Hartford Insurance Customer Service

Hartford Insurance, a renowned name in the insurance industry, prides itself on its exceptional customer service. With a rich history spanning over a century, the company has evolved to become a trusted provider of various insurance solutions, catering to individuals and businesses alike. In this article, we delve into the realm of Hartford Insurance's customer service, exploring its multifaceted nature and the innovative approaches it employs to meet the diverse needs of its clientele.

The Evolution of Hartford Insurance’s Customer Service

Hartford Insurance’s customer service journey is a testament to its commitment to adaptation and innovation. Initially, like many traditional insurance companies, Hartford primarily relied on physical branch networks and call centers to interact with its customers. However, with the digital revolution, the company recognized the need to embrace new technologies and transform its customer service model.

In recent years, Hartford Insurance has undergone a digital transformation, investing heavily in its online platforms and mobile applications. This shift has not only enhanced the convenience and accessibility of its services but has also allowed the company to provide more personalized and efficient customer support.

Multichannel Approach

One of the standout features of Hartford Insurance’s customer service is its multichannel strategy. The company understands that different customers prefer different modes of communication, and thus, it offers a variety of options to suit individual needs.

- Phone Support: Hartford maintains a dedicated customer service hotline, providing real-time assistance to policyholders. Trained professionals are available to address inquiries, offer guidance, and assist with claims.

- Online Chat: For those who prefer instant messaging, Hartford's website features a live chat option. Customers can connect with customer service representatives in real-time, seeking quick resolutions to their queries.

- Email Support: Hartford also offers email support for customers who require more detailed explanations or prefer asynchronous communication. This channel is particularly useful for complex inquiries.

- Social Media Engagement: In today's digital age, social media has become an essential customer service channel. Hartford actively monitors and responds to customer inquiries and feedback on platforms like Twitter and Facebook, ensuring prompt attention to online conversations.

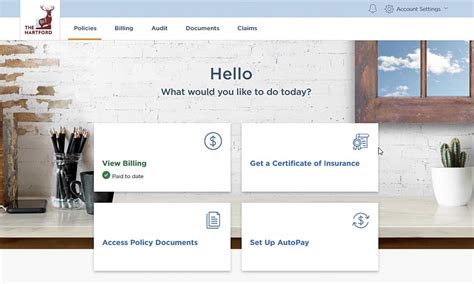

Self-Service Options

Hartford Insurance recognizes the value of empowering customers to take control of their insurance journey. As such, it has developed a range of self-service tools and resources to enhance customer convenience and autonomy.

- Online Account Management: Customers can access their policy details, make payments, update personal information, and manage their insurance needs through a secure online portal. This feature reduces the reliance on manual interventions and provides real-time access to critical policy information.

- Mobile Apps: Hartford's mobile applications offer a user-friendly interface, allowing customers to manage their policies on the go. From filing claims to accessing digital ID cards, the apps provide a seamless and convenient experience.

- Online Knowledge Base: The company's website hosts a comprehensive knowledge base, featuring articles, tutorials, and FAQs. This resource enables customers to find answers to common questions without having to reach out to customer service representatives.

| Channel | Response Time |

|---|---|

| Phone | Average wait time: 3-5 minutes |

| Online Chat | Instant connection |

| Response within 24 hours | |

| Social Media | Average response time: 2-4 hours |

Personalized Customer Experience

Hartford Insurance understands that every customer is unique, and thus, it strives to provide a personalized experience tailored to individual needs. The company utilizes advanced analytics and data-driven insights to offer customized solutions and targeted support.

AI-Powered Assistance

Hartford has embraced artificial intelligence (AI) to enhance its customer service capabilities. AI-powered chatbots and virtual assistants are deployed to handle routine inquiries, freeing up human agents to focus on more complex issues.

- Natural Language Processing (NLP): NLP enables Hartford's chatbots to understand and interpret customer queries accurately, providing relevant and contextually appropriate responses.

- Machine Learning: By leveraging machine learning algorithms, Hartford's AI systems continuously learn and improve, becoming more adept at handling a wider range of customer interactions.

Proactive Customer Care

Hartford Insurance believes in being proactive rather than reactive. The company employs predictive analytics to anticipate customer needs and address potential concerns before they escalate.

For instance, if a customer has recently filed a claim, Hartford's system may proactively reach out to offer additional support or guidance, ensuring a smooth claims process and enhancing customer satisfaction.

