How Much Is Liability Insurance For A Small Business

Understanding the financial risks associated with running a small business is crucial, and liability insurance is an essential aspect of this. It provides protection against unexpected legal and financial burdens, ensuring that your business can weather any storms that may arise. In this comprehensive guide, we will delve into the world of liability insurance for small businesses, exploring its importance, coverage options, costs, and the factors that influence premiums. By the end of this article, you'll have a clear understanding of how much liability insurance costs for a small business and how to make informed decisions to safeguard your enterprise.

The Importance of Liability Insurance for Small Businesses

In the dynamic landscape of small business ownership, risks are an inherent part of the journey. From customer accidents on your premises to lawsuits stemming from your products or services, the potential for financial and legal liabilities is ever-present. This is where liability insurance steps in as a crucial safety net.

Liability insurance acts as a protective shield, ensuring that your business can withstand the financial blows of unexpected legal claims. Whether it's a slip and fall incident in your store, a product malfunction leading to injury, or a client suing for professional negligence, liability insurance provides the means to cover legal fees, settlements, and even damages awarded by courts. By having this coverage in place, you can focus on growing your business with peace of mind, knowing that you're prepared for the unforeseen.

Moreover, liability insurance is often a prerequisite for doing business. Many clients, especially those in highly regulated industries, may require proof of adequate liability coverage before engaging with your company. Additionally, if you have employees, you may be legally obligated to carry certain types of liability insurance to protect them and your business.

Understanding Liability Insurance Coverage Options

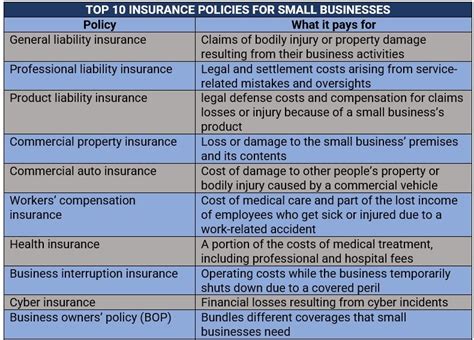

Liability insurance is not a one-size-fits-all solution; it comes in various forms to cater to the unique needs of different businesses. Here’s a breakdown of the primary types of liability insurance and how they can benefit your small business:

General Liability Insurance

General liability insurance is the bedrock of protection for most small businesses. It covers a wide range of common risks, including bodily injury, property damage, and personal and advertising injury claims. For instance, if a customer trips over a loose cable in your office and sustains an injury, general liability insurance would step in to cover the medical costs and any legal fees associated with the claim.

This type of insurance is particularly crucial for businesses that interact with the public, such as retail stores, restaurants, or service providers. It provides a safety net against the financial repercussions of accidental injuries or property damage caused by your business operations.

Product Liability Insurance

If your small business involves manufacturing, distributing, or selling products, product liability insurance is an essential consideration. This coverage protects you from claims arising from defects in your products that cause harm to consumers. It’s a vital safeguard for businesses in the e-commerce space, where products are often shipped directly to customers without immediate oversight.

Product liability insurance covers the costs associated with recalling defective products, as well as legal fees and settlements in the event of a lawsuit. With the rise of online reviews and social media, a single product defect can lead to widespread negative publicity and financial consequences. Having this insurance in place ensures that you can manage such situations effectively.

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is tailored for businesses that provide professional services. This includes consultants, accountants, architects, web designers, and many other professionals. It covers claims arising from alleged or actual mistakes, omissions, or failures to perform services in a competent manner.

For instance, if a client sues your consulting firm for financial losses resulting from your advice, professional liability insurance would step in to cover the legal costs and any compensation awarded. This type of insurance is crucial for maintaining your professional reputation and ensuring that a single mistake doesn't derail your entire business.

Other Specialized Liability Coverages

Beyond the basic liability insurance types, there are specialized coverages available for specific industries and risks. For example, directors and officers (D&O) liability insurance protects business owners and management from personal liability for decisions that impact shareholders. Cyber liability insurance is another specialized coverage, becoming increasingly vital in the digital age to protect against data breaches and cyber attacks.

Additionally, businesses operating in high-risk environments may require specialized coverage for environmental liabilities, employment practices liability, or liquor liability. It's important to assess your unique business risks and tailor your insurance coverage accordingly.

Factors Influencing Liability Insurance Premiums

The cost of liability insurance for small businesses can vary significantly based on a multitude of factors. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums.

Type of Business and Industry

The nature of your business and the industry you operate in play a significant role in determining your liability insurance premiums. High-risk industries, such as construction, manufacturing, or transportation, generally face higher premiums due to the increased likelihood of accidents and claims. Conversely, low-risk industries, like consulting or graphic design, may enjoy more affordable rates.

