the state’s no-fault insurance requirement. Under Florida’s Personal Injury Protection (PIP) law, all registered vehicles must carry at least $10,000 in PIP coverage. This coverage provides for the insured’s medical expenses and lost wages in the event of an accident, regardless of fault. While this system simplifies the claims process, it also limits the ability to pursue compensation beyond the PIP coverage, especially in cases of severe injury.

Severe Weather and Catastrophic Risks

Florida’s geographic location makes it particularly vulnerable to severe weather events, including hurricanes and tropical storms. These natural disasters can cause extensive damage to vehicles, and understanding the insurance implications is crucial. Many standard auto insurance policies in Florida offer comprehensive coverage for damages caused by storms, but it’s important to review your policy’s specific terms and conditions to ensure adequate protection. Additionally, Florida offers a state-run insurance program, the Florida Hurricane Catastrophe Fund (FHCF), which provides an additional layer of coverage in the event of a catastrophic hurricane.

Auto Insurance Coverage Options in Florida

Navigating the various coverage options available in Florida is essential to tailoring an insurance policy that meets your specific needs and provides adequate protection.

Liability Coverage

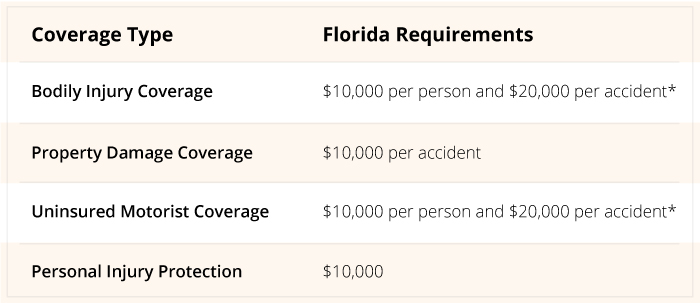

Liability coverage is a fundamental component of any auto insurance policy. It protects you financially if you are found at fault in an accident, covering the costs of injuries and property damage sustained by others. In Florida, the minimum liability limits are 10,000 for bodily injury per person, 20,000 for bodily injury per accident, and $10,000 for property damage. However, it’s important to consider increasing these limits, especially if you have significant assets to protect.

Collision and Comprehensive Coverage

Collision coverage protects your vehicle in the event of an accident, regardless of fault. It covers the cost of repairs or the vehicle’s replacement value if it’s deemed a total loss. Comprehensive coverage, on the other hand, provides protection for non-accident-related damages, such as theft, vandalism, and damage caused by natural disasters. Given Florida’s propensity for severe weather, comprehensive coverage is particularly important for Florida drivers.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an optional coverage in Florida, but it’s highly recommended. This coverage protects you if you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the costs of the accident. With Florida’s relatively high rate of uninsured drivers, UM/UIM coverage can provide crucial financial protection.

Additional Coverages

Florida drivers may also consider other optional coverages to enhance their protection, such as:

- Medical Payments Coverage: Provides additional coverage for medical expenses, regardless of fault.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while yours is being repaired after an insured loss.

- Gap Insurance: Bridges the gap between the actual cash value of your vehicle and the amount you still owe on your loan or lease in the event of a total loss.

Strategies for Securing Affordable Auto Insurance in Florida

While Florida’s unique insurance landscape presents certain challenges, there are strategies you can employ to secure affordable and comprehensive coverage.

Compare Quotes from Multiple Insurers

Obtaining quotes from multiple insurance providers is a key step in finding the best coverage at the most competitive price. Florida’s insurance market is competitive, and insurers offer a range of discounts and incentives to attract new customers. By comparing quotes, you can identify the insurer that offers the best combination of coverage and price for your specific needs.

Explore Discounts and Savings Opportunities

Many insurers offer a variety of discounts that can significantly reduce your insurance premiums. Some common discounts include:

- Multi-Policy Discounts: Combining your auto insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

- Safe Driver Discounts: Insurers often reward drivers with clean driving records and no recent accidents or traffic violations.

- Loyalty Discounts: Staying with the same insurer for an extended period can lead to loyalty discounts.

- Defensive Driving Course Discounts: Completing an approved defensive driving course can qualify you for a discount on your insurance premium.

Understand Your Coverage Needs

Assessing your specific coverage needs is essential to avoid over-insuring or under-insuring your vehicle. Consider your vehicle’s age, value, and usage, as well as your personal financial situation and assets. By understanding your unique circumstances, you can tailor your coverage to ensure you’re adequately protected without paying for coverage you don’t need.

The Future of Auto Insurance in Florida: Technological Innovations and Emerging Trends

The auto insurance industry in Florida, like elsewhere, is undergoing significant transformation driven by technological advancements and changing consumer expectations.

Telematics and Usage-Based Insurance (UBI)

Telematics technology, which uses data from on-board sensors and GPS systems to track driving behavior, is increasingly being used by insurers to offer Usage-Based Insurance (UBI) policies. These policies offer discounts to safe drivers and can provide a more accurate assessment of individual risk, potentially leading to more competitive pricing for low-risk drivers.

Digital Onboarding and Claims Processing

The rise of digital technologies has streamlined the insurance onboarding process, making it faster and more convenient for consumers. Additionally, digital claims processing has enhanced efficiency, with many insurers now offering mobile apps that allow policyholders to submit claims and track their progress in real-time.

The Rise of Personalized Insurance Products

As consumer preferences and expectations evolve, insurers are developing more personalized insurance products. These policies often offer greater flexibility, allowing policyholders to choose specific coverage options and add-ons that align with their individual needs and circumstances.

Conclusion: A Well-Informed Approach to Florida Auto Insurance

Navigating the Florida auto insurance landscape requires a comprehensive understanding of the state’s unique requirements, risks, and coverage options. By familiarizing yourself with the key considerations outlined in this guide, you can make informed decisions to ensure you have adequate protection at a competitive price. Remember, the insurance landscape is constantly evolving, so staying informed and regularly reviewing your coverage is essential to maintaining the right level of protection for your circumstances.

FAQ

How can I lower my auto insurance premiums in Florida?

+

There are several strategies to reduce your auto insurance premiums in Florida. These include comparing quotes from multiple insurers, exploring available discounts (such as multi-policy, safe driver, and loyalty discounts), and understanding your coverage needs to avoid over-insuring. Additionally, maintaining a clean driving record and considering usage-based insurance policies can lead to significant savings.

What is the penalty for driving without insurance in Florida?

+

Driving without insurance in Florida is a serious offense. If caught, you may face penalties including fines, suspension of your driver’s license, and even vehicle impoundment. Additionally, you may be required to provide proof of insurance (SR-22 filing) for a specified period, which can significantly increase your insurance premiums.

Can I choose my repair shop after an accident in Florida?

+

Yes, Florida is a “direct repair” state, which means you have the right to choose the repair shop of your choice after an accident. However, your insurer may have a preferred shop network, and using one of these shops may provide certain benefits, such as expedited repairs or guaranteed workmanship.

What happens if I’m involved in an accident with an uninsured driver in Florida?

+

If you’re involved in an accident with an uninsured driver in Florida, your own uninsured/underinsured motorist (UM/UIM) coverage will come into play. This coverage, if you have it, will provide compensation for your injuries and property damage. If you don’t have UM/UIM coverage, you may have to pursue compensation through the at-fault driver’s assets or through a personal injury lawsuit.

How often should I review my auto insurance policy in Florida?

+

It’s a good practice to review your auto insurance policy annually or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for coverage you no longer need. Additionally, regular reviews can help you identify potential discounts or coverage enhancements that could further improve your policy.