House Insurance In California

California, known for its diverse landscapes and vibrant communities, is a state where natural disasters and unique challenges often intersect with the daily lives of its residents. Among these challenges, the need for robust house insurance is paramount, given the state's susceptibility to earthquakes, wildfires, and other unforeseen events. Understanding the intricacies of house insurance in California is essential for homeowners to protect their most valuable assets and secure their financial futures.

The Importance of House Insurance in California

In a state as geographically diverse as California, the risks to homeowners are varied and significant. From the seismic activity along the Pacific Ring of Fire to the dry, hot summers that can spark devastating wildfires, California residents face unique perils that demand specialized insurance coverage.

House insurance, or homeowners insurance, serves as a financial safety net for homeowners, protecting them from unexpected events that could result in costly damages or losses. In California, where the risk of natural disasters is elevated, having comprehensive insurance coverage is not just a good idea—it's an essential part of responsible homeownership.

The importance of house insurance extends beyond physical damage to a home. It also provides liability coverage, protecting homeowners from financial losses if someone is injured on their property and files a lawsuit. Additionally, many insurance policies include coverage for additional living expenses if a home becomes uninhabitable due to a covered event.

Understanding California’s Insurance Landscape

California’s insurance market is complex and dynamic, offering a wide range of policies and coverage options to meet the diverse needs of its residents. The state’s Department of Insurance plays a vital role in regulating the industry, ensuring fair practices and protecting consumers.

When shopping for house insurance in California, it's crucial to understand the different types of coverage available and the specific risks that are most relevant to your region. For instance, homeowners in earthquake-prone areas may want to consider purchasing earthquake insurance as a separate policy, as it is often not included in standard homeowners insurance.

Similarly, those living in wildfire-prone regions should ensure their policies cover damage from fires, including smoke damage and the cost of debris removal. It's also important to be aware of any exclusions or limitations in your policy, such as coverage for flooding, which is typically not included in standard homeowners insurance and requires a separate flood insurance policy.

Key Coverage Considerations in California

When selecting a house insurance policy in California, there are several key coverage considerations to keep in mind. These include:

- Dwelling Coverage: This provides protection for the physical structure of your home, covering damage from covered perils such as fire, wind, or theft.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing, in the event of a covered loss.

- Liability Coverage: Protects you financially if someone is injured on your property or if you, as a homeowner, cause damage to someone else's property.

- Additional Living Expenses: Provides coverage for temporary living expenses if your home becomes uninhabitable due to a covered loss.

- Medical Payments Coverage: Covers the medical costs for injuries sustained by others on your property, regardless of fault.

Shopping for House Insurance in California

When it comes to shopping for house insurance in California, there are several key steps to ensure you get the right coverage at the best price.

Assessing Your Needs

The first step in shopping for house insurance is to assess your specific needs. Consider the value of your home, the cost of rebuilding or repairing it, and the value of your personal belongings. Also, take into account any unique risks or perils that are specific to your area, such as earthquakes or wildfires.

It's important to remember that house insurance is not a one-size-fits-all product. Your needs will depend on various factors, including the age and condition of your home, its location, and your personal financial situation.

Comparing Policies

Once you have a clear understanding of your insurance needs, it’s time to start comparing policies. Reach out to multiple insurance providers, either directly or through an insurance broker, to obtain quotes and detailed information about their coverage options.

When comparing policies, pay close attention to the coverage limits, deductibles, and any exclusions or limitations. Make sure the policies you're considering align with your specific needs and provide adequate protection against the risks you face as a California homeowner.

Additionally, consider the reputation and financial stability of the insurance company. A reputable insurer with a strong financial standing is more likely to be able to pay out claims in the event of a covered loss.

Understanding Deductibles and Premiums

Deductibles and premiums are two critical components of any insurance policy. The deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. In general, higher deductibles can result in lower premiums, but it’s important to choose a deductible that you can comfortably afford to pay in the event of a claim.

Premiums, on the other hand, are the regular payments you make to maintain your insurance coverage. The cost of your premium will depend on a variety of factors, including the coverage limits you choose, the deductibles you select, and the specific risks associated with your home and location.

Making a Claim: The Process and What to Expect

In the unfortunate event that you need to make a claim on your house insurance policy, it’s important to understand the process and what to expect.

