Ny Pfl Tax

The New York State Personal Income Tax, commonly referred to as the NY PFL Tax, is a crucial aspect of the state's tax system. This tax is specifically designed to provide benefits and protection for employees and employers, making it a unique and essential component of the state's financial landscape. In this comprehensive article, we will delve into the intricacies of the NY PFL Tax, exploring its history, purpose, and the significant impact it has on both individuals and businesses in the state.

Understanding the NY PFL Tax

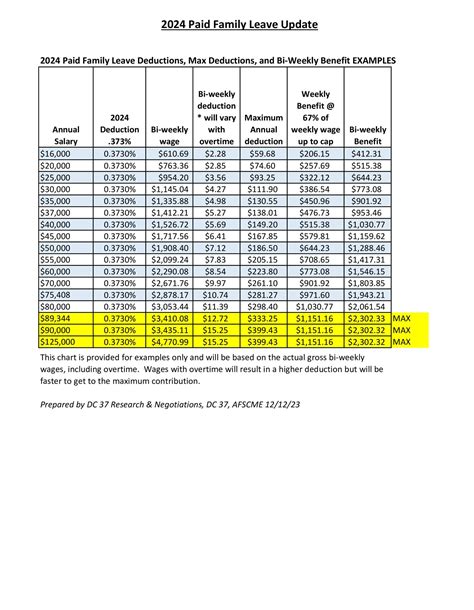

The New York State Personal Income Tax, or NY PFL Tax, is a payroll-based tax that supports the state’s Temporary Disability Insurance (TDI) and Family Leave Programs. It is administered by the New York State Department of Taxation and Finance and is a key revenue source for these essential social programs.

The tax was initially introduced to offer financial support to employees during periods of temporary disability or when taking time off to care for a new child or family member. Over the years, it has evolved to provide more comprehensive benefits, ensuring that New Yorkers have access to crucial support systems when facing challenging life events.

Key Features and Benefits of the NY PFL Tax

The NY PFL Tax offers several significant benefits, which have made it a cornerstone of New York’s social safety net:

- Temporary Disability Insurance (TDI): This program provides income replacement for employees who are unable to work due to a non-work-related illness, injury, or pregnancy. It offers up to 26 weeks of benefits, ensuring that individuals can focus on their recovery without the added stress of financial burden.

- Family Leave Program: This program allows employees to take time off to care for a new child or a seriously ill family member. It provides up to 12 weeks of paid leave, helping families navigate through challenging times and ensuring the well-being of their loved ones.

- Flexible and Comprehensive Coverage: The NY PFL Tax covers a wide range of employees, including full-time, part-time, and even self-employed individuals. This inclusivity ensures that a significant portion of the state's workforce has access to these vital benefits.

- Employer Responsibilities: While the tax is primarily a payroll-based deduction, employers also play a crucial role. They are responsible for withholding the appropriate tax amounts from employee paychecks and for remitting these funds to the state on a timely basis. This collaborative effort ensures the smooth functioning of the program.

Historical Perspective and Evolution

The roots of the NY PFL Tax can be traced back to the early 20th century when the state recognized the need for a social safety net to support its growing population. The initial disability insurance program was introduced in the 1940s, and over the decades, it has undergone significant transformations to meet the evolving needs of New Yorkers.

One of the most notable evolutions was the introduction of the Paid Family Leave Program in 2018. This expansion reflected the state's commitment to supporting working families and ensuring that they could balance their professional responsibilities with personal caregiving duties. The program has since become a model for other states looking to implement similar initiatives.

The tax structure itself has also evolved to keep pace with changing economic conditions and the need to support an expanding range of benefits. Regular reviews and adjustments ensure that the tax remains fair and sustainable, benefiting both employees and employers.

The Impact of NY PFL Tax on Individuals and Businesses

The NY PFL Tax has a profound impact on both individuals and businesses within the state.

For individuals, the tax provides a vital safety net during times of personal crisis. Whether it's recovering from an injury, welcoming a new family member, or caring for a sick loved one, the benefits offered by the NY PFL Tax can make a significant difference in their lives. It ensures that they can access the support they need without compromising their financial stability.

From a business perspective, the NY PFL Tax contributes to a more resilient and productive workforce. By offering comprehensive leave and disability benefits, businesses can attract and retain talented employees. Moreover, the tax encourages a culture of support and understanding, fostering a positive work environment. Employers also benefit from reduced absenteeism and improved employee morale, leading to increased productivity and overall business success.

Performance Analysis and Comparative Insights

The NY PFL Tax has consistently demonstrated its effectiveness in providing financial support to New Yorkers in need. Since its inception, the programs funded by this tax have helped millions of individuals and families navigate through challenging circumstances.

When compared to other states, New York's PFL programs stand out for their comprehensiveness and generosity. While many states offer similar disability insurance programs, New York's inclusion of a robust family leave component sets it apart. This unique feature has not only benefited New Yorkers but has also inspired other states to explore similar initiatives.

| Metric | NY PFL Tax | Other State X |

|---|---|---|

| Benefit Duration | 26 weeks TDI, 12 weeks Family Leave | Varies, often shorter durations |

| Employee Coverage | Broad coverage, including part-time and self-employed | Varies, may exclude certain employee categories |

| Employer Responsibilities | Withholding and remittance duties | Similar duties, but may vary in complexity |

The table above provides a comparative overview of the NY PFL Tax against a hypothetical State X, highlighting the unique features and advantages of New York's program.

Future Implications and Ongoing Developments

Looking ahead, the NY PFL Tax is poised to continue its crucial role in supporting New Yorkers. With an ever-changing economic landscape and evolving societal needs, the tax will likely undergo further refinements to ensure its sustainability and effectiveness.

One area of focus may be expanding the tax base to include additional sources of income, such as gig economy earnings. This would ensure that a broader range of workers have access to the benefits provided by the NY PFL Tax. Additionally, ongoing reviews of benefit levels and eligibility criteria will ensure that the programs remain accessible and adequate for the diverse needs of the state's population.

The NY PFL Tax is a testament to the state's commitment to the well-being of its residents. As New York continues to lead the way in social welfare initiatives, the tax will remain a vital component of its progressive policies.

What is the rate of the NY PFL Tax for the current year?

+The rate for the NY PFL Tax is subject to change annually. For the current year, the rate is set at 0.12% of an employee’s wages, up to a maximum taxable wage of $139,800. This rate is applied to both the TDI and Family Leave components of the tax.

Are there any tax credits or incentives for employers related to the NY PFL Tax?

+Yes, New York State offers a PFL Tax Credit to encourage employers to provide additional benefits to their employees. This credit can offset a portion of the employer’s PFL Tax liability. The specific credit amount and eligibility criteria are determined annually by the state.

How does the NY PFL Tax impact small businesses?

+Small businesses may face unique challenges when it comes to the NY PFL Tax. While the tax provides valuable benefits to their employees, the administrative responsibilities can be burdensome. However, with proper planning and understanding of the tax obligations, small businesses can effectively manage these responsibilities and ensure compliance.