Claim Support and Resolution

One of the critical aspects of any insurance company’s customer service is its claim support and resolution process. Hartford Insurance has implemented several initiatives to streamline and expedite this process, ensuring a positive experience for policyholders during times of need.

Simplified Claim Filing

Hartford has simplified the claim filing process, making it accessible and user-friendly. Customers can initiate claims online or through the mobile app, providing relevant details and supporting documentation.

- Digital Claim Forms: Hartford's digital claim forms are designed to be intuitive and easy to navigate, reducing the chances of errors and streamlining the entire process.

- Document Upload: Policyholders can upload photos, videos, and other documents directly from their devices, eliminating the need for physical mail or fax.

Claim Tracking and Updates

Once a claim is filed, Hartford’s system provides regular updates and tracking information. Customers can access their claim status online, receiving real-time notifications and alerts.

Additionally, Hartford's customer service team ensures prompt communication, keeping policyholders informed about the progress of their claims and addressing any concerns that may arise.

Industry Recognition and Awards

Hartford Insurance’s commitment to exceptional customer service has not gone unnoticed. The company has received numerous accolades and awards for its customer-centric approach, reinforcing its position as a leader in the insurance industry.

J.D. Power Awards

J.D. Power, a renowned market research firm, has consistently recognized Hartford Insurance for its outstanding customer service. The company has been awarded for its performance in various categories, including Auto Insurance and Homeowners Insurance.

The J.D. Power awards are a testament to Hartford's dedication to delivering an exceptional customer experience, from the initial purchase of a policy to the resolution of claims.

Other Industry Honors

In addition to J.D. Power awards, Hartford Insurance has received recognition from other industry bodies and publications. These accolades include:

- National Association of Insurance Commissioners (NAIC) Award for Customer Satisfaction

- Insurance Business America's Elite Award for Customer Service Excellence

- Insurance Journal's Top 100 Customer Service Honor Roll

The Future of Hartford Insurance’s Customer Service

As the insurance industry continues to evolve, Hartford Insurance remains committed to staying at the forefront of customer service innovation. The company is dedicated to leveraging emerging technologies and adopting best practices to enhance its customer experience.

Digital Transformation Continues

Hartford’s digital transformation journey is ongoing, with a focus on further enhancing its online and mobile platforms. The company aims to integrate cutting-edge technologies, such as voice assistants and virtual reality, to provide an even more immersive and convenient customer experience.

Data-Driven Insights

By leveraging advanced analytics and data-driven insights, Hartford plans to refine its customer service strategies. This approach will enable the company to anticipate customer needs, personalize interactions, and deliver targeted solutions, ensuring a highly tailored and efficient service.

Collaborative Partnerships

Hartford Insurance recognizes the value of collaboration and is exploring partnerships with tech startups and industry leaders to innovate its customer service offerings. These collaborations will bring fresh perspectives and innovative solutions to enhance the overall customer experience.

Conclusion

Hartford Insurance’s customer service journey is a testament to its adaptability and customer-centric approach. By embracing digital transformation, offering multichannel support, and prioritizing personalized experiences, the company has solidified its position as a leader in the insurance industry. As Hartford continues to evolve, its commitment to exceptional customer service remains unwavering, ensuring a bright future for its policyholders and a competitive edge in the market.

How can I contact Hartford Insurance’s customer service team?

+You can reach Hartford Insurance’s customer service team through various channels. These include a dedicated phone hotline, online chat on their website, email support, and social media platforms such as Twitter and Facebook. Hartford aims to provide prompt and personalized assistance to all its customers.

What self-service options does Hartford Insurance offer?

+Hartford Insurance provides several self-service options to empower customers. These include an online account management portal, where customers can access their policy details, make payments, and update personal information. Additionally, Hartford’s mobile apps offer a convenient way to manage policies on the go. The company also maintains a comprehensive online knowledge base with tutorials and FAQs.

How does Hartford Insurance use AI to enhance its customer service?

+Hartford Insurance utilizes AI-powered chatbots and virtual assistants to handle routine inquiries, allowing human agents to focus on more complex issues. Natural Language Processing (NLP) and machine learning algorithms enable these systems to understand and interpret customer queries, providing accurate and contextually relevant responses. This approach enhances efficiency and improves the overall customer experience.

What measures does Hartford Insurance take to ensure a smooth claim process?

+Hartford Insurance has implemented several initiatives to streamline the claim process. This includes simplified digital claim forms and document upload capabilities, eliminating the need for physical mail or fax. The company also provides regular claim status updates and ensures prompt communication with policyholders throughout the claims resolution process.