Ny Car Insurance Quotes

When it comes to car insurance in New York, finding the best quote can be a complex and often confusing process. With a wide range of factors influencing premiums and a diverse market of insurance providers, it's crucial to understand the specifics of your needs and how to navigate the insurance landscape effectively. This guide aims to provide an in-depth analysis of the New York car insurance market, offering valuable insights and strategies to help you secure the most advantageous quotes.

Understanding the New York Car Insurance Market

The car insurance market in New York is characterized by its competitiveness and diversity. A multitude of insurance carriers operate in the state, offering a variety of coverage options and price points. This competitive environment can work to your advantage, as it drives insurers to offer competitive rates and personalized policies. However, it also means that finding the right provider requires a nuanced understanding of your specific needs and the market dynamics.

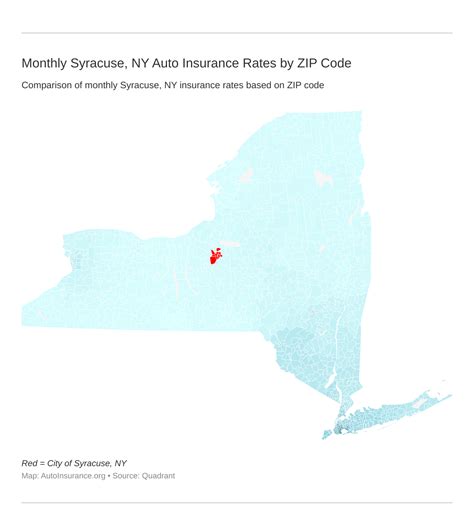

Several key factors influence car insurance rates in New York. These include your age, gender, driving record, the type of vehicle you drive, and your location within the state. Urban areas like New York City typically see higher insurance rates due to increased traffic and the higher likelihood of accidents and claims. Additionally, factors such as credit score and the number of miles driven annually can also impact your premium.

Key Considerations for New York Residents

Understanding the unique aspects of the New York insurance market is essential for securing the best quote. The state requires all drivers to carry minimum liability coverage, including bodily injury liability and property damage liability. However, it’s often advisable to opt for additional coverage types to ensure adequate protection in the event of an accident. These can include collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

One notable feature of New York's car insurance landscape is the state's no-fault insurance system. This means that, in the event of an accident, your own insurance policy will cover your damages and injuries, regardless of who was at fault. This system can provide a smoother claims process, but it also means that insurers take a more comprehensive view of your driving history and personal circumstances when determining your premium.

Strategies for Securing the Best Ny Car Insurance Quotes

Navigating the New York car insurance market effectively requires a strategic approach. Here are some key strategies to consider when seeking the best quotes:

Shop Around and Compare

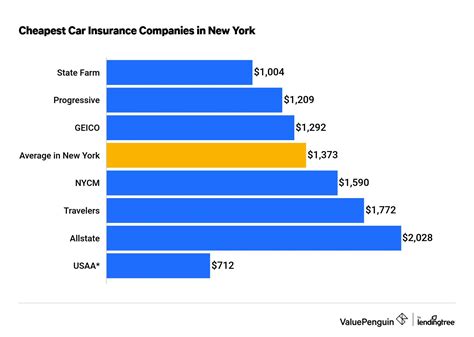

Given the competitive nature of the New York insurance market, it’s essential to compare quotes from multiple providers. Online quote comparison tools can be a valuable resource, allowing you to quickly and easily gather quotes from various insurers. However, be sure to also consider reaching out to local agents or brokers who can provide personalized recommendations and insights tailored to your specific needs.

Understand Your Coverage Options

Familiarize yourself with the various coverage types and their associated costs. While it’s tempting to opt for the lowest premium, ensuring you have adequate coverage is crucial. Consider your personal circumstances, such as the value of your vehicle, your financial situation, and your risk tolerance. Balancing cost and coverage is key to finding the right policy.

Explore Discounts and Savings

Insurance providers in New York offer a range of discounts that can significantly reduce your premium. These can include discounts for safe driving, multiple policies (e.g., bundling car and home insurance), loyalty rewards, and even occupational or educational discounts. Be sure to inquire about these discounts when obtaining quotes and explore how you can qualify for them.

Review Your Policy Regularly

Car insurance needs can change over time. It’s important to review your policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for unnecessary features. Regular policy reviews can also help you identify potential savings and take advantage of new discounts or promotional offers.

Consider Bundling Policies

If you have multiple insurance needs, such as car, home, or renters’ insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle multiple policies, providing a convenient and cost-effective solution. Additionally, having all your insurance needs with one provider can streamline the claims process and provide better overall coverage.

Performance Analysis and Real-World Examples

To illustrate the impact of these strategies, let’s consider a real-world example. Imagine a 30-year-old driver in New York City with a clean driving record. By shopping around and comparing quotes from various insurers, they were able to secure a liability-only policy for 1,200 annually. However, by exploring additional coverage types and taking advantage of discounts for safe driving and bundling their car and renters' insurance, they were able to reduce their premium to 900 annually, a significant savings of $300.

This example highlights the importance of understanding your coverage options and exploring all available discounts. By taking a strategic approach and tailoring your policy to your specific needs, you can secure substantial savings while maintaining adequate coverage.

Future Implications and Industry Insights

The New York car insurance market is likely to continue evolving, influenced by technological advancements and changing consumer preferences. The rise of usage-based insurance (UBI) models, which tailor premiums based on actual driving behavior, is one trend to watch. Additionally, the increasing adoption of electric vehicles and autonomous driving technologies may impact insurance needs and costs in the future.

Insurance providers in New York are also likely to continue investing in digital platforms and online tools, making it even easier for consumers to obtain quotes and manage their policies. This digital transformation can further enhance the competitiveness of the market and provide consumers with greater convenience and control over their insurance needs.

| Insurance Type | Average Annual Premium (NY) |

|---|---|

| Liability Only | $1,000 - $1,500 |

| Full Coverage | $1,200 - $2,000 |

| Usage-Based Insurance | Varies based on driving behavior |

As the New York car insurance market adapts to these changes, staying informed and proactive in your insurance choices will be crucial. Regularly reviewing your policy, exploring new coverage options, and staying up-to-date with industry trends can help you navigate this evolving landscape and secure the best value for your insurance needs.

What is the average cost of car insurance in New York?

+The average cost of car insurance in New York varies based on factors such as age, location, and coverage type. On average, liability-only policies range from 1,000 to 1,500 annually, while full coverage policies can cost between 1,200 and 2,000. However, these are just averages, and actual premiums can vary significantly based on individual circumstances.

How can I reduce my car insurance premiums in New York?

+There are several strategies to reduce your car insurance premiums in New York. These include shopping around and comparing quotes from multiple insurers, understanding your coverage options and tailoring your policy to your needs, exploring discounts and savings opportunities, and regularly reviewing your policy to ensure you’re not paying for unnecessary coverage.

What are some common discounts offered by New York car insurance providers?

+New York car insurance providers offer a range of discounts, including safe driving discounts, multiple policy discounts (bundling car and home insurance), loyalty rewards, and occupational or educational discounts. Be sure to inquire about these discounts when obtaining quotes and explore how you can qualify for them.