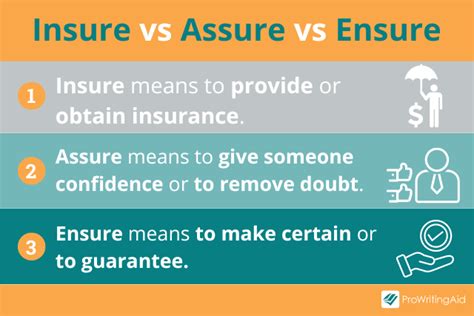

Insure Definition

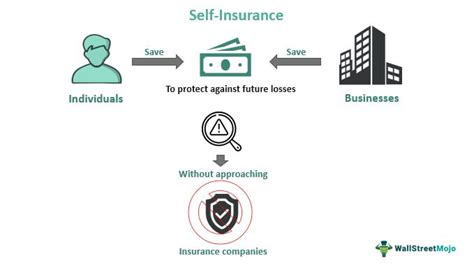

Insurance, a cornerstone of modern society, is a vital tool for managing risks and providing financial protection. It is a contractual agreement between an individual or entity (the policyholder) and an insurance company, wherein the insurer promises to compensate the policyholder for specific losses, damages, or liabilities in exchange for regular premium payments. The concept of insurance is deeply rooted in the principle of risk sharing, where the financial burden of unforeseen events is spread across a large group, making it more manageable for individuals and businesses.

The Nature of Insurance

At its core, insurance is a complex financial mechanism designed to offer peace of mind and stability in an uncertain world. It operates on the fundamental principle of indemnity, which ensures that the policyholder receives compensation for their loss without experiencing a financial gain. This means that the insurance payout should be sufficient to restore the insured to their financial position before the loss occurred, but not more.

The insurance industry is vast and diverse, catering to a wide range of needs and risks. From personal lines such as auto, home, and health insurance, to commercial lines covering businesses and their liabilities, the scope of insurance is broad. Each type of insurance policy is tailored to address specific risks, whether it's a car accident, a natural disaster, or a business interruption.

Key Components of an Insurance Policy

An insurance policy is a legal contract that outlines the rights and obligations of both the insurer and the policyholder. It consists of several key components, including:

- Declarations Page: This section provides an overview of the policy, including the policyholder’s name, address, the period of coverage, and the premium amount.

- Insuring Agreement: This is the heart of the policy, detailing the specific risks covered and the conditions under which the insurer will provide compensation.

- Exclusions: The policy will also outline what is not covered, known as exclusions. These can vary widely depending on the type of insurance and the insurer’s policies.

- Conditions: These are the rules and requirements that the policyholder must follow for the policy to remain in effect. Non-compliance with these conditions can void the policy.

- Definitions: The policy will define key terms and concepts used throughout the document to ensure clarity and avoid ambiguity.

| Policy Component | Description |

|---|---|

| Declarations Page | Provides essential policy information. |

| Insuring Agreement | Outlines the coverage and conditions. |

| Exclusions | Details what the policy does not cover. |

| Conditions | Specifies the policyholder's responsibilities. |

| Definitions | Defines key terms for clarity. |

The Insurance Process

The insurance process typically involves the following steps:

- Risk Assessment: The insurer evaluates the risk involved in insuring the policyholder. This assessment helps determine the premium and the terms of the policy.

- Policy Selection: The policyholder chooses an insurance policy that best suits their needs and budget.

- Premium Payment: The policyholder pays a premium, usually on a monthly or annual basis, to the insurer.

- Claims Process: When a covered loss occurs, the policyholder files a claim with the insurer. The insurer then assesses the claim and, if valid, provides compensation as outlined in the policy.

The Benefits of Insurance

Insurance offers a multitude of benefits that extend far beyond financial protection. Here are some key advantages:

- Financial Security: Insurance provides a safety net against unforeseen expenses, ensuring that policyholders can manage financial setbacks without significant hardship.

- Peace of Mind: Knowing that you are protected against various risks can bring a sense of calm and security, allowing individuals and businesses to focus on their goals without undue worry.

- Risk Management: Insurance enables effective risk management by helping policyholders identify, assess, and mitigate potential risks.

- Economic Stability: On a larger scale, insurance contributes to the stability of the economy by spreading risk and providing a mechanism for recovery after major losses or disasters.

