Insurance Of Car

When it comes to owning a vehicle, understanding car insurance is paramount. It's not just a legal requirement but a crucial aspect of responsible driving and protecting your financial well-being. In this comprehensive guide, we'll delve into the world of car insurance, offering you a deep dive into the policies, coverage options, and the steps to secure the best protection for your vehicle.

Whether you're a seasoned driver or a newcomer to the roads, having the right insurance coverage is essential. It provides peace of mind, ensures compliance with the law, and safeguards you against unexpected expenses arising from accidents or other incidents. So, let's embark on this journey to uncover the intricacies of car insurance and help you make informed decisions.

Understanding the Basics of Car Insurance

Car insurance is a contract between you and an insurance provider. It’s a safeguard that covers you, your vehicle, and others in the event of an accident or other covered events. It’s tailored to meet specific needs, providing financial protection and peace of mind. Here’s a breakdown of the fundamental components of car insurance.

Liability Coverage

Liability coverage is the cornerstone of any car insurance policy. It protects you financially if you’re found at fault in an accident. This coverage pays for the damages and injuries you cause to others, including their medical bills, vehicle repairs, and legal fees. In most states, liability insurance is a legal requirement, ensuring that drivers can cover the costs of accidents they cause.

Liability coverage typically consists of two main components:

- Bodily Injury Liability: Covers the medical expenses and lost wages of injured parties in an accident you caused.

- Property Damage Liability: Pays for the repair or replacement of others' property, such as their vehicles, fences, or buildings, damaged in an accident.

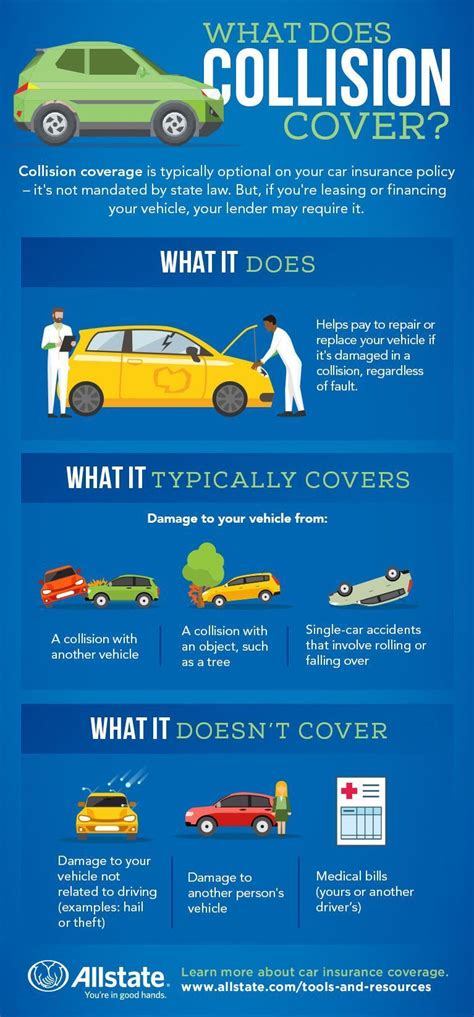

Collision and Comprehensive Coverage

While liability coverage protects others, collision and comprehensive coverage focuses on your vehicle's protection. Collision coverage steps in when your car collides with another vehicle or object, covering the costs of repairing or replacing your vehicle. It's particularly beneficial if you have a loan or lease on your car, as it ensures the financial burden of repairs or replacement is covered.

Comprehensive coverage, on the other hand, offers protection against non-collision incidents. This includes damage caused by theft, vandalism, natural disasters, or collisions with animals. It's an essential coverage for comprehensive protection, ensuring your vehicle is safeguarded against a wide range of unforeseen events.

Medical Payments and Personal Injury Protection (PIP)

Medical payments and PIP coverage provide additional protection for you and your passengers. Medical payments cover the medical expenses incurred by you and your passengers in an accident, regardless of who is at fault. PIP coverage, often required in no-fault states, provides broader coverage, including medical expenses, lost wages, and funeral costs, regardless of fault.

