Home Insurance Qoute

Home insurance is an essential aspect of protecting one's most valuable asset and ensuring financial security in the face of unforeseen events. A home insurance quote serves as the first step towards understanding the coverage options and costs associated with safeguarding your home and its contents. With the right coverage, homeowners can gain peace of mind, knowing they are prepared for various risks, including natural disasters, theft, and accidental damage.

Obtaining a home insurance quote involves a comprehensive evaluation of several factors, including the location, size, and construction of your home, as well as the specific coverage needs you wish to address. This process empowers homeowners to make informed decisions, tailor their policies to their unique circumstances, and secure the best value for their insurance investment.

Understanding the Essentials of Home Insurance

Home insurance, often referred to as homeowners insurance, is a crucial investment that provides financial protection for homeowners. It offers coverage for various perils, including fire, theft, vandalism, and natural disasters, ensuring that policyholders can recover from unforeseen events without incurring significant financial losses.

The importance of home insurance cannot be overstated, as it safeguards not only the physical structure of the home but also the personal belongings within it. Additionally, it provides liability coverage, protecting homeowners from financial responsibilities arising from accidents or injuries that occur on their property.

Key Components of a Home Insurance Policy

A typical home insurance policy consists of several critical components, each designed to address specific risks and provide comprehensive coverage. These include:

- Dwelling Coverage: This covers the physical structure of the home, including the walls, roof, and foundation, against damage caused by perils such as fire, windstorms, and vandalism.

- Personal Property Coverage: This provides protection for the contents of the home, including furniture, electronics, and clothing, in the event of theft, damage, or destruction.

- Liability Coverage: This component protects homeowners from financial liability if someone is injured on their property or if their actions cause damage to others' properties.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to a covered loss, this coverage reimburses the policyholder for additional living expenses incurred while temporary housing is secured.

- Medical Payments Coverage: This provides coverage for medical expenses incurred by guests who are injured on the insured's property, regardless of liability.

Customizing Your Home Insurance Policy

While the above components form the foundation of a standard home insurance policy, the specific needs of each homeowner may vary. Fortunately, home insurance policies can be customized to provide additional coverage for unique circumstances. Some optional coverages include:

- Flood Insurance: As standard home insurance policies typically do not cover flood damage, purchasing separate flood insurance is crucial for homeowners in flood-prone areas.

- Earthquake Insurance: Similarly, earthquake insurance provides coverage for damage caused by seismic activity, which is often excluded from standard policies.

- Personal Belongings Endorsements: Homeowners can opt for additional coverage for high-value items, such as jewelry, fine art, or collectibles, which may exceed the limits of standard personal property coverage.

- Identity Theft Protection: This coverage assists policyholders in recovering from identity theft incidents, providing resources and financial support to mitigate the impact of such crimes.

The Process of Obtaining a Home Insurance Quote

Securing a home insurance quote involves a detailed assessment of various factors that influence the cost and coverage of the policy. Insurance providers carefully consider these elements to tailor a policy that meets the unique needs of each homeowner.

Factors Influencing Home Insurance Quotes

The cost of home insurance is determined by a range of factors, each of which plays a significant role in the final quote. These factors include:

- Location: The geographic location of the home is a crucial factor, as it influences the likelihood of natural disasters, crime rates, and the cost of rebuilding in the event of a loss.

- Home Value and Construction: The size, age, and construction materials of the home impact the cost of rebuilding and therefore affect the insurance premium.

- Personal Property Value: The value of personal belongings within the home influences the cost of replacing them in the event of theft or damage, thus impacting the insurance quote.

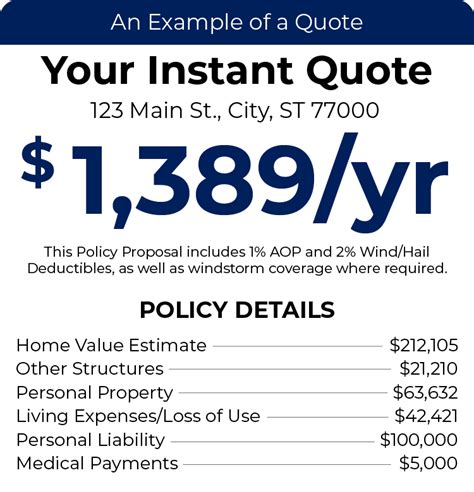

- Coverage Limits and Deductibles: The amount of coverage a homeowner chooses, along with the selected deductibles, directly affects the insurance premium.

