Home Insurance California

Home insurance is a vital aspect of safeguarding your valuable assets and providing peace of mind. In the vibrant state of California, where natural disasters and unforeseen events are not uncommon, having comprehensive home insurance coverage is of utmost importance. This article delves into the intricacies of home insurance in California, offering a detailed guide to help residents understand their options, benefits, and potential risks.

Understanding Home Insurance in California

Home insurance, also known as homeowners insurance, is a contract between a policyholder and an insurance company. It provides financial protection for individuals who own a home, covering various aspects such as the structure of the home, personal belongings, and potential liabilities.

In California, the unique geographical and climatic conditions make home insurance an essential investment. The state is prone to earthquakes, wildfires, floods, and other natural disasters, making it crucial for homeowners to have adequate coverage. Home insurance policies in California typically offer a range of benefits and coverage options to address these specific risks.

Key Coverage Options in California Home Insurance

California home insurance policies often include the following essential coverages:

- Dwelling Coverage: This provides protection for the physical structure of your home, including walls, roofs, and foundations. It covers damages caused by perils such as fire, windstorms, and vandalism.

- Personal Property Coverage: This coverage safeguards your personal belongings, such as furniture, electronics, and clothing, against theft, damage, or loss. It ensures that you can replace or repair these items if necessary.

- Liability Coverage: In the event that someone is injured on your property or you are found legally responsible for an accident, liability coverage provides financial protection. It covers medical expenses and legal fees, protecting you from potential lawsuits.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this coverage helps cover the costs of temporary housing and additional living expenses until you can return to your home.

- Earthquake Coverage: California is notorious for its seismic activity. While standard home insurance policies often exclude earthquake damage, it is crucial to consider adding this coverage to protect your home and belongings.

- Flood Insurance: Flooding is another significant risk in California, especially in coastal areas and regions prone to heavy rainfall. Flood insurance is typically a separate policy that provides coverage for flood-related damages.

It's important to note that the specific coverage options and limits may vary depending on the insurance provider and the policy chosen. Homeowners should carefully review their policy documents and discuss their coverage needs with insurance professionals to ensure they have adequate protection.

Assessing Your California Home Insurance Needs

Determining the right home insurance coverage in California involves considering several factors, including the value of your home, the location, and your personal assets. Here are some key considerations:

Home Value and Replacement Cost

Accurately assessing the value of your home is crucial. The replacement cost, which refers to the amount it would cost to rebuild your home from the ground up, is a key factor in determining your insurance coverage. It's essential to ensure that your policy provides sufficient coverage to rebuild your home in the event of a total loss.

| Metric | Actual Data |

|---|---|

| Average Home Value in California | $747,200 (as of 2023) |

| Average Replacement Cost per Square Foot | $200 - $300 (depending on location and construction materials) |

It's recommended to work with a professional appraiser or real estate agent to get an accurate assessment of your home's value and replacement cost.

Location-Specific Risks

California's diverse geography means that different regions face unique risks. For instance, homes in wildfire-prone areas or near fault lines require specific coverage. Consider the following location-specific risks:

- Wildfire Risk: If your home is in a high-risk wildfire area, ensure your policy covers fire damage and provides adequate personal property coverage.

- Earthquake Risk: For homes located in seismically active zones, adding earthquake coverage is essential. This can be done through a separate policy or as an endorsement to your existing home insurance.

- Flood Risk: Coastal areas and regions with heavy rainfall are susceptible to flooding. Flood insurance is typically not included in standard home insurance policies and must be purchased separately.

Personal Belongings and High-Value Items

Your personal belongings and high-value items, such as jewelry, artwork, or electronics, may require additional coverage. Standard home insurance policies often have limitations on coverage for these items. Consider the following:

- Personal Property Endorsements: These endorsements can increase the coverage limits for specific items or categories of belongings.

- Scheduled Personal Property Coverage: For high-value items, scheduling them on your policy provides additional protection and ensures that you receive the full replacement cost in the event of a loss.

Comparing Home Insurance Providers in California

When shopping for home insurance in California, it's crucial to compare different providers to find the best coverage and rates. Here are some key factors to consider:

Reputation and Financial Stability

Choose insurance providers with a solid reputation and financial stability. Look for companies that have been in business for a significant period and have a strong financial rating. This ensures that they can provide reliable coverage and honor claims in the event of a loss.

