Medicare Supplement Insurance

Medicare Supplement Insurance, often referred to as Medigap, is a crucial component of the healthcare system in the United States, offering essential coverage to individuals enrolled in Medicare. This comprehensive guide aims to unravel the complexities of Medigap, providing an in-depth analysis of its features, benefits, and implications for those seeking to enhance their healthcare coverage.

Understanding Medicare Supplement Insurance

Medicare Supplement Insurance is a set of standardized policies designed to fill the gaps left by Original Medicare, which includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Medigap plans provide additional coverage for expenses such as deductibles, coinsurance, and copayments, ensuring that individuals have more comprehensive financial protection during their healthcare journeys.

The importance of Medigap lies in its ability to address the limitations of Original Medicare. While Medicare provides a solid foundation for healthcare coverage, it often leaves beneficiaries with significant out-of-pocket expenses, especially for those with chronic conditions or frequent medical needs. Medigap plans, with their standardized benefits, offer a reliable solution to mitigate these financial burdens.

Standardized Benefits: A Key Advantage

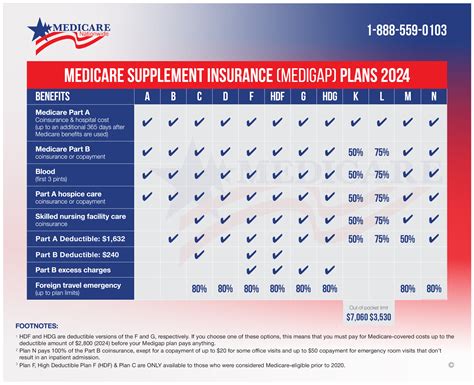

One of the standout features of Medigap plans is their standardization. Each Medigap plan, identified by a letter (such as Plan A, Plan B, or Plan G), offers a specific set of benefits. This standardization ensures that individuals can easily compare plans and make informed choices based on their unique healthcare needs and budget.

| Medigap Plan | Benefits Covered |

|---|---|

| Plan A | Basic coverage, including Part A coinsurance and hospital costs up to an additional 365 days. |

| Plan F | Comprehensive coverage, including all Medicare Part A and Part B deductibles, coinsurance, and copayments. |

| Plan G | Similar to Plan F, but excluding the Part B deductible. Often a more cost-effective option. |

By offering a range of plans with varying levels of coverage, Medigap ensures that individuals can find a plan that aligns with their healthcare requirements. Whether it's covering the cost of skilled nursing facility care or providing protection against high medical expenses, Medigap plans offer a tailored approach to healthcare coverage.

The Process of Enrolling in Medigap

Enrolling in a Medigap plan is a straightforward process, but it requires careful consideration and understanding of the eligibility criteria and enrollment periods. Generally, individuals who are enrolled in Original Medicare (Part A and Part B) are eligible to purchase a Medigap policy.

Key Enrollment Periods

The timing of enrollment in a Medigap plan can significantly impact the availability of plans and the cost of premiums. The two primary enrollment periods for Medigap are:

- Medicare Initial Enrollment Period (IEP): This period begins when an individual turns 65 or becomes eligible for Medicare due to a disability. Enrolling during the IEP ensures the widest range of plan options and, in most cases, the lowest premiums. There is a 6-month window for enrollment, and it's crucial to take advantage of this period to secure the best coverage.

- Medigap Open Enrollment Period (OEP): For individuals who missed their IEP, the OEP provides a second chance to enroll in a Medigap plan without undergoing medical underwriting. This period begins on the first day of the month in which the individual is both 65 years old and enrolled in Medicare Part B. The OEP lasts for 6 months, offering a critical opportunity to secure coverage without the risk of being declined due to pre-existing conditions.

Outside of these enrollment periods, individuals may still be able to enroll in a Medigap plan, but they may face medical underwriting, which can result in higher premiums or even denial of coverage based on their health status.

Choosing the Right Plan

Selecting the most suitable Medigap plan involves a careful assessment of one’s healthcare needs and budget. While some plans offer more comprehensive coverage, they may come with higher premiums. On the other hand, more affordable plans may provide limited coverage, leaving individuals with higher out-of-pocket expenses.

It's essential to evaluate the potential costs associated with various plans, including premiums, deductibles, and copayments. Additionally, considering the frequency of medical visits and the likelihood of needing specialized care can help individuals make an informed decision. Consulting with a licensed insurance agent who specializes in Medigap can provide valuable guidance during this process.