- Claim History: A history of frequent claims can lead to higher premiums, as it indicates a higher risk of future claims.

- Credit Score: In many cases, insurance providers consider the credit score of the policyholder, as it is seen as an indicator of financial responsibility and stability.

- Security Features: The presence of security systems, such as alarm systems or fire prevention measures, can lead to reduced insurance premiums due to the lower risk of losses.

Steps to Obtain a Home Insurance Quote

To obtain a home insurance quote, homeowners can follow these simple steps:

- Gather Relevant Information: Collect details about your home, including its size, construction, and any recent improvements or renovations.

- Assess Your Coverage Needs: Consider the specific risks and coverage requirements for your home and personal belongings.

- Contact Insurance Providers: Reach out to multiple insurance providers to request quotes. Provide them with the gathered information and your coverage preferences.

- Compare Quotes: Carefully analyze the quotes received, considering the coverage limits, deductibles, and any additional perks or discounts offered.

- Choose a Provider: Select the insurance provider that offers the best combination of coverage and value for your needs.

- Purchase the Policy: Finalize the policy by providing the necessary details and making the initial payment.

Maximizing Value and Savings on Your Home Insurance

Home insurance is a significant investment, and homeowners can take several steps to maximize the value of their policy while also reducing costs.

Tips for Saving on Home Insurance Premiums

To reduce the cost of home insurance premiums, consider the following strategies:

- Bundle Policies: Insuring your home and other assets, such as your car or rental properties, with the same provider can often lead to substantial discounts.

- Increase Deductibles: Opting for higher deductibles can result in lower premiums, as you will be responsible for a larger portion of any claim.

- Maintain a Good Credit Score: A strong credit score can positively impact your insurance premiums, as it is seen as an indicator of financial stability and responsibility.

- Install Security Features: Implementing security systems, such as alarm systems or fire prevention measures, can lead to reduced premiums due to the lower risk of losses.

- Review Your Coverage Annually: Regularly review your home insurance policy to ensure it aligns with your current needs and circumstances. This allows you to make necessary adjustments and potentially save on premiums.

Maximizing Coverage with Additional Perks

Beyond basic coverage, home insurance policies often offer additional perks and benefits that can enhance the overall value of the policy. These may include:

- Replacement Cost Coverage: This option ensures that, in the event of a total loss, your home will be rebuilt to its pre-loss condition, regardless of the cost.

- Extended Replacement Cost Coverage: This provides an additional amount, often 20-25% above the policy limit, to cover unexpected costs during the rebuilding process.

- Personal Property Replacement Cost Coverage: This ensures that personal belongings are replaced with new items of like kind and quality, rather than being depreciated based on their age.

- Loss of Use Coverage: This coverage reimburses policyholders for additional living expenses incurred while their home is being repaired or rebuilt after a covered loss.

- Identity Theft Coverage: Some policies offer assistance and resources to help policyholders recover from identity theft incidents, providing peace of mind and financial support.

Navigating Home Insurance Claims and Recovering from Losses

Despite our best efforts to prevent them, accidents and losses can still occur. In such situations, having a solid understanding of the claims process and knowing how to navigate it effectively can make a significant difference in the recovery process.

Steps to Take When Filing a Home Insurance Claim

When faced with a covered loss, follow these steps to file a successful home insurance claim:

- Contact Your Insurance Provider: Reach out to your insurance company as soon as possible to report the loss and initiate the claims process.

- Document the Damage: Take photographs or videos of the damage to provide evidence for your claim. Be sure to include any visible damage, as well as any items that need to be replaced.

- Prepare an Inventory: Create a detailed list of all damaged or destroyed items, including their purchase dates, original costs, and any receipts or appraisals you have.

- Gather Supporting Documentation: Collect any relevant documents, such as repair estimates, police reports, or medical records, to support your claim.

- Cooperate with the Claims Adjuster: Work closely with the assigned claims adjuster, providing them with all the necessary information and documents to process your claim efficiently.

