House Insurance Quotes Online

In today's digital age, obtaining house insurance quotes online has become an increasingly popular and convenient option for homeowners. The ability to quickly and easily compare insurance policies and premiums from the comfort of your home offers a modern approach to a crucial aspect of homeownership. This comprehensive guide will delve into the world of online house insurance quotes, exploring the process, key considerations, and the benefits it offers to homeowners seeking the best coverage for their homes.

Understanding the Online House Insurance Quote Process

The process of acquiring online house insurance quotes is designed to be straightforward and efficient. It typically involves the following steps:

- Personal Information: Begin by providing basic details about yourself, including your name, contact information, and the location of your property.

- Property Details: Input information about your house, such as the type of residence (single-family home, condo, etc.), its age, square footage, and any unique features or amenities.

- Coverage Preferences: Specify the type and amount of coverage you're seeking. This includes deciding on the appropriate limits for liabilities, personal property, and additional living expenses.

- Additional Considerations: Answer questions about your home's risk factors, such as its proximity to natural disasters, the presence of security systems, or any recent home improvements.

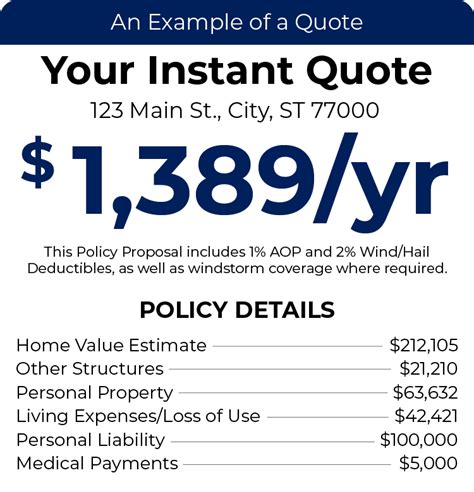

- Quote Generation: Once you've provided all the necessary information, the insurance provider's system generates a quote based on your inputs. This quote will include the premium amount and a breakdown of the coverage details.

Online quote tools often utilize real-time data and advanced algorithms to provide accurate and personalized quotes. These tools consider various factors, including your location, the value of your home, and the specific coverage options you select.

The Benefits of Online House Insurance Quotes

Opting for online house insurance quotes offers a multitude of advantages to homeowners:

- Convenience and Speed: You can obtain multiple quotes from the comfort of your home, without the need for in-person meetings or lengthy phone calls. The process is typically quick, allowing you to compare options efficiently.

- Transparency and Comparison: Online quotes provide a clear breakdown of coverage and premiums, making it easy to compare different policies side by side. This transparency ensures you can make informed decisions about your home insurance.

- Customization: Online quote tools often allow for customization, enabling you to tailor your coverage to your specific needs. You can adjust limits, deductibles, and additional coverage options to find the perfect balance between cost and protection.

- Real-Time Updates: Many online platforms offer real-time updates, providing instant feedback as you adjust your coverage preferences. This feature allows you to experiment with different scenarios and understand the impact on your premium instantly.

- No Obligation: Obtaining online quotes doesn't commit you to any specific policy. You can browse and compare without any pressure, giving you the freedom to make decisions at your own pace.

Key Considerations for Accurate Online Quotes

While online house insurance quotes offer convenience and efficiency, there are a few considerations to keep in mind to ensure you receive accurate and relevant quotes:

Provide Accurate Information

The accuracy of your online quote relies heavily on the information you provide. Ensure that you input correct and up-to-date details about your home, its value, and any recent improvements. Misinformation can lead to inaccurate quotes and potential issues down the line.

Understand Coverage Options

Take the time to understand the different coverage options available and their implications. Research and familiarize yourself with terms like actual cash value vs. replacement cost, liability coverage, and personal property coverage. This knowledge will help you make informed choices when selecting your coverage limits.

Compare Multiple Quotes

Don’t settle for the first quote you receive. Compare quotes from different providers to get a sense of the market rates and the variety of coverage options available. This comparison will help you identify the best value and ensure you’re not overpaying for your house insurance.

