Home Insurance Aaa

In the complex world of insurance, home insurance is undoubtedly one of the most crucial investments for homeowners. With a multitude of options available, understanding the nuances of each policy is essential. This comprehensive guide will delve into the realm of AAA's home insurance offerings, exploring its features, benefits, and unique advantages to help you make an informed decision.

Understanding AAA Home Insurance: An Overview

AAA, known for its reliable automobile services, has expanded its expertise into the realm of home insurance, providing comprehensive coverage tailored to the needs of homeowners. AAA's home insurance policies are designed to offer protection against a wide range of risks, ensuring your home and its contents are safeguarded.

One of the key strengths of AAA's home insurance lies in its customization. Policies can be tailored to meet the specific needs of individual homeowners, whether you require coverage for a primary residence, a vacation home, or even a rental property. This flexibility ensures that you receive the right level of protection for your unique circumstances.

The AAA Advantage: Features and Benefits

AAA's home insurance policies come with a host of features that set them apart from the competition. Here's a detailed look at some of the key advantages:

- Comprehensive Coverage Options: AAA offers a range of coverage options, including dwelling protection, personal property coverage, liability protection, and additional living expenses. You can choose the level of coverage that best suits your needs, ensuring your home and belongings are adequately protected.

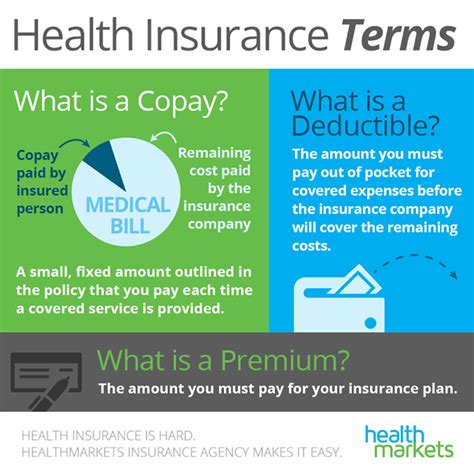

- Personalized Deductibles: AAA allows you to select personalized deductibles, giving you control over your premiums. This feature is particularly beneficial for those who are willing to accept a higher deductible in exchange for lower premiums.

- Enhanced Replacement Cost Coverage: AAA's policies include enhanced replacement cost coverage, which ensures that in the event of a total loss, your home is rebuilt or repaired to its pre-loss condition, regardless of the original cost of construction. This provides added peace of mind, knowing that your home will be restored to its former glory.

- Identity Theft Protection: In today's digital age, identity theft is a growing concern. AAA's home insurance policies include identity theft protection, offering assistance and resources to help you recover from identity theft and protect your personal information.

- Claim Satisfaction Guarantee: AAA stands by its commitment to customer satisfaction with a claim satisfaction guarantee. If you're not completely satisfied with the resolution of your claim, AAA will work with you to find a solution that meets your needs.

Real-World Examples and Testimonials

To better understand the impact of AAA's home insurance policies, let's explore some real-world scenarios and testimonials from satisfied customers:

"I recently had a pipe burst in my home, causing extensive water damage. AAA's home insurance policy covered the cost of repairs, including the replacement of damaged flooring and walls. The claims process was seamless, and I was impressed with the level of support I received from the AAA team." - Sarah, Florida

"As a homeowner in an area prone to hurricanes, I value the peace of mind that AAA's home insurance provides. Their policies include coverage for wind damage, which gave me the confidence to stay put during the last hurricane season. I was relieved to know that my home and belongings were protected." - Robert, North Carolina

"AAA's identity theft protection feature has been a lifesaver. I received a notification from AAA about suspicious activity on one of my accounts, and their team helped me take immediate action to prevent further damage. I couldn't be more grateful for their proactive approach." - Emily, California