- Business Continuity: For businesses, insurance is crucial for maintaining operations and protecting against financial ruin in the event of a loss.

The Role of Insurance in Society

Insurance plays a pivotal role in society by:

- Providing a social safety net that protects individuals and families from financial devastation.

- Encouraging responsible behavior by making individuals and businesses more aware of potential risks and the need for preparedness.

- Facilitating economic growth by enabling businesses to take calculated risks and invest in growth opportunities.

- Contributing to disaster recovery and resilience by providing a means for individuals and communities to rebuild after catastrophic events.

Types of Insurance

The insurance industry offers a wide array of policies to meet diverse needs. Here’s an overview of some common types of insurance:

Personal Insurance

- Auto Insurance: Provides coverage for vehicle-related incidents, including accidents, theft, and damage.

- Homeowners/Renters Insurance: Protects against losses related to homes, including damage, theft, and liability.

- Life Insurance: Offers financial protection to beneficiaries in the event of the policyholder’s death.

- Health Insurance: Covers medical expenses, including doctor visits, hospitalizations, and prescriptions.

Commercial Insurance

- Business Owners Policy (BOP): Combines property and liability coverage for small to medium-sized businesses.

- Commercial Property Insurance: Protects businesses against physical loss or damage to their property.

- Liability Insurance: Covers businesses for third-party claims, including bodily injury and property damage.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it protects professionals against negligence claims.

The Future of Insurance

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here are some key trends shaping the future of insurance:

- Digital Transformation: The rise of digital technology is transforming the way insurance is sold, serviced, and underwritten. Insurers are increasingly leveraging data analytics, artificial intelligence, and machine learning to enhance risk assessment, streamline processes, and personalize coverage.

- Telematics and Usage-Based Insurance: Telematics technology is enabling insurers to offer usage-based insurance policies, where premiums are determined by how, when, and where a vehicle is driven. This data-driven approach is particularly beneficial for younger drivers and those who drive infrequently.

- InsureTech Innovation: The emergence of InsureTech startups is disrupting the traditional insurance model with innovative solutions. These startups are leveraging technology to offer more flexible, customizable, and affordable insurance products, often with a focus on niche markets or specific consumer needs.

- Focus on Prevention: Insurers are increasingly recognizing the value of prevention over reaction. They are investing in initiatives and technologies that help policyholders mitigate risks and prevent losses, such as smart home devices, driver safety programs, and health and wellness apps.

The Impact of Regulation and Consumer Trends

The insurance industry is highly regulated to protect consumers and ensure fair practices. Regulatory bodies oversee insurance practices, enforce standards, and ensure consumer protection. As consumer expectations evolve, insurers are adapting to meet new demands for transparency, simplicity, and convenience. This includes offering more digital self-service options, providing clearer policy language, and enhancing claims processes to ensure timely and fair payouts.

Sustainable and Socially Responsible Insurance

There is a growing trend towards sustainable and socially responsible insurance practices. Insurers are recognizing the impact of environmental and social factors on risk and are incorporating sustainability into their strategies. This includes offering green insurance products, supporting environmental initiatives, and adopting sustainable business practices.

How does insurance work in practice?

+In practice, insurance operates through a series of steps. First, the policyholder pays a premium to the insurer, which assesses the risk involved and sets the terms of the policy. If a covered loss occurs, the policyholder files a claim with the insurer. The insurer then evaluates the claim and, if valid, provides compensation as outlined in the policy. This compensation helps the policyholder restore their financial position and manage the loss.

What are some common exclusions in insurance policies?

+Common exclusions in insurance policies can vary widely depending on the type of insurance and the insurer’s policies. Some common exclusions include acts of war, nuclear incidents, intentional acts, normal wear and tear, and pre-existing conditions. It’s important to carefully review the exclusions section of any insurance policy to understand what is not covered.

How does risk assessment impact insurance premiums?

+Risk assessment is a critical factor in determining insurance premiums. Insurers evaluate various factors, such as the policyholder’s age, health status, driving record, or the location and condition of their property. Based on this assessment, insurers set premiums that reflect the level of risk they are insuring. Higher-risk policyholders generally pay higher premiums to account for the increased likelihood of a claim.