Reporting the Claim

The first step in making a claim is to report the incident to your insurance company as soon as possible. Most insurance companies have a 24⁄7 claims hotline or online claims reporting system. Provide as much detail as you can about the incident, including any relevant photos or videos of the damage.

It's crucial to report the claim promptly, as many insurance policies have time limits for reporting incidents. Failing to report a claim within the specified timeframe could result in your claim being denied.

The Claims Investigation Process

Once you’ve reported your claim, the insurance company will begin an investigation to determine the extent of the damage and whether the incident is covered under your policy. This process may involve an inspection of your property by a claims adjuster, who will assess the damage and document it.

During the investigation, be prepared to provide additional information or documentation as requested by the insurance company. This may include receipts for damaged items, repair estimates, or other relevant documents.

Receiving Your Settlement

After the investigation is complete, the insurance company will determine the amount they will pay out for your claim, which is known as the settlement. The settlement amount will be based on the coverage limits and deductibles of your policy, as well as the actual cash value or replacement cost of the damaged items or property.

It's important to carefully review the settlement offer to ensure it accurately reflects the extent of your losses. If you disagree with the settlement amount, you can negotiate with the insurance company or seek the assistance of an insurance claims lawyer.

Common Misconceptions and Pitfalls to Avoid

When it comes to house insurance in California, there are several common misconceptions and pitfalls that homeowners should be aware of to avoid potential issues.

Underinsurance and Overinsurance

One of the most common pitfalls is underinsuring or overinsuring your home. Underinsurance occurs when your insurance policy does not provide sufficient coverage to fully replace your home and its contents in the event of a total loss. This can leave you financially vulnerable and struggling to rebuild your life.

On the other hand, overinsurance occurs when your policy provides more coverage than you actually need. This can result in higher premiums and, in some cases, may even be considered insurance fraud if you intentionally inflate the value of your home or its contents.

Neglecting Regular Policy Reviews

It’s important to regularly review your insurance policy to ensure it continues to meet your needs. Life changes, such as renovations to your home, the purchase of new valuables, or changes in your financial situation, can all impact your insurance needs. Failing to update your policy accordingly could leave you underinsured or paying for coverage you no longer require.

Misunderstanding Policy Exclusions

Insurance policies often come with a long list of exclusions, or events or damages that are not covered. It’s crucial to thoroughly understand these exclusions to avoid any surprises when making a claim. For instance, many standard homeowners insurance policies do not cover flood damage, which requires a separate flood insurance policy.

The Future of House Insurance in California

As California continues to face unique and evolving challenges, the landscape of house insurance is likely to adapt and innovate to meet these changing needs. The increasing frequency and severity of natural disasters, such as wildfires and earthquakes, are expected to drive further innovation in insurance products and services.

One potential future development is the increased use of technology and data analytics to more accurately assess risks and price insurance policies. This could include the use of satellite imagery to assess property conditions and risks, or even the integration of smart home technology to monitor and prevent potential hazards.

Additionally, the rise of parametric insurance, which pays out based on the occurrence of a predefined event rather than the actual damage sustained, could become more prevalent in California. This type of insurance can provide quicker payouts and reduce the burden of proof on the policyholder, making it particularly relevant in the context of natural disasters.

The future of house insurance in California also holds the potential for greater collaboration between insurance companies, technology providers, and government entities to better manage and mitigate the risks associated with natural disasters. This could involve the development of more comprehensive insurance products that address multiple perils, or even the creation of public-private partnerships to share the financial burden of catastrophic events.

What is the average cost of house insurance in California?

