Old Car Insurance

Old car insurance, often referred to as classic car insurance or vintage car insurance, is a specialized type of coverage designed to cater to the unique needs and requirements of owners and enthusiasts of classic and vintage vehicles. These vehicles, typically over 25 years old, hold a special place in automotive history and are cherished for their classic styling, engineering, and cultural significance. However, insuring such vehicles presents a unique set of challenges due to their age, rarity, and often high value.

This comprehensive guide aims to delve into the intricacies of old car insurance, providing an expert-level analysis to assist classic car owners in navigating the complex world of insurance policies. By understanding the key factors, benefits, and considerations associated with this specialized insurance, classic car enthusiasts can make informed decisions to protect their prized possessions.

The Unique World of Old Car Insurance

Old car insurance operates within a niche market, catering to a specific segment of the automotive industry. Unlike standard auto insurance policies, which are designed for modern vehicles primarily used for daily commuting, old car insurance policies are tailored to meet the unique needs of classic and vintage vehicles. These vehicles, often carefully restored and maintained, serve a variety of purposes, including participation in shows, exhibitions, and occasional pleasure drives.

The value of these vehicles can be significantly higher than their modern counterparts, not just in terms of monetary worth but also in their historical and sentimental value. This makes the need for specialized insurance coverage even more critical. Old car insurance policies recognize these unique aspects, offering coverage that goes beyond the standard collision and comprehensive coverage found in regular auto insurance.

Key Considerations for Old Car Insurance

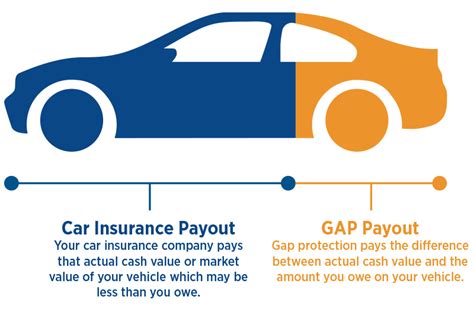

- Agree Value Coverage: One of the primary benefits of old car insurance is the option for Agreed Value Coverage. This type of coverage ensures that in the event of a total loss or damage beyond repair, the insured receives the agreed-upon value of the vehicle, which is typically determined through a thorough evaluation by classic car experts. This approach differs from the actual cash value approach used in standard auto insurance, which often results in lower payouts due to depreciation.

- Limited Mileage: Many old car insurance policies include restrictions on annual mileage. This is because classic and vintage vehicles are often used sparingly, typically for special occasions or events. These mileage restrictions not only help keep insurance premiums lower but also contribute to the preservation of these historic vehicles by limiting their wear and tear.

- Storage Requirements: Insurance providers often require that classic cars be stored in secure, covered locations when not in use. This is to mitigate the risks of theft, vandalism, and natural disasters. Proper storage can also help maintain the vehicle’s condition, ensuring its value and appeal remain intact.

It's important to note that old car insurance policies can vary significantly between providers, with each insurer offering unique coverage options, restrictions, and benefits. Therefore, it's crucial for classic car owners to thoroughly research and compare different policies to find the one that best suits their specific needs and circumstances.

Understanding the Benefits of Old Car Insurance

Old car insurance offers a range of benefits tailored to the unique needs of classic car owners. These benefits go beyond the standard coverage provided by regular auto insurance policies, ensuring that classic cars are protected in a way that recognizes their historical value and the specialized care they require.

Comprehensive Coverage for Historic Vehicles

Old car insurance policies provide comprehensive coverage that extends beyond the basic liability and collision coverage offered by standard auto insurance. This specialized coverage recognizes the unique value and historical significance of classic and vintage vehicles. It takes into account factors such as the vehicle’s age, rarity, and the extensive time and resources invested in its restoration and maintenance.

For instance, old car insurance policies often include coverage for parts that may be difficult to source or expensive to replace. This is especially important for classic cars, as original parts can be scarce and may require special ordering or even custom fabrication. Additionally, these policies may offer coverage for specific events or activities that classic car owners frequently engage in, such as car shows, rallies, and historic races.

| Coverage Type | Description |

|---|---|

| Parts Coverage | Covers the cost of rare or hard-to-find parts required for repairs. |

| Event Coverage | Provides protection during car shows, rallies, and other events. |

| Agreed Value | Ensures payment of the agreed-upon value in case of a total loss. |

Customized Agreed Value Coverage

One of the standout features of old car insurance is the Agreed Value coverage option. This approach to valuation differs significantly from the actual cash value used in standard auto insurance policies. With agreed value coverage, the insured and the insurer agree upon a specific value for the vehicle, typically based on a thorough evaluation by classic car experts.

This agreed value is not subject to depreciation, ensuring that the insured receives the full agreed-upon amount in the event of a total loss or damage beyond repair. This approach provides peace of mind for classic car owners, knowing that their vehicle's unique value is recognized and protected. It also eliminates the need for lengthy and often contentious negotiations about the vehicle's worth after an incident.

Limited Mileage Benefits

Many old car insurance policies include restrictions on annual mileage. While this may seem like a limitation, it’s actually a benefit tailored to the nature of classic car ownership. Classic cars are often used sparingly, typically for special occasions, car shows, or pleasure drives on weekends or holidays. These limited mileage requirements not only help keep insurance premiums lower but also contribute to the preservation of these historic vehicles by minimizing wear and tear.

