Insurance For Apartments

When it comes to safeguarding your assets and providing peace of mind, insurance for apartments is an essential aspect of modern life. In today's world, where unforeseen events can occur at any moment, having the right insurance coverage is crucial for apartment dwellers. This comprehensive guide will delve into the world of insurance for apartments, offering valuable insights and expert advice to help you make informed decisions about protecting your rental space.

Understanding Apartment Insurance

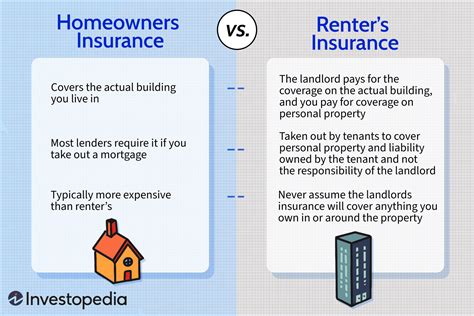

Apartment insurance, also known as renters insurance, is a specialized type of coverage designed to protect tenants from financial losses and liabilities associated with their rented dwelling. It provides a safety net for individuals and families living in apartments, condominiums, or rental homes, ensuring that they are prepared for unexpected situations.

Coverage Options and Benefits

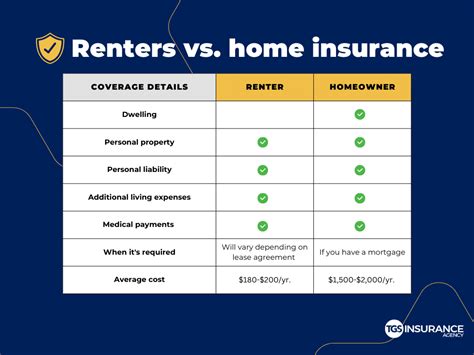

Renters insurance typically offers a range of coverage options to address various risks. Here are some key components to consider:

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing, against damage or loss due to perils like fire, theft, or vandalism. It provides financial compensation to help you replace or repair your possessions.

- Liability Protection: Apartment insurance often includes liability coverage, which safeguards you against claims arising from accidents or injuries that occur on your rental property. It covers legal expenses and settlements, providing peace of mind in case of unexpected incidents.

- Additional Living Expenses: In the event of a covered loss that renders your apartment uninhabitable, this coverage helps cover temporary living expenses, including hotel stays and meal costs, until you can return to your residence.

- Medical Payments: Some policies offer medical payment coverage, which provides funds to cover medical expenses for guests who sustain injuries on your property, regardless of fault.

Why Apartment Insurance Matters

Apartment insurance is essential for several reasons. Firstly, it protects your personal belongings, which can be costly to replace. Secondly, liability coverage is crucial to safeguard against lawsuits resulting from accidents on your property. Additionally, additional living expenses coverage ensures you have a place to stay and can maintain your daily routine during unexpected disruptions.

Factors Influencing Apartment Insurance Rates

The cost of apartment insurance can vary depending on several factors. Understanding these influences can help you make informed decisions and potentially save on your insurance premiums.

Location and Crime Rates

The area where your apartment is located plays a significant role in determining insurance rates. Apartments in high-crime areas or regions prone to natural disasters may face higher premiums due to the increased risk of theft, vandalism, or damage.

Value of Personal Belongings

The value of your personal property is a critical factor. Insurance providers consider the cost of replacing your belongings when calculating premiums. If you have high-value items like jewelry, artwork, or electronics, you may need additional coverage, which can impact your insurance costs.

Deductibles and Coverage Limits

Your choice of deductibles and coverage limits can affect your insurance rates. Opting for a higher deductible, which is the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums. However, it’s essential to strike a balance, as a higher deductible means you’ll bear more financial responsibility in the event of a claim.

