Quote Flood Insurance

As the world continues to grapple with the impacts of climate change, natural disasters such as floods have become increasingly frequent and devastating. Flood insurance has emerged as a critical tool for individuals and businesses to protect themselves financially in the event of such disasters. Obtaining an accurate quote for flood insurance is essential to ensure proper coverage and peace of mind. This comprehensive guide will delve into the intricacies of flood insurance quotes, exploring the factors that influence pricing, the steps involved in obtaining a quote, and the key considerations for making an informed decision.

Understanding Flood Insurance Quotes

Flood insurance quotes are estimates of the cost of flood insurance coverage for a specific property. These quotes are influenced by various factors, each playing a crucial role in determining the overall price. Understanding these factors is essential for property owners seeking to protect their assets and ensure they are adequately covered.

Factors Affecting Flood Insurance Quotes

Several key factors come into play when determining flood insurance quotes. These factors can significantly impact the price and coverage offered. Let's explore each of these elements in detail:

- Location of the Property: The location of the insured property is a primary factor in flood insurance quotes. Properties located in high-risk flood zones, such as coastal areas or floodplains, generally attract higher premiums due to the increased likelihood of flooding. Conversely, properties in low-risk zones may enjoy more affordable rates.

- Type of Coverage: Flood insurance offers various coverage options, including building and contents coverage. Building coverage protects the structure itself, while contents coverage safeguards personal belongings. The extent and value of the coverage chosen will impact the overall quote.

- Value of the Property: The estimated value of the insured property is a significant consideration. Higher-value properties often require more extensive coverage, resulting in higher premiums. Accurate valuation is crucial to ensure adequate protection without overpaying.

- Previous Flood Claims: Insurers carefully consider the property's history of flood claims. Properties with a history of frequent or costly flood claims may face higher premiums or even difficulty obtaining coverage. It is essential to provide accurate information regarding past claims to avoid surprises during the quoting process.

- Elevation and Flood Zone: The elevation of the property and its flood zone classification play a vital role in determining flood insurance quotes. Properties located in higher-elevation areas or less vulnerable flood zones may qualify for lower premiums.

- Mitigation Measures: Insurers may offer discounts or reduced premiums for properties that have implemented flood mitigation measures. These measures could include elevating the structure, installing flood barriers, or utilizing flood-resistant building materials. Investing in mitigation can lead to significant savings on insurance costs.

- Deductibles and Coverage Limits: The choice of deductibles and coverage limits can influence the overall quote. Higher deductibles may result in lower premiums, while higher coverage limits provide more comprehensive protection. Balancing these factors is essential to find the right coverage for your needs.

| Factor | Description |

|---|---|

| Location | Properties in high-risk flood zones face higher premiums. |

| Coverage Type | Building and contents coverage impact the overall quote. |

| Property Value | Higher-value properties require more extensive coverage. |

| Previous Claims | Properties with a history of flood claims may face higher premiums. |

| Elevation and Flood Zone | Properties in higher-elevation areas or less vulnerable zones may qualify for lower premiums. |

| Mitigation Measures | Implementing flood mitigation measures can lead to reduced premiums. |

| Deductibles and Limits | Higher deductibles may result in lower premiums, while higher limits provide more comprehensive coverage. |

The Process of Obtaining a Flood Insurance Quote

The process of obtaining a flood insurance quote is straightforward but requires careful consideration and attention to detail. Here's a step-by-step guide to help you navigate the process effectively:

Step 1: Gather Relevant Information

Before requesting a flood insurance quote, gather the necessary information about your property. This includes details such as the location, estimated value, and any previous flood claims. Additionally, research the flood zone classification and elevation of your property. Accurate information is crucial for obtaining an accurate quote.

Step 2: Choose a Reputable Insurance Provider

Select a reputable insurance provider that offers flood insurance coverage. Research different providers, compare their policies, and read reviews to ensure they have a solid track record and reliable customer service. Consider factors such as their financial stability, coverage options, and claims handling processes.

Step 3: Request a Quote

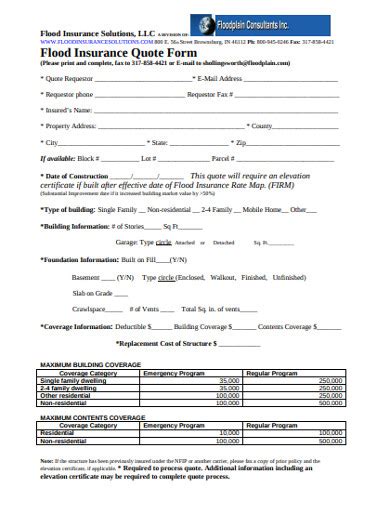

Contact the chosen insurance provider and request a flood insurance quote. You can do this online, over the phone, or by visiting their local office. Provide the necessary information about your property, including the details gathered in Step 1. Be prepared to answer questions about the property's history and any flood-related improvements or modifications.