Uninsured/Underinsured Motorist Coverage

Unfortunately, not all drivers carry adequate insurance. Uninsured/underinsured motorist coverage steps in to protect you when involved in an accident with a driver who lacks sufficient insurance coverage. It covers your medical bills, lost wages, and other expenses, ensuring you’re not left financially burdened by the actions of others.

Assessing Your Car Insurance Needs

When it comes to car insurance, one size does not fit all. Your insurance needs depend on various factors, including your vehicle, driving habits, and personal circumstances. Here’s how to assess your specific requirements.

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining your insurance needs. High-value vehicles, luxury cars, or those with specialized features may require more extensive coverage to adequately protect your investment. Additionally, certain vehicle types, such as sports cars, may have higher insurance premiums due to their increased risk profile.

Driving Record and Habits

Your driving record and habits are key factors in insurance assessments. A clean driving record with no accidents or traffic violations can lead to lower insurance premiums. Conversely, a history of accidents or violations may result in higher rates. Additionally, factors like the number of miles you drive annually and your primary use of the vehicle (commuting, pleasure, or business) can influence your insurance needs and costs.

State Requirements and Personal Preferences

State laws vary regarding the minimum car insurance requirements. Some states mandate only liability coverage, while others require additional coverage, such as uninsured motorist protection. Understanding your state’s legal requirements is crucial to ensure compliance. However, it’s also important to consider your personal preferences and the level of protection you desire beyond the legal minimums.

Comparing Car Insurance Providers and Policies

With a vast array of car insurance providers and policies available, choosing the right one can be daunting. Here’s a guide to help you navigate the process effectively.

Research and Compare

Start by researching multiple insurance providers. Compare their reputation, financial stability, and customer satisfaction ratings. Look for providers with a solid track record of paying claims promptly and providing excellent customer service. Online reviews and ratings can offer valuable insights into the experiences of other policyholders.

Compare policy features and coverage options. Assess the limits and deductibles offered, ensuring they align with your needs. Some providers may offer unique coverage options or endorsements that cater to specific situations, such as rental car coverage or roadside assistance.

Consider Discounts and Savings

Insurance providers often offer discounts to attract and retain customers. These discounts can significantly reduce your premium costs. Common discounts include:

- Multi-Policy Discounts: Combining your car insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record over an extended period may qualify you for discounts.

- Loyalty Discounts: Some providers offer discounts to long-term customers as a reward for their loyalty.

- Occupational and Educational Discounts: Certain professions or educational achievements may make you eligible for discounts.

Seek Expert Advice

Consider consulting an insurance broker or agent who can provide expert guidance. They can assess your specific needs, recommend suitable policies, and help you navigate the complexities of car insurance. Brokers often work with multiple providers, ensuring you receive impartial advice and the best coverage options.

Obtaining and Managing Your Car Insurance Policy

Once you’ve selected the right car insurance policy, it’s essential to understand the steps involved in obtaining and managing your coverage.

Policy Application and Documentation

When applying for car insurance, you’ll need to provide essential information, including your personal details, vehicle information, driving record, and desired coverage limits. Be prepared to answer questions honestly and accurately to ensure you receive the appropriate coverage and premium.

Once your policy is in place, keep all relevant documentation, including your insurance card, policy details, and contact information for your insurance provider. Ensure that your policy information is easily accessible in case of emergencies or when making claims.

Understanding Your Policy and Coverage Limits

Take the time to thoroughly review your car insurance policy. Understand the coverage limits, deductibles, and any exclusions or limitations. Ensure that you’re familiar with the terms and conditions, especially regarding claim processes and dispute resolution.

If you have any questions or concerns about your policy, don't hesitate to reach out to your insurance provider. They should be able to clarify any uncertainties and provide additional guidance.

Regular Policy Review and Updates

Your insurance needs may evolve over time. It’s essential to review your policy annually or whenever significant life changes occur. These changes may include purchasing a new vehicle, moving to a different state, getting married, or adding a young driver to your policy. Regular reviews ensure that your coverage remains adequate and aligned with your current circumstances.

