Is Fire Insurance Required In California

In the state of California, fire insurance is not mandated by law, but it is highly recommended for all property owners and renters alike. With California's unique climate and susceptibility to wildfires, having adequate insurance coverage is essential to protect your assets and ensure financial stability in the face of potential disasters.

Understanding Fire Insurance and Its Benefits

Fire insurance, also known as property insurance or homeowners insurance, provides coverage for damage or loss caused by fires. This type of insurance is designed to protect your home, its contents, and often extends to cover additional living expenses if your residence becomes uninhabitable due to fire damage.

The benefits of fire insurance are twofold. Firstly, it offers financial protection in the event of a fire. Depending on the extent of the damage, repair or replacement costs can be significant. Fire insurance helps cover these expenses, reducing the financial burden on policyholders.

Secondly, fire insurance provides peace of mind. Knowing that you are financially prepared for the unexpected can alleviate stress and anxiety, especially in a state like California where wildfires are an ever-present risk.

California's Wildfire Risk and Insurance

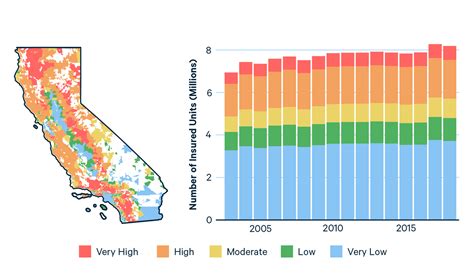

California's geography and climate make it particularly vulnerable to wildfires. The state's Mediterranean climate, characterized by hot, dry summers and mild, wet winters, creates ideal conditions for wildfires to spread rapidly.

In recent years, California has experienced some of the most destructive wildfires in its history. These fires have caused immense devastation, resulting in billions of dollars in property damage and loss of life. The 2018 Camp Fire, for instance, was the deadliest and most destructive wildfire in California's history, claiming 85 lives and destroying nearly 19,000 structures.

Given the increasing frequency and severity of wildfires in California, it is crucial for residents to understand their insurance options. While fire insurance is not a legal requirement, it is a wise investment to safeguard against the potential financial ruin that a wildfire can bring.

Types of Fire Insurance Coverage

Fire insurance policies typically fall into two main categories: replacement cost coverage and actual cash value coverage. Understanding the differences between these types of coverage is essential when choosing an insurance policy.

Replacement Cost Coverage

Replacement cost coverage, as the name suggests, provides coverage for the cost to replace your home and its contents in the event of a total loss. This type of coverage ensures that you can rebuild your home to its pre-loss condition without having to worry about depreciation. It is the most comprehensive and expensive form of fire insurance coverage.

Replacement cost coverage is particularly beneficial for newer homes or those with unique features or high-value items. It ensures that you can fully restore your home and replace any valuable possessions without incurring additional out-of-pocket expenses.

Actual Cash Value Coverage

Actual cash value coverage, on the other hand, takes into account depreciation when calculating the payout for a claim. This means that the insurance company will consider the age and condition of your home and its contents when determining the settlement amount.

While actual cash value coverage is more affordable than replacement cost coverage, it may not provide sufficient funds to fully rebuild or replace your property. This type of coverage is suitable for older homes or those with standard features and average-value possessions.

Additional Considerations for Fire Insurance in California

When obtaining fire insurance in California, there are several important factors to keep in mind:

- Policy Limits: Ensure that your policy limits are sufficient to cover the full replacement cost of your home and its contents. It is recommended to regularly review and update your policy limits to account for inflation and any improvements made to your property.

- Deductibles: Deductibles are the portion of a claim that you must pay out of pocket. Consider your financial situation and choose a deductible that you can comfortably afford.

- Coverage Exclusions: Read the fine print of your policy to understand any exclusions or limitations. Some policies may exclude certain types of fires or damage caused by specific events, such as wildfires or acts of nature.

- Additional Coverage: Depending on your needs and the value of your property, you may want to consider adding additional coverage options to your policy, such as coverage for personal belongings, living expenses, or liability protection.

Comparative Analysis: Fire Insurance Options in California

When shopping for fire insurance in California, it is beneficial to compare policies from multiple providers. Here is a table showcasing some of the leading insurance companies in the state and their average annual premiums for fire insurance policies (based on a sample home with a replacement cost of $500,000):

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| Allstate | $1,350 |

| Farmers Insurance | $1,150 |

| USAA | $1,050 |

| GEICO | $1,250 |

It is important to note that premiums can vary significantly based on individual factors such as location, property value, and the level of coverage desired. Obtaining quotes from multiple insurers and comparing policy details will help you find the best coverage at a competitive price.

Conclusion: The Importance of Fire Insurance in California

While fire insurance is not a legal requirement in California, the state's unique wildfire risks make it a critical component of financial planning for homeowners and renters. By understanding the types of coverage available and tailoring your policy to your specific needs, you can ensure that you have the protection necessary to recover from a fire-related disaster.

Remember, when it comes to fire insurance, it is better to be prepared and protected rather than left vulnerable and exposed to potential financial ruin. Take the time to review your insurance options and make an informed decision to safeguard your assets and peace of mind.

Frequently Asked Questions

Is fire insurance mandatory in California for homeowners?

+No, fire insurance is not legally required in California for homeowners. However, it is strongly recommended to protect your property and financial stability in the event of a wildfire.

What is the difference between replacement cost coverage and actual cash value coverage in fire insurance policies?

+Replacement cost coverage provides funds to replace your home and its contents at their current value, while actual cash value coverage considers depreciation and may not fully cover the cost of replacing your property.

How often should I review my fire insurance policy and coverage limits?

+It is recommended to review your fire insurance policy annually or whenever you make significant improvements or upgrades to your property. This ensures that your coverage limits are adequate and up-to-date.

Can I add additional coverage options to my fire insurance policy?

+Yes, many insurance companies offer additional coverage options such as personal belongings coverage, living expenses coverage, and liability protection. These options can enhance your protection and provide peace of mind.

What should I do if I need to file a fire insurance claim in California?

+If you experience fire damage and need to file a claim, contact your insurance company immediately. They will guide you through the claims process, which typically involves documenting the damage, providing estimates, and submitting a detailed claim form.