Furthermore, some insurance providers offer incentives for classic car owners who can demonstrate that their vehicle is stored for extended periods, such as during the winter months. These incentives can include reduced premiums or additional coverage benefits, further enhancing the value of old car insurance policies.

Tailored Coverage for Classic Car Enthusiasts

Old car insurance policies are designed with the specific needs and circumstances of classic car enthusiasts in mind. These policies recognize that classic cars are more than just modes of transportation; they are investments, pieces of automotive history, and often, cherished collectibles. As such, old car insurance offers a range of coverage options and benefits that cater to the unique nature of classic car ownership.

Specialized Coverage Options

In addition to the standard coverage types, such as liability, collision, and comprehensive, old car insurance policies offer a variety of specialized coverage options. These include:

- Agreed Value Coverage: As mentioned earlier, this coverage ensures that the insured receives the agreed-upon value of their classic car in the event of a total loss or damage beyond repair. This valuation is typically based on the vehicle's condition, rarity, and historical significance, providing a more accurate reflection of its true worth.

- Parts Coverage: Classic cars often require specific, hard-to-find parts for repairs and maintenance. Old car insurance policies often include coverage for these parts, ensuring that the insured has access to the necessary components without incurring significant out-of-pocket expenses.

- Event Coverage: Classic car owners frequently participate in car shows, rallies, and other automotive events. Old car insurance policies often provide coverage for these events, ensuring that the vehicle is protected during transportation, display, and competition.

Preserving the Classic Car Experience

Old car insurance policies are designed to enhance and protect the classic car ownership experience. By offering specialized coverage options and tailored benefits, these policies allow classic car enthusiasts to enjoy their vehicles without the worry of potential financial burdens associated with ownership. For instance, the limited mileage requirements and incentives for extended storage periods not only keep premiums low but also contribute to the preservation of these historic vehicles.

Furthermore, old car insurance policies often include access to a network of classic car specialists, providing insureds with valuable resources for maintenance, restoration, and repair. This network of experts can ensure that the classic car is maintained to the highest standards, preserving its value and condition over time.

Future Implications and Industry Trends

The old car insurance market is expected to experience continued growth and evolution in the coming years, driven by several key factors and industry trends. As the classic car market continues to gain popularity and recognition, the demand for specialized insurance coverage is likely to increase. This trend is particularly evident among younger generations, who are showing a growing interest in classic and vintage vehicles, not just as investments but also as unique and personalized modes of transportation.

The Rising Interest in Classic Cars

The classic car market is witnessing a resurgence, with a growing number of enthusiasts seeking out vintage vehicles for both their historical value and their unique driving experience. This trend is driven by a variety of factors, including the nostalgia associated with classic cars, the increasing affordability of older models, and the growing appreciation for automotive craftsmanship and design from past eras.

As more individuals become passionate about classic cars, the demand for specialized insurance coverage will naturally increase. Old car insurance providers will need to adapt to this changing landscape, offering innovative coverage options and services that cater to the needs and preferences of this growing demographic.

Technological Advancements and Digital Innovations

The insurance industry as a whole is undergoing significant transformation due to technological advancements and digital innovations. These changes are expected to have a profound impact on the old car insurance market, offering new opportunities for enhanced customer service, streamlined processes, and more efficient risk assessment and management.

For instance, the use of telematics and advanced analytics can provide more accurate risk profiling for classic car owners, leading to more precise pricing and coverage options. Additionally, digital platforms and online tools can offer enhanced convenience and accessibility for policyholders, allowing them to manage their policies, file claims, and access resources more efficiently.

Sustainability and Environmental Considerations

With growing concerns about sustainability and environmental impact, the classic car industry is also adapting to these changing priorities. This trend is likely to influence the development of old car insurance policies, with insurers offering incentives and coverage options that encourage responsible ownership and maintenance practices.

For example, insurance providers may offer discounts or other benefits for classic car owners who adopt environmentally friendly practices, such as using biofuels or participating in carbon offset programs. These initiatives not only contribute to a more sustainable future but also enhance the overall appeal and value of classic cars in the eyes of environmentally conscious enthusiasts.

What is old car insurance, and why is it necessary for classic car owners?

+

Old car insurance, also known as classic car insurance, is a specialized type of coverage designed for vehicles that are typically over 25 years old. These vehicles often have a higher value, both monetarily and sentimentally, than modern cars. Old car insurance is necessary for classic car owners to protect their investment, ensuring they receive the full value of their vehicle in the event of an accident or total loss. It also provides specialized coverage for parts and events that standard auto insurance may not cover.

How does Agreed Value Coverage work in old car insurance policies?

+

Agreed Value Coverage is a unique feature of old car insurance. It involves the insured and the insurer agreeing upon a specific value for the classic car, which is typically based on its condition, rarity, and historical significance. In the event of a total loss, the insured receives the full agreed-upon value, ensuring their classic car’s unique worth is protected.

What are some of the specialized coverage options available in old car insurance policies?

+

Old car insurance policies offer a range of specialized coverage options, including Agreed Value Coverage, Parts Coverage (for hard-to-find or rare parts), and Event Coverage (for car shows, rallies, and other automotive events). These options ensure that classic car owners receive comprehensive protection tailored to their unique needs and circumstances.

How do technological advancements impact the future of old car insurance?

+

Technological advancements, such as telematics and advanced analytics, are expected to revolutionize the old car insurance industry. These innovations will enable more accurate risk profiling, leading to better-priced and more tailored coverage options for classic car owners. Additionally, digital platforms will enhance the overall customer experience, providing policyholders with greater convenience and accessibility.