Business Size and Revenue

The size and revenue of your small business are important considerations for insurance providers. Larger businesses with higher revenues often pose a greater financial risk, as they may have more resources to pursue legal claims. As a result, insurance premiums for these businesses tend to be higher.

Location and Geographical Risks

The location of your business is another critical factor. Insurance providers assess the geographic risks associated with your business’s physical address. Areas prone to natural disasters, high crime rates, or frequent lawsuits may result in higher premiums. Additionally, if your business operates in multiple locations, you’ll need to consider the risks and premiums for each individual site.

Business Activities and Operations

The specific activities and operations of your small business can significantly impact your liability insurance costs. For instance, a restaurant that serves alcohol will face higher premiums due to the increased risk of liquor liability claims. Similarly, a manufacturing business that uses heavy machinery will have higher premiums compared to a business that primarily involves office work.

Claim History and Risk Management Practices

Your business’s claim history is a key factor in determining liability insurance premiums. If you’ve had a history of frequent or costly claims, insurance providers may view your business as a higher risk, resulting in higher premiums. On the other hand, implementing robust risk management practices, such as employee training, safety protocols, and thorough quality control, can demonstrate your commitment to minimizing risks and potentially lead to lower premiums.

Insurance Company and Policy Terms

The insurance company you choose and the specific policy terms can also influence your premiums. Different insurance providers have varying risk appetites and pricing strategies. It’s essential to shop around and compare quotes from multiple providers to find the best coverage at the most competitive rates. Additionally, the policy terms, such as deductibles, coverage limits, and exclusions, can impact the overall cost of your liability insurance.

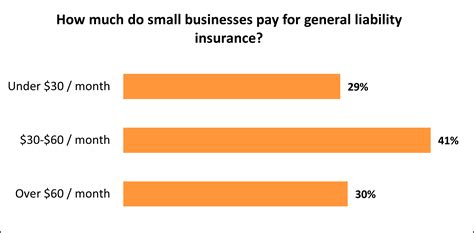

Estimating Liability Insurance Costs for Small Businesses

Estimating the cost of liability insurance for your small business is a complex task that depends on numerous factors. However, as a general guideline, you can expect to pay anywhere from a few hundred to several thousand dollars annually for liability insurance coverage. The wide range of potential costs reflects the variability in business types, sizes, and risk profiles.

For instance, a small retail store in a low-risk industry with a good claim history might pay around $500 to $1,000 per year for general liability insurance. On the other hand, a construction company operating in a high-risk environment with a history of accidents could face premiums exceeding $10,000 annually for comprehensive liability coverage.

It's crucial to remember that these estimates are just a starting point. To get an accurate assessment of your liability insurance costs, it's essential to consult with insurance brokers or agents who can provide tailored quotes based on your unique business circumstances.

| Industry | Average Annual Premium |

|---|---|

| Retail | $500 - $2,000 |

| Construction | $3,000 - $15,000 |

| Manufacturing | $2,000 - $8,000 |

| Professional Services | $500 - $3,000 |

| E-commerce | $1,000 - $5,000 |

The table above provides a rough estimate of average annual premiums for various industries. However, it's important to note that these figures can vary significantly based on the specific characteristics and risk profiles of individual businesses within each industry.

Tips for Reducing Liability Insurance Costs

While liability insurance is an essential investment for small businesses, there are strategies you can employ to potentially reduce your premiums and maximize your coverage. Here are some practical tips to consider:

Choose the Right Coverage

Review your business activities and potential risks carefully to determine the specific types of liability insurance you need. Avoid over-insuring your business by purchasing coverage that goes beyond your actual risks. Conversely, ensure that you have adequate coverage to protect your business effectively.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurance providers. Each insurer has its own risk assessment methodology and pricing structure, so you may find significant variations in premiums. Use online comparison tools and consult with insurance brokers to explore your options.

Bundle Your Insurance Policies

Many insurance providers offer discounts when you bundle multiple policies together. If you need more than one type of insurance, such as liability and property insurance, consider purchasing them from the same insurer to potentially save on premiums.

Implement Risk Management Strategies

Insurance providers view businesses that actively manage risks as more desirable clients. Implement robust risk management practices, such as employee training on safety protocols, regular equipment maintenance, and thorough quality control measures. These steps not only reduce the likelihood of accidents and claims but can also lead to lower insurance premiums.

Raise Your Deductibles

Opting for higher deductibles can result in lower premiums. However, this strategy requires careful consideration, as it means you’ll have to pay more out-of-pocket in the event of a claim. Ensure that you have the financial capacity to cover higher deductibles before making this decision.

