Gap Insurance Auto

In the world of automotive finance and insurance, gap insurance stands out as a crucial yet often misunderstood coverage option. Short for Guaranteed Asset Protection, gap insurance is designed to bridge the financial gap that can occur when a vehicle is totaled or stolen, ensuring that policyholders are not left with a substantial financial burden.

This specialized form of insurance has gained prominence in recent years, especially as vehicle prices rise and loan terms lengthen. It provides an essential layer of protection for vehicle owners, particularly those who have financed or leased their vehicles. This article aims to provide a comprehensive understanding of gap insurance, exploring its benefits, how it works, and why it is a valuable consideration for anyone driving a financed or leased vehicle.

Understanding Gap Insurance

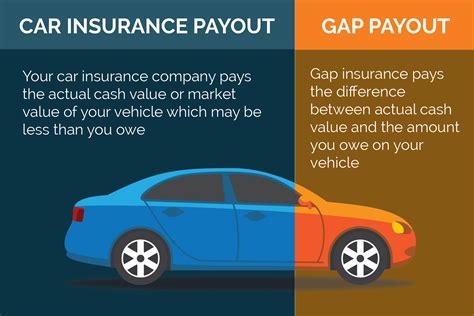

Gap insurance, also known as auto deficit insurance, is a specific type of coverage that addresses a common issue in the automotive industry: the potential financial loss when a vehicle's actual cash value is less than the amount owed on its loan or lease.

When a vehicle is financed or leased, its value typically depreciates quickly in the first few years. During this time, the borrower may owe more on the vehicle than it is worth in the open market. If the vehicle is involved in an accident or is stolen and deemed a total loss, the insurance company will typically pay out the actual cash value of the vehicle, which may be less than the outstanding loan or lease balance.

This is where gap insurance steps in. It covers the difference, or "gap," between the vehicle's actual cash value and the amount owed, ensuring that the policyholder is not left with a large, unexpected bill.

How Gap Insurance Works

Gap insurance is typically an optional add-on to a standard auto insurance policy. It can be purchased from insurance providers, dealerships, or financial institutions offering auto loans and leases. The cost of gap insurance varies based on several factors, including the vehicle's value, the loan or lease term, and the provider.

Here's a simplified breakdown of how gap insurance operates:

- Vehicle Purchase or Lease: When an individual buys or leases a vehicle, they can opt to purchase gap insurance simultaneously or at a later date.

- Insurable Event: If the vehicle is involved in an accident, stolen, or otherwise damaged beyond repair (a total loss), the primary auto insurance policy will pay out the actual cash value of the vehicle.

- Gap Coverage: If the payout from the primary insurance is less than the remaining balance on the vehicle's loan or lease, gap insurance kicks in to cover the difference.

- Claim Settlement: The gap insurance provider will pay the outstanding balance to the lender or lessor, ensuring that the policyholder is not left with a financial deficit.

It's important to note that gap insurance does not cover any personal financial losses unrelated to the vehicle, such as deductible costs or other out-of-pocket expenses.

Benefits of Gap Insurance

Gap insurance offers several significant advantages to vehicle owners, especially those who have financed or leased their vehicles.

Protection Against Financial Loss

The primary benefit of gap insurance is its ability to protect policyholders from unexpected financial burdens. In the event of a total loss, gap insurance ensures that the policyholder is not responsible for paying off the remaining balance on the loan or lease, which can be a substantial amount.

For example, if a vehicle is purchased for $30,000 and after a year, it has depreciated to a value of $25,000, but the outstanding loan balance is still $28,000, gap insurance would cover the $3,000 difference, ensuring the policyholder does not have to pay out of pocket.

Peace of Mind

Knowing that they are protected against financial loss in the event of a total loss can provide significant peace of mind for vehicle owners. It removes the stress and worry associated with potentially owing a substantial amount on a vehicle that is no longer drivable.

Affordable Coverage

Gap insurance is generally an affordable addition to a standard auto insurance policy. The cost is often a one-time fee or a small monthly premium, making it a cost-effective way to secure significant financial protection.

Broad Applicability

Gap insurance is applicable to a wide range of vehicle types, from cars and motorcycles to commercial vehicles and even watercraft in some cases. It is especially beneficial for those who lease vehicles, as leases often have higher monthly payments and shorter terms, resulting in a higher risk of negative equity.

When to Consider Gap Insurance

Gap insurance is a valuable consideration for several scenarios.

Financed or Leased Vehicles

For individuals who have financed or leased their vehicles, gap insurance is often a prudent choice. It provides essential protection against the rapid depreciation that can leave borrowers owing more on their vehicles than they are worth.