Policy Coverage and Customization

Review the coverage options offered by each provider. Ensure that they provide the specific coverages you require, such as earthquake or flood insurance. Additionally, assess their willingness to customize policies to meet your unique needs.

Claims Handling and Customer Service

The claims process is a critical aspect of home insurance. Research the provider's claims handling reputation and customer service quality. Look for providers with a history of prompt and fair claim settlements and positive customer reviews.

Rates and Discounts

Compare the rates offered by different providers. While cost is an important factor, it should not be the sole deciding factor. Ensure that the provider offers competitive rates while providing comprehensive coverage.

Additionally, inquire about potential discounts. Many insurance companies offer discounts for multiple policy bundles (e.g., home and auto insurance), security systems, or loyalty programs. Taking advantage of these discounts can help reduce your overall insurance costs.

Additional Considerations for California Homeowners

Understanding Deductibles and Limits

Deductibles and coverage limits are essential aspects of home insurance. Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, but it’s important to choose a deductible that you can afford in the event of a claim.

Coverage limits refer to the maximum amount your insurance policy will pay for a covered loss. It's crucial to ensure that your limits are sufficient to cover the full replacement cost of your home and belongings. Discuss these limits with your insurance agent to ensure adequate protection.

Maintenance and Prevention

Regular maintenance and proactive measures can help reduce the risk of home insurance claims. Keep your home well-maintained, address any potential hazards, and consider implementing safety measures such as smoke detectors, fire extinguishers, and security systems. These steps not only reduce the likelihood of incidents but may also qualify you for insurance discounts.

Earthquake and Flood Insurance

As mentioned earlier, earthquake and flood insurance are typically not included in standard home insurance policies in California. These are specialized coverages that require separate policies or endorsements. Assess your specific risks and consider adding these coverages to your insurance portfolio to ensure comprehensive protection.

Frequently Asked Questions

How much does home insurance cost in California?

+The cost of home insurance in California varies based on factors such as location, home value, and coverage limits. On average, homeowners in California pay around $1,200 per year for home insurance. However, rates can range from $700 to $2,000 or more depending on individual circumstances.

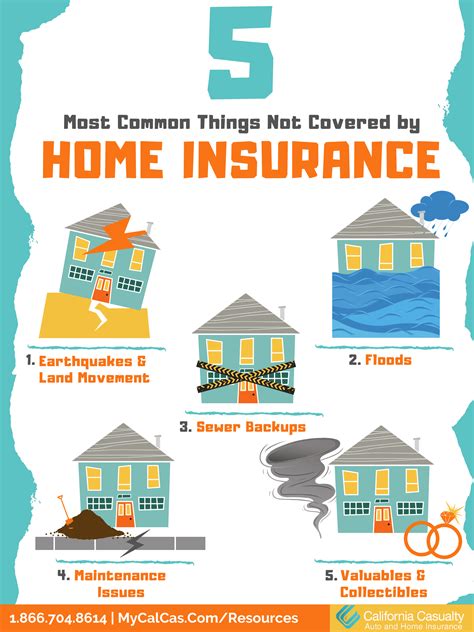

What are the common exclusions in California home insurance policies?

+Common exclusions in California home insurance policies include flood damage, earthquake damage, and damage caused by pests or insects. It's important to review your policy documents carefully to understand the specific exclusions and limitations.

Can I get discounts on my home insurance policy in California?

+Yes, many insurance providers offer discounts on home insurance policies in California. These may include discounts for multiple policies (e.g., bundling home and auto insurance), security systems, smoke detectors, and loyalty programs. Ask your insurance agent about available discounts to reduce your premiums.

What should I do if I need to file a home insurance claim in California?

+If you need to file a home insurance claim in California, the first step is to contact your insurance company and report the incident. Provide as much detail as possible about the loss and any relevant documentation. Follow the guidance provided by your insurance provider and cooperate with their claims process.

How often should I review and update my home insurance policy in California?

+It's recommended to review your home insurance policy annually or whenever significant changes occur in your life or circumstances. This includes major renovations, changes in personal belongings, or moving to a new location. Regular reviews ensure that your coverage remains adequate and up-to-date.

Understanding the intricacies of home insurance in California is crucial for homeowners. By carefully assessing your coverage needs, comparing providers, and implementing proactive measures, you can ensure that you have the right protection for your valuable assets. Remember, home insurance is not just a legal requirement but a vital tool to safeguard your financial well-being and provide peace of mind.