Insurance Cliams

Insurance claims are an essential aspect of the insurance industry, providing a vital safety net for policyholders when unforeseen events occur. Whether it's a car accident, a damaged home, or a medical emergency, the claims process is designed to offer financial protection and support. In this comprehensive guide, we will delve into the world of insurance claims, exploring the key elements, processes, and considerations involved. By understanding the intricacies of insurance claims, individuals can navigate the process with confidence and ensure they receive the coverage they deserve.

The Importance of Insurance Claims

Insurance claims serve as a crucial mechanism for individuals and businesses to recover from unexpected losses. When an insured event takes place, filing a claim allows policyholders to access the benefits outlined in their insurance policy. This financial assistance can prove invaluable in mitigating the impact of accidents, natural disasters, or health-related incidents.

The insurance claims process aims to provide a seamless and efficient experience for policyholders. By promptly addressing and resolving claims, insurance companies fulfill their contractual obligations, fostering trust and satisfaction among their customers. Furthermore, insurance claims contribute to the overall stability and sustainability of the insurance industry, enabling insurers to effectively manage risks and allocate resources.

Understanding the Insurance Claims Process

The insurance claims process involves several key steps, each designed to ensure a fair and timely resolution. Here’s a breakdown of the typical stages involved:

Reporting the Claim

Policyholders initiate the claims process by reporting the incident to their insurance provider. This can be done through various channels, including phone calls, online portals, or in-person visits. Accurate and detailed information about the claim is essential at this stage, as it forms the foundation for the subsequent evaluation and assessment.

Claim Assessment and Verification

Once a claim is reported, insurance companies initiate a thorough assessment process. This involves verifying the policyholder’s coverage, reviewing the specifics of the incident, and gathering relevant documentation. Insurance adjusters play a pivotal role during this stage, as they evaluate the claim’s validity and determine the extent of coverage applicable.

During the assessment phase, insurance companies may request additional information or documentation to support the claim. This can include police reports, medical records, repair estimates, or photographs of the damage. Timely and accurate provision of these details is crucial to expedite the claims process and ensure a fair resolution.

Determining Coverage and Liability

Insurance adjusters carefully review the policyholder’s coverage and the circumstances surrounding the incident to determine liability and the applicable level of coverage. This step involves a detailed analysis of the insurance policy’s terms and conditions, ensuring that the claim falls within the scope of the coverage provided.

In cases where liability is shared or disputed, insurance companies may engage in negotiations or collaborate with legal professionals to reach a resolution. The determination of liability and coverage is a critical aspect of the claims process, as it directly impacts the compensation received by the policyholder.

Settling the Claim

Once the claim has been thoroughly assessed, evaluated, and approved, the insurance company moves forward with settling the claim. This involves providing compensation to the policyholder in accordance with the terms of their insurance policy. The settlement process can vary depending on the type of claim and the specific circumstances involved.

For property damage claims, insurance companies may provide payment directly to the policyholder or arrange for repairs or replacements. In cases of bodily injury or health-related claims, compensation may be offered in the form of medical expenses reimbursement or direct payment to healthcare providers. The settlement process aims to restore the policyholder to their pre-loss financial position as closely as possible.

Types of Insurance Claims

Insurance claims encompass a wide range of scenarios, each with its own unique characteristics and considerations. Understanding the different types of claims is essential for policyholders to navigate the process effectively and maximize their coverage.

Property Damage Claims

Property damage claims involve incidents that result in damage to the policyholder’s personal property or real estate. This can include accidents such as car collisions, natural disasters like hurricanes or floods, or unforeseen events such as fire or theft. Property damage claims often require thorough documentation and assessment to determine the extent of the damage and the applicable coverage.

When filing a property damage claim, policyholders should gather evidence such as photographs, repair estimates, and any relevant insurance policies. Insurance companies will carefully evaluate the claim, considering factors such as the cause of the damage, the policyholder's deductible, and the limits of their coverage. Timely reporting and accurate documentation can significantly streamline the claims process for property damage incidents.

Bodily Injury Claims

Bodily injury claims arise when an individual suffers physical harm or injury due to an accident or negligent act. These claims can result from car accidents, workplace injuries, slip and fall incidents, or medical malpractice. Bodily injury claims often involve complex legal and medical considerations, making it crucial for policyholders to seek legal advice and medical attention as soon as possible.

Insurance companies will assess bodily injury claims based on the extent of the injuries, the cause of the incident, and the applicable coverage. Policyholders should maintain thorough records of medical treatments, diagnoses, and any associated expenses. Additionally, consulting with legal professionals experienced in personal injury cases can provide valuable guidance throughout the claims process.

