Preferred Provider Organization Insurance Plan

In the realm of healthcare coverage, the Preferred Provider Organization (PPO) plan stands as a flexible and popular option, offering a balance between choice and cost. This type of insurance plan has become a preferred choice for many individuals and families due to its unique features and benefits. Let's delve into the intricacies of the PPO insurance plan, exploring its definition, how it works, its advantages, and its impact on healthcare accessibility.

Understanding the Preferred Provider Organization (PPO) Plan

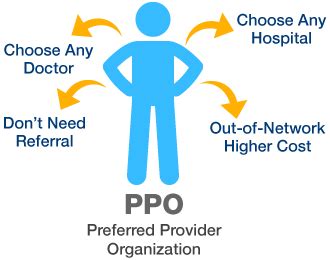

The Preferred Provider Organization plan, often referred to as a PPO, is a type of health insurance coverage that offers policyholders a network of healthcare providers, including doctors, hospitals, and other medical services, from which they can choose. The defining characteristic of a PPO plan is the flexibility it provides in choosing healthcare providers, while still offering potential cost savings through the use of in-network providers.

PPO plans are designed to offer a middle ground between health maintenance organizations (HMOs) and traditional fee-for-service plans. Unlike HMOs, which typically require members to choose a primary care physician and obtain referrals for specialist care, PPO plans allow members to visit any healthcare provider, whether in-network or out-of-network, without the need for prior authorization or referrals.

The Network Advantage

A key aspect of PPO plans is the network of preferred providers they offer. These networks are established by the insurance company and typically include a wide range of healthcare professionals and facilities. By utilizing in-network providers, members can access quality healthcare services at a discounted rate, as the insurance company has negotiated lower fees with these providers.

For instance, let's consider a PPO plan offered by a major insurance provider. This plan may have a network that includes well-known hospitals, such as the Mayo Clinic, renowned specialists like Dr. Smith, a top cardiologist, and a range of local primary care physicians and clinics. Members of this PPO plan can visit any of these providers and benefit from the negotiated rates, which often result in lower out-of-pocket costs.

| In-Network Provider | Discounted Rate |

|---|---|

| Mayo Clinic | $2,000 (20% off) |

| Dr. Smith, Cardiologist | $350 (15% off) |

| Local Primary Care Clinic | $120 (30% off) |

How PPO Plans Work

PPO plans operate on a simple yet flexible premise. Members of a PPO plan can visit any healthcare provider, whether in-network or out-of-network, without the need for prior authorization or referrals. This freedom of choice is a significant advantage over more restrictive plans like HMOs.

In-Network Benefits

When members choose to utilize in-network providers, they benefit from negotiated rates and often face lower out-of-pocket expenses. For example, a routine check-up with an in-network primary care physician might cost 100, while the same service with an out-of-network provider could be 150. Additionally, the insurance company may cover a higher percentage of the cost when an in-network provider is chosen.

Out-of-Network Options

While PPO plans encourage the use of in-network providers, they also allow members to visit out-of-network providers without penalties. However, the cost of out-of-network care can be higher, as the insurance company has not negotiated rates with these providers. Members may be responsible for a larger portion of the cost, known as out-of-network charges.

For instance, if a member chooses to visit an out-of-network specialist for a medical procedure, they might face a bill of $5,000. The insurance company may cover only a portion of this, leaving the member responsible for a significant amount. In contrast, the same procedure with an in-network specialist could cost $3,500, with the insurance company covering a larger share.

Cost-Sharing and Deductibles

Like most insurance plans, PPO plans involve cost-sharing mechanisms, such as deductibles, copayments, and coinsurance. These costs are typically lower when in-network providers are used. For example, a PPO plan might have a deductible of 1,500, meaning members pay for the first 1,500 of covered services out of pocket. After meeting this deductible, the insurance company starts to cover a higher percentage of the costs.

Additionally, PPO plans often have copayments for certain services, such as a $20 copay for a doctor's office visit or a $150 copay for emergency room services. These copayments are typically lower for in-network providers.

