Hmo Vs Ppo Health Insurance

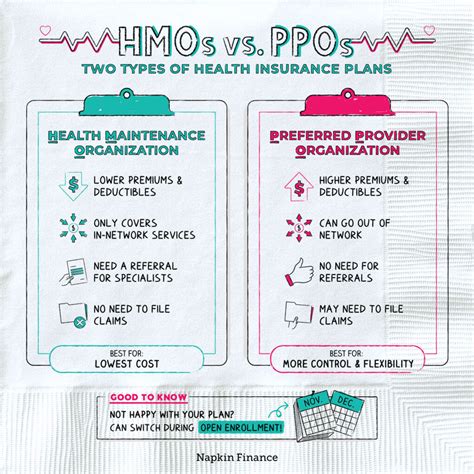

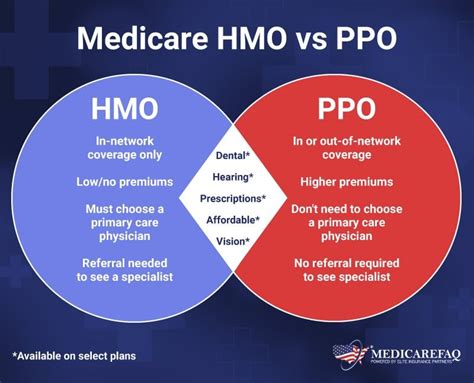

Navigating the complex world of health insurance plans can be a daunting task. Two of the most common types of health insurance plans in the United States are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). While both HMO and PPO plans offer comprehensive healthcare coverage, they differ in their network of providers, cost structures, and flexibility. Understanding these differences is crucial for individuals and families to make informed decisions about their healthcare needs.

In this comprehensive guide, we will delve into the intricacies of HMO and PPO health insurance plans, exploring their features, benefits, and potential drawbacks. By the end of this article, you will have a clear understanding of how these plans work and be able to choose the one that best aligns with your healthcare preferences and budget.

Understanding HMO Health Insurance

An HMO plan is a managed care option that focuses on preventive care and coordinated healthcare services. With an HMO, you select a primary care physician (PCP) who acts as your primary point of contact for all your healthcare needs. This PCP plays a pivotal role in managing your overall health and coordinating any necessary specialist referrals.

Key Features of HMO Plans

- Network of Providers: HMO plans typically have a closed network, meaning you must choose your healthcare providers from a predetermined list. This network includes hospitals, specialists, and other healthcare professionals approved by the HMO.

- Primary Care Physician: As mentioned, you are required to select a PCP who serves as your initial point of contact for all medical concerns. The PCP will refer you to specialists within the HMO network if needed.

- Preauthorization: HMO plans often require preauthorization for certain procedures, tests, or referrals to specialists. This step ensures that the HMO approves the services before you receive them, helping to manage costs and maintain quality control.

- Cost Savings: HMO plans can offer more affordable premiums and out-of-pocket costs compared to other types of insurance. This is because HMOs focus on preventive care and have established relationships with healthcare providers, allowing for negotiated rates.

Pros and Cons of HMO Plans

Pros:

- Lower premiums and out-of-pocket expenses.

- Emphasis on preventive care and coordinated healthcare.

- HMO plans often include wellness programs and disease management initiatives.

- Easy access to primary care physicians.

Cons:

- Limited choice of healthcare providers within the network.

- Need for preauthorization for certain services.

- Potential delays in receiving specialized care due to referral requirements.

- Out-of-network care may not be covered or come with higher costs.

Exploring PPO Health Insurance

A PPO plan offers more flexibility in choosing healthcare providers compared to an HMO. With a PPO, you have the freedom to visit any healthcare provider, whether in-network or out-of-network. However, using in-network providers typically results in lower costs and better coverage.

Key Features of PPO Plans

- Network of Providers: PPO plans have a broad network of healthcare providers, including hospitals, specialists, and other medical professionals. You have the flexibility to choose any provider within this network.

- No Referrals Required: Unlike HMOs, PPO plans do not require you to select a primary care physician or obtain referrals to see specialists. You can directly schedule appointments with specialists without prior approval.

- Out-of-Network Coverage: PPO plans offer coverage for out-of-network providers, although at a higher cost. This flexibility can be beneficial if you have a preferred healthcare provider outside the network.

- Cost Structure: PPO plans generally have higher premiums and out-of-pocket costs compared to HMOs. However, the trade-off is the freedom to choose your healthcare providers without restrictions.

Pros and Cons of PPO Plans

Pros:

- Flexibility to choose any healthcare provider, in-network or out-of-network.

- No need for referrals to see specialists.

