Gap Auto Insurance

Gap insurance, an essential component of vehicle coverage, plays a pivotal role in protecting drivers and their finances. This specialized insurance type bridges the gap between a vehicle's actual cash value and the amount still owed on its loan or lease. In an era marked by rapidly evolving automotive technology and financial innovations, understanding Gap insurance is more critical than ever.

With the automobile industry experiencing a dynamic shift towards electric vehicles and autonomous driving, the landscape of vehicle ownership and financing is also transforming. This evolution underscores the necessity for comprehensive Gap insurance, especially as the value of vehicles can fluctuate rapidly, particularly in the context of rapidly advancing technology.

The Significance of Gap Insurance

Gap insurance, often referred to as Guaranteed Asset Protection, is a critical safeguard for drivers who lease or finance their vehicles. It ensures that, in the unfortunate event of a total loss, the policyholder isn’t left with a substantial financial burden.

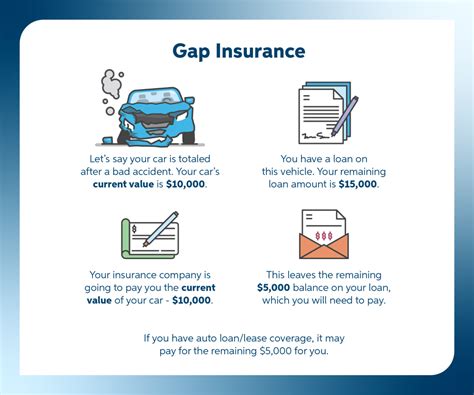

Consider a scenario where a driver, let's call them Alice, purchases a new car worth $30,000 and finances it over five years. Within the first year, the car's value depreciates by approximately 20%, leaving it with an actual cash value of $24,000. However, due to interest and other financing costs, Alice still owes $28,000 on the loan. If, at this juncture, the car is totaled in an accident, the standard insurance policy would only cover the actual cash value, leaving Alice with a $4,000 gap to cover.

This is where Gap insurance steps in, bridging that financial gap. It ensures that Alice receives the full amount owed on the loan, alleviating the stress and financial strain that could otherwise arise from such an incident. This protection is particularly crucial in the initial years of a loan or lease when the vehicle's value depreciates most rapidly.

How Gap Insurance Works

Gap insurance is typically offered as an add-on to a standard auto insurance policy, although some lenders or leasing companies may include it in their agreements. It’s designed to cover the difference between the actual cash value of the vehicle and the amount still owed on the loan or lease.

Upon filing a claim, the insurance provider will assess the vehicle's value at the time of the incident, taking into account factors like its age, mileage, and condition. This value is then compared to the outstanding loan or lease amount. If there's a gap, the Gap insurance policy steps in to cover the difference, ensuring the policyholder isn't left with a financial shortfall.

Key Considerations

- Eligibility: Gap insurance is generally available for new or recently purchased vehicles. The exact eligibility criteria can vary depending on the insurance provider and the jurisdiction.

- Cost: The premium for Gap insurance can be paid as a one-time fee or as an annual addition to the standard auto insurance premium. The cost can vary based on several factors, including the vehicle’s value, the loan or lease term, and the insurer’s rates.

- Claims Process: The claims process for Gap insurance is similar to that of standard auto insurance. Policyholders must file a claim with their insurer, providing relevant documentation, and the insurer will assess the claim based on the terms of the policy.

Benefits and Advantages

Gap insurance offers a multitude of benefits and advantages that make it an invaluable addition to any vehicle owner’s insurance portfolio.

Financial Protection

The primary advantage of Gap insurance is its role in providing financial protection. In the event of a total loss, where the vehicle’s actual cash value is less than the outstanding loan or lease amount, Gap insurance covers the difference. This protection ensures that policyholders aren’t left with a substantial financial burden, allowing them to focus on their recovery without the added stress of financial strain.

Peace of Mind

Knowing that they are protected by Gap insurance provides policyholders with a sense of peace of mind. They can drive with the confidence that, should the worst happen, they won’t be left facing a financial shortfall. This peace of mind can be particularly valuable for those who rely heavily on their vehicles for work or daily life, as it removes the worry of unexpected financial setbacks.

Flexibility and Convenience

Gap insurance offers policyholders flexibility and convenience. It can be easily added to an existing auto insurance policy, making it a simple and straightforward process to obtain this crucial coverage. Additionally, Gap insurance policies often have straightforward terms and conditions, making it easy for policyholders to understand their coverage and make informed decisions.

Comparative Analysis: Gap Insurance vs. Other Coverage Options

When it comes to vehicle insurance, there are several options available to drivers. Understanding how Gap insurance compares to other coverage types is essential for making informed decisions about your vehicle’s protection.

Gap Insurance vs. Standard Auto Insurance

Standard auto insurance policies typically cover the actual cash value of a vehicle in the event of a total loss. This means that, if a vehicle is totaled in an accident, the insurance company will pay out the vehicle’s current market value, which may be lower than the amount owed on the loan or lease.

Gap insurance, on the other hand, is designed to bridge this gap. It ensures that, even if the vehicle's actual cash value is less than the outstanding loan or lease amount, the policyholder is fully covered. This makes Gap insurance an essential add-on for those who lease or finance their vehicles, providing an additional layer of protection beyond what standard auto insurance offers.

Gap Insurance vs. Loan/Lease Payoff Coverage

Loan/Lease Payoff Coverage, also known as Loan/Lease Gap Coverage, is often offered by lenders or leasing companies. This coverage is similar to Gap insurance, as it covers the difference between the vehicle’s actual cash value and the outstanding loan or lease balance.