Step 4: Review the Quote

Once you receive the flood insurance quote, carefully review it. Pay attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure that the quote aligns with your specific needs and circumstances. Consider whether the coverage offered is sufficient to protect your property and belongings in the event of a flood.

Step 5: Compare Quotes

If you have obtained quotes from multiple insurance providers, compare them side by side. Evaluate the coverage, premiums, and any additional benefits or discounts offered. Consider the financial stability and reputation of each provider. Weigh the pros and cons of each quote to make an informed decision about which provider offers the best value and protection for your needs.

Step 6: Ask Questions and Seek Clarification

If you have any questions or uncertainties about the quote, don't hesitate to reach out to the insurance provider. Ask for clarification on any confusing terms or exclusions. It is essential to fully understand the coverage and terms before making a commitment. Insurance providers should be able to provide clear explanations and address any concerns you may have.

Step 7: Make an Informed Decision

After reviewing and comparing the quotes, make an informed decision about which flood insurance policy to choose. Consider your financial situation, the value of your property, and the level of coverage you require. Ensure that the chosen policy provides adequate protection without being excessive or unnecessarily expensive. Trust your judgment and select the policy that best aligns with your needs and budget.

Key Considerations for Flood Insurance

When obtaining a flood insurance quote and making a decision about coverage, it is essential to keep certain key considerations in mind. These considerations will help you make an informed choice and ensure you have the appropriate protection in place.

Assessing Your Risk

Before purchasing flood insurance, assess the flood risk associated with your property. Research the historical flood data for your area and understand the likelihood of flooding. Consider factors such as the proximity to bodies of water, the presence of flood-prone areas nearby, and the overall flood risk profile of your region. Understanding your risk will help you make an informed decision about the level of coverage you require.

Understanding Coverage Limits and Deductibles

Carefully review the coverage limits and deductibles outlined in your flood insurance policy. Coverage limits define the maximum amount the insurer will pay for a covered loss. Ensure that the limits are sufficient to cover the replacement cost of your property and belongings. Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Choose a deductible that aligns with your financial capacity and comfort level.

Reviewing Exclusions and Limitations

Flood insurance policies often come with certain exclusions and limitations. It is crucial to thoroughly review these to understand what is and isn't covered. Some common exclusions may include damage caused by water backing up through sewers or drains, gradual water damage, and damage from certain natural disasters like earthquakes or hurricanes. Ensure that you are aware of any limitations or restrictions before finalizing your insurance decision.

Considering Additional Coverage Options

Flood insurance policies typically provide coverage for the structure of your property and its contents. However, there may be additional coverage options available to enhance your protection. Consider adding coverage for living expenses if you need to relocate temporarily due to a flood. Additionally, explore options for increased coverage limits or endorsements to cover specific valuable items or unique circumstances.

Understanding the Claims Process

Familiarize yourself with the claims process outlined by your insurance provider. Understand the steps you need to take in the event of a flood to initiate a claim. This includes documenting the damage, providing evidence, and following the insurer's guidelines for filing a claim. Being well-prepared and understanding the claims process can streamline the process and ensure a smoother experience when you need to make a claim.

Frequently Asked Questions

What is flood insurance and why is it important?

+Flood insurance is a specialized type of insurance that provides financial protection against damages caused by flooding. It is important because standard homeowners' insurance policies typically do not cover flood-related losses. With climate change leading to more frequent and severe floods, flood insurance is essential to safeguard your property and belongings.

Can I get flood insurance for my rental property?

+Yes, you can obtain flood insurance for your rental property. However, the availability and terms may vary depending on the insurer and the specific location of the property. It is recommended to consult with insurance providers who specialize in rental property coverage to understand your options.

Are there any government-backed flood insurance programs available?

+Yes, the National Flood Insurance Program (NFIP) is a government-backed program that provides flood insurance to property owners, renters, and businesses. It offers coverage for both residential and commercial properties in participating communities. The NFIP is administered by the Federal Emergency Management Agency (FEMA) and aims to provide affordable flood insurance options.

How often should I review and update my flood insurance policy?

+It is recommended to review and update your flood insurance policy annually or whenever significant changes occur. This includes changes in the value of your property, improvements or renovations, or any updates to the flood zone classification. Regularly reviewing your policy ensures that your coverage remains adequate and aligns with your current needs.

What should I do if I have a flood emergency and need to make a claim?

+In the event of a flood emergency, it is crucial to take immediate action to ensure your safety and minimize further damage. Contact your insurance provider as soon as possible to report the incident and initiate the claims process. Follow their instructions and gather necessary documentation, such as photographs and an inventory of damaged items. Act promptly to expedite the claims process and receive the necessary assistance.

In a world where natural disasters can strike unexpectedly, flood insurance provides a crucial layer of protection for property owners. By understanding the factors that influence flood insurance quotes, following the steps to obtain an accurate quote, and considering key aspects such as risk assessment and coverage limits, you can make informed decisions to safeguard your assets. Remember, flood insurance is not just about financial protection; it’s about peace of mind and the ability to rebuild in the face of adversity.