Onlyfans Tax Form

In the ever-evolving world of online content creation, platforms like OnlyFans have emerged as a popular choice for influencers, artists, and content creators to monetize their work directly with their fans. As with any income-generating activity, tax obligations come into play, and understanding the tax landscape is crucial for content creators on OnlyFans. This comprehensive guide will delve into the world of OnlyFans tax forms, exploring the necessary documentation, filing processes, and key considerations to ensure creators stay compliant and maximize their financial gains.

The OnlyFans Tax Landscape

OnlyFans, a subscription-based content platform, has gained traction for its ability to offer a direct connection between content creators and their audience. As a result, it has become a significant income source for many, necessitating a thorough understanding of tax responsibilities.

The tax landscape for OnlyFans creators can vary based on several factors, including their country of residence, the country where the income is earned, and the nature of the content they produce. Here's a breakdown of the key considerations:

Income Classification

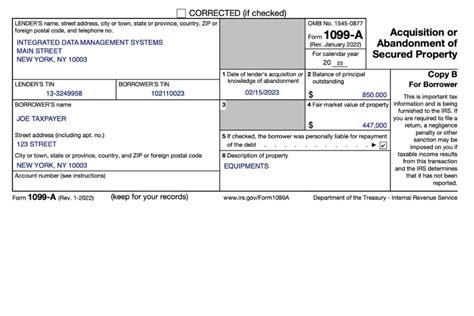

The income generated from OnlyFans can be classified as self-employment income or business income, depending on the creator’s setup and the laws of their jurisdiction. This classification determines the applicable tax rates and filing requirements.

Tax Jurisdiction

Creators must consider the tax implications in both their country of residence and the country where their income is earned. This is particularly relevant for OnlyFans creators who have a global audience and may earn income from multiple jurisdictions.

For instance, U.S.-based creators are subject to federal and state taxes. The Internal Revenue Service (IRS) treats income from OnlyFans as self-employment income, which means creators must pay self-employment tax in addition to income tax. This tax is applied to the net earnings from self-employment, which is calculated by subtracting allowable business expenses from gross income.

In contrast, UK-based creators are typically subject to Income Tax and National Insurance Contributions. The tax rates and thresholds may vary based on the individual's income level and circumstances.

Tax Rates and Thresholds

Tax rates and thresholds can vary significantly based on the jurisdiction. Creators must understand these rates and thresholds to estimate their tax liability accurately. For example, in the U.S., the self-employment tax rate is 15.3% (including Social Security and Medicare taxes), and income tax rates can range from 10% to 37%, depending on the creator’s taxable income.

Reporting Requirements

OnlyFans creators must comply with the reporting requirements of their jurisdiction. This often involves filing tax returns annually and making estimated tax payments throughout the year to cover their tax liability. Failure to comply with these requirements can result in penalties and interest charges.

| Country | Tax Authority | Reporting Frequency |

|---|---|---|

| United States | Internal Revenue Service (IRS) | Annual (Form 1040) with quarterly estimated tax payments |

| United Kingdom | Her Majesty's Revenue and Customs (HMRC) | Annual (Self Assessment) with optional quarterly updates |

| Canada | Canada Revenue Agency (CRA) | Annual (T1 General) with optional quarterly installments |

| Australia | Australian Taxation Office (ATO) | Annual (Tax Return) with optional Pay As You Go (PAYG) installments |

