Money Market Account Is It Fdic Insured

Money Market Accounts (MMAs) are a popular choice for investors and savers seeking a higher interest rate than traditional savings accounts, while still offering liquidity and ease of access to their funds. However, one of the key concerns that potential MMA account holders often have is whether their deposits are insured by the Federal Deposit Insurance Corporation (FDIC). In this comprehensive guide, we will delve into the world of Money Market Accounts, exploring their features, benefits, and most importantly, their FDIC insurance coverage.

Understanding Money Market Accounts

A Money Market Account is a type of savings account offered by banks and financial institutions that provides a higher interest rate than standard savings accounts. These accounts are designed to offer a balance between the safety and liquidity of savings accounts and the potential for higher returns often associated with investments.

MMAs typically require a higher minimum balance to open and maintain the account, often ranging from a few thousand dollars to tens of thousands. In return, account holders can benefit from a higher interest rate, which is usually variable and tied to market rates, such as the federal funds rate.

Features of Money Market Accounts

Money Market Accounts offer a range of features that make them an attractive option for savers:

- Interest Earnings: One of the primary advantages of MMAs is the potential for higher interest earnings compared to regular savings accounts. The interest rate is often tiered, meaning the more you save, the higher the rate you can earn.

- Liquidity: Unlike investment accounts, MMAs provide easy access to funds. Account holders can typically make a limited number of transactions and withdrawals each month without incurring penalties.

- Check Writing: Many MMAs offer the convenience of check-writing capabilities, allowing account holders to write a limited number of checks each month.

- FDIC Insurance: A critical feature for many savers is the FDIC insurance coverage, which we will explore in detail later in this article.

Benefits of Money Market Accounts

Money Market Accounts offer several benefits, including:

- Higher Interest Rates: As mentioned, MMAs generally provide a higher interest rate than standard savings accounts, helping savers maximize their returns.

- Safety and Security: FDIC insurance adds an extra layer of protection, ensuring that even if the bank fails, the depositor’s funds are secure up to the insurance limit.

- Convenience: The ability to write checks and make electronic transfers makes MMAs a convenient option for managing funds.

- Accessibility: While MMAs often require a higher minimum balance, they are still widely accessible to a large portion of savers, providing an opportunity to earn higher interest on their savings.

FDIC Insurance and Money Market Accounts

Now, let’s address the primary concern: Is a Money Market Account FDIC insured? The answer is a resounding yes.

The Federal Deposit Insurance Corporation is a government agency that provides insurance on deposits held in banks and savings associations. FDIC insurance covers both individual and business accounts, including checking, savings, money market, and certificate of deposit (CD) accounts.

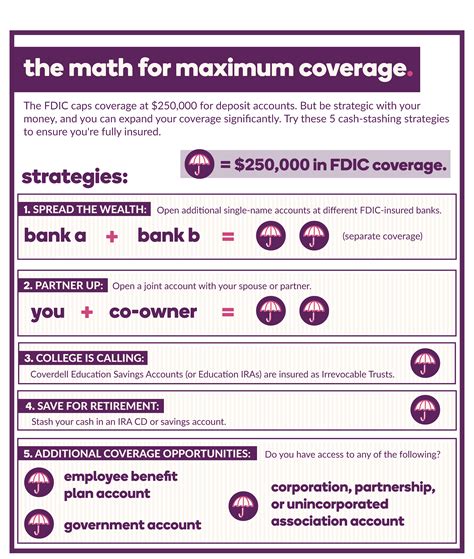

FDIC Insurance Coverage Limits

FDIC insurance provides coverage up to a specific limit. As of my last update in January 2023, the standard insurance amount is $250,000 per depositor, per insured bank, for each ownership category.

This means that if you have multiple accounts at the same bank, such as a checking account, savings account, and MMA, the total combined balance of these accounts is insured up to $250,000. If your balance exceeds this limit, you may consider spreading your funds across multiple banks to maximize insurance coverage.

Eligibility for FDIC Insurance

Not all financial institutions are FDIC insured. To be eligible for FDIC insurance, a bank or savings association must be a member of the FDIC and meet certain criteria and regulations.