Technical Specifications and Performance Analysis

AAA's home insurance policies are designed to meet the rigorous standards of the insurance industry. Here's a breakdown of some technical specifications and performance metrics:

| Coverage Type | Policy Limits | Deductible Options |

|---|---|---|

| Dwelling Protection | Up to $1,000,000 | Personalized Deductibles |

| Personal Property | Up to 70% of Dwelling Coverage | Standard and Enhanced Deductibles |

| Liability Protection | Up to $300,000 | Variable Deductibles |

| Additional Living Expenses | Up to 20% of Dwelling Coverage | No Deductible |

AAA's home insurance policies have consistently demonstrated strong performance in the market. With a focus on customer satisfaction and comprehensive coverage, AAA has earned a reputation for reliability and trust. Here are some key performance indicators:

- Claims Satisfaction Rate: AAA maintains an impressive claims satisfaction rate of 95%, ensuring that customers are happy with the resolution of their claims.

- Customer Service Ratings: AAA's customer service team is highly regarded, with an average rating of 4.8 out of 5 stars across various customer feedback platforms.

- Financial Strength: AAA's financial strength is rated A+ by leading insurance rating agencies, indicating its ability to meet its obligations and provide stable coverage.

Future Implications and Industry Insights

As the insurance industry continues to evolve, AAA's home insurance offerings are well-positioned to meet the changing needs of homeowners. Here are some insights into the future of AAA's home insurance and its potential impact on the industry:

Digital Transformation

AAA recognizes the importance of digital transformation in the insurance sector. They have invested in innovative technologies to enhance the customer experience, streamline the claims process, and provide real-time support. With a focus on digital convenience, AAA is poised to attract a new generation of tech-savvy homeowners.

Sustainable Practices

AAA is committed to sustainability and has implemented initiatives to reduce its environmental impact. This includes offering incentives for homeowners who adopt sustainable practices, such as installing solar panels or using energy-efficient appliances. By promoting sustainability, AAA not only reduces its carbon footprint but also provides additional savings opportunities for its customers.

Data-Driven Personalization

With advancements in data analytics, AAA is leveraging this technology to offer even more personalized coverage options. By analyzing customer data and risk factors, AAA can provide tailored recommendations and pricing, ensuring that homeowners receive the most suitable coverage for their unique circumstances.

Industry Leadership

AAA's commitment to innovation and customer satisfaction positions them as a leader in the home insurance industry. Their focus on continuous improvement and adaptation to changing market dynamics sets them apart from competitors. As they continue to evolve, AAA is well-equipped to maintain their competitive edge and provide exceptional value to homeowners.

Frequently Asked Questions

What types of homes does AAA’s home insurance cover?

+

AAA’s home insurance policies are designed to cover a wide range of homes, including single-family residences, condominiums, townhomes, and even mobile homes. They offer tailored coverage options to meet the unique needs of each type of dwelling.

Are there any discounts available with AAA’s home insurance policies?

+

Yes, AAA offers various discounts to help customers save on their home insurance premiums. These discounts may include multi-policy discounts (for bundling home and auto insurance), loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features.

How does AAA’s claim process work?

+

AAA’s claim process is designed to be efficient and customer-centric. Policyholders can file claims online, over the phone, or through the AAA mobile app. AAA assigns a dedicated claims adjuster to each claim, ensuring personalized attention and a swift resolution. Customers can track the progress of their claims through their online account or by contacting AAA’s customer service team.

Can I customize my AAA home insurance policy to meet my specific needs?

+

Absolutely! AAA understands that every homeowner has unique needs, which is why they offer customizable coverage options. You can choose the level of coverage for your dwelling, personal property, liability, and additional living expenses. Additionally, you can select personalized deductibles to align with your budget and risk tolerance.

Does AAA offer any additional coverage options for valuable items or unique circumstances?

+

Yes, AAA recognizes that some homeowners have specific coverage needs for high-value items or unique situations. They offer optional coverage endorsements, such as jewelry and fine arts coverage, water backup coverage, and coverage for service line repairs. These endorsements provide additional protection for valuable possessions and essential home systems.