Safety Insurance Login

In today's digital age, managing insurance policies has become more convenient with the advent of online portals and mobile apps. One such insurance provider, Safety Insurance, offers its customers a seamless way to access their accounts and policy details through the Safety Insurance Login platform. This article will delve into the features, benefits, and step-by-step process of utilizing the Safety Insurance Login to help you better understand and navigate this essential tool for policyholders.

Understanding the Safety Insurance Login Platform

Safety Insurance, a renowned name in the insurance industry, recognizes the importance of providing its customers with a secure and efficient way to manage their policies. The Safety Insurance Login platform is a dedicated online portal designed to offer policyholders a comprehensive view of their insurance portfolio and enable them to perform various tasks conveniently.

This platform serves as a one-stop solution for policyholders, allowing them to access and manage their auto, home, and business insurance policies. By logging into their accounts, customers can view policy details, make payments, update personal information, and even file claims, all from the comfort of their homes or on the go using their mobile devices.

Key Features and Benefits of Safety Insurance Login

The Safety Insurance Login platform is packed with features that enhance the user experience and streamline policy management. Here are some of the key benefits:

- Policy Overview: Policyholders can access a detailed overview of their active policies, including coverage limits, policy terms, and renewal dates. This feature ensures that customers stay informed about their insurance coverage.

- Online Payments: The platform offers a secure and convenient way to make premium payments. Policyholders can choose from various payment methods, such as credit/debit cards or electronic funds transfer, and receive instant confirmation of successful transactions.

- Personal Information Management: Customers can easily update their personal and contact details, ensuring that Safety Insurance has the most current information. This is particularly useful when moving to a new address or making changes to vehicle information.

- Claims Filing: One of the most significant advantages of the Safety Insurance Login platform is the ability to file claims online. Policyholders can initiate the claims process, provide necessary details, and track the progress of their claims, all within the secure environment of the portal.

- Document Repository: The platform serves as a digital repository for important insurance-related documents. Policyholders can access and download policy documents, claim forms, and other relevant papers whenever needed.

- Notification and Alerts: Safety Insurance Login allows users to set up notifications and alerts for critical events, such as upcoming policy renewals or changes in coverage. This feature helps policyholders stay proactive in managing their insurance needs.

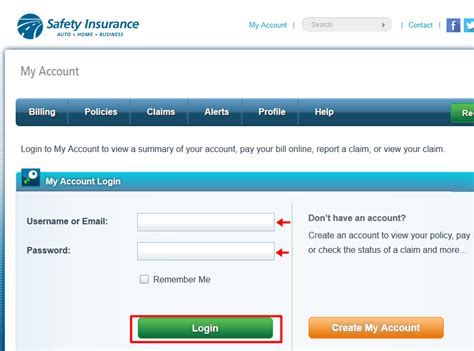

Step-by-Step Guide to Logging into Safety Insurance

Logging into the Safety Insurance Login platform is a straightforward process. Here’s a detailed guide to help you access your account:

Step 1: Visit the Safety Insurance Website

Begin by opening a web browser on your preferred device (computer, laptop, or mobile phone) and navigating to the official Safety Insurance website. You can find the website by searching for “Safety Insurance” in your preferred search engine.

Step 2: Locate the Login Section

Once you are on the Safety Insurance website, look for the “Login” or “My Account” section. This section is typically located in the top right corner of the homepage or in the main navigation menu. It may also be represented by an icon, such as a user profile or a padlock.

Step 3: Enter Your Credentials

Click on the “Login” or “My Account” button to access the login form. Here, you will be prompted to enter your login credentials. These credentials typically consist of your username (often your email address) and a secure password. Ensure that you enter the details accurately to avoid any login issues.

Step 4: Submit and Access Your Account

After entering your credentials, click on the “Submit” or “Log In” button. The Safety Insurance Login platform will verify your details, and if they match the records, you will be granted access to your account. From here, you can explore the various features and manage your insurance policies.

Additional Tips for a Smooth Login Experience

- If you are a new user, you may need to register for an account before logging in. Look for a “Register” or “Sign Up” option on the login page.

- Keep your login credentials secure and confidential. Avoid sharing your username and password with others to maintain the security of your insurance information.

