Insurance Term Life Insurance

The Essentials of Term Life Insurance: A Comprehensive Guide

Life insurance is a vital component of financial planning, offering individuals and their loved ones peace of mind and financial protection in uncertain times. Among the various types of life insurance policies, term life insurance stands out as a straightforward and cost-effective option. This guide aims to provide an in-depth understanding of term life insurance, exploring its key features, benefits, and considerations to help you make informed decisions about your financial future.

Understanding Term Life Insurance

Term life insurance is a type of coverage that provides financial protection for a specified period, known as the policy term. Unlike permanent life insurance policies, which offer coverage for the entirety of one's life, term life insurance is designed to meet specific, short-term needs. During the policy term, the insured individual pays regular premiums, and in the event of their death, the beneficiaries receive a lump-sum payment, known as the death benefit.

One of the key advantages of term life insurance is its affordability. Since it provides coverage for a set period, typically ranging from 10 to 30 years, the premiums are often significantly lower than those of permanent life insurance policies. This makes term life insurance an accessible option for individuals and families looking to secure their financial future without straining their budgets.

Policy Terms and Coverage Periods

The policy term of a term life insurance policy is a critical aspect, as it determines the duration of coverage. The most common policy terms are:

- 10-Year Term: As the name suggests, this policy provides coverage for a decade. It is often chosen by younger individuals with short-term financial goals, such as paying off a mortgage or covering children's education expenses.

- 20-Year Term: This policy term is suitable for those who require coverage for a slightly longer period, perhaps to ensure their children's financial security until they are independent.

- 30-Year Term: Offering the longest coverage period among the standard term life insurance options, this policy is ideal for individuals who want to ensure their loved ones' financial well-being for a significant portion of their lives.

It's important to note that while these are the standard policy terms, some insurers may offer customizable terms to meet specific needs. For instance, a policy term of 15 or 25 years might be available, depending on the insurer.

Renewal Options

One of the key considerations when choosing a term life insurance policy is whether it offers renewal options. Some policies allow for renewal at the end of the initial term, ensuring that the coverage can be extended. However, it's crucial to understand that the premiums for renewed policies are often higher, as the insured individual is typically older and may pose a higher risk to the insurer.

Benefits and Considerations

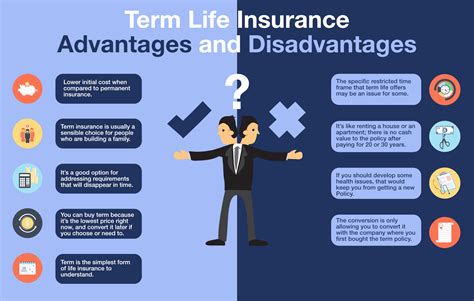

Term life insurance offers several benefits that make it an attractive choice for many individuals and families. Here are some key advantages to consider:

Affordability

As mentioned earlier, term life insurance is renowned for its affordability. The shorter policy terms and the absence of a cash value component (which is present in permanent life insurance policies) make the premiums significantly lower. This makes term life insurance an accessible option for those who may not have the financial means to afford more comprehensive coverage.

Flexibility

Term life insurance policies offer a high degree of flexibility. Insured individuals can choose the policy term that best aligns with their financial goals and needs. Whether it's covering a mortgage, ensuring children's education, or providing financial security during a career transition, term life insurance can be tailored to fit specific circumstances.

Customizable Coverage

Many term life insurance policies allow for customization of coverage amounts. Insured individuals can opt for higher coverage limits if they have more substantial financial responsibilities or lower limits if their needs are more modest. This flexibility ensures that the policy is tailored to the unique financial situation of the insured.

Simplified Application Process

In contrast to permanent life insurance policies, which often require extensive medical examinations and detailed health histories, the application process for term life insurance is generally simpler. Many insurers offer accelerated underwriting, which uses advanced analytics and data to assess an individual's health and lifestyle, making the process quicker and less intrusive.

Conversion Options

Some term life insurance policies come with conversion privileges, allowing the insured individual to convert their term policy into a permanent life insurance policy without undergoing a new medical exam. This is particularly beneficial for those whose financial circumstances change over time and who may need more comprehensive coverage as they age.

Performance Analysis and Real-World Examples

To understand the true value of term life insurance, it's essential to examine real-world scenarios and analyze the performance of these policies in different situations. Let's delve into a few examples to illustrate the impact of term life insurance.

Example 1: Providing for Children's Education

Consider a couple in their early thirties with two young children. They opt for a 20-year term life insurance policy, ensuring that if either parent passes away, the surviving spouse will have the financial means to provide for the children's education. The policy term aligns with the estimated time it will take for the children to complete their education, offering peace of mind and financial security during a vulnerable period.

Example 2: Mortgage Protection

A single individual purchases a home and takes out a 30-year term life insurance policy to ensure that if something were to happen to them, their beneficiaries would have the means to pay off the mortgage. This strategic move provides financial security and ensures that their loved ones can keep their home, even in the face of tragedy.

Example 3: Career Transition Coverage

Imagine a professional in their late forties who is considering a career change. They take out a 10-year term life insurance policy to provide financial protection during this transitional period. The policy ensures that if the worst were to happen, their family would be financially secure, regardless of the outcome of their career shift.

Evidence-Based Future Implications

As the world of finance and insurance evolves, it's essential to consider the future implications of term life insurance. Here are some insights based on current trends and expert predictions:

Technological Advancements

The insurance industry is increasingly leveraging technology to streamline processes and enhance customer experiences. This includes the use of advanced analytics for risk assessment and the development of digital platforms for policy management. These technological advancements are expected to make term life insurance even more accessible and efficient in the future.

Changing Demographics and Lifestyle Trends

Shifts in demographics and lifestyle choices are likely to impact the demand for term life insurance. As more individuals delay parenthood or choose to remain single, the need for coverage to provide for children may decrease. However, the rising cost of living and the increasing complexity of financial obligations may drive a continued demand for term life insurance to protect against unforeseen financial burdens.

Regulatory and Economic Factors

Regulatory changes and economic fluctuations can significantly impact the insurance industry. While it's challenging to predict specific outcomes, staying informed about these factors is essential for understanding how they might influence the future of term life insurance, including potential changes in policy terms, coverage options, and premium rates.

Conclusion

Term life insurance is a versatile and cost-effective tool for financial planning. By offering flexible coverage for specific periods, it provides individuals and families with the peace of mind that comes with knowing their loved ones will be financially secure, even in the event of an unexpected tragedy. Understanding the key features, benefits, and future implications of term life insurance is essential for making informed decisions about your financial future.

How much does term life insurance typically cost?

+

The cost of term life insurance varies based on several factors, including the policy term, coverage amount, and the age and health of the insured individual. On average, a 20-year term policy for a healthy individual in their 30s can range from 20 to 50 per month for $500,000 in coverage. However, it’s essential to obtain personalized quotes to understand the precise cost based on your unique circumstances.

Can I add riders or additional benefits to my term life insurance policy?

+

Yes, many term life insurance policies allow for the addition of riders, which are optional benefits that can enhance your coverage. Common riders include accelerated death benefits (which allow for early payment in case of terminal illness), waiver of premium (which waives premium payments if you become disabled), and child riders (which provide a small death benefit for your children if you pass away during the policy term).

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage simply expires. There is no cash value or payout upon expiration. However, some insurers offer conversion privileges, allowing you to convert your term policy into a permanent life insurance policy without undergoing a new medical exam. This ensures that you can maintain coverage even after the term policy ends.