How To Get Travel Insurance

Travel insurance is an essential aspect of planning any trip, whether it's a leisurely vacation or a business venture. It provides peace of mind and financial protection against unforeseen circumstances that may arise during your travels. In this comprehensive guide, we will delve into the world of travel insurance, offering expert insights and practical advice to help you navigate the process and make informed decisions.

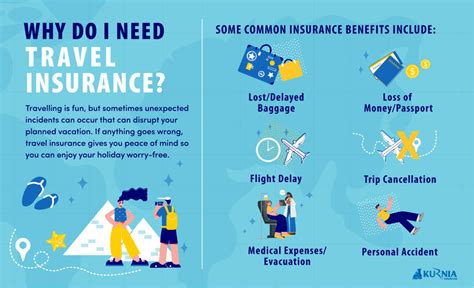

Understanding the Importance of Travel Insurance

Travel insurance acts as a safety net, safeguarding your travel plans and investments. It covers a wide range of potential issues, including medical emergencies, trip cancellations, lost luggage, and travel delays. By purchasing the right policy, you can protect yourself from unexpected expenses and minimize the impact of unfortunate events on your journey.

Consider the following real-life scenario: Ms. Smith, an avid traveler, planned a dream vacation to explore the mountains of Switzerland. Unfortunately, a few days before her departure, she suffered a sprained ankle, rendering her unable to travel. With a comprehensive travel insurance policy, she was able to claim for the cost of her non-refundable trip, avoiding a significant financial loss.

Researching and Choosing the Right Policy

The first step towards obtaining travel insurance is thorough research. Different policies offer varying levels of coverage, and it’s crucial to select one that aligns with your specific needs and travel plans.

Assess Your Travel Needs

Begin by evaluating the nature of your trip. Are you embarking on a solo adventure, a family vacation, or a business trip? Consider the activities you plan to engage in, as certain policies may offer specialized coverage for adventure sports or business-related activities.

For instance, Mr. Johnson, an adventure seeker, opted for a policy that covered his rock climbing expedition in Thailand. This policy included medical evacuation coverage, ensuring he could receive prompt medical attention in a remote location.

Compare Providers and Coverage

Explore multiple travel insurance providers to compare their offerings. Look for reputable companies with a strong track record in the industry. Compare the coverage limits, exclusions, and any additional benefits they provide.

One popular provider, Global Travel Insurers, offers policies with flexible coverage options. Their policies include trip cancellation coverage up to $10,000, medical expense coverage up to $500,000, and emergency medical evacuation coverage up to $50,000. These comprehensive limits provide ample protection for most travelers.

Check for Specific Coverage Requirements

Certain destinations or activities may require specific types of insurance. For example, if you’re planning a trip to a country with unstable political conditions, you might need additional travel safety coverage. Similarly, if you’re engaging in extreme sports, ensure your policy covers such activities.

Mrs. Lee, an avid scuba diver, always ensures her travel insurance policy includes dive trip interruption coverage. This specialized coverage provides reimbursement for any dive trips that need to be canceled due to unforeseen circumstances.

Obtaining Your Travel Insurance Policy

Once you’ve selected the right provider and policy, the next step is to obtain your travel insurance. This process typically involves the following steps:

Provide Personal and Trip Details

When applying for travel insurance, you’ll need to provide accurate information about yourself and your trip. This includes your name, date of birth, travel dates, and the destination(s) you plan to visit.

It's crucial to be transparent and provide all relevant details. Any misinformation or omissions could lead to claim denials or other complications down the line.

Review and Understand the Policy

Before finalizing your purchase, carefully review the policy document. Pay close attention to the coverage limits, exclusions, and any specific conditions that may apply. Ensure you understand the terms and conditions, as these will govern your rights and obligations under the policy.

Seek clarification if any part of the policy is unclear. Most reputable insurance providers offer customer support to address any queries you may have.

Make the Payment

Travel insurance policies typically require upfront payment. You can choose to pay via credit card, debit card, or other secure payment methods offered by the insurance provider.

Ensure you receive a confirmation email or receipt as proof of payment. This serves as your proof of insurance and should be kept safe throughout your trip.

Receive Your Policy Document

After completing the payment process, you’ll receive your travel insurance policy document. This document outlines all the details of your coverage, including the policy number, coverage limits, and any specific conditions or exclusions.

It's advisable to print or save a digital copy of the policy document for easy reference during your travels. You may also consider sharing the policy details with a trusted contact or storing it securely in the cloud.

