Government Insurance Plans

In the complex landscape of healthcare, insurance plays a pivotal role in ensuring accessibility and affordability. Among the various insurance options, government-backed plans stand out for their potential to provide comprehensive coverage to a wide range of individuals. This article aims to delve into the world of government insurance plans, exploring their intricacies, benefits, and impact on healthcare accessibility.

The Evolution of Government Insurance Plans

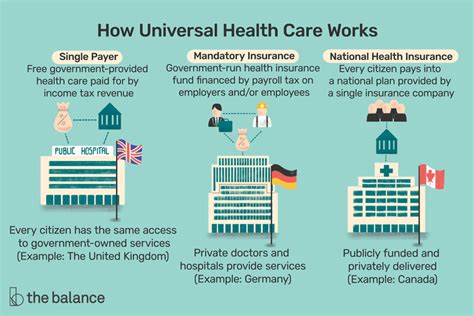

Government insurance plans have a rich history, shaped by societal needs and political ideologies. The concept of government-provided healthcare has its roots in the early 20th century, with pioneering initiatives like the British National Health Service (NHS) and the German Bismarck health insurance system. These early models laid the foundation for a more inclusive and equitable healthcare system, where access to medical services was no longer dictated solely by one’s financial status.

Over the years, government insurance plans have evolved to address emerging challenges. For instance, the introduction of Medicare and Medicaid in the United States marked a significant milestone, extending healthcare coverage to the elderly and low-income individuals, respectively. Similarly, in Canada, the implementation of the Canada Health Act ensured universal healthcare coverage, a cornerstone of the country's social safety net.

Key Features of Government Insurance Plans

Government insurance plans are designed with a set of core principles that distinguish them from private insurance providers. These features often include:

- Universal Coverage: Government plans strive to provide healthcare access to all citizens, regardless of income, age, or pre-existing conditions. This principle ensures that no one is left without the essential medical care they need.

- Comprehensive Benefits: These plans typically offer a wide range of benefits, covering not only basic medical services but also preventive care, mental health support, and long-term care. This holistic approach aims to address the diverse healthcare needs of the population.

- Cost Sharing: While government insurance plans may have premiums, they often come with lower costs compared to private insurance. Additionally, they may incorporate cost-sharing mechanisms like copayments and deductibles to ensure financial sustainability.

- Regulatory Oversight: Government plans are subject to strict regulations, ensuring transparency and accountability. This oversight helps prevent abusive practices and maintains the integrity of the healthcare system.

The Impact on Healthcare Accessibility

The implementation of government insurance plans has had a profound impact on healthcare accessibility, particularly for vulnerable populations. Here’s a closer look at some key aspects:

Reducing Financial Barriers

One of the primary benefits of government insurance plans is their ability to reduce financial barriers to healthcare. By offering affordable premiums and comprehensive coverage, these plans ensure that individuals can access necessary medical services without incurring crippling costs. This is especially crucial for low-income families and those with chronic conditions, who may otherwise face significant financial strain.

Improved Health Outcomes

Government insurance plans contribute to improved health outcomes by promoting early intervention and preventive care. With coverage for regular check-ups, screenings, and vaccinations, individuals are more likely to detect and address health issues before they become critical. This proactive approach not only improves overall well-being but also reduces the burden on the healthcare system by preventing costly emergency treatments.

Addressing Health Disparities

These plans play a vital role in addressing health disparities among different demographic groups. By providing equal access to healthcare, they help reduce inequalities based on income, ethnicity, or geographic location. This equitable approach ensures that all citizens, regardless of their background, have the opportunity to lead healthy lives and receive the medical attention they deserve.

Enhancing Healthcare Infrastructure

Government insurance plans often come with investments in healthcare infrastructure. These investments can lead to the expansion of healthcare facilities, improved access to specialized services, and the recruitment and retention of healthcare professionals. As a result, communities benefit from enhanced medical resources, further contributing to improved health outcomes.

Case Studies: Success Stories and Challenges

To illustrate the impact of government insurance plans, let’s explore a few real-world examples:

The United Kingdom’s NHS

The National Health Service, established in 1948, is a cornerstone of the UK’s healthcare system. The NHS provides universal coverage, ensuring that all UK residents have access to free healthcare at the point of delivery. This model has led to significant improvements in life expectancy and infant mortality rates, positioning the UK as a global leader in healthcare accessibility.

| Metric | Value |

|---|---|

| Life Expectancy | 81.3 years (2021) |

| Infant Mortality Rate | 3.8 deaths per 1,000 live births (2021) |

Australia’s Medicare

Australia’s Medicare program, introduced in 1984, provides universal healthcare coverage to all citizens and permanent residents. This plan covers a wide range of services, including hospital treatment, primary care, and pharmaceutical benefits. Medicare has played a pivotal role in reducing healthcare costs and ensuring access to essential medical services, particularly for those with low incomes.

Challenges and Innovations

While government insurance plans have proven successful, they also face challenges. Rising healthcare costs, an aging population, and changing disease patterns present ongoing obstacles. However, these challenges have spurred innovations, such as the integration of technology for remote healthcare and the adoption of value-based care models. These adaptations ensure that government insurance plans remain sustainable and responsive to evolving healthcare needs.

The Future of Government Insurance Plans

As we look ahead, the future of government insurance plans is poised for further evolution. Here are some potential developments:

- Digital Transformation: The integration of digital technologies is expected to play a significant role. Telemedicine, electronic health records, and data analytics can enhance efficiency, improve patient experiences, and reduce costs.

- Value-Based Care: There is a growing emphasis on value-based care models, which focus on delivering high-quality, cost-effective healthcare. This approach aims to shift the focus from volume-based care to patient-centered outcomes, improving overall health and reducing unnecessary treatments.

- Global Collaboration: With healthcare challenges becoming increasingly global, collaboration between governments and international organizations is likely to intensify. Sharing best practices and resources can lead to more efficient and effective healthcare systems worldwide.

How do government insurance plans compare to private insurance in terms of cost?

+Government insurance plans often offer more affordable options compared to private insurance. While private insurance may provide more tailored coverage, government plans prioritize accessibility and often have lower premiums and reduced cost-sharing.

What are the eligibility criteria for government insurance plans?

+Eligibility criteria can vary depending on the specific plan and country. In many cases, citizenship or residency is a primary requirement. Additionally, some plans may have income-based eligibility, ensuring coverage for those who cannot afford private insurance.

How do government insurance plans impact the private healthcare market?

+The presence of government insurance plans can influence the private healthcare market by providing competition and driving market forces towards greater accessibility and affordability. Private insurers may adapt their offerings to remain competitive, benefiting consumers.