Medicare Gap Insurance Cost

Medicare, the federal health insurance program for individuals aged 65 and over, is a vital component of the US healthcare system. However, it has certain limitations, leaving beneficiaries with out-of-pocket expenses, particularly in the form of deductibles, coinsurance, and copayments. This is where Medicare Gap Insurance, also known as Medigap, steps in to fill these financial gaps, providing coverage for these additional costs. Understanding the cost of Medicare Gap Insurance is crucial for anyone navigating the complexities of the Medicare system.

Understanding Medicare Gap Insurance

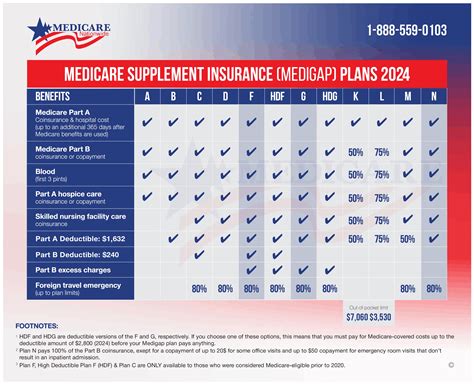

Medicare Gap Insurance, or Medigap, is a supplemental insurance policy designed to cover the costs that Original Medicare (Parts A and B) does not. These costs typically include deductibles, coinsurance, and copayments, which can be significant and often unexpected. Medigap policies are offered by private insurance companies and are standardized, meaning that Plan A in one state will offer the same benefits as Plan A in another state.

There are currently 10 standardized Medigap plans available (labeled A through N, excluding F and H), each offering a different set of benefits. The most basic plan, Plan A, covers only the Medicare Part A deductible, while the most comprehensive plan, Plan F, covers all Medicare-approved costs not covered by Original Medicare.

Factors Affecting Medicare Gap Insurance Cost

The cost of Medicare Gap Insurance can vary significantly based on several factors. These factors influence the premium that an individual will pay for their Medigap policy, and understanding them can help in making informed decisions about coverage.

Age

Age is a primary factor in determining Medigap premiums. In most states, insurance companies are allowed to use attained age rating, which means that your premium is based on your current age when you purchase the policy. This means that the older you are when you enroll, the higher your premium is likely to be. However, this also means that your premium will not increase as you get older, as long as you remain with the same insurance company.

Location

The cost of Medigap policies can vary significantly from one state to another. This variation is due to differences in state regulations, the cost of healthcare in the area, and the competition among insurance companies. For instance, a Medigap Plan F in Florida might have a different premium than the same plan in New York.

Gender

Historically, gender has been a factor in determining Medigap premiums. Insurance companies used to charge different rates for men and women, with women often paying higher premiums due to their generally longer lifespans. However, since the implementation of the Affordable Care Act (ACA) in 2014, this practice has been largely phased out. Now, most states prohibit insurance companies from charging different rates based on gender.

Health Status

In most states, insurance companies are prohibited from considering an individual’s health status when determining their Medigap premium. This means that even if you have pre-existing conditions, your premium for a Medigap policy should be the same as someone with no health issues. This is known as guaranteed issue rights, and it ensures that everyone has access to the same coverage regardless of their health.

Plan Type

The type of Medigap plan you choose will also impact the cost. As mentioned earlier, each plan offers a different set of benefits, and the more comprehensive the plan, the higher the premium. For example, a Plan F, which covers nearly all out-of-pocket costs, will typically have a higher premium than a Plan A, which only covers the Medicare Part A deductible.

Insurance Company

The insurance company you choose can also affect the cost of your Medigap policy. Different companies may offer the same plan, but with different premiums. This is because each company sets its own rates based on its own cost structure and profit goals. It’s always a good idea to compare rates from several companies to find the best value.

| Medigap Plan | Average Monthly Premium |

|---|---|

| Plan A | $150 - $200 |

| Plan F | $250 - $350 |

| Plan G | $200 - $300 |

| Plan N | $150 - $250 |

When to Enroll in Medicare Gap Insurance

The timing of your enrollment in Medicare Gap Insurance can also impact the cost. There are specific periods when you can enroll in Medigap without undergoing medical underwriting, which means the insurance company cannot deny you coverage or charge you more due to your health status.

Initial Enrollment Period

When you first become eligible for Medicare, you have a six-month Initial Enrollment Period (IEP) to enroll in a Medigap policy. This period starts the first day of the month you turn 65, and you are enrolled in Medicare Part B. During this IEP, you can enroll in any Medigap plan offered in your state without medical underwriting.