Medigap and Its Impact on Healthcare

The implementation of Medigap plans has had a significant impact on the healthcare landscape, particularly for individuals with Medicare coverage. By providing additional financial protection, Medigap has improved access to healthcare services and reduced the financial burden on Medicare beneficiaries.

Improved Access to Healthcare

Medigap plans have made it more feasible for individuals to seek necessary medical care without worrying about the financial implications. With coverage for deductibles and coinsurance, beneficiaries are more likely to utilize preventive services and address health issues early on, leading to better overall health outcomes.

Furthermore, Medigap's coverage of skilled nursing facility care and home healthcare services has enabled individuals to receive essential care in their preferred settings. This flexibility in care delivery enhances patient satisfaction and can lead to faster recovery times.

Financial Protection and Peace of Mind

One of the primary benefits of Medigap is its role in providing financial protection to Medicare beneficiaries. By covering a significant portion of out-of-pocket expenses, Medigap plans alleviate the financial strain associated with unexpected medical costs. This financial security is especially crucial for individuals on fixed incomes, ensuring they can access the care they need without compromising their financial stability.

The peace of mind that comes with Medigap coverage cannot be overstated. Knowing that one has a robust support system in place to manage healthcare expenses can reduce stress and anxiety, allowing individuals to focus on their health and well-being.

The Future of Medicare Supplement Insurance

As the healthcare industry continues to evolve, the role of Medigap is likely to remain a crucial aspect of healthcare coverage for Medicare beneficiaries. With an aging population and increasing healthcare costs, the demand for comprehensive insurance plans is expected to grow.

Potential Changes and Innovations

Looking ahead, there may be several developments in the Medigap landscape. One potential area of focus is the expansion of plan options to cater to the diverse needs of beneficiaries. This could include the introduction of more specialized plans, such as those tailored for individuals with specific chronic conditions or those requiring long-term care.

Additionally, the integration of technology and telemedicine services into Medigap plans could revolutionize the way healthcare is delivered and accessed. Telemedicine, in particular, has gained prominence during the COVID-19 pandemic, and its continued integration could enhance the convenience and accessibility of healthcare for Medigap beneficiaries.

From a regulatory standpoint, there may be ongoing efforts to streamline the enrollment process and enhance consumer protection. This could involve simplifying the language used in Medigap policies and providing clearer guidance on plan benefits and costs.

Ensuring Long-Term Sustainability

Maintaining the long-term sustainability of Medigap plans is essential to ensure that beneficiaries continue to have access to affordable and comprehensive coverage. This involves a delicate balance between providing adequate coverage and keeping premiums manageable for individuals on fixed incomes.

One strategy to achieve this balance is the exploration of cost-sharing initiatives. By encouraging beneficiaries to take a more active role in managing their healthcare costs, such as through the use of health savings accounts (HSAs) or flexible spending accounts (FSAs), individuals can have more control over their healthcare expenses while still benefiting from the comprehensive coverage offered by Medigap plans.

Additionally, promoting preventive care and health education can help reduce overall healthcare costs, benefiting both beneficiaries and insurance providers. By investing in preventive measures, individuals can avoid more costly treatments down the line, leading to a more sustainable healthcare system.

Conclusion

Medicare Supplement Insurance, or Medigap, is a vital component of the healthcare system, offering enhanced coverage and financial protection to individuals enrolled in Medicare. With its standardized benefits and range of plan options, Medigap provides a flexible and reliable solution for managing healthcare expenses.

From improving access to healthcare services to providing peace of mind, Medigap plans have had a positive impact on the lives of millions of Americans. As the healthcare landscape continues to evolve, the role of Medigap is likely to remain pivotal in ensuring that individuals have the coverage they need to maintain their health and well-being.

What is the difference between Medicare and Medigap?

+Medicare is a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities. It provides coverage for various healthcare services, but it has gaps in coverage, leaving beneficiaries with out-of-pocket expenses. Medigap, on the other hand, is a set of supplemental insurance policies designed to fill those gaps, offering additional coverage to reduce these expenses.

How much does a Medigap plan cost?

+The cost of a Medigap plan varies based on several factors, including the specific plan chosen, the insurance company, and the individual’s age and location. Generally, premiums for Medigap plans can range from around 100 to 300 per month, with some plans costing even more. It’s essential to shop around and compare plans to find the best fit for your budget.

Can I have both Medicare and Medigap coverage simultaneously?

+Yes, you can have both Medicare and Medigap coverage at the same time. Medigap plans are designed to work alongside Original Medicare, filling in the gaps in coverage. However, it’s important to note that Medigap plans only work with Original Medicare (Part A and Part B) and not with Medicare Advantage plans (Part C).