Consider Endorsements and Add-Ons

Online quotes often provide options for endorsements and add-ons to your base policy. These can include coverage for specific items or situations, such as jewelry, fine art, or water backup. Consider your unique needs and assess whether these additional coverages are necessary for your situation.

Review Policy Details

Beyond the premium and coverage limits, review the fine print of the policy. Understand the deductibles, policy exclusions, and conditions to ensure the policy aligns with your expectations. Pay attention to details like the claims process and customer service ratings to gauge the overall quality of the insurance provider.

Maximizing Your Online Quote Experience

To make the most of your online house insurance quote journey, consider the following tips:

- Shop Around: Utilize multiple online quote platforms to compare a wide range of providers and policies. This approach ensures you're not limited to a single insurer's offerings.

- Use Advanced Quote Tools: Some insurance providers offer advanced quote tools with additional features. These tools may provide more detailed quotes based on specific home characteristics and your unique needs.

- Read Reviews: Research the insurance providers you're considering. Read online reviews and seek recommendations from trusted sources to gauge the quality of their services and customer satisfaction.

- Bundle Policies: Explore the option of bundling your house insurance with other policies, such as auto insurance. Bundling can often lead to significant discounts and simplified billing.

- Consider Discounts: Online quotes may not always highlight available discounts. Discuss your eligibility for discounts based on factors like home security systems, loyalty, or even your profession. These discounts can further reduce your premium.

Potential Challenges and Solutions

While online house insurance quotes are generally user-friendly, you may encounter certain challenges. Here’s how to navigate them:

- Complex Situations: If your home has unique features or you have specific coverage needs, the standard online quote process might not suffice. In such cases, consider reaching out to an insurance agent who can provide personalized advice and guide you through the process.

- Comparing Apples to Apples: When comparing quotes, ensure you're comparing similar coverage options. Different providers may use different terminology or have slightly different policy structures. Take the time to understand the nuances to make an informed decision.

- Additional Questions: If you have specific questions or concerns about your quote, don't hesitate to contact the insurance provider's customer support. They can provide clarification and guidance to address your queries.

The Future of House Insurance Quotes

The landscape of house insurance quotes is continually evolving, driven by advancements in technology and changing consumer preferences. Here’s a glimpse into the future of online house insurance quotes:

Artificial Intelligence and Machine Learning

AI and machine learning technologies are expected to play a more significant role in the quote process. These technologies can analyze vast amounts of data, including satellite imagery and real-time weather patterns, to provide even more accurate and personalized quotes.

Enhanced Risk Assessment

Insurance providers are investing in advanced risk assessment tools. These tools can utilize data analytics to identify potential risks associated with specific properties, allowing for more precise underwriting and potentially better rates for homeowners.

Streamlined Claims Process

The future of house insurance quotes may also involve a more streamlined and efficient claims process. With the integration of technology, homeowners could benefit from faster and more accurate claim settlements, reducing the stress and hassle associated with filing claims.

Increased Personalization

Online quote tools are likely to become even more personalized, offering tailored recommendations based on individual homeowner profiles. This level of personalization could lead to better-suited coverage options and potentially lower premiums.

Data-Driven Insights

Insurance providers will increasingly rely on data-driven insights to understand customer needs and preferences. This data-driven approach can result in more innovative and customer-centric insurance products, meeting the evolving demands of homeowners.

Conclusion

Obtaining house insurance quotes online has revolutionized the way homeowners approach their insurance needs. The convenience, transparency, and customization offered by online quote tools empower homeowners to take control of their insurance journey. By understanding the process, considering key factors, and staying informed about industry advancements, you can navigate the world of house insurance quotes with confidence, ensuring your home and its contents are adequately protected.

How often should I review and update my house insurance policy?

+It’s recommended to review your house insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures your coverage remains up-to-date and adequate for your needs.

Can I bundle my house insurance with other policies to save money?

+Yes, bundling your house insurance with other policies, such as auto insurance, can often lead to significant discounts and simplified billing. It’s worth exploring this option with your insurance provider.

What factors can influence the cost of my house insurance premium?

+Several factors can influence the cost of your house insurance premium, including the location and value of your home, the coverage limits you choose, your claims history, and the presence of security features. Understanding these factors can help you negotiate better rates.