Advantages of PPO Plans

PPO plans offer several advantages that have contributed to their popularity in the healthcare insurance market.

Flexibility in Provider Choice

The primary benefit of PPO plans is the flexibility they offer in choosing healthcare providers. Members can visit any doctor, specialist, or hospital, whether in-network or out-of-network, without prior authorization or referrals. This freedom is particularly beneficial for those with specific healthcare needs or preferences.

Cost Savings with In-Network Providers

PPO plans encourage the use of in-network providers by offering potential cost savings. Through negotiated rates, members can access quality healthcare at reduced costs. This is especially advantageous for routine and preventive care, where the savings can be significant.

No Referrals or Prior Authorization

Unlike HMOs, PPO plans do not typically require members to obtain referrals or prior authorization for specialist care. This simplifies the process of accessing healthcare and reduces the administrative burden on both members and providers.

Wide Network of Providers

PPO plans often have extensive networks of healthcare providers, offering members a broad range of choices. This network includes not only primary care physicians and specialists but also hospitals, urgent care centers, and other medical facilities. The wide network ensures that members can find a provider that meets their needs and preferences.

Impact on Healthcare Accessibility

The PPO plan model has had a significant impact on healthcare accessibility and the overall healthcare landscape.

Encouraging Preventive Care

By offering potential cost savings for in-network preventive care, PPO plans encourage members to prioritize their health. Routine check-ups, vaccinations, and other preventive measures become more affordable, leading to better health outcomes and potentially reducing the need for more costly treatments later.

Expanding Provider Choices

The flexibility of PPO plans in allowing members to choose any provider, regardless of network status, expands the range of healthcare options available. This is particularly beneficial in rural or underserved areas, where the network of in-network providers might be limited. Members can still access necessary care, even if it’s with an out-of-network provider.

Simplifying Insurance Administration

PPO plans, with their lack of referral requirements and simplified administrative processes, reduce the burden on both members and providers. This streamlining of insurance administration can lead to more efficient healthcare delivery and potentially lower administrative costs.

Competitive Market Dynamics

The popularity of PPO plans has contributed to a more competitive healthcare insurance market. Insurance companies must negotiate favorable rates with healthcare providers to attract members to their PPO networks. This competition can drive down costs and improve the quality of healthcare services.

Conclusion: A Balanced Approach to Healthcare Coverage

The Preferred Provider Organization plan offers a balanced approach to healthcare coverage, providing flexibility in provider choice while encouraging cost-effective care through its network of preferred providers. PPO plans have become a popular choice for individuals and families seeking a blend of freedom and affordability in their healthcare coverage.

As the healthcare landscape continues to evolve, PPO plans will likely remain a key player, offering a model that balances the needs of members and providers, while also contributing to a more accessible and competitive healthcare system.

How do PPO plans differ from HMOs?

+PPO plans differ from HMOs primarily in their flexibility and provider choice. PPO plans allow members to visit any healthcare provider without prior authorization or referrals, while HMOs typically require members to choose a primary care physician and obtain referrals for specialist care.

What are the potential costs associated with out-of-network care in a PPO plan?

+Out-of-network care in a PPO plan can be more expensive. Members may face higher out-of-pocket costs, such as higher copayments or coinsurance, and the insurance company may cover a smaller percentage of the total cost. It’s important to check with your insurance provider for specific out-of-network charges.

How can I find out if a provider is in-network with my PPO plan?

+You can typically find a list of in-network providers on your insurance company’s website or by contacting their customer service. Some insurance companies provide online tools or mobile apps that allow you to search for in-network providers based on your location and healthcare needs.

Are there any disadvantages to PPO plans?

+One potential disadvantage of PPO plans is the higher cost compared to other plan types like HMOs. Additionally, while PPO plans offer flexibility, the out-of-network costs can be significant. It’s important to carefully review your plan’s benefits and costs to ensure it aligns with your healthcare needs and budget.