Essential Tax Forms for OnlyFans Creators

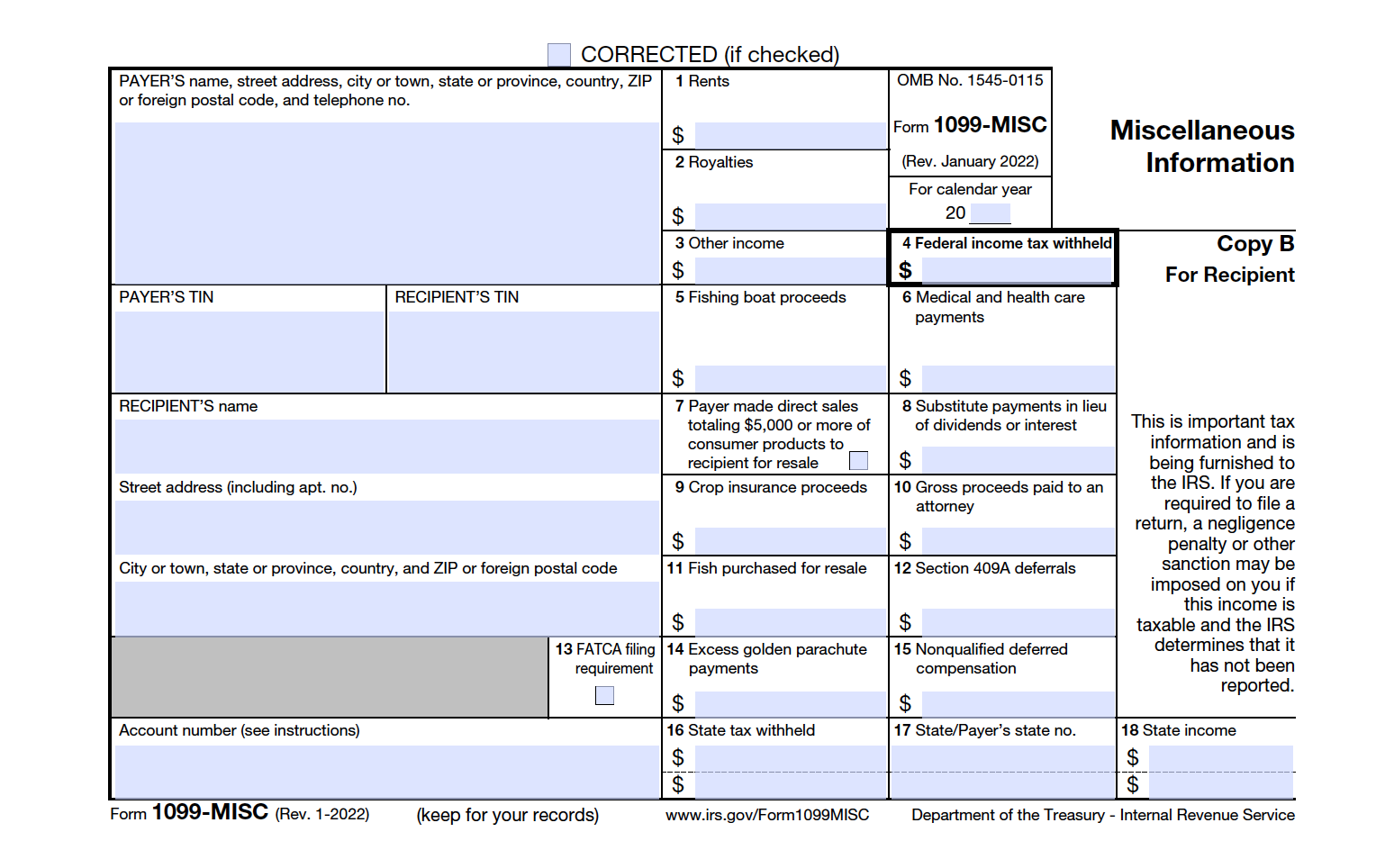

Understanding the relevant tax forms is crucial for OnlyFans creators to ensure they meet their tax obligations accurately and on time. Here’s a breakdown of the key tax forms creators should be familiar with, based on their jurisdiction:

United States

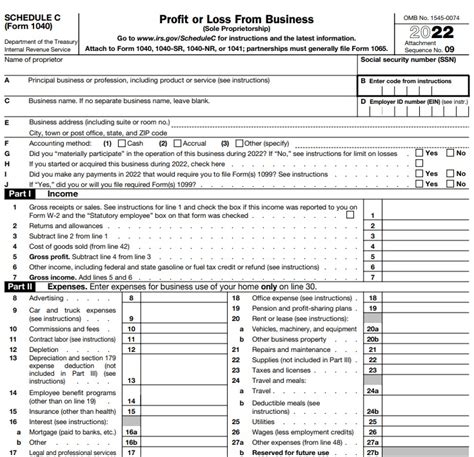

Form 1040: This is the primary tax return form for individuals in the U.S. It includes spaces to report various types of income, including self-employment income. Creators must complete Schedule C (Profit or Loss from Business) to report their OnlyFans earnings and expenses.

Schedule SE: This form is used to calculate and report self-employment tax. Creators must complete this schedule to determine their self-employment tax liability, which is then included on their Form 1040.

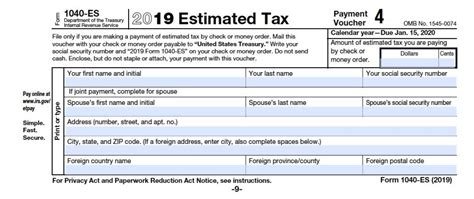

Estimated Tax Payments: To cover their tax liability throughout the year, creators may need to make estimated tax payments. These payments are typically due quarterly and are reported on Form 1040-ES.

United Kingdom

Self Assessment: In the UK, the Self Assessment process is used to declare income and calculate tax liabilities. Creators must register for Self Assessment and complete a tax return annually. This process includes reporting income from OnlyFans and any allowable expenses.