Filing a Car Insurance Claim: A Step-by-Step Guide

In the unfortunate event of an accident or incident, knowing how to file a car insurance claim is crucial. Here’s a step-by-step guide to help you through the process.

Assess the Situation and Ensure Safety

After an accident, prioritize your safety and the safety of others involved. Move to a safe location if possible, and check for injuries. If necessary, call for emergency medical services.

Gather Information

Collect as much information as possible at the scene of the accident. This includes:

- Names, contact details, and insurance information of all parties involved.

- License plate numbers and vehicle descriptions.

- Photos of the accident scene, vehicles, and any visible damage.

- Witness statements and contact information.

- A copy of the police report, if applicable.

Notify Your Insurance Provider

Contact your insurance provider as soon as possible to report the accident. Provide them with all the details you’ve gathered, including any relevant documentation. Be prepared to answer their questions and follow their instructions regarding the claim process.

Cooperate with Your Insurer

Your insurance provider will guide you through the claim process. Cooperate fully and provide any additional information or documentation they may request. Be honest and accurate in your communications, as any misleading information can impact your claim.

Understand Your Coverage and Deductible

Review your policy to understand your coverage limits and deductible. Your deductible is the amount you’ll need to pay out of pocket before your insurance coverage kicks in. Ensure you have the necessary funds available to cover your deductible, if applicable.

Choose a Repair Shop

Your insurance provider may have a network of preferred repair shops. Consider using one of these shops, as they often have established relationships with insurers, ensuring efficient repairs and smooth claim processing. However, you have the right to choose your own repair shop, and your insurer should honor your choice.

Tips for Maximizing Your Car Insurance Coverage

To ensure you’re getting the most out of your car insurance policy, consider these valuable tips.

Maintain a Clean Driving Record

A clean driving record is not only essential for obtaining lower insurance premiums but also for ensuring continuous coverage. Avoid accidents and traffic violations to keep your insurance costs down and maintain a positive relationship with your insurer.

Bundle Your Policies

If you have multiple insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same provider. Bundling often results in significant discounts, saving you money across all your insurance policies.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. While this means you’ll pay more out of pocket in the event of a claim, it can be a cost-effective strategy if you have sufficient savings to cover potential expenses.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative option that considers your actual driving habits. These policies use telematics devices or smartphone apps to track your driving behavior, offering discounts for safe driving practices. It’s an excellent choice for cautious drivers who want to save on insurance costs.

Stay Informed and Review Regularly

Stay up to date with changes in the car insurance landscape. Keep an eye on new coverage options, discounts, and provider offerings. Regularly review your policy and coverage limits to ensure they align with your current needs and circumstances.

Conclusion: A Secure Journey Ahead

Navigating the world of car insurance can be complex, but with the right knowledge and understanding, you can make informed decisions to protect yourself, your vehicle, and others on the road. By assessing your needs, comparing policies, and choosing the right coverage, you can drive with confidence, knowing you’re adequately insured.

Remember, car insurance is a vital aspect of responsible driving, and by staying informed and proactive, you can ensure a secure journey ahead. So, embrace the knowledge, choose wisely, and drive with peace of mind.

How much does car insurance cost on average?

+Car insurance costs vary based on factors like location, driving record, and vehicle type. On average, drivers pay between 500 and 1,500 annually for car insurance. However, rates can be significantly higher or lower depending on individual circumstances.

What factors impact car insurance rates?

+Insurance rates are influenced by various factors, including age, gender, marital status, driving record, vehicle type, location, and coverage limits. Younger drivers and those with a history of accidents or violations often pay higher premiums.

How can I lower my car insurance premiums?

+To lower premiums, consider raising your deductibles, maintaining a clean driving record, bundling policies, and exploring usage-based insurance. Additionally, shop around and compare quotes from multiple providers to find the best rates.

What should I do if I’m involved in an accident?

+If you’re in an accident, prioritize safety and gather information. Notify your insurance provider promptly and cooperate with their claim process. Have your policy information and documentation ready for a smooth claim process.