Most Affordable Auto Insurance California

When it comes to finding the most affordable auto insurance in California, it's important to understand the factors that influence insurance rates and explore the various options available to save money on your policy. With its diverse population and extensive road network, California offers a wide range of insurance providers and policies. In this comprehensive guide, we will delve into the world of auto insurance in the Golden State, providing you with valuable insights, tips, and strategies to secure the most cost-effective coverage tailored to your needs.

Understanding Auto Insurance in California

California is known for its strict regulations and comprehensive insurance requirements. The state’s insurance laws aim to protect drivers and ensure financial responsibility in the event of accidents or vehicle-related incidents. Understanding these regulations is crucial for navigating the insurance landscape and making informed decisions.

One of the key factors that influence auto insurance rates in California is the state's Insurance Rate Regulation. Unlike some other states, California employs a regulated market system, where insurance rates are approved and monitored by the California Department of Insurance (CDI). This regulation aims to prevent excessive rate hikes and ensure fair pricing for consumers.

Additionally, California's Vehicle Registration and Licensing Requirements play a significant role in auto insurance. Drivers must maintain valid insurance coverage to register their vehicles and obtain a license. This requirement ensures that all drivers on California roads have at least a basic level of financial protection.

Factors Affecting Auto Insurance Rates

Several factors contribute to the cost of auto insurance in California. By understanding these factors, you can make strategic choices to lower your insurance premiums. Here are some key considerations:

1. Your Driving History

Your driving record is a crucial factor in determining insurance rates. Insurance providers carefully assess your driving history, including any traffic violations, accidents, or claims. A clean driving record can lead to lower premiums, while multiple violations or accidents may result in higher rates.

2. Vehicle Type and Usage

The type of vehicle you drive and its intended usage impact your insurance costs. Insurance providers consider factors such as the make, model, and age of your vehicle, as well as its safety features and repair costs. Additionally, the distance you drive and the purpose of your trips (e.g., commuting, pleasure, business) can affect your rates.

3. Coverage and Deductibles

The level of coverage you choose and your deductible amount significantly influence your insurance premiums. Opting for higher coverage limits and lower deductibles typically results in higher premiums. On the other hand, selecting lower coverage and higher deductibles can lead to more affordable policies.

4. Location and Demographic Factors

Your geographic location within California plays a role in determining insurance rates. Insurance providers consider factors such as the population density, crime rates, and accident statistics in your area. Additionally, demographic factors like age, gender, and marital status can also impact your premiums.

5. Credit History

In California, insurance providers are allowed to use your credit score as a factor in determining insurance rates. A good credit history can lead to lower premiums, while a poor credit score may result in higher rates. It’s important to maintain a healthy credit profile to potentially save on insurance costs.

Strategies to Find Affordable Auto Insurance

Now that we’ve explored the factors affecting auto insurance rates, let’s delve into some effective strategies to find the most affordable coverage in California:

1. Compare Multiple Insurance Providers

California boasts a competitive insurance market with numerous providers offering a range of policies. Take the time to compare quotes from multiple insurers. Online comparison tools and insurance brokers can streamline this process, allowing you to quickly assess different options and find the most competitive rates.

2. Bundle Your Insurance Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them. Bundling can lead to significant savings and simplify your insurance management.

3. Choose the Right Coverage Levels

Evaluate your insurance needs and select coverage levels that provide adequate protection without unnecessary expenses. Assess your financial situation and risk tolerance to determine the appropriate coverage limits and deductibles. Balancing your coverage and premiums is key to finding the most cost-effective option.

4. Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations, practice defensive driving, and ensure you have valid driver’s license and vehicle registration. A spotless driving history demonstrates responsibility and can lead to substantial savings on your insurance policy.

5. Explore Discounts and Special Programs

Insurance providers in California offer a variety of discounts and special programs to attract customers and reward safe driving. Some common discounts include:

- Good Driver Discount: Reward for maintaining a clean driving record.

- Multi-Policy Discount: Savings for bundling multiple insurance policies.

- Safe Driver Program: Incentives for completing safe driving courses.

- Student Discount: Lower rates for students with good grades.

- Anti-Theft Device Discount: Savings for installing approved anti-theft devices.

Be sure to inquire about these discounts and programs when obtaining quotes. They can significantly reduce your insurance costs.

6. Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Work on improving and maintaining a good credit history. This not only benefits your insurance premiums but also other financial aspects of your life.

7. Consider Usage-Based Insurance

Some insurance providers in California offer usage-based insurance programs, also known as pay-as-you-drive or telematics insurance. These programs use data from a device installed in your vehicle to monitor your driving behavior, such as mileage, driving habits, and locations. If you have a safe and efficient driving pattern, you may qualify for lower premiums.

