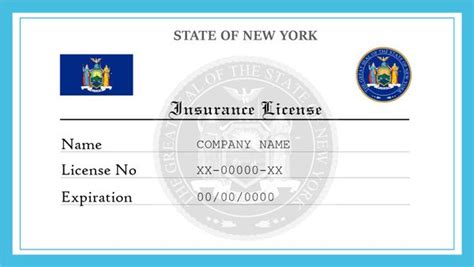

New York Insurance License Lookup

Are you searching for information about a specific insurance license in New York? Perhaps you're a consumer wanting to verify the legitimacy of an insurance agent, or maybe you're an insurance professional interested in understanding the licensing requirements and regulations in the state. In this comprehensive guide, we will delve into the world of insurance license lookup in New York, providing you with all the necessary details and insights.

The Importance of Insurance License Verification

In the insurance industry, license verification is a critical aspect of ensuring consumer protection and maintaining regulatory compliance. By conducting a license lookup, individuals can obtain valuable information about an insurance professional’s credentials, qualifications, and compliance history. This process empowers consumers to make informed decisions when choosing an insurance agent or broker and helps maintain trust in the industry.

For insurance professionals, license lookup services provide a means to demonstrate their legitimacy and professionalism. A valid and up-to-date license is a testament to an agent's commitment to staying informed about the latest industry developments and adhering to the strict standards set by the state. It also allows insurance companies and brokers to easily verify the credentials of their employees or partners.

New York’s Insurance Licensing Process

New York, being one of the largest insurance markets in the United States, has a comprehensive and well-regulated licensing process. The state’s Department of Financial Services (DFS) is responsible for overseeing the insurance industry and ensuring compliance with various regulations. Here’s an overview of the key steps involved in obtaining an insurance license in New York.

Prerequisites and Eligibility

To become an insurance agent or broker in New York, individuals must meet certain eligibility criteria. These typically include being at least 18 years old, possessing a high school diploma or equivalent, and having a clean criminal record. Additionally, applicants must pass a background check conducted by the DFS to ensure they meet the state’s standards of honesty and integrity.

Education and Exam Requirements

New York requires insurance license applicants to complete pre-licensing education courses specific to the line of authority they wish to obtain. These courses cover topics such as insurance principles, laws and regulations, and ethical practices. After completing the required education, applicants must pass the corresponding licensing exams. The DFS administers these exams, which assess an individual’s knowledge and understanding of insurance concepts and state regulations.

Application and Fingerprinting

Once an applicant has met the educational and exam requirements, they can proceed with the licensing application process. This involves completing an application form, providing personal and professional details, and paying the applicable licensing fees. Additionally, applicants must undergo fingerprinting to comply with the state’s security measures.

License Renewal and Continuing Education

Insurance licenses in New York are typically valid for a specific period, usually two to three years. To maintain their license, insurance professionals must complete continuing education (CE) requirements. These CE courses ensure that agents stay updated with the latest industry developments, regulations, and best practices. Completing the required CE hours is a prerequisite for license renewal.

License Lookup Options in New York

Now that we understand the licensing process, let’s explore the different ways to conduct an insurance license lookup in New York.

DFS License Verification Website

The Department of Financial Services provides an online license verification tool on its official website. This user-friendly platform allows individuals to search for insurance professionals by name, license number, or business entity. The search results provide detailed information about the license holder, including their name, license type, status, expiration date, and any associated appointments or registrations.

Third-Party Verification Services

In addition to the DFS website, several third-party platforms offer insurance license lookup services. These platforms aggregate data from various state insurance departments, including New York, and provide a centralized search interface. While these services may offer additional features and user-friendly interfaces, it’s essential to ensure the reliability and accuracy of the information they provide.

Direct Contact with Insurance Companies

Insurance companies and brokers often maintain internal databases of licensed agents and brokers. If you have specific concerns or queries about an insurance professional, you can directly contact the insurance company they are affiliated with. These companies can provide information about the agent’s credentials, appointments, and compliance history.

Key Information to Verify

When conducting an insurance license lookup, it’s crucial to pay attention to specific details to ensure the license is valid and in good standing. Here are some key aspects to consider:

License Type and Line of Authority

Insurance licenses in New York are categorized based on the line of authority they cover. Common license types include Life and Health, Property and Casualty, and Combination licenses. Understanding the license type and line of authority helps determine the scope of an agent’s practice and the types of insurance products they can offer.

License Status and Expiration

Checking the status of an insurance license is essential to verify its validity. Active licenses are those that are currently in good standing and allow the agent to conduct business. Inactive or expired licenses may indicate that the agent is no longer practicing or has failed to meet the renewal requirements. It’s crucial to ensure that the license you’re verifying is up-to-date and active.

Compliance and Disciplinary Actions

License lookup tools often provide information about any disciplinary actions or complaints associated with an insurance professional. This is a critical aspect of license verification as it helps identify potential red flags or instances of misconduct. Disciplinary actions may include fines, suspensions, or revocations of the license, indicating serious violations of insurance regulations.

Appointments and Affiliations

Insurance agents and brokers typically represent multiple insurance companies. License lookup results may include information about the companies an agent is appointed with, providing insight into their affiliations and the range of insurance products they can offer. This information is valuable for consumers seeking specific insurance coverage options.

The Role of Technology in License Verification

Advancements in technology have significantly enhanced the efficiency and accessibility of insurance license verification. Online platforms and digital tools have made it easier for individuals to conduct license lookups from the comfort of their homes or offices. These technological innovations have also enabled real-time updates and streamlined the verification process, reducing delays and enhancing consumer protection.

Furthermore, technology has facilitated the integration of license verification services with other insurance-related platforms. For example, insurance comparison websites and brokerage platforms often incorporate license verification features, allowing users to easily check the credentials of the agents or brokers they interact with.

Future Implications and Industry Trends

The insurance industry is constantly evolving, and license verification processes are likely to undergo further advancements and improvements. As technology continues to advance, we can expect more sophisticated and secure license verification systems. These systems may leverage blockchain technology, biometric authentication, or artificial intelligence to enhance data accuracy and security.

Additionally, the insurance industry is increasingly embracing digital transformation, with a shift towards digital insurance products and services. This digital evolution may impact license verification processes, potentially leading to the development of integrated platforms that combine license verification with other insurance-related functions, such as policy issuance and claims management.

Conclusion

Insurance license lookup is a vital process that ensures consumer protection and promotes transparency in the insurance industry. In New York, the Department of Financial Services and various third-party platforms provide accessible and user-friendly tools for license verification. By understanding the licensing process, key information to verify, and the role of technology, individuals can make informed decisions and contribute to a robust and trustworthy insurance market.

How often should I verify an insurance agent’s license?

+It is recommended to verify an insurance agent’s license before entering into any insurance-related transactions. Additionally, periodic license checks, especially before renewing policies or making significant changes, can help ensure the agent remains in good standing.

What should I do if I find disciplinary actions against an insurance agent during a license lookup?

+If you discover disciplinary actions against an insurance agent, it is advisable to further investigate the nature and severity of the violations. Consider discussing your concerns with the insurance company or seeking alternative agents to ensure you receive the best possible service and protection.

Can I verify an insurance license if I only have the agent’s name?

+Yes, most license lookup tools allow searches by name. However, it’s essential to ensure that you have the correct and complete name of the insurance agent to obtain accurate results. Providing additional information, such as the agent’s license number or business entity, can further enhance the accuracy of the search.