- Understand Your Coverage and Policy Limits: Familiarize yourself with the specifics of your policy, including coverage limits and any exclusions, to ensure you receive the full benefits you are entitled to.

Common Challenges and Solutions in the Claims Process

While the claims process can be straightforward, there may be challenges along the way. Being aware of potential issues and knowing how to address them can help ensure a smoother recovery.

- Underinsurance: If your home or belongings are underinsured, you may not receive sufficient compensation to fully recover from a loss. Regularly review your coverage limits and adjust them as necessary to avoid this issue.

- Delays in Claims Processing: Delays can occur due to various reasons, such as the complexity of the loss or a high volume of claims. Stay in communication with your insurance provider to track the progress of your claim and address any delays promptly.

- Denials or Underpayments: Insurance companies may deny claims or offer less than the full amount due to various reasons, including policy exclusions or disputes over the extent of the damage. If you believe your claim was unfairly denied or underpaid, consider appealing the decision or seeking legal advice.

The Future of Home Insurance: Trends and Innovations

The home insurance industry is continually evolving, driven by advancements in technology and changing consumer needs. These trends and innovations are shaping the future of home insurance, offering new opportunities for enhanced protection and convenience.

Emerging Technologies and Their Impact

Technology is playing a pivotal role in transforming the home insurance landscape. Here are some key technological advancements that are shaping the industry:

- Artificial Intelligence (AI) and Machine Learning: AI-powered systems are being used to streamline claims processing, detect fraud, and provide personalized risk assessments, leading to more efficient and accurate insurance experiences.

- Telematics and Smart Home Devices: Telematics devices and smart home technologies are enabling insurers to offer usage-based insurance and monitor homes remotely, providing real-time data on risks and potential losses.

- Blockchain Technology: Blockchain is enhancing data security and transparency in the insurance industry, making it easier to verify policy details, process claims, and prevent fraud.

- Drone Technology: Drones are being utilized to assess damage quickly and accurately, especially in hard-to-reach areas, improving the speed and efficiency of claims handling.

Innovative Insurance Products and Services

In response to changing consumer needs and market dynamics, home insurance providers are introducing innovative products and services. Some notable examples include:

- On-Demand Insurance: This concept allows homeowners to purchase insurance coverage for specific events or periods, such as hosting a party or going on vacation, providing flexible and cost-effective protection.

- Parametric Insurance: Parametric policies pay out based on predefined parameters, such as wind speed or earthquake magnitude, providing rapid and predictable payouts, even before the actual loss is assessed.

- Microinsurance: Microinsurance products are designed to offer affordable coverage to individuals with low incomes or limited access to traditional insurance, ensuring that everyone can benefit from financial protection.

- Insurtech Startups: Innovative startups are disrupting the home insurance industry with digital-first approaches, leveraging technology to offer streamlined processes, personalized coverage, and enhanced customer experiences.

Conclusion: Empowering Homeowners with Knowledge

Understanding the intricacies of home insurance is essential for homeowners to make informed decisions and protect their most valuable asset effectively. By grasping the basics of home insurance, the factors influencing quotes, and the steps to obtain coverage, homeowners can secure the best value for their insurance investment.

Moreover, by staying informed about the latest trends and innovations in the home insurance industry, homeowners can anticipate and adapt to future changes, ensuring they remain protected and prepared for whatever the future may hold.

How often should I review my home insurance policy?

+It is recommended to review your home insurance policy annually to ensure it aligns with your current needs and circumstances. This allows you to make necessary adjustments, such as increasing coverage limits or adding endorsements, to maintain adequate protection.

What should I do if my home insurance claim is denied or underpaid?

+If your claim is denied or you believe it was underpaid, contact your insurance provider to discuss the reasons for the decision. You may need to provide additional evidence or documentation to support your claim. If the issue remains unresolved, consider seeking legal advice or assistance from a public adjuster.

How can I ensure my home is adequately insured for its replacement cost?

+To ensure your home is adequately insured, regularly review and update your policy’s coverage limits to reflect the current replacement cost of your home. Consider purchasing replacement cost coverage or extended replacement cost coverage to ensure your home is rebuilt to its pre-loss condition, regardless of the cost.