How Much Does It Cost For Car Insurance

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. The cost of car insurance is a significant concern for many drivers, and it can vary greatly depending on various factors. In this comprehensive article, we will delve into the factors influencing car insurance costs, explore average rates, and provide insights on how to obtain affordable coverage.

Factors Affecting Car Insurance Costs

The price of car insurance is influenced by a multitude of elements, each playing a role in determining the final premium. Here are some key factors that insurance companies consider when calculating insurance costs:

Driver Profile

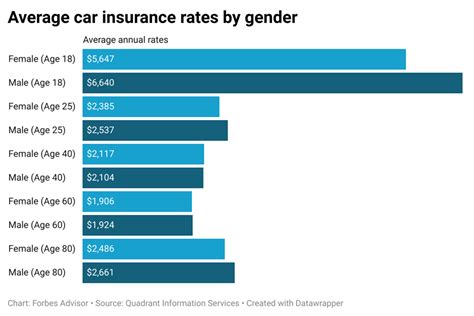

Your personal characteristics as a driver have a significant impact on insurance rates. Insurance companies assess factors such as your age, gender, driving history, and years of experience. Younger drivers, especially those under 25, often face higher premiums due to their lack of experience and higher accident rates. Similarly, individuals with a history of accidents or traffic violations may be considered higher risk, resulting in increased insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also affects insurance costs. Insurance rates for sports cars, luxury vehicles, and high-performance cars tend to be higher due to their expensive repairs and higher likelihood of accidents. Additionally, the primary use of your vehicle matters. If you primarily drive for work or commute long distances, your insurance premiums may be higher compared to someone who primarily uses their vehicle for leisure.

Location and Coverage Level

Your geographic location plays a vital role in determining insurance costs. Areas with higher accident rates, theft, or natural disaster risks may have higher insurance premiums. Furthermore, the level of coverage you choose also impacts the cost. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, typically costs more than basic liability coverage.

Insurance Company and Discounts

The insurance company you choose can significantly affect your insurance costs. Different companies offer varying rates and discounts. It’s essential to compare quotes from multiple insurers to find the most competitive rates. Additionally, many insurance companies provide discounts for safe driving, good academic performance, loyalty, or bundling multiple insurance policies. Exploring these discounts can help reduce your overall insurance costs.

| Discount Type | Description |

|---|---|

| Safe Driving Discount | Lower rates for maintaining a clean driving record. |

| Multi-Policy Discount | Reduced premiums when bundling multiple insurance policies (e.g., auto and home insurance) |

| Good Student Discount | Discounts for young drivers with good academic standing. |

| Loyalty Discount | Lower rates for long-term customers who have maintained their insurance policies. |

Average Car Insurance Costs

The average cost of car insurance varies depending on factors such as location, coverage level, and driving history. According to recent data from the Insurance Information Institute, the average annual premium for car insurance in the United States was approximately $1,674 in 2021. However, it’s important to note that this is just an average, and actual insurance costs can vary widely.

Here's a breakdown of average insurance costs based on different coverage levels:

- Minimum Liability Coverage: The minimum liability coverage required by law varies by state. On average, this basic coverage costs around $500 to $700 annually.

- Standard Coverage: Standard coverage, which includes liability, collision, and comprehensive coverage, typically costs between $1,000 and $2,000 per year.

- Comprehensive Coverage: Full comprehensive coverage, including all available add-ons, can range from $1,500 to $3,000 annually.

Regional Variations

Insurance costs can vary significantly from one state to another. Here’s a glimpse at the average annual insurance premiums in some U.S. states, based on data from the National Association of Insurance Commissioners:

| State | Average Annual Premium |

|---|---|

| California | $1,454 |

| Texas | $1,033 |

| Florida | $1,566 |

| New York | $1,426 |

| Michigan | $2,646 |

Tips for Reducing Car Insurance Costs

While insurance costs can be influenced by various factors beyond your control, there are strategies you can employ to potentially reduce your insurance premiums. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance companies to find the most competitive rates. Online insurance comparison tools can simplify this process.

- Increase Deductibles: Opting for higher deductibles can lower your insurance premiums. However, ensure you choose a deductible amount you can afford in case of an accident.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to keep your insurance costs down. A clean driving record is a significant factor in determining insurance rates.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as home or renters insurance. Many insurers offer discounts for bundling multiple policies.

- Take Advantage of Discounts: Explore all available discounts, including safe driving, good student, loyalty, and multi-policy discounts. Ask your insurance provider about any applicable discounts.

- Consider Telematics Devices: Some insurance companies offer telematics devices or apps that track your driving behavior. Safe driving habits recorded by these devices may lead to reduced insurance premiums.

- Review Coverage Levels: Regularly review your insurance coverage to ensure it aligns with your needs. Avoid paying for unnecessary coverage, but also ensure you have adequate protection.

Understanding Insurance Quotes

When obtaining insurance quotes, it’s essential to understand the components that make up your insurance premium. Insurance quotes typically consist of the following:

- Base Rate: This is the standard rate for the coverage you've selected, considering factors like your vehicle type and location.

- Discounts: Any applicable discounts, such as safe driving or multi-policy discounts, are applied to reduce the base rate.

- Fees and Taxes: Insurance companies charge various fees, and these are added to the discounted base rate.

- Total Premium: The final insurance premium is the sum of the discounted base rate, fees, and taxes.

Remember, insurance quotes can vary between insurance companies, so it's crucial to compare multiple quotes to find the most affordable option that suits your needs.

What is the average cost of car insurance for a young driver?

+On average, young drivers under 25 years old pay higher insurance premiums due to their lack of driving experience. The average annual premium for a young driver is around 2,500 to 3,000. However, maintaining a clean driving record and exploring discounts can help reduce these costs.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts.

Can I lower my insurance costs by adding safety features to my car?

+Yes, adding safety features like anti-lock brakes, airbags, and advanced driver-assistance systems can potentially reduce your insurance costs. These features reduce the risk of accidents and may qualify you for safety discounts.