High-Value or Depreciation-Prone Vehicles

Vehicles that are particularly prone to rapid depreciation, such as certain luxury brands or specific models known for high depreciation rates, can benefit greatly from gap insurance. These vehicles can quickly lose value, making gap insurance a wise investment to protect against potential financial loss.

Long-Term Loans or Leases

Vehicles with longer loan or lease terms are also prime candidates for gap insurance. Over time, the vehicle's value can depreciate significantly, potentially leaving the borrower with a large balance to pay off if the vehicle is totaled or stolen.

Real-World Examples

To illustrate the value of gap insurance, let's consider a few real-world scenarios:

Scenario 1: New Car Purchase

John purchases a new car for $40,000 and finances it over 60 months. After 2 years, the car's value has depreciated to $30,000, but John still owes $35,000 on his loan. If John's car is totaled in an accident, his primary insurance will pay out $30,000. However, with gap insurance, John would be covered for the remaining $5,000, ensuring he does not have to pay out of pocket.

Scenario 2: Lease Agreement

Emily leases a new SUV for 36 months. After 18 months, she decides to move to a different city and no longer needs the SUV. However, the early termination fee on her lease is $6,000, and the SUV's current market value is only $4,000. With gap insurance, Emily would be covered for the $2,000 difference, making it more feasible for her to end her lease early without incurring significant costs.

Scenario 3: Commercial Vehicle

A small business owner, David, purchases a new delivery van for his business. He finances the van over 48 months. After 24 months, the van is involved in an accident and is deemed a total loss. The van's actual cash value at the time of the accident is $22,000, but David still owes $28,000 on his loan. With gap insurance, David is protected and does not have to pay the additional $6,000 out of pocket.

Gap Insurance vs. Other Coverages

Gap insurance is distinct from other forms of auto insurance coverage and should not be confused with them.

Gap Insurance vs. Comprehensive and Collision Coverage

Comprehensive and collision coverage are part of standard auto insurance policies and protect against physical damage to the insured vehicle. Comprehensive coverage covers damage from non-collision events like fire, theft, or natural disasters, while collision coverage covers damage from collisions with other vehicles or objects.

In contrast, gap insurance does not cover physical damage to the vehicle but instead covers the financial gap that can occur when a vehicle is totaled or stolen. It is an additional layer of protection that complements comprehensive and collision coverage.

Gap Insurance vs. Loan/Lease Payoff Coverage

Loan/Lease Payoff Coverage, also known as Debt Cancellation Coverage or Loan Life Insurance, is a type of insurance that pays off the remaining balance on a vehicle loan or lease if the borrower dies or becomes permanently disabled. It is often offered by lenders and financial institutions.

While gap insurance also covers the remaining loan or lease balance, it does so in the event of a total loss, theft, or other specified circumstances. Loan/Lease Payoff Coverage, on the other hand, is triggered by the borrower's death or disability, making it a form of life and disability insurance rather than auto insurance.

Frequently Asked Questions

Does gap insurance cover all vehicles?

+Gap insurance is widely available for most types of vehicles, including cars, motorcycles, and even commercial vehicles. However, the specific coverage and eligibility may vary depending on the provider and the type of vehicle. It's always recommended to check with the insurance provider or dealership to confirm coverage details.

How much does gap insurance cost?

+The cost of gap insurance can vary based on several factors, including the vehicle's value, the loan or lease term, and the provider. It can be a one-time fee or a small monthly premium. On average, gap insurance can range from $100 to $600 for the life of the policy, but it's essential to get specific quotes for your vehicle and circumstances.

Can gap insurance be purchased at any time?

+In most cases, gap insurance can be purchased at any time, even after the vehicle has been financed or leased. However, it's often most beneficial to purchase gap insurance when the vehicle is first financed or leased, as this is when the vehicle's value is highest relative to the loan or lease balance. Some providers may have specific timeframes for purchasing gap insurance, so it's best to check with your provider.

Is gap insurance necessary for all vehicle owners?

+Gap insurance is not necessary for all vehicle owners, but it is highly recommended for those who have financed or leased their vehicles. It provides valuable protection against the financial gap that can occur when a vehicle is totaled or stolen. For those who own their vehicles outright, gap insurance may not be as crucial.

What happens if I sell my vehicle before the gap insurance expires?

+If you sell your vehicle before the gap insurance expires, you typically have the option to cancel the policy and receive a prorated refund for the remaining coverage period. It's important to notify your insurance provider as soon as possible to ensure the proper cancellation and refund process.

Gap insurance is a valuable tool in the automotive finance landscape, offering a critical layer of protection for vehicle owners. By understanding its benefits, how it works, and when to consider it, individuals can make informed decisions to safeguard their financial well-being.