Pos Insurance Meaning

In the world of finance and insurance, various terms and concepts can be confusing, especially for those new to the industry or seeking a better understanding of their coverage. One such term that often raises questions is "POS insurance." In this comprehensive article, we will delve into the meaning, workings, and implications of POS insurance, offering a detailed guide to help readers navigate this financial landscape with confidence.

Understanding POS Insurance

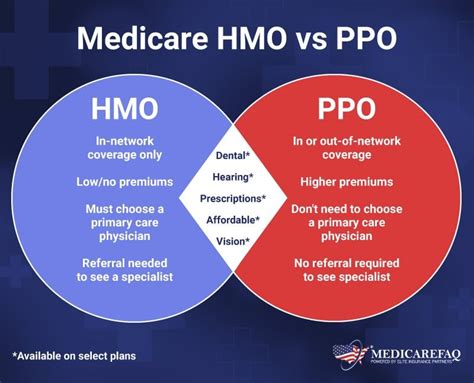

POS, an acronym for Point of Service, is a type of health insurance plan that combines elements of both health maintenance organizations (HMO) and preferred provider organizations (PPO). This unique blend of features aims to provide policyholders with flexibility in their healthcare choices while also offering cost-effective coverage.

At its core, POS insurance operates on the principle of managing healthcare costs by steering policyholders towards a network of preferred healthcare providers. These providers have negotiated rates with the insurance company, ensuring that costs remain manageable for both the insured individual and the insurer.

Key Characteristics of POS Insurance

- Primary Care Physician (PCP) Requirement: Similar to HMOs, POS insurance plans typically require policyholders to select a primary care physician (PCP) who will coordinate their healthcare needs. The PCP acts as a gatekeeper, providing referrals for specialty care when necessary.

- In-Network Benefits: When policyholders choose to receive care from providers within the insurer’s network, they enjoy the benefits of lower out-of-pocket costs. These include reduced copays, deductibles, and coinsurance rates.

- Out-of-Network Options: Unlike traditional HMOs, POS insurance plans offer some flexibility by allowing policyholders to seek care from out-of-network providers. However, this comes at a higher cost, as out-of-network services may not be fully covered, and policyholders may face higher out-of-pocket expenses.

- Referral Flexibility: While a PCP’s referral is generally required for specialty care, POS plans often provide more freedom compared to HMOs. Policyholders can often choose to receive referrals from their PCP or directly from another in-network provider, offering a level of convenience and choice.

| Characteristic | POS Insurance |

|---|---|

| PCP Requirement | Yes, with referral flexibility |

| In-Network Benefits | Lower costs, preferred providers |

| Out-of-Network Options | Available, but with higher costs |

| Referral Process | PCP or in-network provider referrals |

How POS Insurance Works

To grasp the mechanics of POS insurance, it’s essential to understand the step-by-step process involved in utilizing this type of health coverage.

Selecting a POS Plan

Policyholders begin by choosing a POS insurance plan that suits their healthcare needs and budget. This involves evaluating factors such as the network of providers, coverage limits, and out-of-pocket expenses.

Choosing a Primary Care Physician (PCP)

Upon enrolling in a POS plan, policyholders must select a PCP who will oversee their healthcare. The PCP acts as a trusted advisor, guiding the policyholder towards appropriate healthcare services and ensuring cost-effectiveness.

Receiving In-Network Care

When seeking healthcare services, policyholders are encouraged to use providers within the insurer’s network. These providers have negotiated rates, ensuring lower costs for both the policyholder and the insurer. In-network care is typically more affordable, with reduced copays and deductibles.

Utilizing Out-of-Network Options

While in-network care is preferred, POS insurance plans allow policyholders to seek care from out-of-network providers if necessary. This flexibility is particularly beneficial when specialized care is required or when traveling outside the network’s coverage area. However, it’s important to note that out-of-network care may result in higher out-of-pocket expenses, as the insurance company may not fully cover these costs.

The Role of Referrals

In a POS plan, referrals play a crucial role in managing healthcare costs and ensuring appropriate utilization of specialty care. Policyholders must obtain a referral from their PCP or an in-network provider before seeking specialty care. This referral process helps the insurer track and manage healthcare expenses while also ensuring that policyholders receive the necessary care.

Benefits and Considerations of POS Insurance

POS insurance offers a unique set of advantages and considerations that policyholders should carefully evaluate when choosing their healthcare coverage.

Advantages

- Cost-Effectiveness: POS plans are designed to keep healthcare costs down by steering policyholders towards a network of preferred providers. This can result in significant savings, especially for those who prioritize in-network care.

- Flexibility: Unlike strict HMOs, POS plans offer more flexibility by allowing policyholders to seek care from out-of-network providers if needed. This can be advantageous for those with specific healthcare needs or preferences.

- Referral Options: POS plans provide policyholders with the choice of obtaining referrals from their PCP or directly from an in-network provider, offering a level of convenience and control over their healthcare journey.

Considerations

- Out-of-Network Costs: While out-of-network options are available, they often come with higher out-of-pocket expenses. Policyholders should carefully consider their healthcare needs and budget to determine if the flexibility of out-of-network care outweighs the potential financial burden.

- Referral Requirements: The referral process, while necessary for cost management, can be seen as a drawback by some. Policyholders must remember to obtain referrals before seeking specialty care, which may add an extra step to their healthcare journey.

- Network Limitations: POS plans have a defined network of providers. Policyholders should ensure that their preferred healthcare providers are included in the network to avoid unexpected out-of-network costs.

Performance and Future Implications

POS insurance has gained popularity due to its ability to strike a balance between cost-effectiveness and flexibility. As more individuals and families seek comprehensive healthcare coverage, POS plans offer a viable option that caters to a range of healthcare needs.

Performance Analysis

POS insurance plans have demonstrated success in managing healthcare costs while providing policyholders with a satisfactory level of coverage. By encouraging the use of in-network providers, these plans have helped control rising healthcare expenses without compromising on the quality of care.

Additionally, the flexibility offered by POS plans has contributed to their appeal, especially among those who value the freedom to choose their healthcare providers. This balance between cost-effectiveness and choice has made POS insurance a competitive option in the healthcare market.

Future Implications

Looking ahead, POS insurance is expected to continue its growth trajectory as a preferred choice for many. The ongoing trend of rising healthcare costs and the demand for flexible coverage options are likely to drive further adoption of POS plans.

Moreover, as healthcare technology advances, POS insurance plans may integrate innovative solutions to enhance the efficiency of the referral process and improve overall cost management. This could involve the use of digital platforms for streamlined referrals and the development of advanced analytics to optimize healthcare utilization.

In conclusion, POS insurance represents a well-rounded approach to healthcare coverage, offering a blend of cost-effectiveness and flexibility. As the healthcare landscape evolves, POS plans are poised to play a significant role in providing accessible and affordable healthcare solutions for individuals and families.

What are the key differences between POS insurance and HMO plans?

+While both POS and HMO plans require a primary care physician (PCP), POS plans offer more flexibility by allowing policyholders to seek care from out-of-network providers and obtain referrals from in-network specialists directly. In contrast, HMOs typically require all care to be coordinated through the PCP.

Can I change my PCP in a POS plan?

+Yes, policyholders can typically change their PCP within the insurer’s network. However, it’s important to check the specific terms of your plan and consider the impact on continuity of care when making such a change.

Are there any limitations on specialty care in a POS plan?

+While POS plans offer flexibility, specialty care is generally subject to referral requirements. Policyholders must obtain a referral from their PCP or an in-network provider before seeking specialty care, ensuring appropriate utilization and cost management.