- In case you forget your password, most login platforms offer a “Forgot Password” or “Reset Password” option. Follow the instructions provided to reset your password and regain access to your account.

- Regularly update your contact information, especially your email address and phone number, to ensure that Safety Insurance can reach you with important updates and notifications.

Security Measures and Data Protection

Safety Insurance understands the importance of data security and privacy. The Safety Insurance Login platform employs robust security measures to protect your personal and insurance-related information. Here are some key security features:

- Encryption: All data transmitted between your device and the Safety Insurance servers is encrypted using advanced security protocols. This ensures that your information remains secure during online transactions.

- Two-Factor Authentication: Safety Insurance may offer an optional two-factor authentication feature. This adds an extra layer of security by requiring a second form of verification, such as a unique code sent to your mobile device, in addition to your password.

- Regular Security Audits: The platform undergoes regular security audits and updates to address any potential vulnerabilities. Safety Insurance stays proactive in maintaining a secure online environment for its policyholders.

- Privacy Policies: Safety Insurance has a comprehensive privacy policy that outlines how your personal information is collected, used, and shared. It is essential to review and understand these policies to make informed decisions about your data.

Customer Support and Assistance

While the Safety Insurance Login platform is designed to be user-friendly, there may be instances where you require assistance. Safety Insurance offers various support channels to help policyholders with their login and account-related queries.

- Online Help Center: The Safety Insurance website often features an extensive help center or FAQ section. Here, you can find answers to common questions and troubleshooting guides for various account-related issues.

- Contact Center: Safety Insurance provides a dedicated contact center or customer support team. You can reach out to them via phone, email, or live chat during business hours for personalized assistance.

- Social Media Support: In today's digital landscape, many insurance providers offer support through social media platforms. Safety Insurance may have a presence on popular platforms like Facebook or Twitter, where you can connect with their support team.

- In-Person Assistance: For more complex issues or if you prefer face-to-face interaction, Safety Insurance may have physical branches or offices where you can seek assistance from their customer service representatives.

Future Developments and Enhancements

Safety Insurance is committed to continuously improving its digital services, including the Safety Insurance Login platform. Here are some potential future developments and enhancements to look forward to:

- Mobile App Integration: Safety Insurance may develop a dedicated mobile app to provide policyholders with a more convenient and seamless experience. The app could offer features like push notifications, quick access to policy details, and an improved claims filing process.

- Enhanced Security Features: With evolving cyber threats, Safety Insurance may implement advanced security measures such as biometric authentication (e.g., fingerprint or facial recognition) to further safeguard user accounts.

- AI-Powered Assistance: Artificial intelligence (AI) could be leveraged to provide intelligent virtual assistants or chatbots within the platform. These AI assistants can offer real-time support, answer queries, and guide users through various account-related tasks.

- Integration with Smart Home Devices: Safety Insurance may explore partnerships with smart home device manufacturers to integrate insurance-related features. For example, integrating with smart home security systems could offer enhanced protection and monitoring for homeowners.

Frequently Asked Questions

Can I access my Safety Insurance account on my mobile device?

+Absolutely! Safety Insurance has optimized its login platform for mobile accessibility. You can access your account using your smartphone’s web browser or by downloading the Safety Insurance mobile app (if available) from the App Store or Google Play.

What if I forget my Safety Insurance login credentials?

+Don’t worry! Safety Insurance provides a “Forgot Password” or “Reset Password” option on the login page. Simply click on this link, follow the instructions, and you’ll be able to reset your password and regain access to your account.

Is my data secure when using the Safety Insurance Login platform?

+Yes, Safety Insurance takes data security very seriously. The platform employs advanced encryption protocols to protect your information during transmission. Additionally, optional features like two-factor authentication add an extra layer of security to your account.

Can I update my personal information through the Safety Insurance Login platform?

+Absolutely! One of the key benefits of the Safety Insurance Login platform is the ability to manage your personal information. You can easily update your contact details, address, and other relevant information to ensure that Safety Insurance has the most current records.

How often should I log into my Safety Insurance account?

+It’s recommended to log into your Safety Insurance account regularly to stay informed about your insurance policies. Checking your account at least once a month can help you keep track of policy details, upcoming renewals, and any important notifications from Safety Insurance.