8. Shop Around Regularly

Insurance rates can fluctuate over time, and new providers may enter the market with competitive offers. It’s beneficial to regularly shop around and compare quotes, especially during policy renewal periods. This ensures you stay up-to-date with the most affordable options available.

The Importance of Comprehensive Coverage

While finding affordable auto insurance is essential, it’s equally crucial to ensure you have adequate coverage. California’s insurance regulations mandate certain minimum coverage limits, but it’s recommended to assess your specific needs and consider purchasing additional coverage to protect yourself and your assets.

Comprehensive coverage includes liability insurance, which covers damages and injuries you cause to others, as well as collision insurance, which covers damages to your own vehicle in the event of an accident. Additionally, consider uninsured/underinsured motorist coverage to protect yourself from financial losses caused by uninsured or underinsured drivers.

Consult with insurance professionals to understand the coverage options available and select the right combination for your situation.

Future Implications and Industry Insights

The auto insurance landscape in California is constantly evolving, driven by technological advancements, changing regulations, and market dynamics. Here are some future implications and industry insights to consider:

1. Technological Innovations

The rise of telematics and usage-based insurance programs is expected to continue, offering more personalized and data-driven insurance options. Additionally, advancements in autonomous vehicles and connected car technologies may impact insurance premiums and coverage requirements in the future.

2. Regulatory Changes

California’s insurance regulations are subject to periodic updates and amendments. Keeping up with these changes is essential to understand how they may impact insurance rates and coverage options. Stay informed about any proposed or enacted regulatory changes that could affect your insurance landscape.

3. Competitive Market Dynamics

California’s competitive insurance market is likely to remain active, with new providers entering and existing providers adapting to market demands. This competition can drive innovation and potentially lead to more affordable insurance options for consumers.

4. Consumer Education and Awareness

Empowering consumers with knowledge and understanding of the insurance industry is crucial. Education initiatives and awareness campaigns can help drivers make informed decisions, recognize their rights, and navigate the complex world of auto insurance effectively.

Conclusion

Finding the most affordable auto insurance in California requires a comprehensive understanding of the factors influencing rates and a strategic approach to policy selection. By comparing multiple providers, bundling policies, maintaining a good driving record, and exploring discounts, you can secure cost-effective coverage. Additionally, prioritizing comprehensive coverage ensures you’re adequately protected on California’s roads.

As the auto insurance industry evolves, staying informed and adapting to changes will be key to making the most of your insurance choices. Remember, affordable insurance doesn't have to compromise on quality or protection.

Frequently Asked Questions

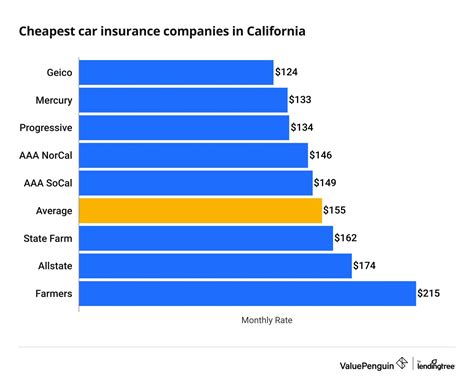

What is the average cost of auto insurance in California?

+

The average cost of auto insurance in California varies depending on several factors such as driving history, vehicle type, coverage levels, and location. According to recent data, the average annual premium in California is approximately 1,350, but this can range significantly based on individual circumstances.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any state-specific discounts available for auto insurance in California?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, California offers various state-specific discounts to encourage safe driving and responsible behavior. These include discounts for completing approved defensive driving courses, maintaining a good driving record, and installing approved anti-theft devices. It's important to inquire about these discounts when obtaining insurance quotes.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I get auto insurance without a license in California?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>No, it is generally not possible to obtain auto insurance without a valid driver's license in California. Insurance providers require proof of a valid license to assess your driving history and determine insurance rates. However, there may be specific circumstances or exceptions, so it's best to consult with insurance professionals for accurate guidance.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What are the minimum coverage requirements for auto insurance in California?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>California's minimum liability insurance requirements are 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and 5,000 for property damage per accident. These minimums are set by state law to ensure a basic level of financial protection. However, it’s recommended to consider additional coverage to protect yourself and your assets.

How can I improve my chances of getting affordable auto insurance in California?

+

To improve your chances of obtaining affordable auto insurance in California, focus on maintaining a clean driving record, exploring bundling options, comparing quotes from multiple providers, and taking advantage of available discounts. Additionally, regularly reviewing and updating your insurance policy can help you stay informed about the most cost-effective options.