However, there are some key differences between Loan/Lease Payoff Coverage and Gap insurance. Loan/Lease Payoff Coverage is typically included in the loan or lease agreement, whereas Gap insurance is an optional add-on to a standard auto insurance policy. Additionally, Loan/Lease Payoff Coverage may have specific eligibility criteria or restrictions set by the lender or leasing company, while Gap insurance is generally more flexible and can be tailored to the policyholder's needs.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to understand the impact and importance of Gap insurance.

Case Study 1: Total Loss of a Financed Vehicle

Imagine a driver, David, who has recently purchased a new car worth 40,000 and financed it over a period of 6 years. Within the first year, due to rapid depreciation, the car's value drops to 32,000. However, due to the terms of the loan, David still owes $38,000 on the vehicle.

Unfortunately, David gets into an accident that totals his car. Without Gap insurance, David would be responsible for paying the $6,000 gap between the car's actual cash value and the outstanding loan amount. However, with Gap insurance in place, the insurance company covers this gap, ensuring David isn't left with a financial burden.

Case Study 2: Leasing a Vehicle

Consider Sarah, who leases a new SUV for a period of 3 years. During this time, the SUV’s value depreciates significantly, leaving its actual cash value at 25,000. However, due to the terms of the lease, Sarah still owes 30,000 on the vehicle.

If Sarah were to experience a total loss during her lease period, she would face a significant financial challenge without Gap insurance. However, with Gap insurance coverage, the insurance company would cover the $5,000 gap, ensuring Sarah isn't left paying for a vehicle she no longer has.

Performance Analysis: Gap Insurance in Action

Gap insurance has proven its worth time and again in various scenarios, providing financial relief and peace of mind to policyholders. Here’s a deeper look at how Gap insurance performs in real-world situations.

Rapid Depreciation and Vehicle Financing

Vehicles, especially new ones, often experience rapid depreciation in their initial years. This means that the outstanding loan or lease amount can quickly exceed the vehicle’s actual cash value. Gap insurance steps in during these situations, covering the difference and ensuring that policyholders aren’t left with a financial burden.

For example, consider a driver who purchases a new car worth $35,000 and finances it over 5 years. Within the first year, the car's value depreciates to $28,000, but the outstanding loan amount remains at $32,000. In the event of a total loss, Gap insurance would cover the $4,000 gap, ensuring the driver isn't left paying for a vehicle they no longer have.

Total Loss Scenarios

Gap insurance is particularly crucial in total loss scenarios, where a vehicle is deemed a write-off due to an accident, theft, or natural disaster. In such cases, the standard auto insurance policy would typically only cover the vehicle’s actual cash value, leaving a gap between this value and the outstanding loan or lease amount.

With Gap insurance in place, this gap is covered, ensuring that policyholders receive the full amount owed on their loan or lease. This protection is invaluable, as it alleviates the financial stress that can accompany a total loss, allowing policyholders to focus on their recovery and finding a new vehicle.

Future Implications and Industry Insights

As the automotive industry continues to evolve, with advancements in technology and changes in vehicle ownership models, the role of Gap insurance is likely to become even more critical.

Autonomous Vehicles and Electric Cars

The rise of autonomous vehicles and the increasing popularity of electric cars are set to bring significant changes to the automotive landscape. These advancements may impact vehicle values and depreciation rates, potentially affecting the need for Gap insurance.

For instance, as autonomous driving technology becomes more prevalent, it's possible that the value of vehicles with this feature could increase, potentially slowing down the rate of depreciation. On the other hand, the transition to electric vehicles may lead to a shift in resale values, as traditional fuel-based vehicles become less desirable. In both cases, Gap insurance would play a crucial role in protecting policyholders from unexpected financial burdens.

Industry Trends and Regulatory Changes

The insurance industry is constantly evolving, with new trends and regulatory changes shaping the landscape. These developments can impact the availability, cost, and coverage of Gap insurance.

For example, as more insurers offer Gap insurance as an add-on to standard auto insurance policies, competition may drive down prices, making this coverage more accessible and affordable. Additionally, regulatory changes aimed at protecting consumers could influence the terms and conditions of Gap insurance policies, ensuring they provide adequate coverage.

Adapting to Changing Market Conditions

In today’s dynamic market, where vehicle values can fluctuate rapidly due to various factors, Gap insurance offers a vital layer of protection. It ensures that policyholders aren’t left vulnerable to financial losses, especially in the event of a total loss or rapid depreciation.

As the market continues to evolve, with new technologies and ownership models emerging, Gap insurance will need to adapt to meet these changing needs. This may involve developing new policies that cater to specific vehicle types or ownership models, ensuring that policyholders receive the coverage they need in a rapidly changing automotive landscape.

Is Gap insurance necessary for all vehicle owners?

+Gap insurance is particularly beneficial for those who lease or finance their vehicles, as it protects them from potential financial burdens in the event of a total loss. For those who own their vehicles outright, Gap insurance may not be as critical, but it can still provide peace of mind and financial protection in certain situations.

How much does Gap insurance typically cost?

+The cost of Gap insurance can vary depending on several factors, including the vehicle’s value, the loan or lease term, and the insurer’s rates. It can be paid as a one-time fee or as an annual addition to the standard auto insurance premium. It’s recommended to get quotes from multiple insurers to find the best rate for your specific situation.

Can I get Gap insurance if my vehicle is already financed or leased?

+In many cases, yes. Gap insurance is often available as an add-on to an existing auto insurance policy, even if your vehicle is already financed or leased. However, it’s important to check with your insurer and understand the specific eligibility criteria and coverage options available.