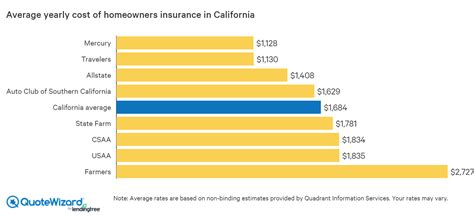

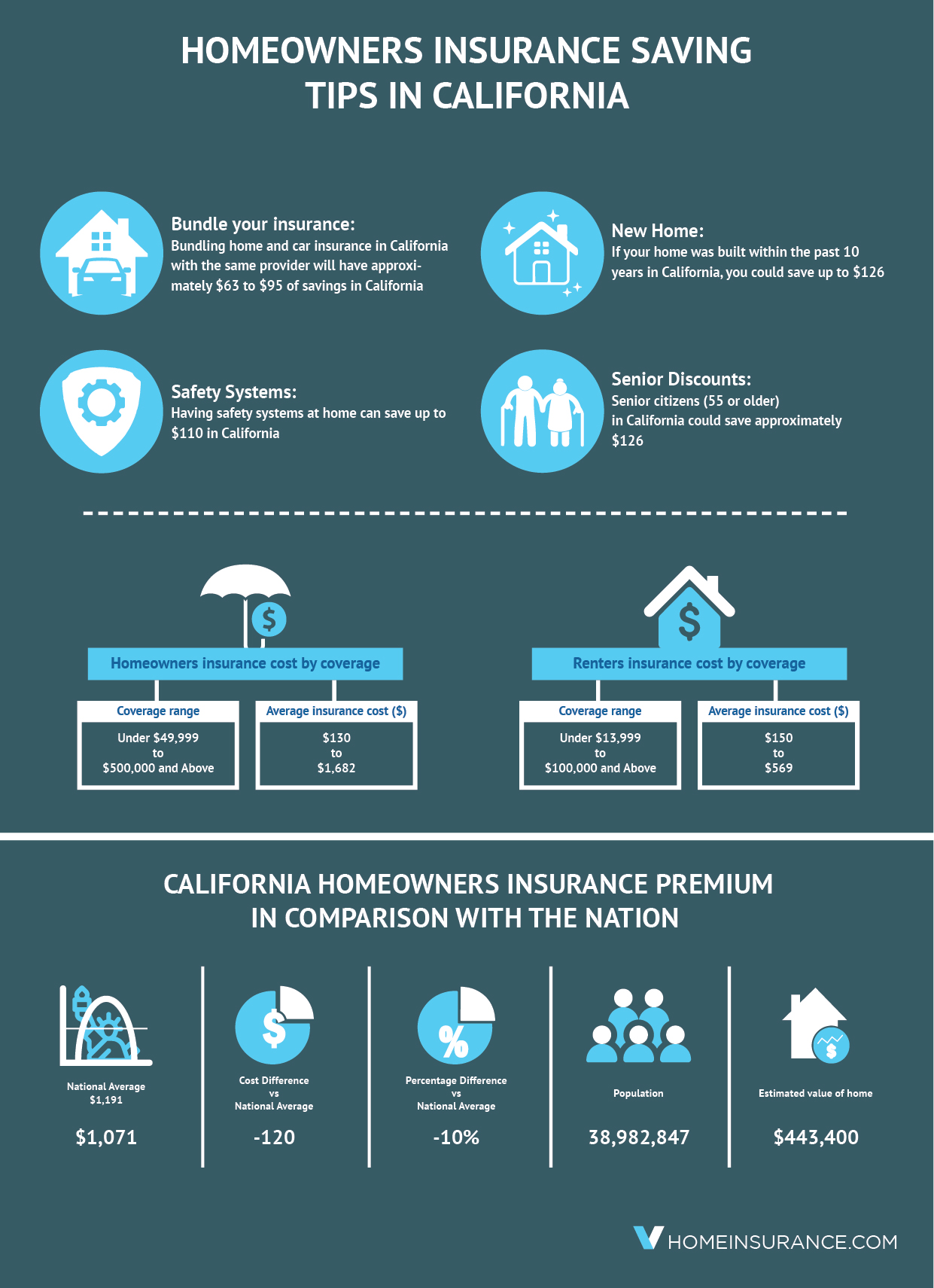

+The average cost of house insurance in California can vary widely depending on factors such as the location, size, and age of your home, as well as your chosen coverage limits and deductibles. According to recent data, the average annual premium for homeowners insurance in California is around $1,000, but this can range from a few hundred dollars to several thousand dollars.

Are there any discounts available for house insurance in California?

+Yes, there are often discounts available for house insurance in California. These can include discounts for having multiple policies with the same insurer (e.g., home and auto insurance), discounts for certain safety features or improvements to your home (such as smoke detectors or a fire sprinkler system), and discounts for being claim-free for a certain period of time.

How often should I review my house insurance policy?

+It’s generally recommended to review your house insurance policy at least once a year, or whenever there are significant changes to your home or your personal circumstances. This ensures that your coverage remains adequate and up-to-date. Regular policy reviews can also help you identify potential discounts or coverage gaps that you may want to address.