Discounts and Bundling Options

Many insurance providers offer discounts to encourage policyholders to take certain safety measures. For instance, you may qualify for discounts by installing security systems, smoke detectors, or fire extinguishers in your apartment. Additionally, bundling your apartment insurance with other policies, such as auto insurance, can lead to significant savings.

| Discounts | Potential Savings |

|---|---|

| Security System | Up to 20% off |

| Smoke Detector | 5-15% off |

| Bundling Policies | Varies, but often 10-20% |

Choosing the Right Apartment Insurance

Selecting the appropriate apartment insurance policy requires careful consideration of your specific needs and circumstances. Here are some tips to guide you in the process:

Assess Your Risks

Evaluate the unique risks associated with your apartment. Consider factors such as the crime rate in your neighborhood, the likelihood of natural disasters, and the value of your personal belongings. Understanding these risks will help you determine the coverage levels you require.

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare coverage options and premiums. Online comparison tools can be valuable resources for this task. Ensure that you’re comparing policies with similar coverage limits and deductibles to make an accurate assessment.

Understand Policy Exclusions

Read the fine print to understand what is excluded from your policy. Some common exclusions include damage caused by floods, earthquakes, or certain types of water damage. If you live in an area prone to such risks, you may need additional coverage.

Consider Additional Coverage

Evaluate whether you need extra coverage for high-value items. Apartment insurance often has limits on the amount it will pay for specific types of property, such as jewelry or electronics. If you have valuable possessions, consider purchasing separate endorsements or riders to ensure they are adequately protected.

Real-Life Examples of Apartment Insurance Claims

To illustrate the importance of apartment insurance, let’s explore a few real-life scenarios where renters insurance played a crucial role in providing financial protection:

Case Study 1: Fire Damage

Sarah, a tenant in a Chicago apartment building, experienced a devastating fire in her unit. The fire destroyed her furniture, electronics, and clothing. Fortunately, Sarah had renters insurance with personal property coverage. Her insurance company compensated her for the replacement cost of her belongings, allowing her to rebuild her life and purchase new essentials.

Case Study 2: Liability Claim

John, a tenant in a busy city, hosted a dinner party for friends. Unfortunately, one of his guests slipped on a recently mopped floor and injured their ankle. The guest sued John for medical expenses and pain and suffering. John’s apartment insurance policy included liability coverage, which covered the legal fees and settlement costs, saving him from significant financial burden.

Case Study 3: Natural Disaster

In Miami, a severe hurricane caused extensive flooding, leading to water damage in Maria’s apartment. Her belongings were ruined, and she was unable to live in her apartment for several weeks while repairs were made. Maria’s apartment insurance policy included additional living expenses coverage, which covered her temporary housing and meal costs during the restoration period.

Future Trends and Implications

The world of apartment insurance is constantly evolving, driven by technological advancements and changing consumer needs. Here are some future trends and their potential implications:

Digital Transformation

The insurance industry is increasingly embracing digital technologies, making it easier for renters to obtain quotes, file claims, and manage their policies online. This trend enhances convenience and accessibility, especially for younger generations who prefer digital interactions.

Personalized Coverage

Insurance providers are developing more sophisticated algorithms to offer personalized coverage options based on individual risk profiles. This trend ensures that renters receive tailored policies that meet their specific needs, providing more efficient and cost-effective protection.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. These companies often leverage technology to offer more affordable and flexible coverage options, appealing to renters who seek convenience and value.

FAQ

What is the average cost of apartment insurance per month?

+

The average cost of apartment insurance can vary depending on factors like location, coverage limits, and deductibles. As a rough estimate, you can expect to pay around 15 to 30 per month for basic renters insurance. However, rates can be higher or lower based on your specific circumstances.

Does apartment insurance cover damage caused by roommates?

+

Yes, apartment insurance typically covers damage caused by roommates or other tenants living in your unit. However, it’s important to note that the policy may have specific conditions or exclusions related to roommate coverage, so it’s crucial to review your policy documents carefully.

Can I get apartment insurance if I’m a student living in a dorm?

+

Yes, apartment insurance is available for students living in dorms or off-campus apartments. It’s essential to assess your coverage needs and consider factors like the value of your belongings and potential liability risks. Many insurance providers offer specialized policies for students, so be sure to explore your options.

In conclusion, apartment insurance is a vital aspect of protecting your rental space and personal belongings. By understanding the coverage options, factors influencing rates, and real-life examples of claims, you can make informed decisions to secure your peace of mind. Stay vigilant, assess your risks, and choose a policy that provides the coverage you need to navigate life’s unexpected challenges.