Explore Small Business Associations and Groups

Many industry associations and business groups offer group insurance plans that can provide significant savings on liability insurance. These plans leverage the collective buying power of member businesses to negotiate more favorable rates. Check if your industry association or local business group offers such benefits.

Stay Claim-Free

Insurance providers reward businesses that maintain a clean claim history. Avoid filing small or minor claims that may not be worth the long-term impact on your premiums. Instead, focus on risk prevention and management to keep your claim history clean, which can lead to lower premiums over time.

Choosing the Right Liability Insurance Provider

Selecting the right liability insurance provider is a critical decision for your small business. Here are some key considerations to help you make an informed choice:

Financial Strength and Stability

Ensure that the insurance provider you choose has a strong financial rating. This indicates their ability to pay out claims and remain solvent in the long term. Check with reputable rating agencies like AM Best, Moody’s, or Standard & Poor’s to assess the financial strength of potential insurers.

Industry Expertise and Experience

Look for an insurance provider with experience and expertise in your specific industry. They will have a better understanding of the unique risks and coverage needs associated with your business, ensuring that you receive tailored and comprehensive protection.

Claims Handling Reputation

Research the insurer’s reputation for handling claims efficiently and fairly. Read customer reviews and seek recommendations from industry peers to gauge their claims handling process. A provider with a positive claims reputation will give you peace of mind knowing that they’ll be there to support you when you need it most.

Customer Service and Support

Excellent customer service is crucial when dealing with insurance providers. Assess the insurer’s responsiveness, accessibility, and willingness to answer your questions and address your concerns. A provider with a dedicated small business support team can be a valuable asset when navigating the complexities of liability insurance.

Policy Terms and Flexibility

Review the policy terms and conditions carefully. Look for policies that offer flexibility in coverage limits, deductibles, and additional endorsements to tailor the insurance to your specific needs. Ensure that the policy provides clear and comprehensive coverage for the risks you face.

Future Implications and Considerations

As the business landscape continues to evolve, so too do the risks and liabilities faced by small businesses. Staying abreast of emerging trends and potential threats is essential for effective risk management and liability insurance planning.

One of the key trends to watch is the increasing prevalence of cyber risks. With more businesses operating online and storing sensitive data digitally, the risk of cyber attacks and data breaches has risen significantly. Cyber liability insurance is becoming an essential component of comprehensive risk management for many small businesses.

Additionally, the growing focus on environmental sustainability and social responsibility brings new liabilities into the spotlight. Small businesses that embrace sustainable practices and corporate social responsibility initiatives may face unique risks, such as environmental liability claims or lawsuits related to fair labor practices. Keeping abreast of these emerging risks and considering specialized insurance coverages can be crucial for long-term business resilience.

Furthermore, the ongoing pandemic has highlighted the importance of business interruption insurance and the need for comprehensive pandemic coverage. Small businesses that experienced significant losses due to COVID-19-related closures and disruptions have faced challenges in obtaining adequate compensation. This serves as a reminder of the value of having robust business interruption insurance in place, as well as the need for insurers to adapt policies to cover pandemic-related risks.

In conclusion, liability insurance is a critical aspect of small business risk management. By understanding the different coverage options, assessing your unique business risks, and implementing strategic approaches to insurance procurement, you can safeguard your business against financial and legal liabilities. Stay informed, adapt to emerging trends, and work with reputable insurance providers to ensure your small business remains protected and resilient in the face of uncertainty.

What is the average cost of liability insurance for a small business?

+The average cost of liability insurance for a small business can vary widely based on factors such as industry, business size, location, and risk profile. As a rough estimate, you can expect to pay anywhere from a few hundred to several thousand dollars annually. It’s important to obtain tailored quotes to get an accurate assessment of your specific costs.

How can I reduce my liability insurance premiums as a small business owner?

+There are several strategies to potentially reduce your liability insurance premiums. These include choosing the right coverage for your business, shopping around for quotes from multiple providers, implementing effective risk management practices, bundling insurance policies, raising your deductibles, and exploring small business association or group insurance plans.

What are the key factors that influence liability insurance premiums for small businesses?

+Liability insurance premiums for small businesses are influenced by various factors, including the type of business and industry, business size and revenue, location and geographical risks, business activities and operations, claim history, and the insurance company and policy terms. Each of these factors can significantly impact the cost of liability insurance.

Is liability insurance mandatory for all small businesses?

+While liability insurance is not legally mandatory for all small businesses, it is highly recommended. Many businesses are required to carry specific types of liability insurance based on their industry or regulatory requirements. Additionally, having liability insurance is crucial for protecting your business from financial and legal liabilities, which can be devastating for small businesses.