National Insurance Contributions: UK creators must also pay National Insurance Contributions based on their earnings. The rates and thresholds for National Insurance are different from Income Tax and are calculated separately.

Canada

T1 General: Canadian creators must file a T1 General tax return annually to report their income, including income from OnlyFans. This form includes schedules for reporting business income and expenses.

Business Number (BN): Creators who operate a business or are self-employed may need to register for a Business Number with the Canada Revenue Agency. This number is used for various tax programs, including GST/HST, payroll, and import/export.

Australia

Individual Tax Return: Australian creators must complete an individual tax return (usually Form NAT 2557) to report their income, including income from OnlyFans. The tax return includes sections for reporting business income and expenses.

Pay As You Go (PAYG) Installments: Creators may need to make PAYG installments throughout the year to cover their tax liability. These payments are based on estimates of their income and tax liability for the year.

Maximizing Deductions and Expenses

As a self-employed individual or business owner, OnlyFans creators can deduct certain expenses to reduce their taxable income. These deductions can significantly impact their tax liability and overall financial health. Here’s a detailed look at the key deductions and expenses creators can consider:

Business Expenses

Creators can deduct a wide range of business expenses directly related to their OnlyFans activities. These expenses can include:

- Production Costs: Equipment, software, and studio rental for content creation.

- Marketing and Promotion: Advertising, social media management, and promotional materials.

- Subscription Services: Tools and platforms used for content management and delivery.

- Office Expenses: Rent, utilities, and office supplies for a dedicated workspace.

- Travel and Accommodation for content-related trips and events.

Home Office Deduction

If creators have a dedicated home office space exclusively used for their OnlyFans business, they may be eligible for a home office deduction. This deduction can cover a portion of their home expenses, including rent, mortgage interest, utilities, and maintenance.

Mileage and Transportation Costs

Creators who use their vehicles for business purposes, such as traveling to events or meeting with clients, can deduct mileage expenses. The IRS provides standard mileage rates, which can simplify the calculation process.

Meals and Entertainment

Meals and entertainment expenses related to business activities can also be deductible. This can include meals with clients, business meetings, and networking events. However, these expenses are subject to certain limitations and restrictions.

Professional Services

Creators may incur expenses for professional services, such as accounting, legal advice, website development, and marketing consultancy. These expenses can be fully deductible, provided they are directly related to the creator’s OnlyFans business.

Employee or Contractor Costs

If creators hire employees or engage contractors for their OnlyFans business, they can deduct the wages and other related expenses. This includes payroll taxes, benefits, and any contract fees paid to independent contractors.

Education and Training

Creators who invest in their professional development through courses, workshops, or conferences can deduct these expenses. This includes tuition fees, books, and other related costs.

Depreciation and Amortization

Creators can claim depreciation on equipment and assets used for their OnlyFans business. This allows them to deduct a portion of the asset’s cost over its useful life. Amortization can be claimed for intangible assets like software and website development costs.

Navigating Tax Compliance and Filing

Ensuring tax compliance and filing tax returns accurately is a critical aspect of managing the financial health of your OnlyFans business. Here’s a comprehensive guide to help you navigate the tax filing process and ensure you meet your tax obligations effectively:

Setting Up Your Tax Structure

Before you begin filing taxes, it’s important to establish your tax structure. This decision will impact your tax obligations and the forms you need to file. The two primary structures for OnlyFans creators are:

- Sole Proprietorship: This is the default structure for most creators. Your OnlyFans income is considered personal income, and you report it on your individual tax return. This structure is simple but may not offer the same tax benefits as other structures.

- Limited Liability Company (LLC): Forming an LLC can provide creators with liability protection and tax advantages. An LLC allows you to pass profits and losses directly to your personal tax return while offering flexibility in how you're taxed (as a corporation or a sole proprietorship/partnership). However, setting up and maintaining an LLC requires additional paperwork and fees.

Tracking Income and Expenses

Accurate record-keeping is crucial for tax compliance. Keep detailed records of all your OnlyFans income, including subscription fees, tips, and any other revenue streams. Also, track all your business expenses, as these can be deducted to reduce your taxable income.

Consider using accounting software or spreadsheets to organize your financial data. This will make it easier to prepare your tax returns and provide accurate financial statements if needed.

Understanding Tax Deadlines

Staying aware of tax deadlines is essential to avoid penalties and interest charges. Here are some key deadlines to keep in mind:

- Estimated Tax Payments: If your OnlyFans income exceeds certain thresholds, you may need to make quarterly estimated tax payments. These payments are due on specific dates throughout the year.