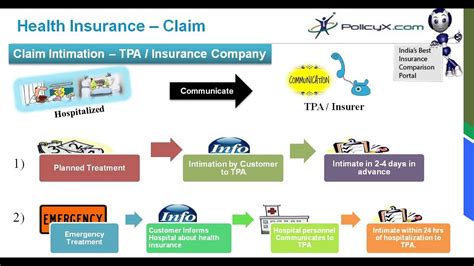

Health Insurance Claims

Health insurance claims relate to the reimbursement of medical expenses incurred by policyholders. These claims can cover a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and specialized treatments. Health insurance claims are typically submitted by healthcare providers on behalf of the policyholder, but individuals may also be involved in the process.

Policyholders should familiarize themselves with their health insurance policy's coverage limits, deductibles, and co-payment requirements. When seeking medical treatment, it's important to inform healthcare providers of the insurance coverage and obtain necessary documentation, such as itemized bills and treatment records. Staying organized and proactive in managing health insurance claims can help ensure timely reimbursement and avoid unnecessary complications.

Tips for a Successful Insurance Claims Process

Navigating the insurance claims process can be complex, but by following these tips, policyholders can enhance their chances of a successful outcome:

- Understand Your Policy: Familiarize yourself with your insurance policy's terms and conditions. Know the types of coverage provided, the applicable deductibles, and any exclusions or limitations. This knowledge will empower you to make informed decisions during the claims process.

- Report Claims Promptly: Timely reporting of claims is crucial. Contact your insurance provider as soon as possible after an incident occurs. Delays in reporting can complicate the claims process and potentially impact your coverage.

- Gather Comprehensive Documentation: Collect and organize all relevant documentation related to your claim. This includes photographs, repair estimates, medical records, police reports, and any other supporting evidence. Detailed and accurate documentation strengthens your claim and facilitates a smoother resolution.

- Cooperate with Your Insurance Provider: Maintain open and transparent communication with your insurance company throughout the claims process. Provide accurate and timely responses to their inquiries and cooperate with their investigation. Building a positive relationship with your insurer can contribute to a more favorable outcome.

- Seek Legal Advice if Needed: In cases where liability is disputed or complex legal issues arise, consider consulting with an attorney who specializes in insurance law. Legal professionals can provide valuable guidance and representation, ensuring your rights are protected and your interests are advocated for.

Future Trends in Insurance Claims

The insurance industry is continuously evolving, and the claims process is no exception. Here are some future trends and developments to watch out for:

Digital Transformation

Insurance companies are increasingly embracing digital technologies to streamline the claims process. Online claim portals, mobile apps, and automated systems are being utilized to enhance efficiency and convenience for policyholders. Digital transformation is expected to further revolutionize the way claims are filed, assessed, and resolved, making the process more accessible and user-friendly.

Data Analytics and AI

Advancements in data analytics and artificial intelligence (AI) are transforming the insurance industry. Insurance companies are leveraging these technologies to analyze large volumes of data, identify patterns, and improve claim handling processes. AI-powered systems can assist in claim evaluation, fraud detection, and even predictive modeling, enabling more accurate and timely decisions.

Enhanced Customer Experience

Insurance providers are recognizing the importance of delivering a superior customer experience throughout the claims process. This includes providing clear and transparent communication, offering personalized support, and implementing innovative solutions to address policyholders’ needs. By prioritizing customer satisfaction, insurance companies aim to build trust and loyalty, leading to long-term relationships.

Collaboration and Integration

The insurance industry is witnessing increased collaboration and integration among various stakeholders. Insurance companies are partnering with technology providers, repair services, and healthcare networks to create seamless ecosystems for claim resolution. This collaborative approach aims to streamline processes, reduce administrative burdens, and provide policyholders with a more efficient and integrated experience.

Conclusion

Insurance claims are an integral part of the insurance industry, offering financial protection and support to policyholders during challenging times. By understanding the claims process, the types of claims, and the tips for a successful outcome, individuals can navigate the complexities with confidence. As the insurance industry continues to evolve, embracing digital transformation, data analytics, and enhanced customer experiences, the claims process is poised to become even more efficient and customer-centric.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, it’s important to review the reasons provided by your insurance company. Understand the basis for the denial and assess whether there are any grounds for an appeal. Gather additional evidence or documentation that may support your claim. Consider seeking legal advice from an insurance law specialist who can guide you through the appeals process and help you understand your rights.

How long does the insurance claims process typically take?

+The duration of the insurance claims process can vary depending on the type of claim, the complexity of the incident, and the responsiveness of all parties involved. Simple claims with clear evidence and documentation may be resolved within a matter of days or weeks. More complex claims, especially those involving disputes or legal issues, can take several months or even longer to reach a resolution. It’s important to maintain open communication with your insurance provider and regularly inquire about the status of your claim to stay informed.

Can I negotiate the settlement amount offered by my insurance company?

+Yes, you have the right to negotiate the settlement amount offered by your insurance company. It’s important to carefully review the settlement proposal and assess whether it adequately covers your losses and expenses. If you believe the offered amount is insufficient, you can present additional evidence, provide detailed calculations, or seek professional advice to support your negotiation. Remember to maintain a respectful and cooperative tone throughout the negotiation process.