Hmo Vs Ppo Insurance

When it comes to health insurance options, two common terms you may encounter are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). These two types of health plans offer different structures and benefits, catering to varying preferences and healthcare needs. Understanding the key differences between HMO and PPO plans is crucial for making an informed decision about your health coverage.

Unraveling the HMO Structure

An HMO plan operates as a managed care organization, emphasizing preventive care and a network of pre-approved healthcare providers. Here’s a deeper look into its characteristics:

- Provider Network: HMO plans typically have a restricted network of doctors, hospitals, and specialists. You are required to choose a primary care physician (PCP) from the HMO’s network, who acts as your gateway to other healthcare services.

- Referrals: If you need to see a specialist, your PCP will provide a referral. This means you cannot directly access specialists without the approval of your PCP.

- Cost Savings: HMO plans often offer lower premiums and out-of-pocket costs compared to other plans. This is because they negotiate discounted rates with their network providers.

- Coverage Area: HMO plans may have limited coverage areas, so if you frequently travel or move, it’s important to consider the network’s reach.

- Wellness Focus: HMOs emphasize preventive care and often include additional wellness programs to promote overall health.

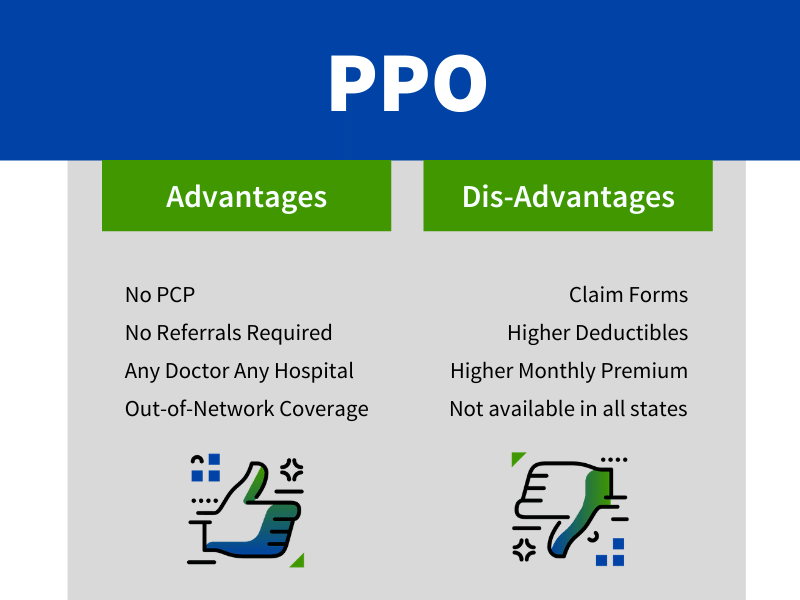

Exploring the Flexibility of PPO Plans

PPO plans, on the other hand, offer a more flexible approach to healthcare. They allow you to choose from a larger network of providers and provide greater freedom in selecting healthcare services. Here’s what you need to know about PPO plans:

- Provider Network: PPO plans have a broader network of doctors, hospitals, and specialists. You can choose any provider within the network without needing a referral.

- Freedom of Choice: Unlike HMOs, PPOs allow you to visit specialists directly without first consulting a primary care physician. This flexibility is especially beneficial for those with specific healthcare needs or preferences.

- Cost Consideration: While PPO plans generally offer more flexibility, they often come with higher premiums and out-of-pocket costs compared to HMOs. However, the increased costs may be worth it for those who value the freedom to choose their healthcare providers.

- Coverage Area: PPO plans typically have a larger coverage area, making them suitable for individuals who travel frequently or live in areas with limited healthcare options.

- In-Network vs. Out-of-Network: PPO plans often have two levels of coverage: in-network and out-of-network. In-network providers offer discounted rates, while out-of-network providers may charge higher fees. However, you still have the freedom to choose either option.

Key Differences and Considerations

When deciding between an HMO and a PPO plan, several factors come into play:

- Healthcare Needs: Consider your current and potential future healthcare requirements. If you have complex medical conditions or prefer a specific specialist, a PPO plan’s flexibility might be advantageous. On the other hand, if you prioritize cost savings and have stable health needs, an HMO plan could be a suitable choice.

- Provider Network: Research the provider networks of both HMO and PPO plans in your area. Ensure that your preferred doctors and hospitals are included in the network to avoid unexpected out-of-network costs.

- Premiums and Out-of-Pocket Costs: Evaluate the premiums and potential out-of-pocket expenses for each plan. While PPO plans may offer more flexibility, they can be costlier. HMOs, on the other hand, often provide cost-effective options for those with more predictable healthcare needs.

- Travel and Mobility: If you travel frequently or plan to move in the future, consider the coverage areas of both plans. PPO plans tend to have broader networks, making them a more suitable choice for individuals with an active lifestyle or those who frequently relocate.

Making an Informed Decision

Choosing between an HMO and a PPO plan depends on your unique circumstances and healthcare preferences. Here are some additional considerations to guide your decision-making process:

- Review Plan Details: Carefully examine the summary of benefits and coverage details provided by each plan. Pay attention to specific services, prescription drug coverage, and any exclusions or limitations.

- Check Provider Reviews: Research the reputation and quality of care provided by the doctors and hospitals in the plan’s network. Online reviews and recommendations from friends or family can offer valuable insights.

- Assess Your Financial Situation: Evaluate your budget and financial stability. While PPO plans may offer more flexibility, they can be costlier in the long run. Consider your ability to manage higher premiums and out-of-pocket expenses.

- Consider Family Needs: If you have a family, think about their healthcare requirements. Some plans offer family-friendly benefits, such as pediatric care or maternity coverage, which could be crucial for your decision.

Performance and Satisfaction

According to a recent survey by Healthcare.gov, HMO plans have a higher satisfaction rate among users, with 78% reporting positive experiences. This can be attributed to the focus on preventive care and the streamlined healthcare process. On the other hand, PPO plans offer a more personalized approach, allowing individuals to choose their preferred providers, which may be a priority for those with specific healthcare needs.

| Plan Type | User Satisfaction Rate |

|---|---|

| HMO | 78% |

| PPO | 72% |

Can I change my HMO or PPO plan during the year if my needs change?

+Yes, you can switch plans during open enrollment periods or if you experience a qualifying life event, such as marriage, divorce, or a change in employment status.

Are there any disadvantages to HMO plans?

+HMO plans may limit your choice of providers and require referrals for specialists. Additionally, if you frequently travel outside the coverage area, an HMO plan might not be the best fit.

What if I need to see a specialist, but my PPO plan has a limited network in my area?

+In such cases, you may have to pay out-of-network rates, which can be significantly higher. It’s essential to research the network’s availability in your area before choosing a PPO plan.