Making a Claim

Should an unfortunate event occur during your trip, you’ll need to know how to make a claim on your travel insurance policy. Here’s a step-by-step guide:

Gather the Necessary Information

When an incident occurs, gather all relevant information and documentation. This may include medical reports, police reports, receipts for any out-of-pocket expenses, and any other evidence that supports your claim.

For example, if you suffer a medical emergency, ensure you obtain detailed medical records from the treating facility. These records will be crucial when submitting your claim.

Contact Your Insurance Provider

Reach out to your insurance provider as soon as possible to notify them of the incident. Most providers have dedicated customer support lines or online portals for claim submissions.

Provide them with all the necessary information and documentation. Be prepared to answer any questions they may have regarding the incident and your claim.

Submit Your Claim

Follow the instructions provided by your insurance provider to submit your claim. This may involve filling out a claim form, providing additional documentation, or even undergoing an assessment process.

Ensure you meet all the required deadlines and provide all the necessary information to avoid delays in processing your claim.

Wait for the Claim Assessment

Once you’ve submitted your claim, the insurance provider will assess it based on the terms and conditions of your policy. This process may take some time, especially if further investigations or clarifications are required.

Stay patient and keep in touch with your insurance provider. They will keep you updated on the progress of your claim and inform you of any additional steps needed.

Receive Your Settlement

If your claim is approved, you’ll receive a settlement from your insurance provider. This settlement may be in the form of a reimbursement for your expenses or a direct payment to the service provider, depending on the nature of your claim.

Ensure you understand the settlement amount and how it aligns with your expenses. If you have any queries or concerns, don't hesitate to reach out to your insurance provider for clarification.

Tips and Considerations

Here are some additional tips and considerations to keep in mind when navigating the world of travel insurance:

-

Read the Fine Print: Always read the policy document carefully, paying attention to the exclusions and conditions. This ensures you understand what is and isn't covered.

-

Compare Prices: While price shouldn't be the sole deciding factor, it's worth comparing premiums across different providers. You can often find affordable policies that offer excellent coverage.

-

Check for Existing Coverage: Some credit cards or membership programs may offer travel insurance as a benefit. Check if you already have coverage through these channels before purchasing a separate policy.

-

Travel Insurance for Pre-Existing Conditions: If you have a pre-existing medical condition, it's crucial to disclose this when applying for travel insurance. Some providers offer coverage for pre-existing conditions with certain limitations.

-

Travel with a Group: If you're traveling with a group, consider purchasing a group travel insurance policy. This can often provide better value and coverage compared to individual policies.

-

Travel Insurance for Frequent Travelers: If you travel frequently, an annual multi-trip policy may be more cost-effective than purchasing separate policies for each trip.

The Bottom Line

Travel insurance is an essential investment for any traveler, providing protection and peace of mind during your adventures. By understanding the importance of travel insurance, researching and choosing the right policy, and knowing how to make a claim, you can ensure a smooth and secure travel experience.

Remember, travel insurance is not just a necessity but also a smart financial decision. It safeguards your travel plans and ensures you can enjoy your journey without worrying about unexpected expenses or disruptions.

So, whether you're embarking on a solo backpacking trip or a family vacation, make sure to prioritize travel insurance and protect your travels with the right coverage.

Can I purchase travel insurance after my trip has started?

+In most cases, it’s best to purchase travel insurance before your trip begins. However, some providers offer last-minute or emergency travel insurance policies. These policies often have limited coverage and may come with higher premiums.

What if I have a pre-existing medical condition? Can I still get travel insurance?

+Yes, many travel insurance providers offer coverage for pre-existing medical conditions. However, it’s crucial to disclose these conditions accurately when applying for insurance. Some providers may offer limited coverage or charge higher premiums for certain conditions.

How soon should I purchase travel insurance after booking my trip?

+It’s generally recommended to purchase travel insurance as soon as you book your trip. This ensures you have coverage from the moment you make your travel plans. Some policies may have specific deadlines for purchasing insurance to be eligible for certain benefits.

What happens if I need to cancel my trip due to a covered reason, but my travel insurance policy doesn’t cover trip cancellation?

+If your travel insurance policy doesn’t cover trip cancellation, you may be able to seek reimbursement through other means. For example, some credit cards offer trip cancellation coverage as a benefit. Additionally, you can explore options like travel protection plans offered by your travel provider or trip organizer.

Are there any situations where travel insurance might not be necessary?

+While travel insurance is highly recommended for most trips, there may be certain situations where it’s not necessary. For example, if you’re traveling domestically and already have comprehensive health insurance coverage, you may not need additional travel insurance. However, it’s always wise to assess your specific needs and circumstances before deciding.