When opening a Money Market Account, it's essential to verify that the financial institution is FDIC insured. Typically, this information is prominently displayed on the bank's website or in their branch locations. You can also check the FDIC's online BankFind tool to verify insurance status.

Calculating FDIC Insurance Coverage

To calculate your FDIC insurance coverage for your Money Market Account, you need to consider the ownership category of your account and any other accounts you hold at the same bank.

| Ownership Category | Insurance Limit |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $250,000 per co-owner |

| Revocable Trust Accounts | $250,000 per beneficiary |

| Irrevocable Trust Accounts | $250,000 per beneficiary |

| Corporations, Partnerships, and Other Entities | $250,000 per ownership interest |

Money Market Accounts vs. Other Savings Options

When considering a Money Market Account, it’s beneficial to compare it to other popular savings options to determine the best fit for your financial goals.

Money Market Accounts vs. Savings Accounts

Money Market Accounts and regular savings accounts share some similarities, but there are key differences:

- Interest Rates: MMAs typically offer higher interest rates than savings accounts.

- Minimum Balance: MMAs often require a higher minimum balance to open and maintain the account.

- Transactions: Savings accounts usually have stricter limits on transactions and withdrawals, while MMAs offer more flexibility.

- Check Writing: MMAs often provide check-writing capabilities, which regular savings accounts may not offer.

Money Market Accounts vs. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another popular savings option, but they differ significantly from Money Market Accounts:

- Interest Rates: CDs often provide higher interest rates than MMAs, but they come with a catch - a fixed term and early withdrawal penalties.

- Term: CDs have a fixed term, ranging from a few months to several years, during which you cannot access your funds without incurring penalties. MMAs, on the other hand, offer more liquidity.

- Flexibility: MMAs provide the flexibility to access your funds when needed, making them a more suitable option for those who may require frequent access to their savings.

Maximizing Returns with Money Market Accounts

If you’re considering opening a Money Market Account, here are some strategies to help you maximize your returns:

- Shop Around: Interest rates can vary significantly between financial institutions. Take the time to compare rates and choose an MMA that offers a competitive rate.

- Maintain a High Balance: Many MMAs offer tiered interest rates, meaning the more you save, the higher the rate you can earn. Aim to maintain a high balance to take advantage of these tiers.

- Avoid Excessive Transactions: While MMAs offer liquidity, excessive transactions can trigger penalties. Be mindful of the transaction limits and only make necessary withdrawals.

- Consider Online Banks: Online banks often offer competitive interest rates on MMAs due to their lower overhead costs. Consider opening an MMA with an online bank to potentially earn higher interest.

Conclusion: The Safety and Benefits of Money Market Accounts

Money Market Accounts offer a compelling combination of higher interest rates, liquidity, and FDIC insurance coverage. By understanding the features, benefits, and FDIC insurance limits, you can make an informed decision about whether an MMA is the right choice for your savings goals.

Remember, always verify the FDIC insurance status of your financial institution and consult with a financial advisor if you have specific questions or concerns about your savings strategy.

Can I have multiple Money Market Accounts to increase my FDIC insurance coverage?

+Yes, you can have multiple Money Market Accounts at different banks to increase your FDIC insurance coverage. Each account at a separate FDIC-insured bank will be insured up to the standard insurance limit of $250,000.

Are there any fees associated with Money Market Accounts?

+Fees can vary depending on the financial institution. Some banks may charge monthly maintenance fees or require a minimum balance to waive fees. It’s essential to review the account terms and conditions to understand any potential fees associated with an MMA.

Can I link my Money Market Account to other accounts for easier transfers?

+Yes, many banks allow you to link your MMA to other accounts, such as checking accounts, for convenient transfers. This can make it easier to manage your funds and take advantage of the higher interest rate offered by the MMA.

Are there any tax implications with Money Market Accounts?

+Interest earned on Money Market Accounts is generally taxable. You will receive a 1099-INT form from the bank at the end of the year, which you will need to report on your tax return. Consult with a tax professional for specific guidance on your tax obligations.