Quick Insurance Quote

Quick Insurance Quote: A Comprehensive Guide to Understanding the Process and Benefits

Introduction: Navigating the World of Insurance Quotes

In today’s complex financial landscape, insurance plays a pivotal role in safeguarding our assets, health, and livelihoods. Obtaining a quick insurance quote is often the first step towards securing comprehensive coverage tailored to our unique needs. This guide aims to demystify the process, shedding light on the key considerations and advantages associated with seeking insurance quotes.

Understanding the Insurance Quote Process

The journey towards securing the right insurance coverage begins with a quick insurance quote, an essential tool that provides an initial assessment of the costs and benefits associated with various insurance policies. This process involves a series of steps, each designed to ensure an accurate and personalized quote.

Step 1: Defining Your Insurance Needs

The first step in obtaining a quote is to clearly define your insurance requirements. Are you seeking health insurance to cover medical expenses, auto insurance to protect your vehicle, or homeowner’s insurance to safeguard your property? Understanding your specific needs is crucial as it forms the foundation for an accurate quote.

Step 2: Gathering Essential Information

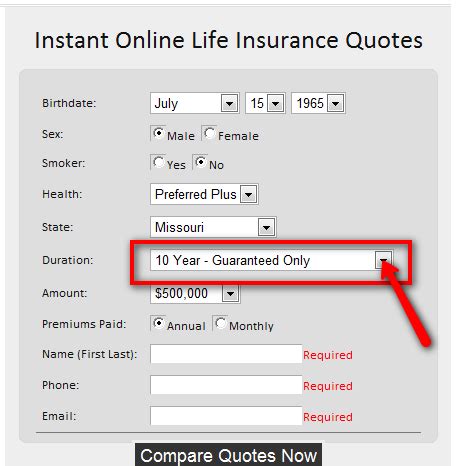

Once you’ve identified your insurance needs, the next phase involves gathering relevant information. This may include personal details such as age, gender, and occupation, as well as specific data related to the item or person being insured. For instance, if you’re seeking auto insurance, details about your vehicle, driving history, and the number of miles driven annually will be required.

Step 3: Completing the Quote Application

With the necessary information at hand, you can proceed to complete the insurance quote application. This process is typically straightforward and can be done online, via phone, or in person with an insurance agent. Ensure that you provide accurate and detailed information to ensure an accurate quote.

Step 4: Receiving and Reviewing the Quote

Upon submitting your application, you’ll receive a quote detailing the estimated cost of the insurance policy. This quote will include information about the coverage limits, deductibles, and any additional features or riders. Take the time to review the quote carefully, ensuring that it aligns with your insurance needs and expectations.

Benefits of Obtaining a Quick Insurance Quote

Seeking a quick insurance quote offers a myriad of advantages, empowering individuals and businesses to make informed decisions about their insurance coverage.

Cost Efficiency

One of the primary benefits of obtaining a quote is the ability to compare insurance policies and their associated costs. This comparative analysis ensures that you secure the most cost-effective coverage without compromising on quality. By evaluating quotes from multiple providers, you can identify the policy that best aligns with your budget and requirements.

Personalized Coverage

Insurance quotes are tailored to your specific needs, ensuring that the coverage you receive is personalized and comprehensive. Whether you require health insurance, auto insurance, or property insurance, the quote process takes into account your unique circumstances, providing a policy that offers the right level of protection.

Time-Saving Convenience

In today’s fast-paced world, time is a precious commodity. The quick insurance quote process is designed to be efficient, allowing you to obtain multiple quotes within a short timeframe. This convenience ensures that you can secure the insurance coverage you need without sacrificing your schedule.

Educational Value

Obtaining insurance quotes serves as an educational tool, providing valuable insights into the world of insurance. Through the quote process, you’ll gain a deeper understanding of the various types of insurance, their coverage limits, and the factors that influence premiums. This knowledge empowers you to make informed decisions and negotiate the best terms with insurance providers.

Case Study: A Real-World Example

Let’s illustrate the benefits of quick insurance quotes with a real-world scenario. Imagine a small business owner, Sarah, who is looking to insure her fleet of delivery vehicles. By obtaining quick insurance quotes from multiple providers, Sarah is able to compare coverage options and premiums. This process not only helps her secure the most cost-effective policy but also ensures that her vehicles are adequately protected, allowing her business to operate smoothly.

| Insurance Provider | Coverage Limits | Premium |

|---|---|---|

| Provider A | $1,000,000 | $1,200/year |

| Provider B | $2,000,000 | $1,500/year |

| Provider C | $1,500,000 | $1,350/year |

In this scenario, Sarah can quickly assess which provider offers the best combination of coverage and cost, making an informed decision that benefits her business.

Maximizing the Benefits of Insurance Quotes

To fully leverage the advantages of quick insurance quotes, consider the following strategies:

- Compare Quotes: Don't settle for the first quote you receive. Take the time to compare quotes from multiple providers to ensure you're getting the best deal.

- Understand Coverage: Carefully review the coverage limits and exclusions in each quote to ensure the policy aligns with your needs.

- Negotiate Terms: Use the quotes as a starting point for negotiations with insurance providers. Leverage competitive quotes to secure better terms and rates.

- Seek Expert Advice: Consult with insurance professionals who can provide guidance and insights based on your specific circumstances.

Future Trends in Insurance Quoting

As technology continues to advance, the insurance quoting process is evolving to become even more efficient and personalized. Here are some trends to watch:

- AI-Driven Quoting: Artificial intelligence is being leveraged to streamline the quoting process, providing accurate and instant quotes based on real-time data.

- Personalized Recommendations: Advanced algorithms are enabling insurance providers to offer personalized coverage recommendations based on individual needs and preferences.

- Digital Platforms: Online insurance platforms are becoming more sophisticated, offering users a seamless and intuitive experience for obtaining quotes and managing policies.

Conclusion: Empowering Your Insurance Decisions

In the complex world of insurance, obtaining a quick insurance quote is a powerful tool that empowers individuals and businesses to make informed decisions. By understanding the quote process, leveraging its benefits, and staying abreast of emerging trends, you can secure the coverage you need with confidence and cost-efficiency.

Frequently Asked Questions

How long does it take to receive an insurance quote?

+

The time it takes to receive an insurance quote can vary depending on the complexity of your insurance needs and the provider’s processes. Typically, you can expect to receive a quote within a few hours to a few days after submitting your application.

Can I negotiate the terms of my insurance policy based on quotes I’ve received?

+

Absolutely! Insurance quotes serve as a starting point for negotiations. By comparing quotes and understanding the market rates, you can negotiate better terms and rates with insurance providers. It’s a powerful tool to ensure you’re getting the best value for your insurance coverage.

Are insurance quotes binding contracts?

+

No, insurance quotes are not binding contracts. They are estimates of the cost and coverage of an insurance policy based on the information you’ve provided. To finalize your insurance coverage, you’ll need to review and accept the terms and conditions outlined in the policy document.

Can I get multiple insurance quotes simultaneously?

+

Yes, you can obtain multiple insurance quotes simultaneously from different providers. This allows you to compare coverage options and premiums, ensuring you find the best policy for your needs. Online insurance marketplaces and comparison websites can be particularly useful for this purpose.