Open Enrollment Period

If you miss your IEP, you still have the opportunity to enroll during the six-month Open Enrollment Period (OEP), which begins the month you turn 65 and are enrolled in Medicare Part B. During this OEP, you can also enroll in any Medigap plan without medical underwriting, regardless of your health status. This is a valuable opportunity to secure coverage without the risk of being denied or charged more due to health issues.

Strategies for Managing Medicare Gap Insurance Costs

Managing the cost of Medicare Gap Insurance can be a complex task, but there are several strategies that can help. Here are some tips to consider:

Compare Plans and Premiums

Take the time to research and compare the different Medigap plans and their premiums. While the benefits of each plan are standardized, the premiums can vary significantly between insurance companies. Use online tools and resources to compare plans and find the best value for your needs.

Consider High-Deductible Plans

If you’re in good health and are comfortable with a higher deductible, you may want to consider a high-deductible Medigap plan. These plans typically have lower premiums, but you’ll pay more out-of-pocket if you need medical services. However, if you rarely need medical care, this could be a cost-effective option.

Review Your Coverage Regularly

Your healthcare needs and financial situation can change over time. It’s important to regularly review your Medigap coverage to ensure it still meets your needs. This might involve switching plans or insurance companies to find a better fit for your current situation.

Take Advantage of Special Enrollment Periods

If you miss your Initial Enrollment Period or Open Enrollment Period, you may still have opportunities to enroll in Medigap without medical underwriting. These Special Enrollment Periods (SEPs) can occur when you lose other health coverage or move to a new state. Understanding these SEPs can help you secure the coverage you need without the risk of being denied due to your health.

The Future of Medicare Gap Insurance

The landscape of Medicare Gap Insurance is continually evolving, influenced by changes in federal and state regulations, advancements in healthcare, and shifts in the insurance industry. One significant development is the potential for the elimination of the Medicare Part B deductible for certain high-deductible Medigap plans.

Currently, all Medigap plans, except for Plan G and Plan N, cover the Medicare Part B deductible. However, there is a proposal to eliminate this coverage for certain high-deductible Medigap plans, which would result in beneficiaries paying the Part B deductible out-of-pocket. This change is not yet in effect, but it is a potential development that could impact the cost and coverage of Medigap policies.

Another area of potential change is the expansion of Medigap plans. Currently, Medigap plans are standardized and limited to 10 options (Plans A through N, excluding F and H). However, there have been discussions about introducing new plans, such as a Plan M, which would offer additional coverage options for beneficiaries. While these changes are not yet implemented, they highlight the dynamic nature of the Medicare Gap Insurance landscape and the ongoing efforts to enhance coverage options.

Conclusion

Understanding the cost of Medicare Gap Insurance is crucial for anyone navigating the Medicare system. The cost of Medigap policies can vary significantly based on factors such as age, location, gender, health status, plan type, and insurance company. By considering these factors and taking advantage of enrollment periods, you can make informed decisions about your Medicare coverage and ensure that you have the financial protection you need.

Stay informed about potential changes in the Medicare Gap Insurance landscape, as these developments can impact your coverage and costs. Regularly review your Medigap policy to ensure it continues to meet your needs, and don't hesitate to seek professional advice if you have questions or concerns. With the right knowledge and strategy, you can effectively manage the cost of Medicare Gap Insurance and protect your financial well-being.

What is the difference between Medicare and Medicare Gap Insurance (Medigap)?

+Medicare is the federal health insurance program for individuals aged 65 and over, as well as certain younger people with disabilities. It is divided into several parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). Medicare Gap Insurance, or Medigap, is a supplemental insurance policy designed to fill the gaps in Original Medicare coverage, providing coverage for deductibles, coinsurance, and copayments.

When is the best time to enroll in Medicare Gap Insurance (Medigap)?

+The best time to enroll in Medigap is during your Initial Enrollment Period (IEP) or Open Enrollment Period (OEP). The IEP begins the first day of the month you turn 65 and are enrolled in Medicare Part B, and it lasts for six months. The OEP also lasts for six months and begins the month you turn 65 and are enrolled in Medicare Part B. During these periods, you can enroll in any Medigap plan without medical underwriting, ensuring you get the coverage you need regardless of your health status.

Can I switch my Medigap plan if I find a better option or my needs change?

+Yes, you can switch your Medigap plan if you find a better option or your needs change. However, it’s important to note that you may have to go through medical underwriting if you switch plans outside of your Initial Enrollment Period or Open Enrollment Period. This means the insurance company can deny you coverage or charge you more based on your health status. To avoid this, it’s a good idea to switch plans during a Special Enrollment Period (SEP), such as when you lose other health coverage or move to a new state.