- Annual Tax Returns: Depending on your jurisdiction, you'll need to file your annual tax return by a certain deadline. For instance, in the U.S., the deadline for filing your individual tax return is typically April 15th.

- Extensions: If you're unable to meet the annual tax return deadline, you can request an extension. However, keep in mind that an extension only provides more time to file, not more time to pay your taxes.

Completing Your Tax Return

When it’s time to file your tax return, make sure you have all the necessary forms and documentation. Here are some key steps to follow:

- Gather Information: Collect all your financial records, including income statements, expense receipts, and any other relevant documentation.

- Choose Your Filing Method: You can file your tax return online or use paper forms. Online filing is often faster and more convenient, but paper forms may be necessary if you're filing complex returns or have unique circumstances.

- Complete the Forms: Fill out the appropriate tax forms for your jurisdiction. This may include Form 1040 (U.S.), Self Assessment (UK), T1 General (Canada), or individual tax return forms (Australia) and any associated schedules or attachments.

- Calculate Your Tax Liability: Use the information from your forms to calculate your total tax liability. This includes income tax, self-employment tax, and any other applicable taxes.

- Make Your Payment: If you owe taxes, you must pay the full amount by the deadline. You can pay online, by check, or through other payment methods offered by your tax authority.

- E-File or Mail Your Return: Submit your completed tax return by the deadline. If you're filing online, follow the instructions provided by your tax authority's e-filing system. If you're mailing your return, ensure it's postmarked by the deadline.

Dealing with Audits

While tax audits are relatively rare, it’s important to be prepared in case your tax return is selected for review. Here are some tips to navigate an audit effectively:

- Stay Calm: Receiving a notice for an audit can be stressful, but it's important to remain calm and cooperate with the tax authorities.

- Gather Your Records: Compile all the financial records and documentation related to your OnlyFans business. This includes income statements, expense receipts, and any other relevant information.

- Respond Promptly: Reply to the audit notice within the specified timeframe. Provide all the requested information and be as transparent as possible.

- Consider Professional Help: If you're unsure about the audit process or have complex tax issues, consider hiring a tax professional or accountant to assist you.

Future Outlook and Industry Insights

The world of online content creation and platforms like OnlyFans continue to evolve, offering exciting opportunities for creators and influencing the digital content landscape. As we look ahead, here are some key trends and insights that shape the future of OnlyFans and the broader creator economy:

Diversification of Content and Monetization

OnlyFans has demonstrated that creators can successfully monetize various forms of content, from adult entertainment to fitness routines, cooking tutorials, and more. As the platform continues to grow, we can expect to see even more diverse content types and creative ways to monetize them.

This diversification also opens up opportunities for collaborations and cross-promotion between creators from different niches, further enhancing the value and reach of the platform.

Integration of New Technologies

The integration of emerging technologies like virtual reality (VR) and augmented reality (AR) could revolutionize the OnlyFans experience. These technologies could enhance the immersive nature of content, offering fans an even more engaging and personalized experience.

Additionally, blockchain and cryptocurrency technologies may play a more significant role in the future, providing creators with new avenues for monetization and potentially reducing the platform's fees.

Enhanced Creator Support and Tools

OnlyFans and similar platforms are likely to invest in providing creators with better tools and resources to manage their content, fans, and business. This could include more sophisticated analytics, improved content management systems, and enhanced security features to protect creator and fan data.

We may also see the development of dedicated creator support teams, offering personalized guidance and assistance to help creators maximize their potential on the platform.

Global Expansion and Regulatory Challenges

As OnlyFans continues its global expansion, it will face various regulatory challenges in different countries. These challenges may include tax compliance issues, data privacy regulations, and varying cultural norms and sensitivities.

The platform's ability to navigate these challenges while maintaining its core values and creator-friendly environment will be crucial for its long-term success and sustainability.

Embracing Sustainability and Creator Welfare

The creator economy has brought to the forefront the importance of supporting and empowering creators. OnlyFans and similar platforms are likely to place increasing emphasis on creator welfare, including mental health support, financial literacy education, and resources to help creators build sustainable businesses.

By prioritizing creator well-being, platforms can foster a positive and supportive community, leading to long-term success and engagement.

Conclusion

Navigating the world of OnlyFans tax forms and obligations can be complex, but with careful planning and a thorough understanding of your jurisdiction’s tax laws, it’s a manageable process. By staying organized, keeping detailed records, and taking advantage of the available deductions, creators can ensure they’re compliant with their tax obligations while maximizing their financial gains.

As the creator economy continues to thrive and evolve, platforms like OnlyFans will play a