Life Insurance Definition

Life insurance is a vital financial tool that provides individuals and their families with a safety net during uncertain times. It serves as a contractual agreement between an insurance policyholder and an insurance company, ensuring financial security and peace of mind. In this article, we will delve into the world of life insurance, exploring its definition, purpose, and the various aspects that make it an essential component of personal finance.

Understanding the Concept of Life Insurance

At its core, life insurance is a means to protect loved ones from the financial burdens that arise when a primary income earner passes away. It offers a death benefit, a sum of money paid to the designated beneficiaries, which can be utilized to cover a range of expenses, including funeral costs, outstanding debts, daily living expenses, and even funding for the policyholder’s children’s education.

The concept of life insurance is founded on the principle of risk pooling, where a large group of individuals contribute to a collective fund. In the event of an insured individual's death, a portion of this fund is utilized to provide the promised death benefit to the beneficiaries. This mutual sharing of risk ensures that those who need financial support receive it during a challenging period.

Key Components of Life Insurance Policies

Life insurance policies are intricate contracts that outline the terms and conditions of coverage. Here are some key components to consider:

- Death Benefit: This is the primary reason individuals opt for life insurance. The death benefit is a lump-sum payment made to the beneficiaries upon the insured person's death. The amount can be customized based on the policyholder's needs and financial goals.

- Premiums: Policyholders are required to pay regular premiums, which are the cost of maintaining the insurance coverage. Premiums can be paid monthly, quarterly, semi-annually, or annually, depending on the policy and the insurer's options.

- Policy Term: Life insurance policies have a specified term or duration. Common terms include whole life (permanent coverage), term life (coverage for a set period), and universal life (flexible coverage with cash value accumulation). The term chosen depends on the policyholder's financial objectives and personal circumstances.

- Beneficiaries: Beneficiaries are the individuals or entities designated to receive the death benefit. Policyholders can name multiple beneficiaries and specify the distribution of the benefit among them.

- Rider Options: Riders are additional benefits or coverage enhancements that can be added to a base policy. Common riders include accelerated death benefits for terminal illnesses, waiver of premium in case of disability, and child riders to provide coverage for the policyholder's children.

Types of Life Insurance Policies

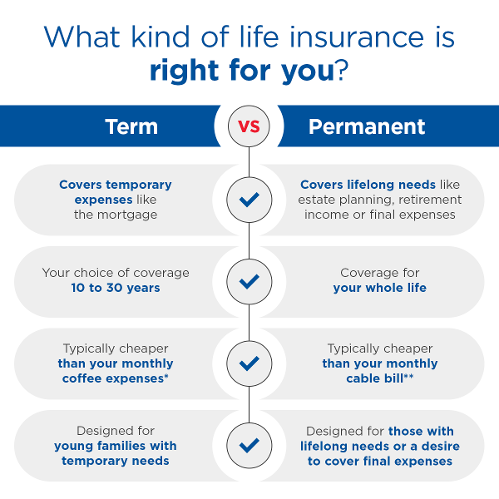

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type serves different financial goals and provides distinct benefits.

Term Life Insurance

Term life insurance is a straightforward and cost-effective option designed to provide coverage for a specific period, typically ranging from 10 to 30 years. It offers a fixed death benefit for a set premium during the policy term. If the insured individual passes away within the term, the beneficiaries receive the death benefit. However, if the policy term expires without a claim, the coverage ends, and the policyholder may need to seek new coverage.

| Term Life Insurance | Key Features |

|---|---|

| Affordable | Term life policies are generally more affordable compared to permanent life insurance, making them accessible to a wider range of individuals. |

| Flexibility | Policyholders can choose the term length based on their financial needs and goals, such as covering children's education or mortgage payments. |

| Clear-Cut Coverage | Term life policies provide straightforward coverage with a fixed death benefit, ensuring beneficiaries receive the promised amount. |

Permanent Life Insurance

Permanent life insurance, also known as whole life insurance, provides lifelong coverage. It offers a death benefit and accumulates cash value over time. The cash value can be used for various purposes, such as paying policy premiums, taking loans, or accessing the funds for specific financial needs. Permanent life insurance policies typically have higher premiums compared to term life insurance.

| Permanent Life Insurance | Key Features |

|---|---|

| Lifetime Coverage | Permanent life insurance policies provide coverage for the insured individual's entire life, ensuring peace of mind. |

| Cash Value Accumulation | These policies build cash value over time, which can be utilized for various financial goals, such as retirement planning or funding business ventures. |

| Tax Benefits | The cash value growth and death benefit of permanent life insurance policies are typically tax-free, offering significant tax advantages. |

The Importance of Life Insurance

Life insurance plays a crucial role in financial planning and provides numerous benefits to individuals and their families. Here are some key reasons why life insurance is essential:

- Financial Security: Life insurance offers a financial safety net, ensuring that loved ones are not burdened with financial struggles in the event of the policyholder's death. The death benefit can cover immediate expenses and provide long-term financial stability.

- Debt Repayment: The death benefit can be used to repay outstanding debts, such as mortgages, personal loans, or credit card balances, preventing financial hardship for the surviving family members.

- Income Replacement: Life insurance can replace the lost income of the primary earner, helping the family maintain their standard of living and meet ongoing expenses.

- Education Funding: The death benefit can be allocated towards funding the policyholder's children's education, ensuring they have access to quality educational opportunities.

- Legacy Planning: Life insurance allows individuals to leave a legacy for their loved ones, providing financial support and a sense of security for future generations.

Conclusion

Life insurance is a vital tool that empowers individuals to protect their loved ones and ensure their financial well-being. By understanding the different types of policies, their key components, and the importance of life insurance, individuals can make informed decisions to secure their family’s future. It is an essential aspect of personal finance, offering peace of mind and a safety net during life’s uncertainties.

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, while permanent life insurance offers lifelong coverage. Term life policies are more affordable but do not build cash value, while permanent life insurance accumulates cash value over time and provides tax benefits.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial goals and obligations. It’s recommended to consider factors such as outstanding debts, income replacement needs, and future financial goals. Consulting with a financial advisor can help determine the appropriate coverage amount.

Can I change my life insurance policy after purchasing it?

+Yes, it is possible to make changes to your life insurance policy. You can typically adjust the coverage amount, add or remove riders, or convert a term life policy to a permanent life policy. However, it’s important to review the policy’s terms and conditions and consult with your insurance provider to understand the implications of any changes.