- Coverage for out-of-network providers, although at a higher cost.

- May be suitable for those with specific healthcare needs or preferred providers.

Cons:

- Higher premiums and out-of-pocket expenses compared to HMOs.

- Potentially higher costs for out-of-network care.

- Lack of coordination between providers may result in less efficient healthcare.

- No emphasis on preventive care like HMOs.

Comparing HMO and PPO Plans: A Comprehensive Analysis

When deciding between an HMO and a PPO plan, it's essential to consider your personal healthcare needs, budget, and preferences. Here's a detailed comparison to help you make an informed choice:

| Category | HMO | PPO |

|---|---|---|

| Network of Providers | Closed network; limited choice | Broad network; flexibility to choose any provider |

| Primary Care Physician | Required; serves as a point of contact | Not required; direct access to specialists |

| Referrals | Required for specialists | No referrals needed |

| Preauthorization | Often required for certain services | Less common; may be required for major procedures |

| Cost Savings | Lower premiums and out-of-pocket costs | Higher premiums and out-of-pocket expenses |

| Preventive Care | Emphasizes preventive care and coordinated healthcare | Focuses on flexibility and choice, with less emphasis on preventive care |

Choosing the Right Plan for You

The decision between an HMO and a PPO plan depends on several factors:

- Healthcare Needs: If you have specific healthcare needs or prefer certain providers, a PPO plan might be more suitable. On the other hand, if you value coordinated care and preventive services, an HMO plan could be a better fit.

- Budget: Consider your financial situation. HMO plans are generally more affordable, while PPO plans come with higher costs but offer more flexibility.

- Convenience: Do you prefer easy access to primary care physicians and coordinated care, or do you value the freedom to choose any provider without restrictions? Your answer to this question can guide your decision.

Future Implications and Considerations

As the healthcare landscape continues to evolve, it’s essential to stay informed about the potential changes and considerations when choosing between HMO and PPO plans. Here are some key points to keep in mind:

Healthcare Reform and Policy Changes

The Affordable Care Act (ACA) and other healthcare reforms have brought about significant changes to the insurance industry. These reforms aim to make healthcare more accessible and affordable, and they can impact the availability and cost of HMO and PPO plans. Stay updated on policy changes to ensure you’re making the right choices for your healthcare coverage.

Advancements in Healthcare Technology

The integration of technology into healthcare is revolutionizing the way we access and manage our health. Telemedicine, for example, allows for remote consultations and can be particularly beneficial for individuals enrolled in HMO plans, as it provides an alternative to in-person visits with their primary care physician.

Consumer-Driven Healthcare

The rise of consumer-driven healthcare plans, such as Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs), offers individuals more control over their healthcare spending. These plans can be paired with either HMO or PPO options, providing additional flexibility and cost savings.

Wellness and Preventive Care Initiatives

Both HMO and PPO plans are increasingly focusing on wellness and preventive care to improve overall health outcomes. Look for plans that offer comprehensive preventive services, such as annual check-ups, screenings, and wellness programs, to maintain your health and potentially reduce future healthcare costs.

Frequently Asked Questions

What happens if I need to see a specialist with an HMO plan?

+

With an HMO plan, you’ll need to obtain a referral from your primary care physician to see a specialist. This ensures that your healthcare is coordinated and that the specialist visit is deemed necessary. However, some HMOs may have certain specialists that you can access directly without a referral.

Are PPO plans suitable for families with diverse healthcare needs?

+

Yes, PPO plans can be an excellent option for families with diverse healthcare needs. The flexibility to choose any provider, in-network or out-of-network, allows family members to access the specialized care they require without restrictions. However, it’s important to consider the potential higher costs associated with out-of-network care.

Can I change my health insurance plan during the year?

+

In most cases, you can only change your health insurance plan during specific enrollment periods, such as the Open Enrollment Period or if you experience a qualifying life event (e.g., marriage, birth of a child, loss of other coverage). Check with your insurance provider or employer for specific guidelines.

What is the difference between an HMO and an EPO (Exclusive Provider Organization) plan?

+

Both HMO and EPO plans have closed networks, meaning you must choose your healthcare providers from a predetermined list. However, an EPO plan typically has a larger network than an HMO, offering more flexibility in provider choice. While HMO plans require referrals for specialists, EPO plans often allow direct access to specialists within the network.

Choosing the right health insurance plan is a crucial decision that impacts your access to healthcare and your financial well-being. By understanding the differences between HMO and PPO plans, you can make an informed choice that aligns with your healthcare needs and preferences. Remember to stay updated on healthcare reforms and consider the evolving landscape of healthcare technology and consumer-driven plans to make the most of your coverage.