Geico Insurance Geico Insurance

In today's fast-paced world, finding reliable insurance coverage is crucial to protect our assets and provide peace of mind. One prominent player in the insurance industry is GEICO, an acronym that stands for Government Employees Insurance Company. With a rich history dating back to the mid-20th century, GEICO has evolved into a leading provider of auto insurance and a trusted name in the world of personal finance. In this comprehensive article, we will delve into the depths of GEICO Insurance, exploring its origins, services, impact, and future prospects.

The Evolution of GEICO: A Historical Perspective

To understand the significance of GEICO, we must first journey back to its inception. Founded in 1936 by Leo Goodwin Sr. and his wife, Lillian Goodwin, GEICO initially targeted government employees, offering them affordable auto insurance rates. This innovative idea stemmed from the Goodwins’ belief that government employees, known for their stability and reliability, should have access to insurance coverage that reflected their trusted status.

Over the decades, GEICO's focus expanded beyond government employees, embracing a broader customer base. This strategic move allowed the company to grow and adapt to the changing landscape of the insurance industry. GEICO's commitment to customer satisfaction and its innovative approach to insurance have been key factors in its enduring success.

GEICO’s Comprehensive Insurance Services

GEICO Insurance offers a diverse range of insurance products and services to cater to the varied needs of its customers. Here’s an overview of some of the key areas where GEICO excels:

Auto Insurance

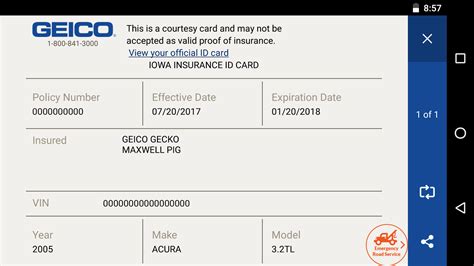

GEICO’s flagship service is its auto insurance. With a focus on providing comprehensive coverage at competitive rates, GEICO has become a go-to choice for vehicle owners across the United States. The company offers various auto insurance plans, including liability, collision, comprehensive, and personalized policies tailored to individual needs.

One of GEICO's unique selling points is its digital-first approach. Customers can easily obtain quotes, manage policies, and file claims online or through the GEICO mobile app, offering unparalleled convenience.

Home and Property Insurance

In addition to auto insurance, GEICO provides home and property insurance solutions. Whether you’re a homeowner, renter, or landlord, GEICO offers customizable coverage to protect your residence and its contents. From natural disasters to theft and vandalism, GEICO’s home insurance policies provide peace of mind and financial security.

Life Insurance and Retirement Planning

GEICO understands that financial protection extends beyond physical assets. That’s why the company also offers life insurance and retirement planning services. GEICO’s life insurance policies provide beneficiaries with financial support in the event of the policyholder’s passing, ensuring loved ones are taken care of.

Furthermore, GEICO's retirement planning services help individuals prepare for their golden years. With a range of investment options and expert guidance, GEICO assists customers in building a secure financial future.

Additional Services

Beyond the traditional insurance offerings, GEICO provides a suite of additional services to enhance customer experiences. These include:

- Emergency Roadside Assistance: GEICO offers 24/7 roadside assistance, providing peace of mind for drivers facing emergencies such as flat tires, dead batteries, or vehicle lockouts.

- Travel Insurance: GEICO's travel insurance plans protect travelers from unforeseen events, covering medical emergencies, trip cancellations, and lost luggage.

- Identity Theft Protection: In today's digital age, identity theft is a growing concern. GEICO's identity theft protection services help customers monitor and protect their personal information, offering assistance in the event of a breach.

The Impact of GEICO: Industry Leadership and Customer Satisfaction

GEICO’s influence on the insurance industry is undeniable. The company’s innovative approach, customer-centric philosophy, and competitive pricing have set new standards for the industry. GEICO’s success has not only benefited its customers but has also driven other insurance providers to enhance their services and improve their offerings.

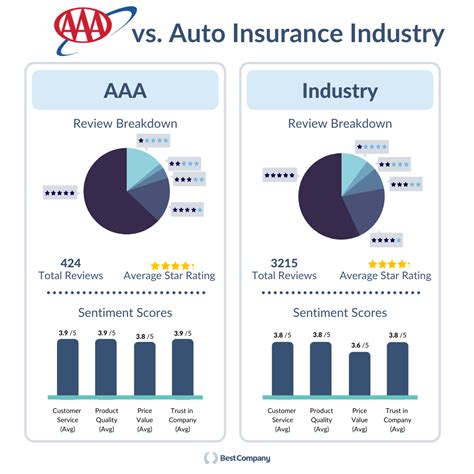

One of the key indicators of GEICO's impact is its customer satisfaction ratings. GEICO consistently ranks among the top insurance providers in customer satisfaction surveys. This is a testament to the company's commitment to delivering exceptional service and building long-lasting relationships with its policyholders.

Furthermore, GEICO's marketing campaigns, often featuring humorous and memorable characters like the famous GEICO Gecko, have become cultural phenomena. These campaigns have not only raised brand awareness but have also helped GEICO connect with customers on a personal level, solidifying its position as a trusted and approachable insurance provider.

The Future of GEICO: Technological Advancements and Expansion

As the insurance industry continues to evolve, GEICO remains at the forefront of innovation. The company is actively embracing technological advancements to enhance its services and improve the overall customer experience.

One notable area of focus for GEICO is the development of AI-powered chatbots and virtual assistants. These cutting-edge technologies enable customers to receive real-time assistance, obtain quotes, and manage their policies efficiently. By leveraging AI, GEICO aims to provide faster, more accurate, and personalized customer service.

Additionally, GEICO is exploring partnerships and collaborations with tech startups and established technology companies to stay ahead of the curve. These collaborations allow GEICO to access cutting-edge technologies and integrate them into its insurance offerings, ensuring its continued relevance and competitiveness in the digital age.

Looking ahead, GEICO's expansion plans include branching out into new markets and offering an even wider range of insurance products. The company aims to become a one-stop shop for all insurance needs, providing comprehensive coverage for individuals, families, and businesses.

Conclusion

GEICO Insurance has come a long way since its humble beginnings in 1936. From its initial focus on government employees to its current status as a leading insurance provider, GEICO has demonstrated a commitment to innovation, customer satisfaction, and financial protection. With its comprehensive range of insurance services, industry leadership, and forward-thinking approach, GEICO is well-positioned to thrive in the dynamic insurance landscape.

As we navigate the complexities of modern life, having a trusted insurance partner like GEICO can provide invaluable peace of mind. Whether you're seeking auto insurance, home protection, or financial planning assistance, GEICO's expertise and dedication to its customers make it a top choice in the insurance industry.

Frequently Asked Questions (FAQ)

How does GEICO determine insurance rates?

+GEICO uses a combination of factors to determine insurance rates, including the type of coverage, the insured’s driving record, location, and the value of the vehicle or property being insured. They also consider individual risk profiles and offer discounts for safe driving practices and certain vehicle safety features.

What makes GEICO’s customer service stand out?

+GEICO’s customer service is renowned for its efficiency, knowledge, and accessibility. The company offers 24⁄7 customer support through multiple channels, including phone, email, and live chat. Their trained agents provide personalized assistance and strive to resolve customer inquiries promptly.

Does GEICO offer insurance coverage outside the United States?

+Currently, GEICO primarily operates within the United States. However, they are exploring opportunities to expand their international presence and provide insurance coverage to customers in select global markets in the future.