Insurance In Healthcare

In the complex landscape of healthcare, insurance plays a pivotal role, impacting not only the financial health of individuals and institutions but also shaping the very delivery of medical services. Understanding the intricate relationship between insurance and healthcare is essential for both patients and industry professionals, as it directly influences accessibility, affordability, and the overall quality of care.

The Foundation: Understanding Insurance in Healthcare

Insurance, at its core, is a mechanism designed to protect individuals and entities from financial risks. In the context of healthcare, insurance providers offer coverage plans that help mitigate the costs associated with medical treatments, prescriptions, and various health-related services. This system ensures that individuals can access necessary medical care without incurring overwhelming financial burdens.

The healthcare insurance industry operates on a vast scale, with a multitude of players including private insurance companies, government-sponsored programs, and employer-provided plans. Each of these entities offers a unique set of policies, benefits, and coverage limitations, catering to the diverse needs and financial capabilities of their respective client bases.

For instance, consider the Medicare program, a federal government initiative in the United States. Medicare provides health insurance for Americans aged 65 and older, as well as certain younger people with disabilities and those with end-stage renal disease. This program exemplifies how insurance can be a vital social safety net, ensuring that a vulnerable segment of the population has access to essential healthcare services.

Navigating the Complex Web of Healthcare Insurance

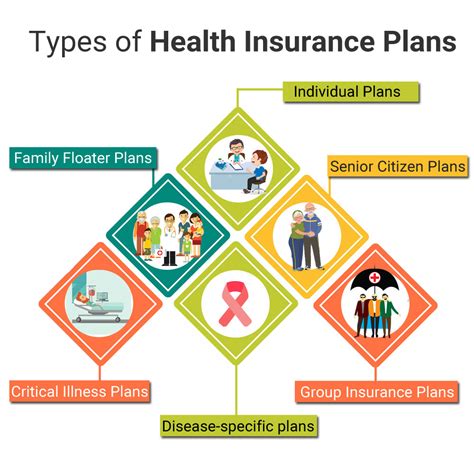

The world of healthcare insurance is multifaceted and often daunting to navigate. Individuals and families face a multitude of choices when selecting an insurance plan, each with its own set of premiums, deductibles, copays, and covered services. The complexity increases when we consider the different types of insurance plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service (POS) plans, each with its unique network of providers and coverage rules.

Moreover, the insurance landscape is continually evolving, with frequent policy updates, changing provider networks, and the introduction of new plans. Keeping abreast of these changes is crucial for individuals to ensure they maintain adequate coverage that aligns with their healthcare needs and financial situation.

Real-Life Scenario: Understanding Insurance Coverage

Imagine a family with a young child who requires regular check-ups and occasional specialized medical treatments. Their insurance plan, a PPO, offers a network of providers that includes their preferred pediatrician and a nearby children’s hospital. The plan’s coverage includes a deductible of $1,500, after which the insurance provider covers a significant portion of the medical costs. This family benefits from the plan’s flexibility, allowing them to choose from a wide range of healthcare providers, and the cost-sharing structure, which protects them from catastrophic expenses.

| Insurance Plan Type | Description |

|---|---|

| HMO | Requires members to select a primary care physician who coordinates all healthcare services. Typically, HMOs have lower premiums and out-of-pocket costs but may limit the choice of healthcare providers. |

| PPO | Offers more flexibility, allowing members to choose from a network of providers without a referral. PPOs often have higher premiums and out-of-pocket costs but provide broader coverage and more provider options. |

| POS | Combines features of both HMOs and PPOs. Members choose a primary care physician but can go outside the network for a higher out-of-pocket cost. |

Understanding these insurance nuances is critical for individuals to make informed decisions about their healthcare. It ensures they are not only protected financially but also have access to the medical services they require without unnecessary barriers.

The Impact of Insurance on Healthcare Delivery

Insurance is not merely a financial safeguard but a driving force that influences the very fabric of healthcare delivery. It dictates the way medical services are structured, delivered, and accessed, affecting everything from the design of healthcare facilities to the development of new treatments and technologies.

For instance, insurance coverage decisions can impact the adoption of innovative medical technologies. If a new treatment or diagnostic tool is not covered by insurance plans, its uptake may be significantly slower, limiting patient access and potentially hindering advancements in healthcare.

Case Study: Insurance and Innovation

Consider the introduction of a new, highly effective but expensive cancer drug. This drug could potentially revolutionize treatment outcomes for a specific type of cancer. However, if insurance companies do not cover this drug due to its high cost, patients may not be able to afford it, and its impact on public health could be severely limited.

On the other hand, if insurance providers recognize the drug's potential and include it in their coverage plans, it could lead to improved treatment outcomes and a significant step forward in cancer care. This scenario underscores the profound influence insurance can have on healthcare innovation and patient outcomes.

The Future of Insurance in Healthcare

As we look ahead, the future of insurance in healthcare promises exciting developments and complex challenges. With advancements in medical technology and a growing emphasis on value-based care, insurance providers are increasingly shifting towards outcome-based models, focusing on preventive care, and adopting more personalized approaches to coverage.

The rise of digital health solutions is also transforming the insurance landscape. From telemedicine services to wearable health tracking devices, these innovations are providing new avenues for insurance providers to engage with their policyholders, collect valuable health data, and potentially reduce healthcare costs.

Furthermore, the ongoing global dialogue on healthcare accessibility and affordability is pushing the insurance industry to reevaluate its role and responsibilities. This includes exploring new models of coverage, such as universal healthcare systems, that aim to provide comprehensive healthcare access to all citizens.

Exploring the Potential of Universal Healthcare

Universal healthcare, a system where all residents of a country are provided with healthcare coverage, has the potential to revolutionize the accessibility and equity of healthcare. While the specifics of such a system can vary greatly, the core principle is to ensure that financial status does not become a barrier to accessing necessary medical care.

Implementing a universal healthcare system is a complex undertaking, involving significant policy changes and resource allocation. However, the potential benefits, including improved public health outcomes, reduced healthcare disparities, and a more efficient use of healthcare resources, make it an attractive prospect for many countries.

How do insurance premiums work in healthcare?

+Premiums are the regular payments made by an individual or employer to an insurance company for healthcare coverage. They are determined by factors such as the age and health status of the insured, the type of coverage, and the location. Premiums can be paid monthly, quarterly, or annually, and they represent the cost of maintaining the insurance policy.

What is the difference between private and public healthcare insurance?

+Private healthcare insurance is typically provided by for-profit insurance companies and offers a wide range of coverage options. These plans often have higher premiums and provide more flexibility in choosing healthcare providers. On the other hand, public healthcare insurance, such as Medicare or Medicaid, is funded and administered by the government and aims to provide healthcare coverage to specific segments of the population, often with lower premiums and more limited provider choices.

How does insurance impact healthcare costs for individuals and providers?

+Insurance plays a significant role in controlling healthcare costs. For individuals, insurance provides financial protection by covering a portion of their medical expenses, reducing the risk of catastrophic financial losses. For healthcare providers, insurance companies negotiate rates for services, which can help control costs but may also limit provider revenue. Additionally, insurance companies often require providers to adhere to specific protocols and documentation requirements, which can impact the delivery of care.